Welcome to the Baobab Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.

This week, we cover Carbacid FY 2021 results and the start of the Kenyan banks’ earnings seaosn. We also take a look at Centum’s Private Equity business.

Our newsletter this week is brought to you by:

Vuka. Vuka is a product from Acorn Holdings Limited. Vuka is committed to providing access to quality real estate investments. Through them, you can purchase a limited number of units to be purchased within VUKA. Check out their website for more details:

Carbacid Reports 28% Profit Growth

Turnover grew 32.8% to Ksh 906.6m translating to operating profit of Ksh 553.6m [+30.5%].

Profit after tax came in at Ksh 415.1m [+27.9%] after an income tax expense of Ksh 125.2m on profit before tax of Ksh 540.3m [+26.5%].

Cash rich: Net cash from operating activities rose to Ksh 487.8m [+25.2%] helping the company finish with Ksh 167.6m in cash and cash equivalents [FY 2020: Ksh 6.1m].

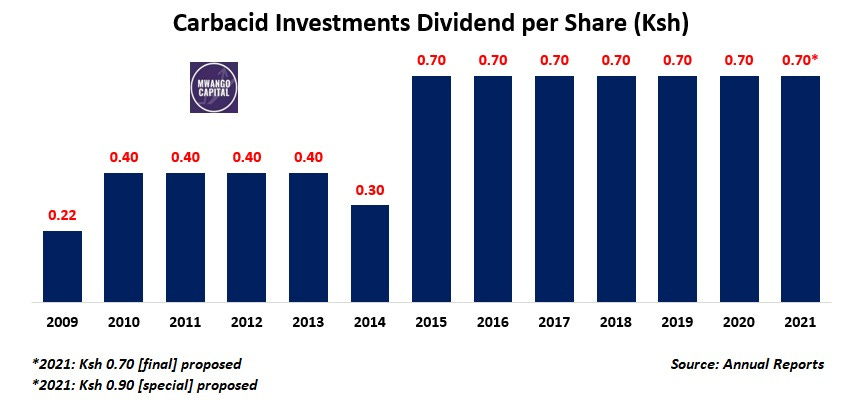

Special dividend: The board resolved to recommend a final dividend of Ksh 0.70 plus special dividend of Ksh 0.90 translating to a total payout of Ksh 407,763,176 and a 12.3% dividend yield (as per Friday’s Ksh 13.05 closing price).

Who’s CEO?: The firm’s annual report doesn't make mention of the CEO despite extensive mention of the board and the chairman.

Find the full results here.

