Welcome to the Baobab Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.

This week, we cover Centum RE’s KES 17B commitment from GEM, KMRC’s upcoming KES 10.5B MTN, and Sasini’s FY 2021 results.

Our newsletter this week is brought to you by:

Mwango Capital. Mwango Capital provides A+ quality analysis and research on the East African capital markets. Follow us on Twitter, join us on Telegram, check out our website. If you would want to sponsor our weekly newsletter, memes, or Twitter Spaces, reach us at hello@mwangocapital.com.

Don’t miss our new weekly business news in memes segment!:

Centum RE‘s Agreement with GEM

Contingent on listing: The wholly-owned subsidiary of Centum Investments Company PLC has signed an agreement with GEM Global Yield LLC SCS, the Luxembourg-based private alternative investment group, to provide Centum Real Estate with a share subscription facility of up to KES 17B for a 36-month term following a public listing in an exchange yet to be determined. The facility will allow Centum RE to draw down funds by issuing shares of common stock to GEM, with the real estate firm controlling the timing and maximum size of such drawdowns.

Investment grade asset: In 2020, Centum RE received an investment grade credit rating from GCR. The firm, governed by an independent board, has a listed bond at the Nairobi Securities Exchange. It is developing over 1,400 homes, many of which have already been completed, while another 3,000+ homes are to be developed in the near term.

“This commitment by GEM to invest in Centum Real Estate is in line with Centum’s mission to build extraordinary African enterprises and to provide a channel through which investors can access them. We are proud of what we have achieved in building a market leading company that is playing a critical role in providing housing across East Africa and the vision is to scale it up across the continent”

Centum CEO Dr. James Mworia

More:

We hosted the Centum RE Managing Director Samuel Kariuki and Managing Partner at Centum Capital Fred Murimi on our Twitter Space this week. A podcast will be available soon.

Business Redefined host Julians Amboko also engaged Samuel Kariuki on the Centum RE agreement with GEM. Listen in here.

KMRC Bond Approved

First tranche: The Capital Markets Authority has approved the issuance of an unsecured KES 10.5B Medium Term Note Programme by Kenya Mortgage Refinance Company. KMRC is seeking to raise KES 1.4B from the first tranche. The state-backed mortgage firm offers funds to banks and saccos for onward lending to prospective homeowners at an annual interest of 5%.

Boost to affordable housing: The KMRC issuance comes on the back of an 18 year, 11% KES 3.9B issuance by Urban Housing Renewal Development Ltd approved by the regulator in December 2021.

