👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.This week, we cover the changes in boards of financial markets and some highlights from the Safaricom investor day and also we prepare for the earnings season. We held a Twitter Spaces last week to discuss the issue of Excise Duties. Catch the episode here:

First off, enjoy a dose of our weekly business news in memes:

Changes, Changes, Changes

There were changes at key financial institutions in the Kenyan financial markets as the new government seeks to stamp its authority in the market.

A Refreshed CMA: The CMA now has a new chair in Ugas Mohamed for a 3-year period starting 24th February. He replaces Nick Nesbitt whose appointment was revoked.

The board also got 5 new members: Natasha A. Aduwo, Elena Natalia Pellegrini, Meshack Moses Kiprono, Gibson Kimani Maina, and Prof. Michael Bowen. Not much can be found online on these appointees so we can but wait. The changes in leadership will hopefully bring new perspectives to an institution in need of much refreshing.

More Safaricom Board Changes: The National Treasury and Economic Planning Cabinet Secretary last week appointed Karen Kandie as Alternate Director and Ory Okolloh as Independent Director to the Board of Directors at Safaricom.

Kandie currently serves as the Director of Parastatal Reforms (Financial) at National Treasury & Planning.

Ory Okolloh is the Director of Investments at Omidyar Network and brings with her a lot of board-level experience from the many places she serves at.

Notably, Linda Watiri Muriuki resigned from the Safaricom board.

KRA Changes: Commissioner General, FCPA Githii Mburu, last week resigned from his position after a three-year stint. The Board of Directors appointed FCCA Rispah Simiyu to be the Acting Commissioner General in addition to other 4 others changes at the management level. With the focus on increasing tax collections for the country, this is one institution to pay attention to.

More To Come: One would expect more changes in more key Kenyan financial markets with the terms of the NSE CEO and that of the CBK governor ending this year.

Safaricom Investor Day Highlights

Safaricom held its first investor day earlier this month and here are some key takeaways:

Revenue growth still solid: There was a significant rise in Absolute Service Revenue, growing by over 12% compared to the previous year (the investor day mostly used calendar year results even though Safaricom’s financial year ends in March).

The contribution from M-PESA to this revenue was also noteworthy, accounting for 38.3% of the total revenue generated, as compared to 33% in 2021.

Regarding customer usage, M-PESA continued to show strong numbers with over 31M 30-day active customers, equivalent to 72.2% of gross customers during the operating period.

Voice revenue as a share of total ASR fell for the fourth consecutive year to 29.6% in 2022 [2021: 33%], its fourth consecutive decline despite a 30% growth in voice traffic to 55.1B Minutes.

The Data Segment revenues accounted for 17.2% of revenues compared to 17.9% in 2021 and 16.1% in 2019. In terms of usage, data volume was up 2.4X to 545.7TB in 2022.

A key issue the company identified regulatory-wise was the changes around Mobile Termination Rates which are set to affect revenue streams with the projection of the hit in 2022 at KES 1B:

Ethiopia Business Still growing: Safaricom Ethiopia recorded 2M Gross Adds as of February 2023 with coverage of at least 10% of the population. In terms of mobile data customer protection, the customer active base was 64%. They had 103 distributor shops and 5K Acquisition Agents. The total number of retailers stood at 28K. For comparison, here is their competitor Ethio Teleco’s data:

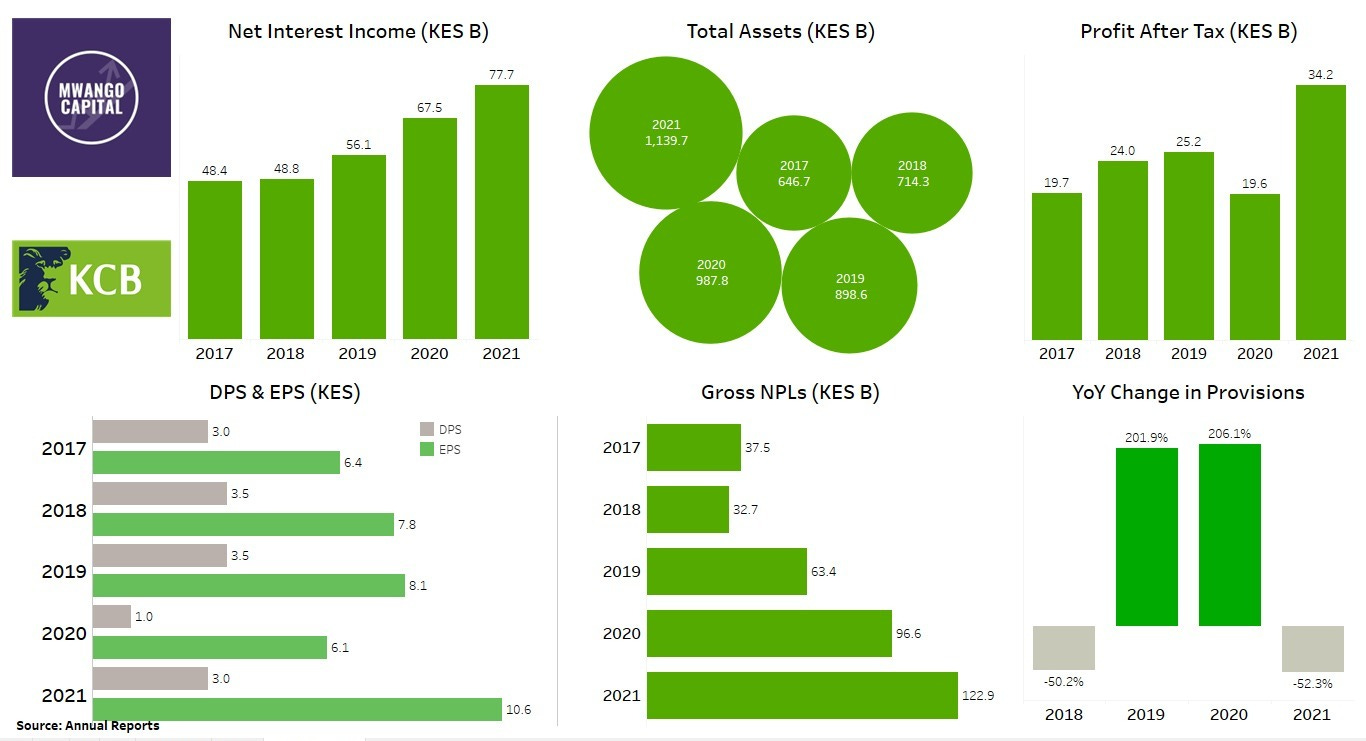

KCB Prepares For Earnings Season

Kenyan banks are expected to release their full-year results for 2022 next month. As we await the results, last week, the KCB Group CEO Paul Russo held an interview with Julians Amboko from which we took a few notes.

Dealing with NPLs: The KCB Group has created a Special Assets Team to tackle Non-Performing Loans. Here is what the CEO had to say about the creation:

“KES 120B across the Group is not pocket change. The stock is significant and that is why it requires investment in a specialised team to be able to handle them. And because it is Group-wide, I am housing it in the CEO’s office to give it that focus and that independence. And also release mostly the subsidiaries to focus on their own growth while creating a niche team to handle such problems.”

KCB’s Role in Hustler Fund: KCB Group is among the financial institutions in the Hustler Fund. What is KCB’s exact role?

“At the heart of it, we had to do modelling as well as risk assessment and assign limits. That was done by our team. The lessons and the accuracy is something that I would not trade off for anything. Even as we remodel increased limits that have gone live because the 6.6mill people that have been paying have got revised limits. You Know modelling that and determining within a limited path has been done by our team in Credit Risk Lending.”

On inroads in the DRC: On TMB Bank, the new subsidiary in the DRC:

“It's early days. But the built competencies - these guys run 130 branches across almost every location or major location in that country. Remember it's a cash economy. Those guys have their own jet to move cash from one place to another. Their biggest client is the Army and the Police. They pay their salaries. They can teach us a bit of lessons on logistics. We want to triple their performance, year-on-year.”

KCB snapshot

Weekly Capital Markets Wrap

The NSE: In Week 8 of 2023, BOC Gases was the top gainer, up 10%, while NBV was the top loser, down 11.6%. The NSE 20 and NSE 25 indices fell by 1.5% and 1.2% to 1,655.1 and 3,150.3 points, respectively while the NSE All Share Index fell 1.2% to 126.5 points. Equity turnover was down 39.3% to KES 0.8B while bonds turnover was down 4.7% to KES 12.3B.