Banks’ Earnings Season

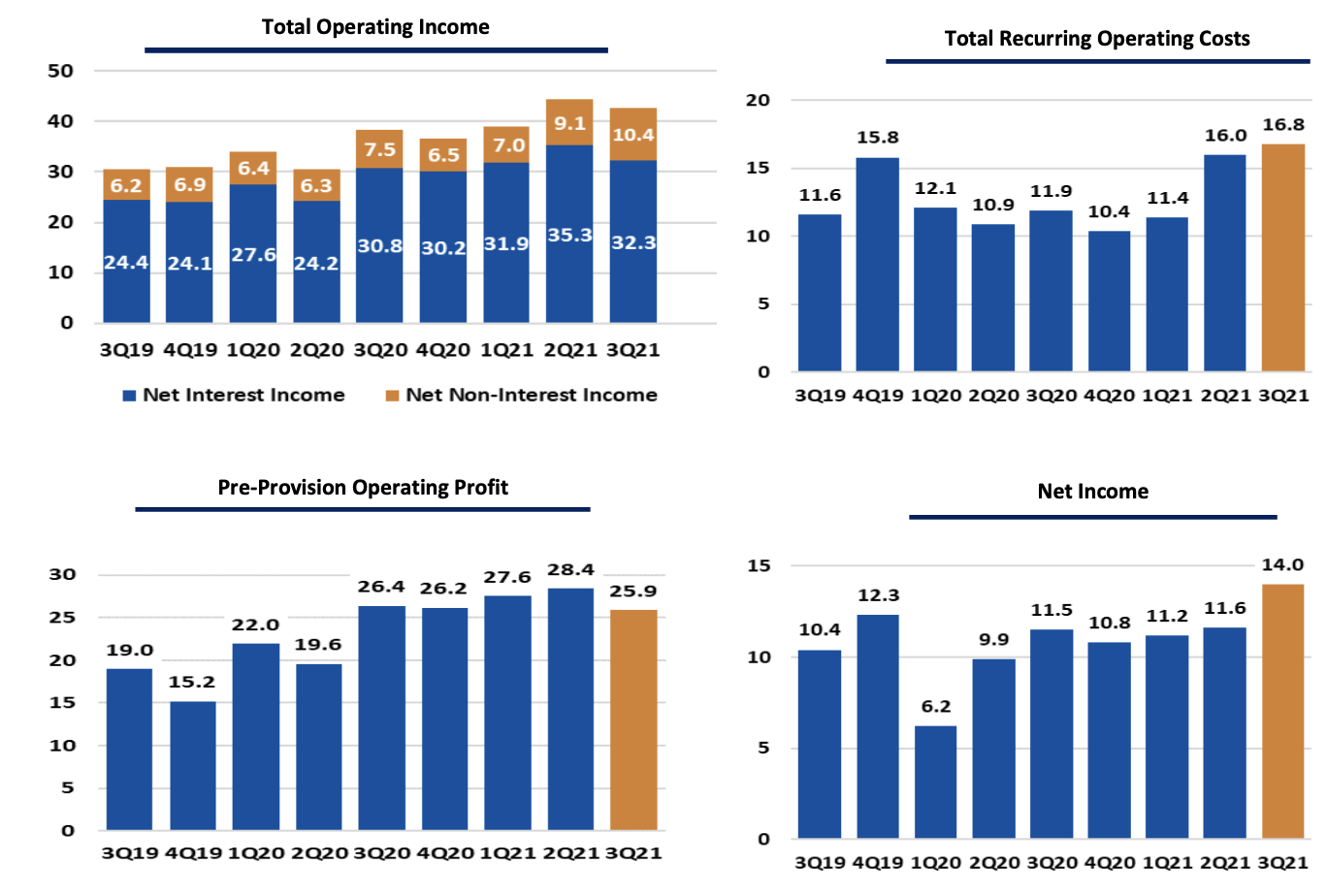

Results trickling in: Kenyan banks have started reporting their Q3 results with BK Group reporting this past week.

BK Group posted impressive results with total operating income up 23% and profit after tax jumping 33% to Rwf 36.7B. Net loan provisions were up a modest 3.6%.

“BK Group Plc recorded strong growth in Q3 & 9M 2021; we have recorded double digit growth on all key performance metrics and have kept a prudent stance with regards to impairements…We are happy to see improvement in asset quality which allows us to look forward to close the year with a solid performance.”

Dr. Diane Karusisi, Chief Executive Officer.

Find our analysis of the earnings here.

Equity Reports: Kenya’s largest bank by asset base Equity Group Holdings, is due to report on Monday, 6th November 2021. The rest of the big banks are expected to report within the month.

In Tanzania: Banks are mostly done with Q3 results and have reported some exceptional results.

In an analysis done by The Citizen Tanzania, 13 of the most profitable banks in Tz had a 35.7% YoY increase in profits to TShs 471B in the 9-month period to 30th September. NMB Bank and CRDB Bank accounted for 80% of this profit.

Week Ahead:

We will host Bank of Kigali Group CFO Nathalie Mpaka on Twitter Spaces on Tuesday 9th November 2021 from 7pm EAT for a discussion of their Q3 earnings.

We hosted the BK Group CEO last month and we will be posting a recording of the podcast on Monday, 8th November.

Centum Targets New Acquisitions

East African targets: Ksh 5B has been set aside by Centum’s PE arm as it scouts for profitable businesses looking for growth capital or or firms whose owners are seeking to cash in on part of their equity investment.

“We are building a promising pipeline of deals, we’re in talks with a number of investee targets that we hope to conclude in the coming months. Three of the targeted firms are based in Kenya while two are in neighbouring countries”

Managing Partner Centum Capital Partners (CCP), Fred Murimi

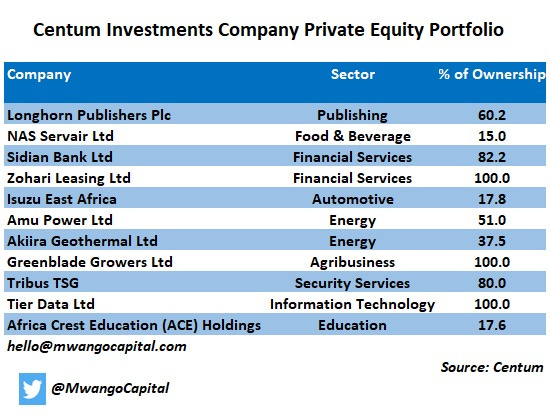

Centum’s current private equity portfolio (20.5% of its Ksh 47.5B total assets) includes household names such as Sidian Bank, Longhorn Publishers, and Isuzu East Africa.

Mwango Explainer: Private Equity (PE) refers to investments (either debt or equity) made into companies that are not publicly traded.

Highlights from Twitter Spaces

This week, we hosted Acorn Holdings Founder & CEO Edward Kirathe and Chief Investment Officer Raghav Gandhi for a discussion on how Acorn is transforming Kenya’s capital markets. Here are a few highlights from the conversation:

Acorn’s History: Acorn started off in the development management business undertaking notable projects including former Coca Cola Regional HQ (Upper Hill) and Deloitte East Africa (Waiyaki Way). The company later ventured into property operations and investment management. CEO Edward Kirathe has been in the real estate space for 25 years.

Wealth creation through capital markets: Capital markets offer a great opportunity in building wealth. REITs, for instance, offer great investing opportunities due to their tax incentives. Even with past issuances having gone wrong, development of the capital markets still needs to continue. “Don't abandon our capital markets even if some companies have failed,” Edward Kirathe said.

Real estate in Kenya: The real estate investment space is largely unregulated and thus filled with developers with no expertise and experience. A substantial amount of capital tied up in the real estate sector is dead and needs unlocking. Edwin Kirathe estimates that land owned speculatively by Kenyans in the Nairobi Metropolitan Area is worth Ksh 12T ($120B), more than Kenya’s annual GDP.

Kenyan corporate debt markets: Acorn will continue being a regular participant in Kenya’s corporate debt market. Having recently upsized the Medium Term Note (MTN) Programme Amount to Ksh 5.7B from Ksh 5B, Acorn can issue additional notes.

Acorn’s future: Having started in student accommodation, the next phase for Acorn is the Private Rental Sector (PRS) providing rental housing for young professionals.

We will be sending out a podcast of this Twitter Space next week. Subscribe to get a notification:

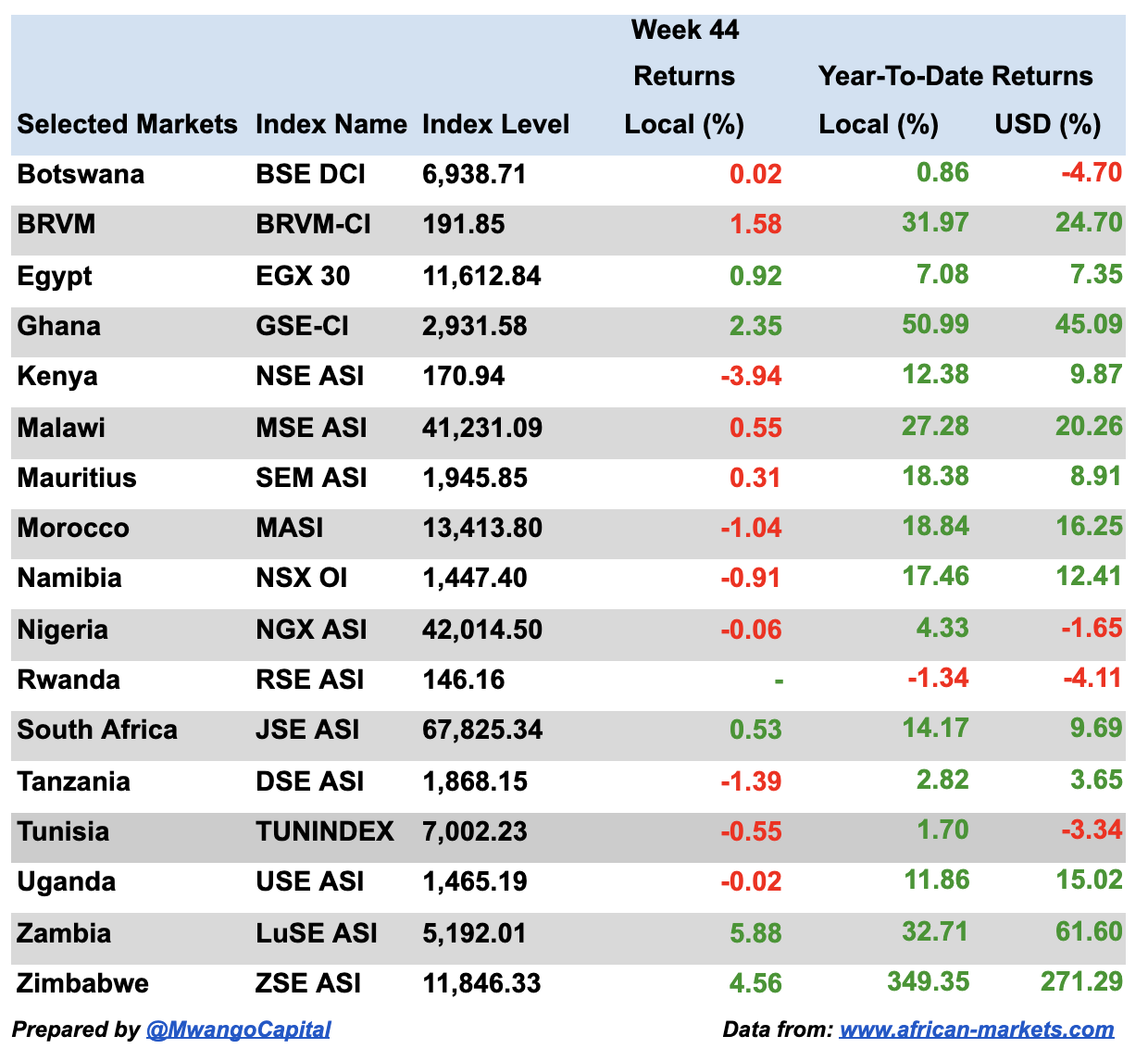

African Markets this Week

In East Africa, Kenya recorded a 3.94% drop in the Nairobi Securities Exchange All Share Index, closing the week at 170.94, down from last week’s 177.96. Tanzania’s DSE ASI was down 1.39% to close at 1,868.15 down from last week’s 1,894.44, while Uganda’s USE ASI recorded a 0.02% drop to close at 1,465.19.

Across Africa: Zambia’s LuSE ASI recorded the highest increase in returns this week, up 5.88%, to close at 5,192.01.

Charts of the Week:

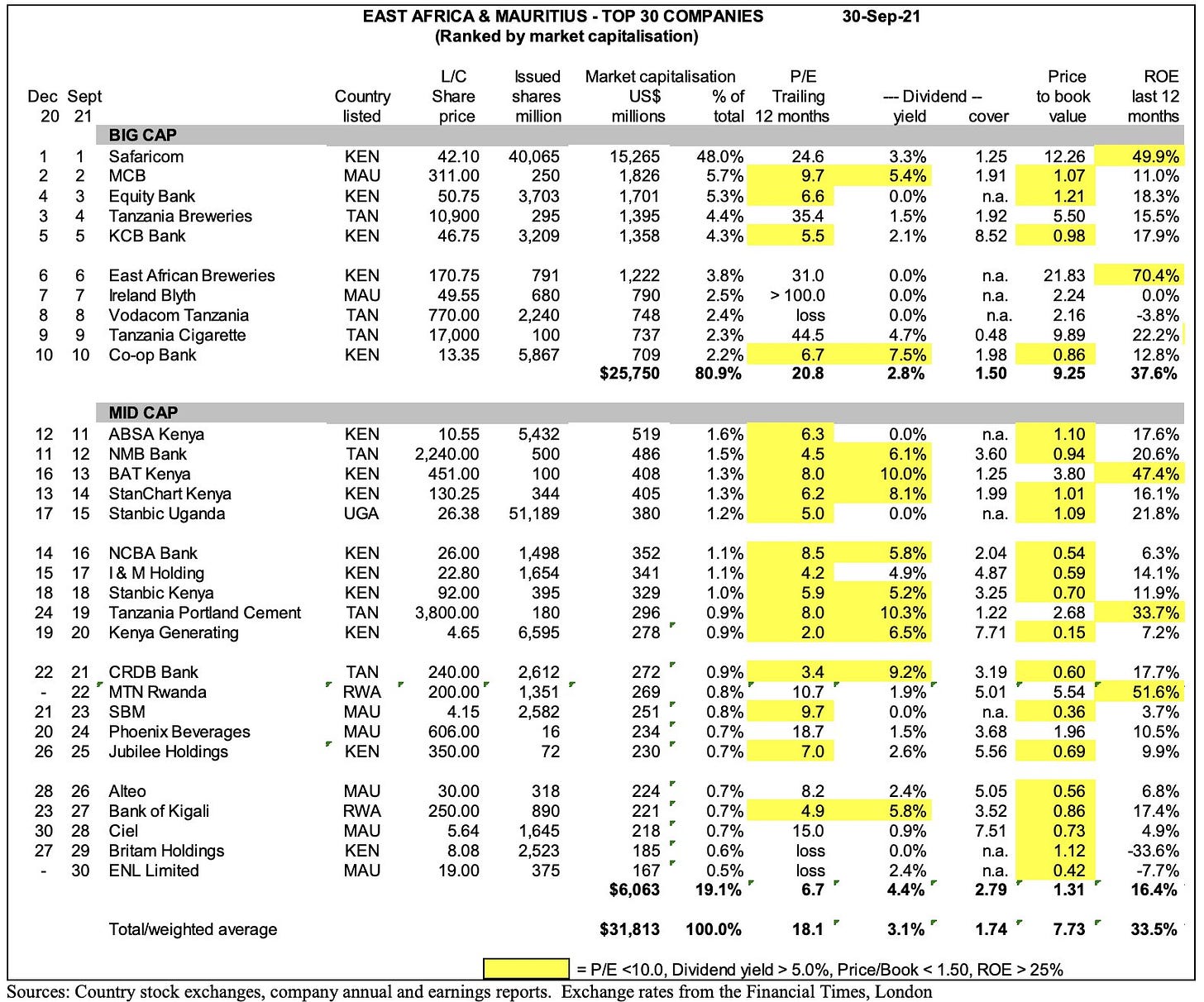

Top 30 Companies in East Africa and Mauritius:

Source: African Financials

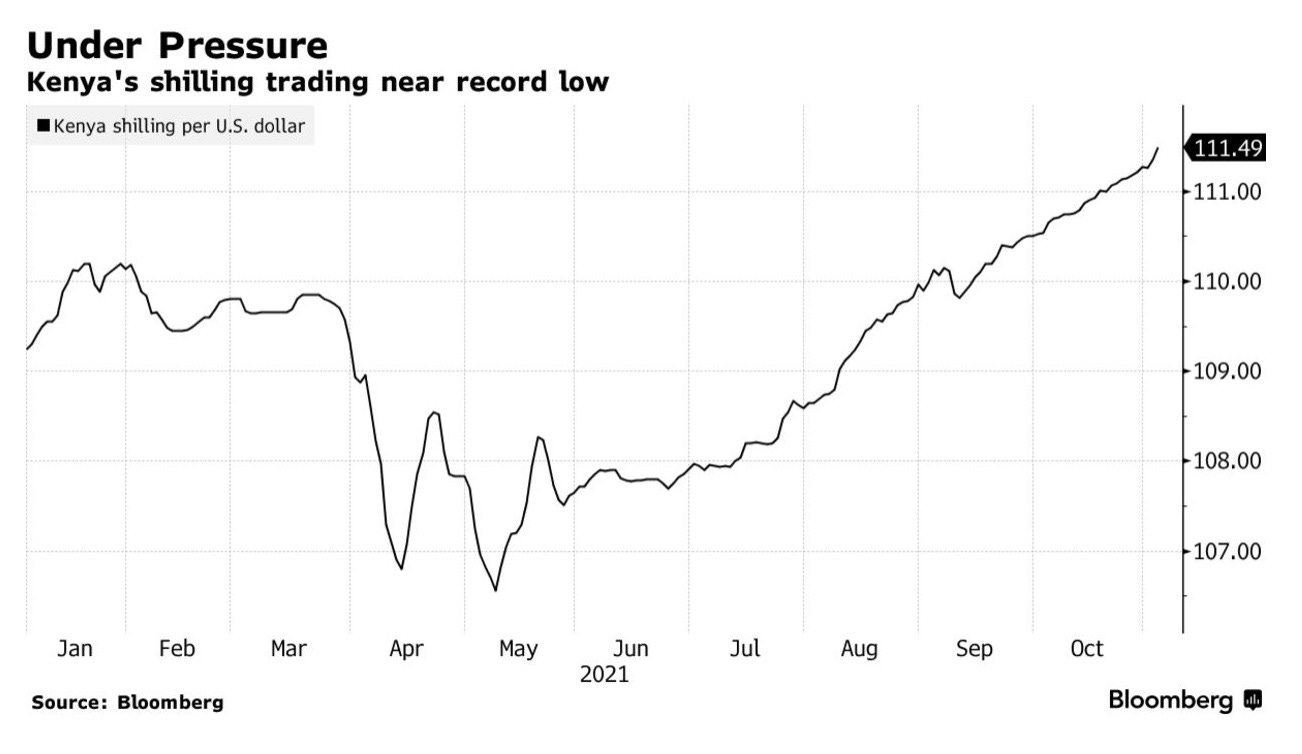

The Kenyan Shilling:

What Else Happened This Week?

Telco dominance? Safaricom shrugged off accusations of being abusive of its dominant position in Kenyan telco market and asked competitors to “work hard and innovate” [Business Daily + Nation].

IMF’s Extended Fund Facility: Kenya set to access Ksh 29.4B following conclusion of second review. Total draw down in 2021 stands at Ksh 109.7B (program size is US$ 2.34B) [IMF].

Taxman surpasses target: KRA continued it’s strong run collecting Ksh 154.38B in October against its target of Ksh 142.29B [Julians Amboko]

Fixing Kenya Power: Top leadership of the supply chain division at Kenya Power were suspended to pave way for a forensic audit [Julians Amboko].

Deals:

Food distributor Twiga Foods announced a $50m Series C round to expand across Africa [Tech Crunch].

Payments company Chipper Cash has raised $150m in a Series C extension round [Tech Crunch].

Kenya-DRC mission: Kenya, DRC governments announced a 15-day trade mission to DRC from 29th November 2021 to 13th December 2021 [Equity Group Holdings].

Ethiopia: A 6-month long state of emergency declared. How will this impact Safaricom’s presence in the nation? [Reuters].

Kigali International Financial Centre: Qatar Investment Authority and Rwanda Social Security Board (RSSB) are the anchor investors in a $250m investment fund dubbed “Virunga Africa Fund 1” [KIFC].

It’s telcos v banks in Nigeria: MTN Nigeria and Airtel Africa receive approval in principle from Central Bank of Nigeria to operate as payment service banks [MTN Nigeria + Airtel Africa].

If you enjoyed our newsletter, please share it:

This newsletter is a product of Mwango Capital. Mwango Capital provides A+ quality analysis and research on the East African capital markets. Follow us on Twitter, join us on Telegram, check out our website. If you would want to sponsor our weekly newsletter and Twitter Spaces, contact us via email at hello@mwangocapital.com.