Welcome to the Baobab Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.

This week we cover earnings at the NSE as Centum, EABL report their FY ended 2021 results, the hard hit hospitality industry and President Uhuru Kenyatta’s visit to the UK.

Our newsletter this week is brought to you by:

Mwango Capital. Mwango Capital provides A+ quality analysis and research on the East African capital markets. Follow us on Twitter, join us on Telegram, check out our website and drop us an email at mwangocapital@gmail.com for any engagements.

Centum swings into loss, cuts dividends

A swing from profit into losses: Centum Group reported a Kshs 1.37B net loss in the financial year ended March 2021 a swing from the Kshs 4.6B profit reported the previous year. Notably, 96% of the consolidated loss before tax were driven by Longhorn and Two Rivers Development Ltd ( TRDL).

Dent in investment income: Lower dividends were received from portfolio companies as they looked to preserve liquidity in an unfavorable business environment. Also, half of the portfolio companies remained profitable, but exits were paused owing to the tough business environment.

Dividend policy abandoned: The company declared a meagre Ksh 0.33 dividend, a 72.5% cut citing a need to retain liquidity for the lower dividend. The payout is also contrary to the company's policy of paying 30% cash dividends from annuity cash returns.

“The dividend is intended to cushion our shareholders from the effects of the difficult economic conditions while allowing the company to retain liquidity”Centum CEO James Mworia

Other Highlights:

Wholly owned subsidiary Centum Real Estate returned Ksh 4.5B to Centum representing 58% of total capital invested.

High Yield Portfolio, which provides liquidity to Centum posted a 12% return, with the portfolio mainly allocated to cash and fixed income.

TRDL, which is 50% owned, recorded a loss of Ksh 1.9B driven by impact of finance costs. Centum is expected to sell off part of its shareholding in

TRDL to a new investor in order to pay off a Kshs 4B debt in FY 21/22.Net asset value declined to Ksh 62.85 from Ksh 71.30 in FY 2020.

Want to dig deeper?: Here are the links to the Investor briefing, Press release and Results. This interview of Centum CEO James Mworia by Julians Amboko is also a goldmine.

EABL Revenues Up

Subsidiaries boost revenue: Group revenues were up 15% to Kshs 86.0B. Net sales grew 33% and 15% respectively in Uganda and Tanzania, albeit with restaurant and bar restrictions in Uganda. The company also embraced e-commerce and home deliveries to grow revenues.

Profit dips slightly: Profit after tax dipped 1% to stand at Ksh 7B on higher costs, taxes and negative foreign exchange movement. Find a link to the results here

Cash rich: Net cash from operating activities were up 337% to Ksh 14.6 billion helping the company finish the year with a solid 4.4B in cash and cash equivalents [FY 2020: 1.7B]. surprisingly, they are not recommending the payment of dividends.

Other Earnings reports this week and our analysis can be found in the links below:

Markets this Week

Dividends: Payments of dividends by Jubilee Holdings and Total Energies.

Safaricom: During the AGM, the Ksh 0.92 dividend was approved and shareholders ratified subscription of shares in Ethiopia entity.

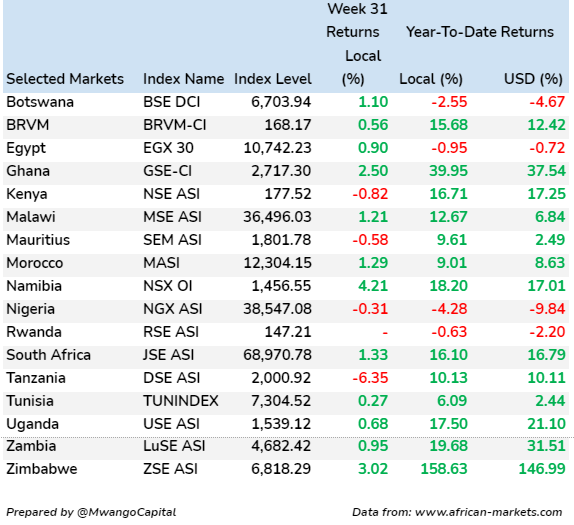

In East Africa, Kenya recorded a 0.82% decrease with the Nairobi Securities Exchange All Share Index closing the week at 177.52, down from last week's 178.98. Tanzania’s DSE ASI was down 6.35% to close at 2,000.92 from last week’s 2,136.52 while Uganda’s USE ASI recorded a 0.68% increase to close at 1,539.12 from last week’s 1,528.69

Across Africa, Namibia’s NSX 0I recorded the highest increase in returns last week, up 4.21% to close at 1,456.55.

City Lodge Group exits East Africa

East Africa units on sale: Nairobi based Fairview Hotel, Town Lodge and City Lodge Two Rivers are set to be sold to private equity fund Actis for Ksh 1B. Dar es Salaam based City Lodge Hotel is also set to be sold for Ksh 7.3M. The four hotels are owned by JSE listed City Lodge Group.

Hard hit industry: COVID has ravaged the hospitality industry with low occupancy levels at Two Rivers and the Tanzania unit. Fairview has however had a robust performance.

About Actis: Founded in 2004 Actis is a leading real estate investor in growth markets across Africa, Asia and Latin America. Shares of the four East Africa units will be disposed of to Faraja and Ukarimu, which are owned by Actis.

UK Goodies

Kenyan President Uhuru Kenyatta was in London this week and came back with promises of investments.

The Nairobi International Financial Center (NIFC): This has been in the works since 2014 but may finally be nearing launch with UK insurer Prudential PLC having signed an agreement to join and also planning to set up its Africa headquarters in Nairobi. NIFC aims to raise $2B in investments by 2030 but not everyone is boarding though.

Nurses to work in the UK: Kenyan health professionals set to benefit from a special route to work in the UK before returning to Kenya under new Kenya-UK health agreements launched by the President in London. UK and Kenyan institutions- universities, teaching hospitals will also cooperate on health partnerships.

Affordable green housing: UK Climate Investments (UKCI) and FSD Africa commit Ksh 8.7B to develop 10,000 green affordable houses in Kenya.

Other goodies:

Ksh 20B investment into Big Four agenda

Ksh 1.2B support for the Kenya Defence Forces

817,000 doses of the Oxford Astra Zeneca vaccine

Ksh 4.2B private investment into manufacturing

What Else Happened This Week?

No names for “Lipa na M-PESA”- Safaricom to hide identities and only display first and last digits of a phone number. This comes soon after an EY survey shows that 41% of firms in Kenya shared client data with third party providers [Business Daily]

Kenya inflation- Inflation in July 2021 in Kenya rose to 6.4% up from 6.32% in June 2021 and 5.87% in May. Also, the Central Bank of Kenya governor held a talk this week giving perspective on what is driving inflation. Read our notes of it here.

Debt Market: The Central Bank of Kenya reopened ten year, twenty year and new twenty year on offer [Central Bank of Kenya] even as the CBK held its key interest rates at 7%. In Rwanda, it’s maiden corporate bond raised Rwf 3.5B marking a subscription of 100% and started trading at the Rwanda Stock Exchange

More NSE listing talk- Gold miner Caracal Gold, based in the UK, picked Faida Investment Bank as its financial adviser and joint broker as it plans to list Ksh 2.1B worth of shares at the Nairobi Securities Exchange [Africa Inc]. Another firm Mayflower Gold also plans to list there too [Business Daily] . Notably, there has been a lot of talk lately about new companies being listed at the Nairobi Securities Exchange so the hope some of these come to fruition.

Changing times in Tanzania- In a incident that shows the turnaround in government policy, Tanzanian President Suluhu got her covid-19 vaccine jab this past week [BBC + Aljazeera]. In other news, the Tanzanian central bank introduced special loans of around $432m which will be given to banks for onward-lending at rates no more than 10%.

Cordial relations between Kenya & South Sudan- Both countries have chosen to mutually waive Visa requirements [The East African]