👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.This week, we cover Q3 results from Tanzania's leading banks, Safaricom launching its 5G network, and KPLC's FY22 results.First off, enjoy our weekly business news in memes brought to you by the Competition Authority of Kenya:

CRDB, NMB Banks Q3 Results

CRDB Q3 2022 Performance:

Interest Income grew 18% year-over-year to reach TZS 235.6B ($101M), while non-interest income edged 44.4% higher to TZS 96.3B ($41.3B). Operating income grew marginally by 5.4% to TZS 117.4B ($50M), and the bank registered TZS 82.5B ($35M) in net income in the review period, a 5% increase. CRDB posted a 6.6% return on equity.

Non-performing loans grew 22% to TZS 206.5B ($88.7M) to bring the cost of risk to 3.3%. The loan book was up 37.2% to reach TZS 6.2T ($2.7B) while investments in government securities rose 21.5% to reach TZS 1.9T ($855.9M) in Q3 2022. Total assets grew 35% to reach TZS 10.9T ($4.7B).

NMB Q3 2022 Performance:

Interest income grew 14.9% year-over-year to TZS 240.4B ($103.2M), while non-interest income was up 35.7% to TZS 112.3B ($48.2M). Operating income was up 53.9% to TZS 166.2B ($71.3M) while net profit grew 53% bringing the ROE to 8.1%. NMB’s operating income and net profit surpassed those of CRDB in the review period.

The loan book expanded 25.6% to TZS 5.6T ($2.4B), while the TZS 1.9T ($804M) in holdings of government securities were up 26.8% and accounted for 19.8% of the balance sheet. Non-performing loans grew 6.3% to TZS 190.2B ($81.6M) bringing the cost of risk to 3.4%. Total assets were up 16% to reach TZS 9.5T ($4.1B).

Safaricom’s 5G

First-mover Advantage: Last week, East Africa’s largest company by market capitalization, Safaricom, switched on its 5th generation mobile network across various parts of the country, becoming the first telecommunications firm to roll out and trial 5G in East Africa. Safaricom activated its 5G Service for individual and enterprise users in Nairobi, Kisumu, Kisii and Kakamega, which have a combined population of more than 9M people; and is set to expand to 150 sites across nine towns over the next 12 months.

“Today marks a major milestone for the country. With 5G, we aim to empower our customers with super-fast internet at work, at home and when on the move, supplementing our growing fibre network. At Safaricom, we are proud to be the first in the country and the region to bring this latest innovation to both our retail and enterprise customers empowering them to start exploring new opportunities that 5G provides.”

Safaricom PLC Chief Executive Officer, Peter Ndegwa

Network Access: 5G will be available for all 5G-capable devices, and according to an explainer, users should be able to connect to the network in areas where the network is available. Other devices that have 5G support as of launch include Huawei Mate 30 Pro and P40, and as from the end of April 2021, Nokia 8.3, Samsung Galaxy S21 Series, Samsung Galaxy Z Fold2 and Samsung Galaxy S20 Ultra 5G. The initial targeted internet speeds are up to 700 Megabits Per Second, and the firm is planning to increase the speeds to 1,000Mbps in the later stages of the trial.

Product Costs: The initial available service under the 5G offering will be Fixed Wireless access. Users will have to purchase a router costing KES 25K with an attendant installation and setup fee of KES 5K to access Safaricom 5G Wifi. Safaricom has outlined prices for various speeds and data bandwidths.

KPLC FY22 Results

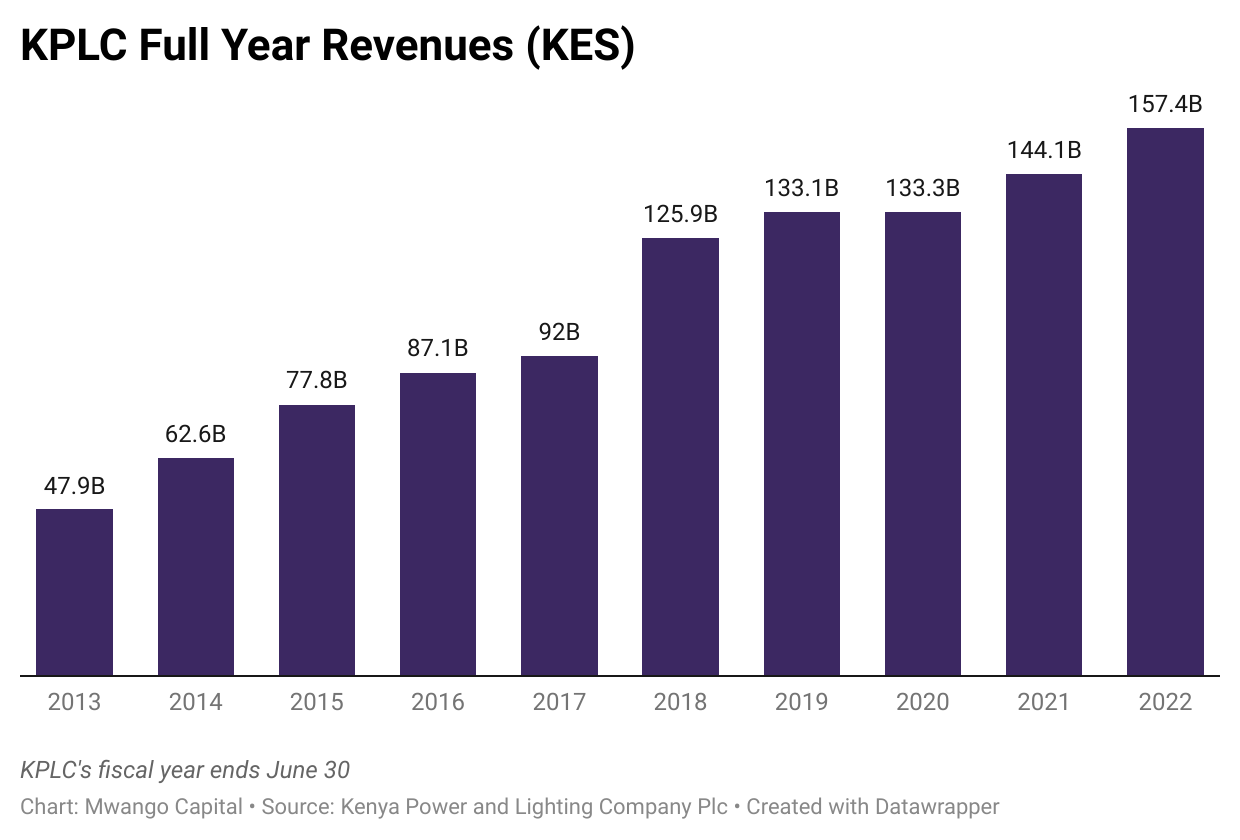

Revenue Crosses KES 150B: In the fiscal year ended June 30 2022, Kenya Power and Lightning Company (KPLC) reported KES 157.3B in gross sales, year-over-year growth of 9.2%. At 22.3% growth, the cost of sales more than doubled the pace of revenue growth, bringing the gross margin for the year down 15.5% to KES 42.1B.

Fuel Costs Up 137%: Increases in global fuel prices and increased dispatch from thermal plants as a mitigation strategy to inadequate electricity generation from hydro sources as a result of failed rains in the review period saw fuel power purchase costs leap 136.8% to KES 26.5B. Thermal energy plants dispatched 1,539GWh of electricity, an increase of 75.7% year-over-year. The fuel power purchase costs were equivalent to 16.8% of revenue in 2022 compared to 7.8% in 2021.

Price Cuts Bite Revenue?: In January earlier this year, KPLC cut utility tariffs by 15% as part of measures by then President Uhuru Kenyatta to bring down the cost of electricity. The latest inflation release for September showed the price of 200KWh of electricity jumped 0.4% - the least change after tomatoes across the average prices of the selected commodities. In its full-year results, KPLC reported a year-over-year decline of 0.3% in electricity revenue, the first drop in 6 years.

Net Income More than Doubles: Earnings Before Taxes fell 37.5% to KES 5.1B. The income tax consideration for the year was KES 1.6B - 24% of what was reported in 2021 - bringing the net result for the year to KES 3.5B, an increase of 135.2%.

EAPCC FY Results

Gross Loss Falls 4.7%: In the fiscal year ended June 2022, East African Portland Cement reported a topline of KES 2.1B, down 22.4% year-over-year from KES 2.8B recorded in the year ended June 2021. The cost of goods sold was down 18.4% to bring the gross loss for the year to KES 782M.

KCB Loan Retirement: Finance costs reduced by a whopping 87.9% to KES 100.9M in the year ended June 2022 as EAPCC completed the settlement of its KES 6.8B debt to KCB Group. EAPCC cleared the debt through land transfers to the lender, including a transfer that offset the debt by KES 4.85B in June 2021.

Fair Value Gains Buoy Bottom Line: While fair value gains on investment property fell 57.3% to KES 2.5B in 2022, the gains booked in the period under review helped to absorb KES 1.8B in losses from operating activities, bringing the Profit Before Tax to KES 529.2M, a decrease of 69.5%.

Bottom Line: The net result from trading operations in the period under review was KES 541.6M, a decline of 71.3% compared to KES 1.9B recorded in the previous year. At 2.3% of net income, the impact of the tax credit on after-tax profits in the year ended June 2022 was 3.5X smaller than it was in the year ended June 2021, where it stood at 8%.

CAK's Capacity Building Workshop

Highlights: Last week, the Competition Authority of Kenya held its 9th Annual Capacity Building Workshop from Tuesday through Thursday, and capped off with its 9th Annual Symposium on Friday which was graced by its Director General, Wang'ombe Kariuki. The Workshop drew officials from the Central Bank of Kenya, the Organisation of Economic Cooperation and Development and the East African Community Competition Authority.

Thematic Areas: Key areas of discussion that were covered during last week's events include the future of competition law, consumer protection and supervision in the digital finance sector, merger control frontiers, and Kenya's digital economy. Notably, while there is an appreciation of Kenya's financial inclusion - which has risen to 83% in 2019 from 27% in 2009, Kenyans' financial health remains low, according to the CAK.

Debt Markets

T-bills: In the short-term public debt markets, the Central Bank of Kenya (CBK) accepted KES 17.6B bids out of a targeted KES 24B - bringing the acceptance rate to 73.5%. The CBK accepted KES 11.9B from the 91-Days paper at a market-weighted average interest rate of 9.127%.

Infrastructure Bond Prospectus: Last week, the CBK issued a prospectus for an Infrastructure Bond Offer for 14-year amortized IFB1/2022/14. The total value of the bond is KES 60B and the period of sale will run upto November 8. Infrastructure bonds are tax-free which makes them attractive to investors. Given the lacklustre performance the bond markets have registered in H2 2022, it remains to be seen how investors will participate in this issue.

Eurobond Market: In terms of week-on-week performance, yields on all outstanding Kenya Eurobonds fell last week, with KENINT 2024 falling 182.5 basis points (bps) - posting the highest decline. KENINT 2032 had its yields fall the least, by 79.3 basis points, to bring the average drop in performance on all outstanding papers to 76.3 bps.

What Else Happened This Week

✅ Parliament Approves Ruto's Cabinet: Last week, Parliament approved the appointment of President William Ruto's cabinet - a key step in the formation of the new government that now embarks on the delivery of its manifesto. Oaths of office were administered at the State House in Nairobi with Ruto's government marking 46 days in power today.

👨💼KenGen's New Acting CEO: Following the appointment and subsequent approval to the Cabinet of the immediate former Chief Executive Officer (CEO) of Kenya National Electricity Generating Company (KenGen) Rebecca Miano, the Board of Directors has appointed the firm's head of Human Resources and Administration Abraham Serem as acting CEO. Separately, KenGen last week announced it will be releasing its financial results for the year ended June 30 2022 in November.

💰 Kenya to Take Over KQ Debt: A default on a $525M US Export-Import Bank loan to Kenya Airways (KQ) has forced Kenya to take over the debt it backstopped. The loan is part of the $841.6M 10-year facility KQ took to buy 7 aircraft and 1 engine.

Interest Rate Watch

🇪🇬 Egypt: The Monetary Policy Committee (MPC) of the Central Bank of Egypt (CBE) in a special sitting last week hiked the key interest rate by 200 bps to 13.25% from 11.25%. The hike makes it the third in 2022 after 100 bps and 200 bps hikes in March and May, respectively. Last week’s policy action brings the cumulative hike delivered by the CBE to 500 bps Year-To-Date. Annual inflation rose 40 bps month-on-month to 15% in September from 14.6% recorded in August.