👋 Welcome to the Baobab Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.This week, we cover various companies reporting their 2021 earnings. First off, enjoy our weekly business news in memes brought to you by Safaricom’s tech solutions:

Kenya Airways Reduces Loss by Half

In the Red: Kenya’s flagship airline slashed its full-year loss by half to reach KES 15.8B in a period where revenue grew 32.9% to KES 70.22B. This is the 9th consecutive year the company’s bottom line is in the red.

Business Recovery: The pandemic crippled the aviation industry in 2020 and most international travel was muted due to covid restrictions. The airline registered 11.5% capacity growth albeit it was still 65% below pre-pandemic levels. The revenue numbers are an indicator of expected top-line growth as Covid recedes and the operating environment re-adjusts to pre-2019 levels. Whether this translates to a profit is uncertain.

Here comes the cavalry: The airline is in line for a KES 20B bailout following approval of the supplementary budget in Parliament. The funds have been earmarked for restructuring, working capital support, and balance sheet stabilization. [Bloomberg]

Diamond Trust Bank 2021 Results

Double-Digit Earnings: Profit Before Tax and Net income grew 41.9% and 25.1% to reach KES 15.5B and 4.4B respectively. The Board has recommended a KES 3 DPS to shareholders, a 21.5% payout arriving at just under KES 1B in total dividend payout. The bank’s dividend payout ratio history is outlined below.

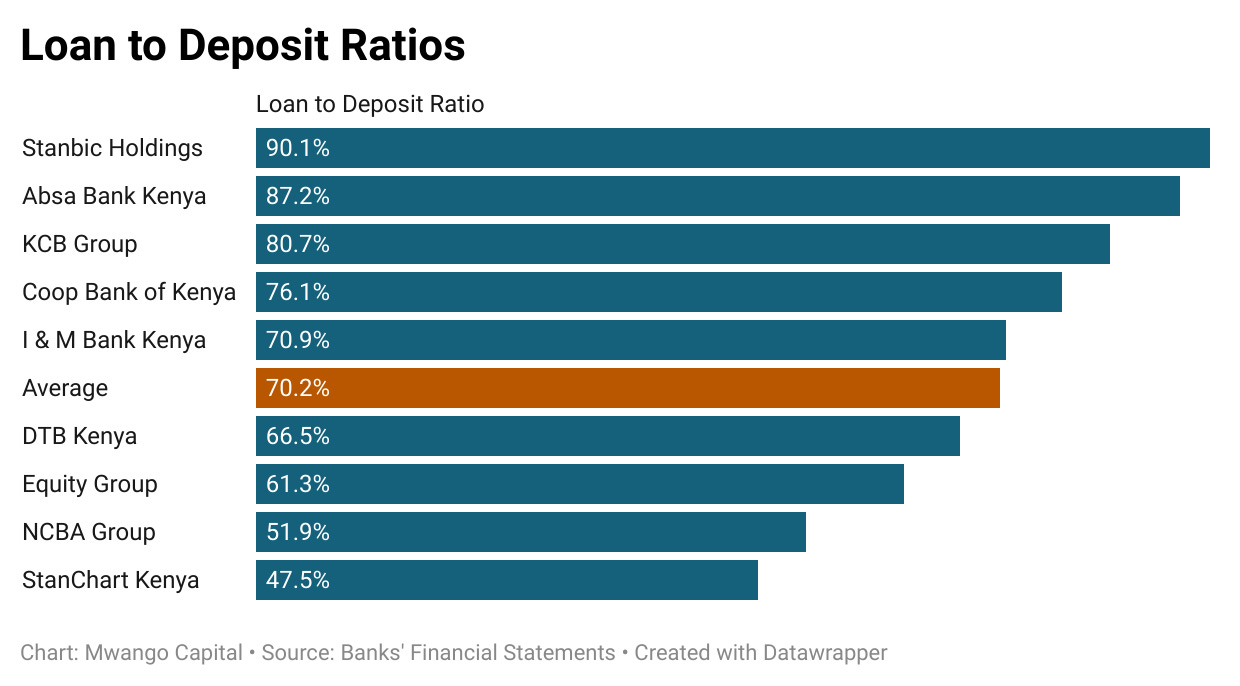

Industry-wide Declining NFI Contribution: DTB’s Non-Funded Income contribution to Total Operating Income dropped from 2020’s mark - a trend that StanChart appears to be the only bank to have evaded in the current reporting period. However, even for StanChart’s case, it is not that clear-cut. Were it to step up its Loan to Deposit ratio from current 47.2% to match or near the average of 70.2% listed banks have registered, its NFI contribution to total revenue would have been suppressed by a potentially higher Net Interest Spread.

I&M Bank 2021 Results

Mixed bag: Net income grew 2.5% to reach KES 8.1B on the back of 22.7% growth in total operating income. The headline growth was not adequately reflected in the bottom line as provisioning grew 69.8% to KES 4.1B at a time where other banks are recording massive deprovisioning and booking record profit growths on the same.

Dividends: The bank is paying KES 1.50 in dividends per share, a growth of 33.3% compared to 2020’s number [KES 1.125]. The payout ratio for 2021 stands at 30.4%.

Jubilee Holdings 2021 Results

Earnings in Brief: Net insurance premiums grew 8.9% to KES 21.9B and investment income edged up 41% to KES 15.9B - pushing net income 67% higher YoY. To investors, the board recommended a KES 9 full year dividend [2020: KES 9] and further recommended to shareholders a KES 5 special dividend per share on Allianz transactions the underwriter engaged in.

Other companies:

Other companies that reported this week include:

NSE: Despite revenue growing by 0.4% on YoY terms, the Nairobi Securities Exchange recommended a dividend of KES 1.40 per share to investors [2020: 0.53]. The NSE has given out two tranches of KES 0.50 special dividend per share in the 2021 financial year, and a KES 0.40 final dividend per share; bringing the total dividend per share to KES 1.40.

Total Energies: While gross sales and net sales came in 13.1% and 14.1% higher YoY, the impact was not translated to the bottom line as net income shrank 16.9% to reach KES 2.7B. With it, EPS took a hit to stand at KES 4.35 [2020: 5.24], cutting down Dividends Per Share by 16.5% to KES 1.31 from 2020’s KES 1.57.

KMRC: The mortgage refinancier reported a 55.6% growth in total assets to push up the balance sheet to KES 9.8B. On the Profit and Loss, total interest income edged up 221% to stand at KES 710.9M, netting the firm KES 196M in income - a 154.6% YoY growth.

What Else Happened This Week?

📱Sharia-compliant Mobile Money: In partnership with Gulf African Bank, Kenya’s most valuable company Safaricom launched a Shariah-compliant mobile money service dubbed Halal Pesa. The facility will loan up to a maximum of 20K and be extended at a 5% Murabaha margin. [Business Daily]

💰Weakening Shilling: The Kenyan shilling has been on a steady decline for the 10th straight month against the US Dollar hitting 115.35 on Friday. [AF24 News]

📈 Inflation in the Up: March CPI numbers pointed to the growing cost of living in the country. March inflation was 5.56% compared to February’s 5.08%. All indices edged up on both YoY and MoM bases. Among the indices, the Food and Non-Alcoholic Beverages index advanced the most by 9.92% YoY while in commodities, LPG Gas prices rose the most YoY by 38.18%. [KNBS]

🌍 DRC Officially Joins EAC: The largest country in the SSA this week officially joined the East African Community, increasing the bloc’s membership to 7. At $274B Cumulative GDP, the bloc now accounts for over 10% of SSA GDP. [Mwango Capital]

🏦Central Bank of Kenya MPC Meeting: In a post MPC press release, the bank’s governor pointed out the growing gross NPLs in the banking sector, highlighting that at least 16 loans account for KES 40B in non-performing loans. Gross NPLs as a proportion of gross loans stood at 14% in Feb 2022 compared to 13.1% in Dec 2021 [CBK]

"I think we reported the NPLs as a ratio of gross loans now stands at 14%. The increase from 13.1% that we reported in December really relates to about is about KES 40B in terms of the facilities or the loans that led to the increase in that ratio and relate to something like 16 accounts or 16 loans. The point to make is this is not systemic across the sectors or for that matter even in a particular sector like manufacturing. It is true there are few of those loans that were in the manufacturing sector but manufacturing has continued to perform very well but for this specific let's say institution that had borrowed because of issues that are specific to them those loans have now been classified as NPLs" - CBK Governor Patrick Njoroge

🏗️Acorn to Float Supplementary Bond in Mid-April: Property developer Acorn Holdings is set to return to market with supplementary offers in mid-April targeting KES 3.2B. KES 2.8B has been earmarked for the income REIT which will be deployed in the acquisition of two new properties in the next 6 months; while KES 400M for the development REIT is slated to go into acquisitions of land. [Nation]

Interest Rate Watch

Kenya: The Central Bank of Kenya held rates steady at 7.00%, highlighting the appropriateness of the current monetary policy stance. [Bloomberg]

Mozambique: Monetary authorities in Maputo hiked interest rates by 200bps to 15.25% - a near 4-year high. Banco de Mozambique cited rising prices among factors behind the hike. [Bloomberg]

Charts of the Week

Fuel prices in Kenya

Loan to Deposit Ratios

Dividend Payouts

Fertiliser Consumption in Kenya

If you like our newsletter, please like and share: