Asset-light Airtel Africa

Airtel Africa sells Tanzanian tower business as it aims to become more asset-light

Welcome to The Baobab Weekly by Mwango Capital, where we bring you a succinct summary of key business news from East Africa.

This week, we cover Bharti Airtel’s sale of its Tanzanian tower business, Safaricom’s risks in Ethiopia, and activity in the NSE bond market as EABL redeems its bonds.

Contacts: Follow us on Twitter, join us on Telegram and check out our website. Also drop us an Email at mwangocapital@gmail.com.

Airtel Africa Becoming Asset-light

Airtel Africa, a subsidiary of Indian multinational telecommunications services company Bharti Airtel, has sold its Tanzanian tower operations for about $175m. The first $157.5 million will be payable on the first closing date while the balance becomes payable on the completion of the transfer of any remaining towers. The deal was a strategic divestment of the group's tower portfolio as the company focuses on an asset-light business model and on its core subscription services. The Airtel Tanzania tower portfolio comprises about 1,400 towers that form part of the group's telecommunications infrastructure network. Bharti Airtel has a presence in 14 countries in Africa.

“The transaction is the latest strategic divestment of the Group’s tower portfolio as it focuses on an asset-light business model and on its core subscriber-facing operations...Around USD 60m from the proceeds will be used to invest in network and sales infrastructure in Tanzania and for distribution to the Government of Tanzania, as per the settlement described in the Airtel Africa IPO Prospectus document published in June 2019.

— Airtel Africa

The group has been on a divestment spree across Africa. Earlier this year, it sold its towers in Madagascar and Malawi to Helios Towers for around $119 million. It also entered an MoU to sell its tower assets in Chad and Gabon by the end of the fiscal year 2022. Airtel usually sells these Towers then enters into lease agreements to use the towers. This helps them become asset-light. This move towards an asset-light model is one Buffett would be proud of:

The four largest companies today by market value do not need any net tangible assets. They are not like AT&T, GM, or Exxon Mobil, requiring lots of capital to produce earnings. We have become an asset-light economy

— Buffett at the 2018 Berkshire AGM

The best results occur at companies that require minimal assets to conduct high-margin businesses – and offer goods or services that will expand their sales volume with only minor needs for additional capital.

— Warren Buffett in his 2020 Annual Letter

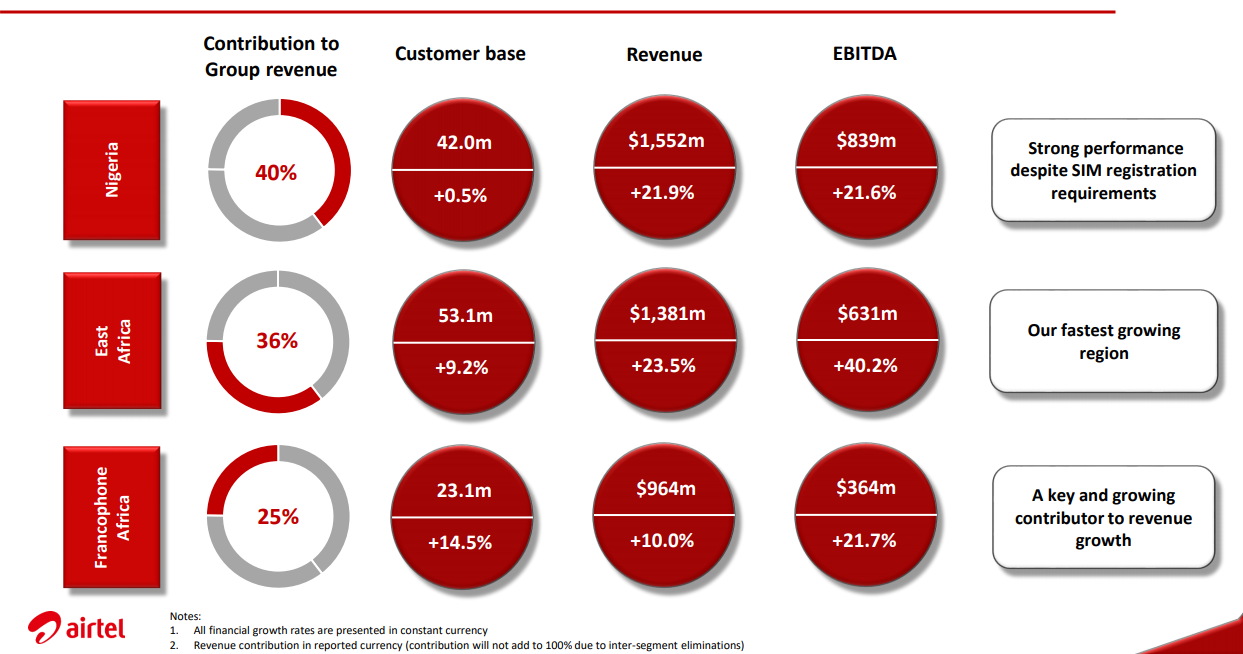

This is how Airtel Africa performed in Financial Year 2021 (year ended 31

March 2021):

How will Safaricom Handle Risks in Ethiopia?

