Budget Week in East Africa

East African countries’ finance ministers laid out their FY 2021/22 Budgets

Welcome to the Baobab, a capital markets newsletter that provides a succinct summary of key business news items from East Africa.

Send us your feedback to mwangocapital@gmail.com and on Twitter at @MwangoCapital

Don’t miss! Next week on our Twitter Spaces, we host I&M Bank Kenya CEO Kihara Maina to help us understand the bank better.

This week we cover the East Africa countries’ FY 2021/2022 budget, Williamson Tea Kenya’s profit warning, and Crown Paints’ takeover exemption

Budget Week

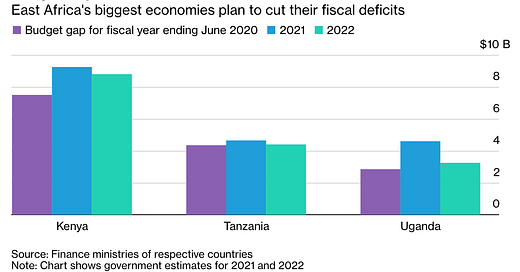

What Happened? On Thursday this week, the East African countries’ finance ministers laid out their FY 2021/22 Budgets simultaneously, a requirement of the East Africa Community treaty. Planned expenditures for the next fiscal year were different for Kenya [Kshs. 3.66T ($33.9B)], Tanzania [Tshs. 36.3T ($15.7B)] and Uganda [Ushs. 44.7T ($12.6B)]. The countries all have plans to reduce their huge budget deficits as shown below:

Source: Bloomberg

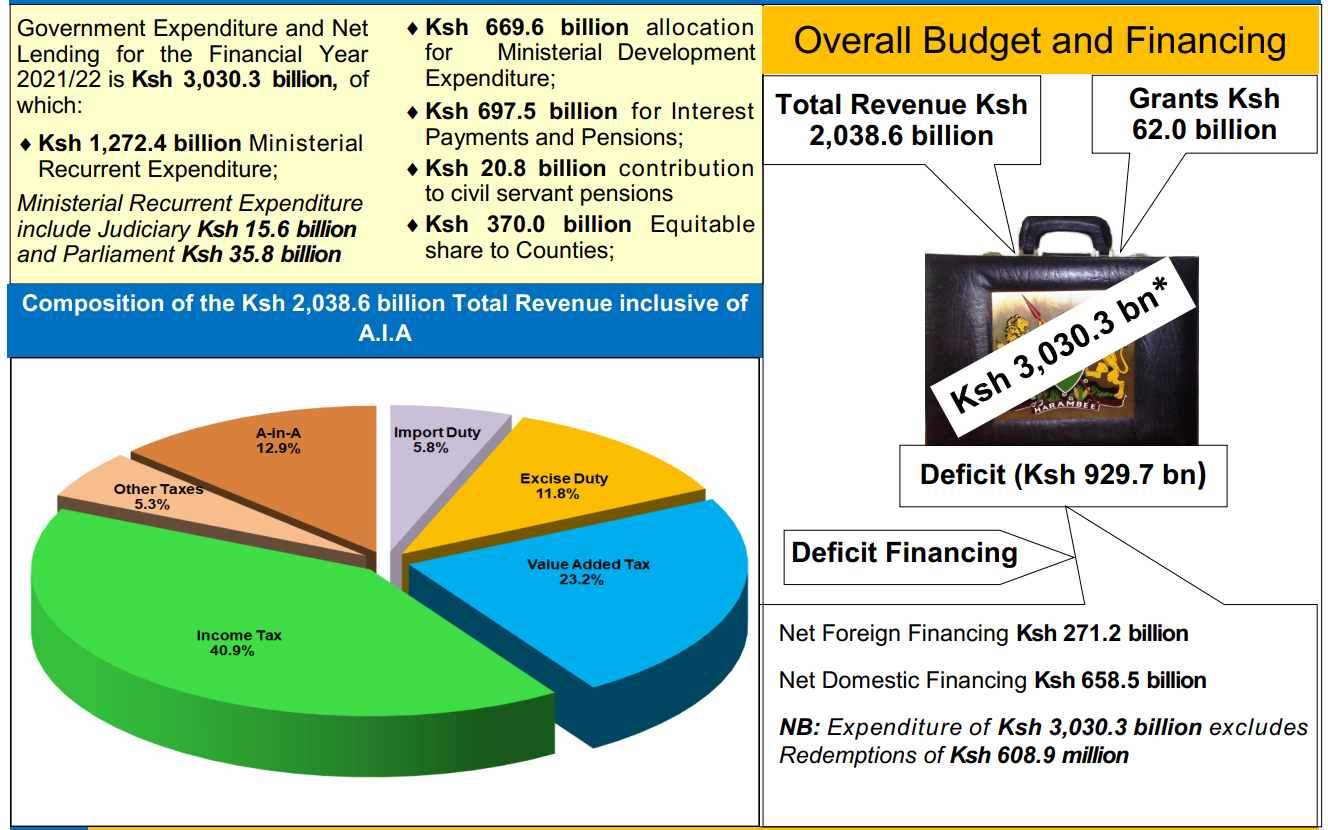

In Kenya, National Treasury Cabinet Secretary Ukur Yatani released the FY 2021/22 budget with government expenditure and net lending for this financial year standing at Kshs. 3.030T. That excluded debt redemptions of Kshs. 608.9B.

Source: Kenyan Government

Growth prospects: The Kenyan Treasury estimated that economic growth had slowed down to 0.6% in 2020 from 5.4% in 2019 and projected that the economy was expected to bounce back to around 6.6% growth in 2021 supported by a stable macroeconomic environment and a resumption of full economic activities due to the ongoing COVID-19 vaccinations, for which Kshs. 14.3B was earmarked. Across the border, Tanzania seemed a little less optimistic with an expected growth of 5.6% this year from 4.8% in 2020 with Uganda projecting even less growth of 4.3% this year [versus 3.3% in 2020].

“We remain committed to reducing the level of tax exemptions to create parity of treatment, while also raising more revenues to fund social programs and reducing the fiscal deficit”

- National Treasury Cabinet Secretary Ukur Yatani

Want to learn more? We shared a link to the Kenyan budget statement and budget highlights here. The full budget speech from Uganda can be found here. Citizen Tanzania has some excellent analysis of highlights from the Tanzanian budget. A number of subject matter experts covered various components of the Kenyan budget extensively on Twitter. Here are some of our favorite informative threads: Ramah Nyang, Wehliye Mohammed, and Reuben M. Wambui

More Profit Warnings

Williamson Tea Kenya this week announced a profit warning for the year ended 31st March 2021

What this means: They expect their profits for the year ended 31st March 2021 to decline by 25% from the Kshs. 137m they posted in FY 2020. They cited a depressed property market leading to losses on the revaluation of the group’s investment properties coupled with rising production costs and lower global market prices impacted by COVID-19 (Find the press release on Mwango Capital Twitter). Here is how the company has performed for the last 5 years:

Do note: The decline in profits has more to do with non-cash charges than cash charges, and therefore the liquidity of the company is not affected by this. A challenging macro environment has made it difficult for companies, with several listed companies projecting losses and issuing profit warnings in the latest financial year.

Rights Issues

Crown Paints this week received CMA’s authority with respect to a takeover exemption application. The company had earlier announced that it intended to raise approximately Kshs. 711.8m through a renounceable 1:1 rights issue, for which it subsequently received board and shareholder approval.

The Mwango Explainer: For the 1:1 rights issue, if you own 1 share of Crown Paints, you get the right to buy 1 more share of it at a discount. The shareholders can renounce that right meaning they can trade them on the open market separately. A non-renounceable right is not transferable, and therefore, cannot be bought or sold

Importantly, since the major shareholders, Crown Paints and Building Products Limited and Barclay Holdings, hold 62.05% of the issued share capital, an acquisition of an additional stake in the Company by either of them would trigger the need for the major shareholders to make a take-over offer. The Company, therefore, applied to the CMA for an exemption allowing the major shareholders to acquire additional shares beyond their pro-rata allocation thereby increasing their shareholding in the Company beyond their current 62.05% shareholding should the rights issue not be fully subscribed.

The company also released its FY 2020 results [vs 2019]:

Revenues were up 7% [2019: up 3%]

Profit before tax was up 63% [2019: up 33%]

Profit after tax was up 85.6%

No dividend was declared

TransCentury Ltd also received shareholders’ green light at its AGM for a rights issue to raise additional capital.

Source: NSE

Why this is important? The two companies need additional capital and they are choosing to raise it from existing shareholders at a discount.

More Loans

The World Bank has approved $750m in development policy financing to Kenya to support policy reforms that will strengthen transparency and accountability in public procurement and promote efficient public investment spending. The funds are aimed at improving medium-term fiscal and debt sustainability:

"The operation prioritizes reforms in hard-hit sectors, such as healthcare, education, and energy, which have been made urgent by the impacts of the COVID-19 crisis. In recognition of the severity of the crisis and the need for a comprehensive response, we are supporting the government’s post-COVID-19 Economic Recovery Strategy, which is designed to mitigate the adverse socio-economic effects of the pandemic and accelerate economic recovery and attain higher and sustained economic growth.”

Keith Hansen, World Bank Country Director for Kenya

“Stabilizing the debt trajectory and reducing high debt costs is a top priority. This policy operation supports measures to reduce the budget deficit over time, such as by making public spending more efficient, whilst minimizing debt costs by helping to meet the government’s current financing requirements on concessional terms.”

Alex Sienaert, Senior Economist and Task Team Leader, World Bank Kenya

The East African picture: Last week, IMF’s staff agreed to provide $1B to Uganda under the Extended Credit Facility (ECF). Tanzania expects a $574m loan once it publishes the Covid-19 data as requested by the IMF. Kenya, Uganda, and Tanzania need to borrow ~$16B to fund their economic revival and plug the significant budget deficits.

Notable Items:

In an interesting trading session on June 10 this week, the NCBA counter witnessed massive action with 54.4M shares being traded. With total volume traded for the day hitting 67.6M, the NCBA counter accounted for 80.47% of market volume (Mwango Capital).

Kenya Breweries Limited to spend Kshs. 1B on an additional line for local spirit production as demand for spirits grows faster than that for beer. The funds will be used to purchase new line machinery and expand storage capacity at its sister company, UDV Kenya

Nairobi Securities Limited (NSE) resolved to incorporate the Nairobi Securities Exchange Ltd to be a wholly-owned subsidiary that runs securities business during its 67th AGM last week. NSE will be renamed to NSE Group Plc, which will be a non-operating holding company.

Rubis Energy is suing for a Kshs. 4B refund from Gulf Energy for overvaluation in the 2019 buyout deal. Rubis Energy made the demand after retrieving former Gulf Energy’s staff members’ deleted files from the company’s servers.

The Kenyan government will make a compulsory acquisition of 44.7ha of land in a move aimed at expanding the Angama airstrip to accommodate larger commercial aircraft and boost connectivity to the tourism-rich area.

Kenya Airways picks the British consultancy firm Steer Group to help it analyze its most viable turnaround options.

The Kenya Tea Development Agency Holdings has received the green light for future listing at the Nairobi Securities Exchange, as the new shareholding structure takes shape.

The tax tribunal has ordered the State Bank of Mauritius (SBM) to pay Kshs. 400m in taxes and penalties on a Kshs. 9.6B interest-free loan it took from the Central Bank of Kenya during the purchase of the collapsed Chase Bank's assets.

Kenya Power canceled a tender in which it sought a restructuring technical adviser to implement its plans for debt and electricity theft reduction and renegotiation of bulk power purchases.

Kenya Revenue Authority deactivated 66,000+ PINs of individuals and businesses that had defaulted on their VAT payments, effectively stopping the affected from making transactions that require proof of active registration as taxpayers until they are reactivated.

Hackers breached the Nairobi Metropolitan Services’ online application system, forcing a suspension of development plan approvals.

Nairobi Securities Exchange Plc appoints Donald Wangunyu and Stephen Chege as directors. Paul Mwai, CEO of AIB-AXYS Africa was appointed as the Vice-Chairman of the Exchange, replacing Bob Karina of Faida Investment Bank.

NCBA placed Multiple Hauliers under the administration of Ernst & Young. The administrators have taken control over the company’s business assets and management affairs and will engage key stakeholders of the company to work out the best possible outcome.