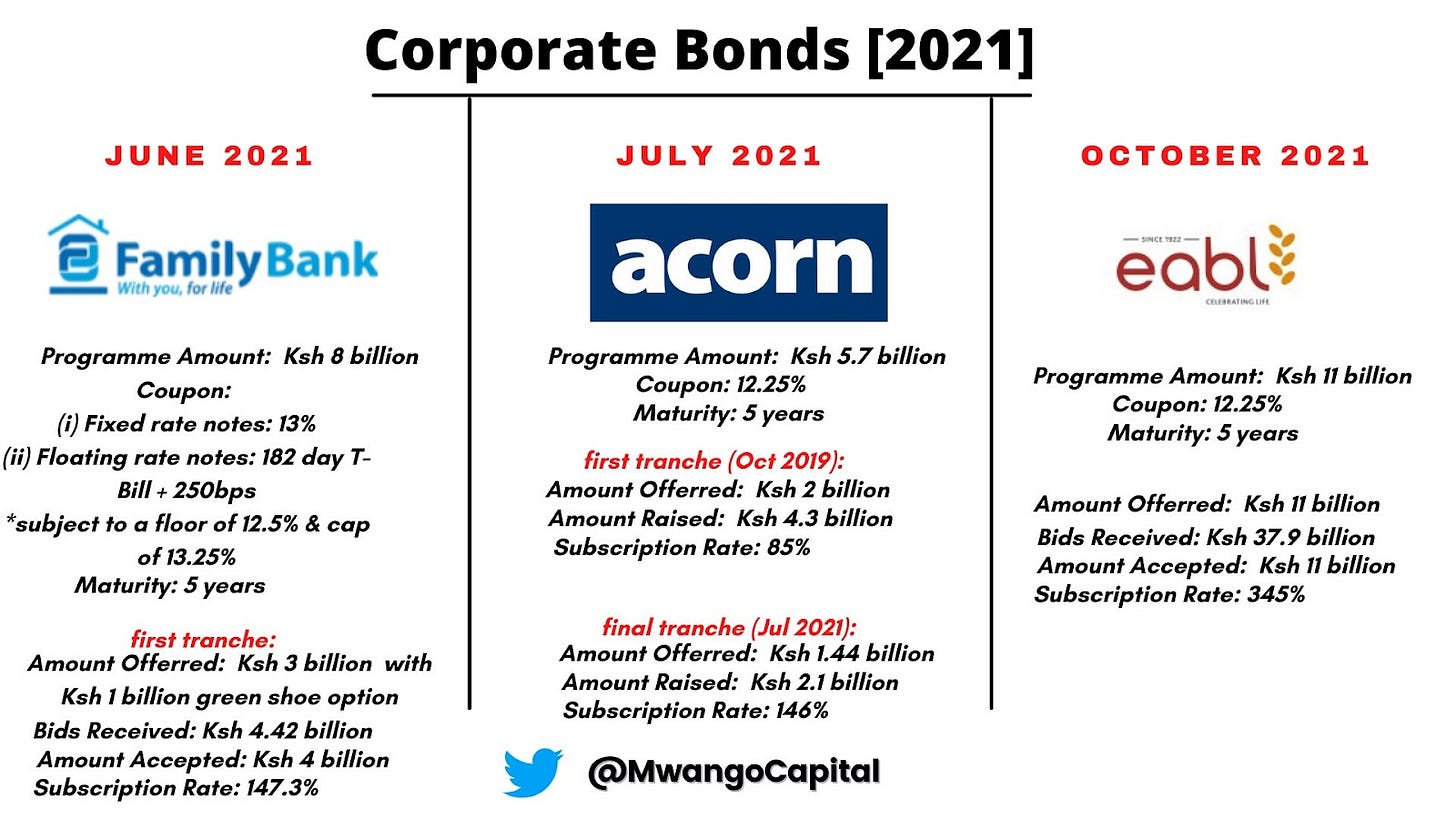

Revival times: Kenya’s corporate debt market was buzzing in 2021 indicating renewed investor confidence. Notably, all issuances in 2021 were oversubscribed.

Sasini 2021 Results

Revenue & Profit shoot: Revenues were up 27% to KES 5.3B at the close of September 2021. The group also earned KES 63.5m from finance income, which was up 2x from the previous year. The group posted a profit after tax and non-controlling interest of KES 573.2m compared to KES 12.6m the previous year. This comprises profit from operating activities of KES 438.1m and KES 129.8m from changes in the value of biological assets.

Dividend: A KES 0.50 final dividend was recommended in addition to the KES 0.50 interim dividend paid last year. This represents a 4.75% dividend yield as per Friday’s 13 January 2022 closing price of KES 21.05

Fun fact: Sasini, Car & General, and Eveready East Africa are the 3 listed firms whose financial year ends on 30 September.