Ethiopia recently awarded a license for telecommunications operations to a Safaricom-led consortium. The Ethiopian government confirmed to have received the license fees this week marking the official start of Safaricom’s business in Ethiopia:

We have begun license execution on May 31st and on June 2nd it has paid 850 million USD to the government through the National Bank of Ethiopia. This money has already been paid to Ethiopia without any pressure under the signature of the provider and license winner.

— Balcha Reba, Ethiopian Communications Authority Director General

However, it seems likely that Ethiopia will issue another telecom license soon. The Ethiopian government stated that it was working on issuing a new tender for another license, with MTN’s CEO stating that if the license was to be reissued with mobile money, the company may consider reapplying. The competition might heat things up:

We are currently making the final adjustments to a new call for tender. The call for expressions of interest will be relaunched for an additional license. If MTN wants to participate again and make a more complete offer, there is a good chance that they will be selected.

— Brook Taye, Advisor to the Ethiopian Ministry of Finance

There are views that the Ethiopian authorities will reissue the license with mobile money, and if they do that and do that and in a relatively short period of time, we will apply our minds on the issue, we have not made a firm decision on that.

— Ralph Mupita, MTN Group CEO

Safaricom’s CEO, Peter Ndegwa, in an interview this week said that the investment in Ethiopia faced political, liquidity, and currency risks. He asserted that Safaricom would take appropriate risk insurance to secure the business against political risk. He also noted the Ethiopian government’s commitment to liberalize its foreign exchange market by 2023 which would reduce the liquidity and currency risks. Medium-term, the company’s risk levels are heightened by the entry into Ethiopia. Capex spending will definitely be high with a slight risk that dividends might be cut to keep the operations in Ethiopia alive. A lot depends on what the government of Ethiopia does from here. We have an article coming up next week on Safaricom and Ethiopia.

Meanwhile, Safaricom continues to dominate activity with 56.5% of the total market turnover for May 2021 at the Nairobi Securities Exchange:

Bonds: EABL Redeems, Family Bank to Issue

The corporate bond markets at the NSE have been busy these past few weeks, with the continuing trend of more redemptions than issuances. NSE-listed firm, East African Breweries Limited, this week issued a notice of its intention to exercise its right of early redemption of the outstanding KES 6B Medium Term Notes (MTN). The early redemption will be effected on June 28, 2021, with the redemption amount being disbursed to holders registered as Notes owners in the CDSC register as of June 14, 2021, following which, the Notes will be delisted from the NSE. EABL issued the MTN in April 2017, with a maturity date of March 2022, and bearing interest at a fixed annual rate of at least 14.17%. This was the second and final tranche of its domestic (MTN) programme, with the first fixed MTN note of KES 5B being issued in March 2015.

On the other hand, Family Bank, which reported strong financials last week, has received the go-ahead to issue a multicurrency Medium Term Note from the Capital Markets Authority. The KES 8B bond will be used to strengthen its capital base and boost lending. The bank intends to raise KES 4B in the first tranche and raise another KES 4B in multiple tranches within the next five years.

We are positioning the bank for the second phase of growth as per our 2020-2024 strategy anchored on the growth and stability of the bank. Through this capital raising, the bank is eyeing to strengthen its capital base to support lending to micro, small and medium-sized enterprises and heavily invest in technology infrastructure while diversifying our product and market offerings.

— Rebecca Mbithi, Family Bank CEO

It was not too long ago in April when the bank redeemed its five and a half years Medium Term Notes worth KES 2B issued in 2015. One can only speculate that the new issue will be at lower rates.

Britam reduces Equity Stake

Notably, Britam, a diversified financial services company, sold 20.1 million shares of Equity Group valued at KES 852m, effectively reducing its ownership in the bank to 6.77% from 7.3% in 2019. In the annual report, the company noted that it was keen to reduce the volatility of its earnings from the exposure in equities stating that it had been gradually reducing the proportion of equities in its Investment Assets portfolio and moving towards fixed income securities. Given the potential in Equity Bank, we are not sure if this is a wise move.

Britam Holding also said it will stop the development of new property. In its 2020 annual report, the company said that it has changed its property strategy from property development to property management services. The company noted that the poor performance of the commercial and residential housing property in Kenya was attributable to the excess supply in the market, which was also struggling with suppressed demand. This caused low occupancy levels and low rental yields that led to revaluation losses and reduced profitability. The company also cited the introduction of capital charge regulations which meant that more capital would be required for property investments.

Nuggets of wisdom from Twitter Spaces

This week we hosted Thinkst Canary CEO, Haroon Meer, on our Twitter Space, where we discussed start-ups and bootstrapping. Here are a few lessons and insights from the conversation:

Specialization/Focus: Haroon and most of the early Thinkst team have been in the security industry for a long time. This allows you to see trends and problems in the industry that others might not be able to see. Also, by actively participating in community events, you build credibility and that makes it easier to build traction. For example, Haroon has been speaking at DefCon and other security conferences for a long time. Also, aim to build a good reputation in the industry you want to operate in.

Building products allows you to scale faster/better than consultation: Consulting is a good way to get started, but eventually, your growth is constrained by your ability to get and nature good people. Consulting is basically selling man-hours. The effort to recruit and retain talent can soon be overwhelming. Building products on the other hand allows you to scale. Once a product attains market-fit, scaling is limited by your ability to sell and support customers. Experiment and build products early in your life, preferably while in university. Get someone to pay you as quickly as possible. This helps you learn to be good at making money.

Customer obsession: Always have a customer obsession. Go out of your way to support your customers. If you err, own up to your mistakes and make sure the customer feedback is heard and taken seriously. Also, be proactive. If you fail to deliver as promised, make sure you are transparent with your customers.

Value/Nature talent: All great companies are built on a small core of employees that are massive producers. For most companies, this could be a handful of employees. Find these people that believe in your mission and build around them.

On bootstrapping vs seeking external funding: He leans more towards bootstrapping but if you are to get external VC funding, remember this old saying: "VCs invest in exits, not companies." Once VCs invest in you, it serves them well to talk about your company in their circles. Having good VCs is important as they hook you up with your typical customer. Bad VCs give you money and headaches. Know the value the VC is bringing onboard before giving away a part of your company.

Join us next week on Twitter Spaces as we bring a Private Equity player to discuss the healthcare industry in Kenya and a bank CEO to help us understand their bank better.

Other Q1 2021 results

Bank of Kigali Group Q1 2021 [vs Q1 2020]:

Net interest income up 15.8%

Provisions down 6.3%

Other income up 34.9%

EPS up 79.3%

Total assets up 6.4%

CitiBank Q1 2021 results [vs Q1 2020]:

Total Assets up 21% to KES 115B

Total Interest Income up 9%

Customer Deposits up 34%

Loans & Advances up 50%

PAT down 3.3% to KES 902m

Consolidated Bank Q1 2021 results [vs Q1 2020]:

Total Assets up 13% to KES 13B

Total Interest Income up 11%

Customer Deposits up 5%

Loans & Advances up 20%

Loss After Tax down 18% to KES 58m

Kenya Re 2020 results:

Gross written premiums up 5.7%

Claims incurred up 21.7%

Profit before tax down 4.6%

Total Assets up 5.7%

Dividend of Kshs. 0.20 (DPR:20%)

Other noteworthy items:

Standard Chartered Bank Kenya received approval from the Central Bank of Kenya to start digital mobile lending. Also, Patrick Obath retired as the Chair of the Board at Standard Chartered Bank Kenya with effect from May 30, 2021, with FCPA Kellen Eileen Kariuki takes over as the new Chair of the Board with effect from May 31, 2021. We wish her well.

May’s year-on-year inflation rose to 5.87% from 5.76% in April. CPI increased by 0.20% from 114.746 to 114.977 in the same period.

We learned that Equity bank [@KeEquityBank] holds 41% of its balance sheet in US dollars to fund cross-border transactions.

Treasury reopens 20-Year fixed-coupon treasury bonds Issue FXD1/2019/20 with a tenor of 17.9 years and FXD1/2012/20 with a tenor of 11.4 years. It’s seeking to raise KES 30B for budgetary support.

WPP Scangroup PLC pushed its results release date from May 31, 2021, to July 31, 2021, due to the ongoing investigation following the recent senior management changes.

Two Rivers Development Limited opened the next phase of the sale of bulk land rights to developers. Two Rivers Development Ltd has up to 1.3m square metres of space available under the bulk sale plan. Development rights include the land and key infrastructure such as power, water, sewer, ICT, and sports and social amenities. Later this month, Centum reports its FY 2021 results.

Tanzania to begin building the delayed $30B natural gas project within 2 years as talks with companies including Equinor restart. Plans for an LNG plant on the country’s Southern Coast and a pipeline connecting offshore fields have been under consideration since 2014.

The IMF’s staff have this past week agreed to provide $1B to Uganda $1 billion under the Extended Credit Facility (ECF).

Devki Group of Companies withdraws bid to lease Mumias Sugar Company (in receivership) due to increased public scrutiny in the transaction, with Western Kenya politicians voicing their opposition to the lease earlier this week.