T-Bills: In the short-term public debt markets, the weighted average interest rate of accepted bids for the 91-Day, 182-Day, and 364-Day instruments were 9.667%, 10.117%, and 10.676% respectively. The total amount on offer was KES 24B with the CBK accepting KES 19.4B of the received bids. The acceptance rate was 78.5%.

Eurobonds: Last week, the yields were mixed on a week-on-week basis across all 6 outstanding papers.

KENINT 2024 recorded the largest fall, declining by 12.3 basis points (bps) week-on-week to 11.818%.

All instruments except KENINT 2024 were up on a Year-To-Date basis. KENINT 2024 was down by 90.8bps while KENINT 2034 was up the most, rising by 34 bps to 9.995%.

KENINT 2024 led price gains year-to-date, rising 1.9% to 94.227. On a week-on-week basis, prices fell across the board led by KENINT 2048 at -1.1% to 76.875.

Other Market Gleanings:

💸 | Car and General Acquisition | Car & General (Trading) Limited (C&G), a subsidiary of Car & General (K) PLC, is set to acquire 50% of shares in Cummins C&G Holdings Limited (the Cummins CG) from CMI Africa Holdings BV (Cummins BV) in a share purchase agreement. The transaction will be completed after regulatory approval and C&G will own 100% of shares in Cummins C&G post-transaction.

🧾 | TransCentury Rights Issue | The KES 2.063B issue failed to reach the 50% success threshold, leading to CMA’s approval to reopen it between the 20th and 31st of March 2023. TransCentury’s issue target was 1.8B new shares at a unit price of KES 1.1. The firm also issued a notice to its shareholders of an Extraordinary General Meeting on March 16th with the main agenda being the consideration of conversion of a shareholder loan into ordinary shares pursuant to the Issue.

🫴🏾 | Phase I of EABL Tender Offer Closes | The first phase of the tender offer for shares in EABL by Diageo Plc that opened on 6th February 2023 closed on Friday last week with the results expected to be announced on 6th March. The second and final phase of the offer will open on 27th February and close on 17th March

Since the announcement of the Tender Offer in October 2022, the share price has appreciated by 5% to KES 174 as of market close last week. In 2023, the share price is up 6% and is currently 10% below Diageo’s offer price of KES 192 per share.

🏦 | JPMorgan to Set up Office | Global Investment powerhouse JP Morgan is set to set up a regional office in Nairobi eyeing more business deals here. This was revealed after the President met Daniel Zelikow, global head of JP Morgan's Public Sector Group. Seems like JPMorgan setting up here has been in the works since 2013. They were one of 3 applicants for setting up a Representative Office that "had been granted approval-in-principle by the end of 2012, and processing for final authorization was at an advanced stage."

📉 | EAPC in the Red | In the 6 months ended December 2022, East African Portland Cement (EAPC)’s gross revenue grew by 54.8% to KES 1.5B. The firm, however, recorded a KES 260M gross loss, down 31.5%. The net loss for the period was down by KES 105M or 11.6% to KES 801.9M.

📱 | CBK Goes Digital | According to the Central Bank of Kenya Governor, Dr Patrick Njoroge, registration to trade in government securities will be accessible via mobile phones starting next month. This will allow investors to open CDS/portfolio accounts without visiting the bank. The new process will make the process of investing in government securities more efficient and is expected to increase foreign investor participation in public debt markets.

🚧 | UG, TZ Greenlight EACOP | Tanzania has given the green light for the construction of the East Africa Crude Oil Pipeline (EACOP). The 1,443KM pipeline is set to transport crude from Lake Albert in North Western Uganda to ports off Tanzania’s Coast. Separately, EACOP last week said its compensation of project-affected persons for the labour camps to facilitate the pipeline’s construction reached 81%, paving the way for the start of actual project works. The Uganda section of the EACOP project will affect 3,648 persons, of whom 2,940 have signed their compensation agreements. At least 2,502 have been fully compensated and the pipeline is expected to cross through 10 districts, 25 sub-counties, and 172 villages.