Markets Wrap-Up

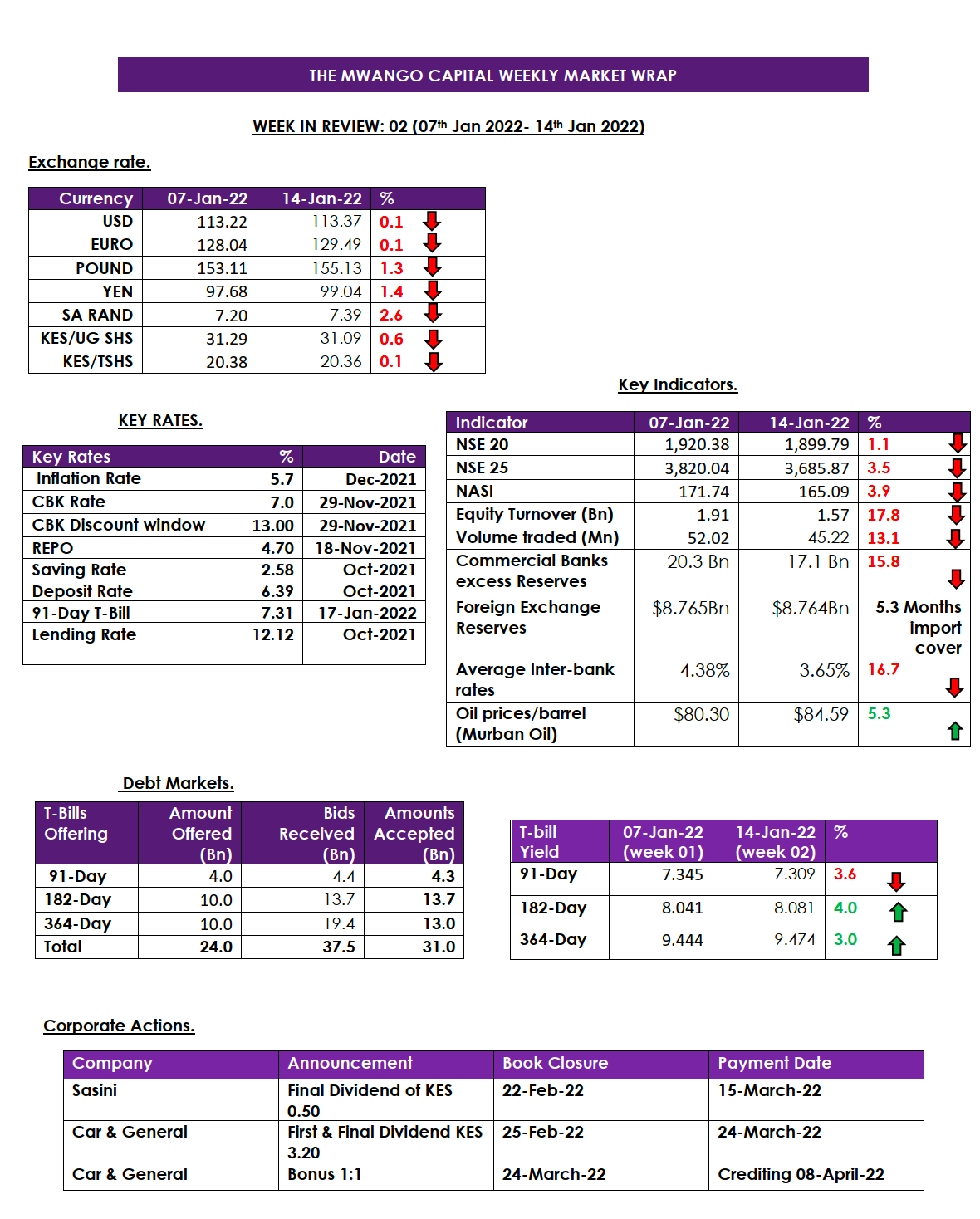

Kenyan Markets

EA Bond Markets (with Churchill Ogutu)

Primary: T-Bill subscription in Kenya hit the highest subscription this fiscal year at KES 37.5B (USD 331.1M), with KES 31.1B (USD 274.0M) accepted. Tanzania raised TZS 75.7B (USD 32.8M) in its fortnightly T-Bill auction, while Rwanda raised RWF 16.0B (USD 15.6M) in its weekly auction. Uganda was out of the primary action in the week.

Secondary: Turnover (in face value terms) jumped in the week across the EA markets. Kenya traded USD169.7M (+522.4% w/w), mainly through IFBs. Uganda followed suit with USD 98.8M (+21.4% w/w), with longer-dated bonds ('40s) trading the most. Tanzania clocked USD 27.2M (+240.2% w/w) with the belly of the curve ('31s and '32s) having the lion's share of the activity. Rwanda registered 632.2k (+1,311.3% w/w) boosted by single trades on the front ('27s) and belly ('30s) of the curve.

Coming week: Kenya and Rwanda have T-Bond auctions featuring re-opening of existing papers on the 19th. All the markets will also see T-Bill auctions in the week, with TZ/UG holding their auctions on the 19th, while KE/RW on the 20th.

What Else Happened This Week?

Fuel: Pump prices remained unchanged for the fourth time [EPRA]. At the same time, oil marketing companies are disgruntled as they are yet to be compensated for last year’s slashed margins [Business Daily].

