👋 Welcome to the Baobab Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.This week,we cover an upcoming busy week in bank earnings, CBK’s approval of Equity Bank’s risk-based lending model, and MTN Uganda FY 2021 results.Our newsletter this week is brought to you by:

Mwango Capital. Mwango Capital provides A+ quality analysis and research on the East African capital markets. Follow us on Twitter, join us on Telegram, and check out our website. To sponsor our weekly newsletter, memes, or Twitter Spaces, reach us at hello@mwangocapital.com.

First off, our weekly business news in memes:

Bank Earnings Ahead

Stanbic went first: Stanbic was the first listed bank to release its results in what is a month of releases for FY2021 results.

This week: In the coming week, Standard Chartered will release results on the first trading day of the week. Tier 1 banks, including Absa, Equity, KCB, and Cooperative, are slated to release their annual results mid this week.

Keep it here: We will give you the full analysis throughout the week and in next week’s newsletter. We are keenly following the growth in total assets, the issuance of dividends, and the approvals for risk-based lending.

Equity’s Risk-Based Lending

First Approval: CBK this week granted approval to Equity Bank to price their loans according to customer risk, becoming the first Tier 1 bank to get risk-based lending approval.

“Interest on loans will now be based on the risk of the client. We are using sovereign risk as the base, then adding the risk of the individual sector and then within the sector the specific client risk and then we add operational costs. So instead of the previous [pricing model] where we had loan appraisal fees, and all the rest, we are now saying here is one rate of interest and it is annualized and on reducing balances.”

James Mwangi, CEO Equity Bank

Impact: Net interest margins are expected to increase while the bank projects that yields on loans will come in at 12% in FY 2022, up from 11.8% in Q3 2021. For banks that are heavily invested in government securities, higher and attractive interest rates will lead to more loans to the private sector leading to higher interest income.

Mwango Explainer: Risk-based lending is where a financial institution adopts a tiered pricing structure that assigns loan rates that take into account an individual’s or company's credit risk. Financial institutions like banks are able to charge more to higher-risk borrowers and offer lower rates for more credit-worthy members.

Bank charges: Equity Bank this week asked the CBK to reinstate bank charges on bank-to-mobile money wallet transfers. The charges were waived as part of financial intervention measures to counter the pandemic 2 years ago.

MTN Seeks Investors

Spin-Off: MTN Group, Africa’s largest telecommunications company, is looking for minority investors in its African fintech unit. The telco has spun off its fintech division to a fully-fledged outfit, separating it from the core telecoms business. The modalities for the spin-off are expected to be complete by the end of June with the is aimed at maximizing growth in the fast-growing sector.

$429.4B: M-Pesa and MTN Mobile Money are among the leading mobile money solutions offered by telcos in Africa. In 2021, M-PESA transaction value reached $190B, while that of MTN Group topped $239.4B. Cumulatively, these two telcos moved $429.4B through their mobile money systems - almost 25% of 2020 SSA GDP.

FY 21: MTN Uganda’s Profit After Tax grew 20.4% to USHS 340.4B (KES 10.79B). The telco will pay USHS 335.6B(KES 10.64B) in dividends, a 98.59% dividend payout ratio.

Coverage: The telco set up 664 4G sites in 2021, a 55% YoY increase, putting coverage at 62.7%. 3G sites grew 23% YoY. Active data users grew 16% with the 4G sites play helping the telco book $412B in data revenue.

What Else Happened This Week?

🌐 Jubilee Adds SEACOM Stake: Jubilee Holdings acquired a 10% additional stake in SEACOM - a cable systems and communications company with operations - raising its shareholding from 8.8% to 18.8%. [Jubilee Holdings]

📱 M-Pesa Milestone: M-Pesa reached 30M monthly active customers this week as businesses accepting payments on Lipa Na M-PESA grew 124% from April 2020 to reach 387,000. Africa-wide, M-Pesa has 51M users. [Safaricom]

😷 Covid Measures Eased: The Ministry of Health has lifted mask and temperature screening requirements in public spaces and offered new guidelines on public road transport and air travel. [The East African]

📈 Rising Prices: Bamburi Cement issued a notice for a 2-10% price hike for its Nguvu, Tembo, and Fundi brands as a result of rising costs of input raw materials. [Mwango Capital]

🚌 Electric Bus Launch: BasiGo, a local electric vehicle startup, has launched its KES 5M 25-seater electric. The firm will run a pilot programme in partnership with Citi Hoppa and East Shuttle. [Business Daily]

🔌 EV Charging Capacity: Kenya Power’s acting CEO Rosemary Oduor says the utility has the capacity to charge electric vehicles with its installed capacity of 2,991MW and an off-peak load of 1,200 MW. [Business Daily]

Charts of the Week

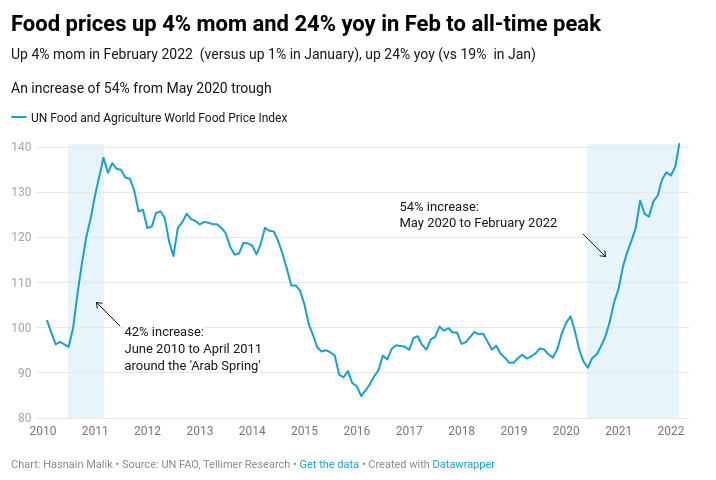

Food Prices: FAO index rose to an all-time peak in February as countries worldwide experience food inflation.

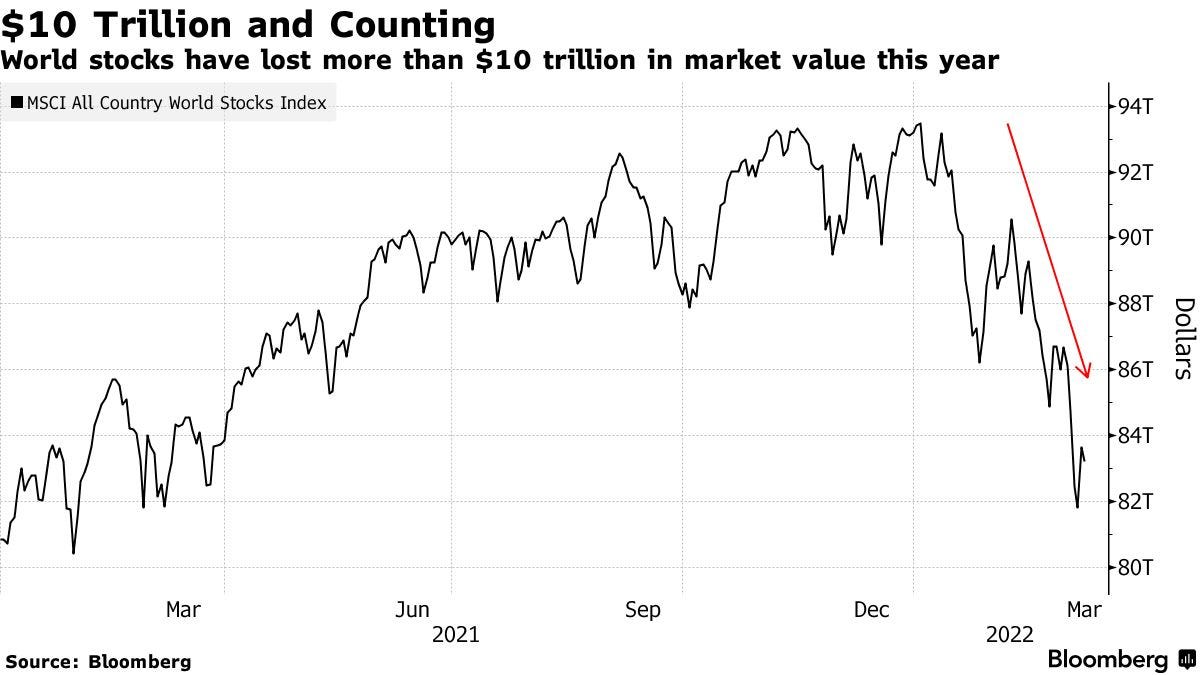

Global Sell-off: Equities worldwide have so far experienced a $10T drawdown in 2021.

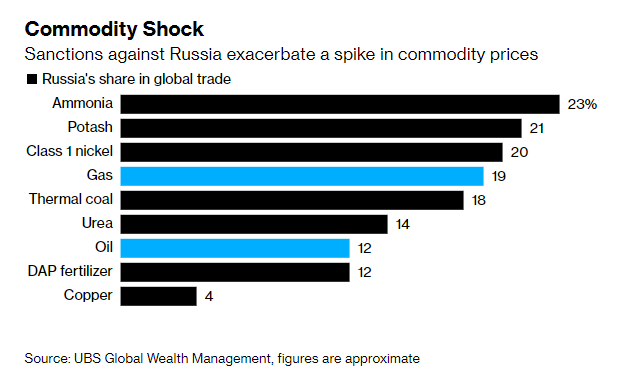

Commodity Disruption: Sanctions on Russia over the Ukraine invasion have stifled trade and commodity prices are showing it.