Equity spreads its wings into insurance: Equity Life Assurance, fully owned by Equity Group Insurance Holding and a subsidiary of Equity Group Holdings, obtained a life insurance business license [Equity Bank].

Insurance premiums increase halted: High Court suspended the planned increase of motor vehicle insurance premiums by up to 50% [Business Daily].

Britannia biscuits sale: PKF has invited bids for the firm’s manufacturing plant. Britannia was placed under administration in Aug 2021 over default of KES 1.3B debt [Business Daily + Mwango Capital]

Car & General on a roll: Counter was up 56.55% this week [Mwango Capital]

Source: FT

Profit warnings: Limuru Tea issued a profit warning for its FY ended 31 Dec 2021 results [Mwango Capital].

Kenya Gazette this week: Check out some highlights from the Kenya Gazette including:

The formation of a task force to review road design manuals and standard specifications for roads and bridge construction.

Treasury CS’s statement on revenues and net exchequer issues as at 31st December 2021 which includes a historic KES 180B monthly tax revenue collection by KRA in December 2021 [KES 868.3B in July to Dec]

Charts of the Week

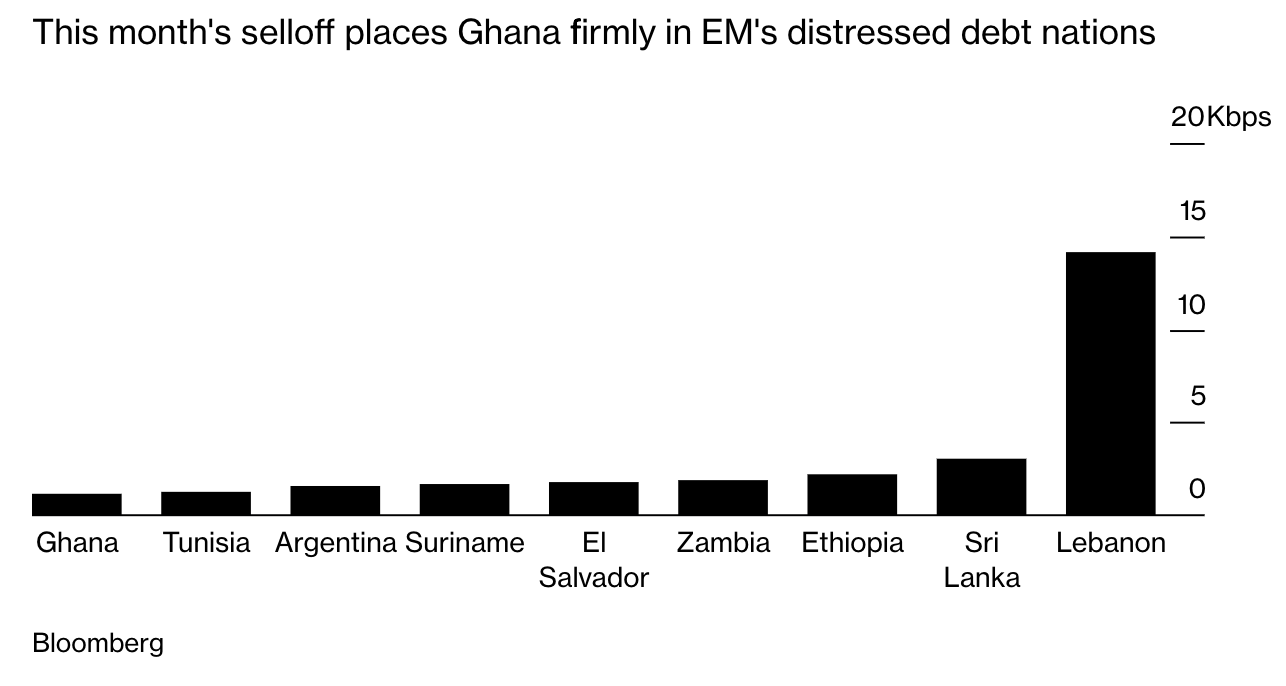

Ghana ’s dollar bonds have slumped 10% in 10 days, moving deeper into distressed territory:

If you liked our newsletter, please share it: