Welcome to the Baobab Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.

This week, we cover results from Nation Media Group’s concluded share buyback program. We also cover earnings releases from Unga Group and WPP Scangroup.

Our newsletter this week is brought to you by:

Mwango Capital. Mwango Capital provides A+ quality analysis and research on the East African capital markets. Follow us on Twitter, join us on Telegram, check out our website. If you would want to sponsor our weekly newsletter and Twitter Spaces, contact us via email at hello@mwangocapital.com.

Results from East Africa’s first share buyback program

Buyback open: On Monday 28 June 2021, Nation Media Group kicked off its share buyback program, a debut in East Africa. The media giant sought to buy 10% of its issued share capital at a maximum buyback price of Ksh 25.

Buyback close: The transaction closed on Friday, 24 September 2021 with 17.1 million shares being bought back against a target of 20.7 million shares, representing a decent 82.5% success rate. 190.3 million shares are now available for trading following completion of the buyback from 207.4 millions shares prior to the exercise.

Positive: NMG’s share buyback performance, albeit shy from the target, is positive for a first buyback exercise in East Africa. It opens the door for more buyback exercises at the Nairobi Securities Exchange.

More: Business Redefined host Julians Amboko sat down with the Nation Media Group CEO to recount the exercise. Find a link to the interview here.

Will we see more buybacks?:

Jubilee Holdings shareholders during the company’s AGM held on 29th June 2021 approved amendments to the company’s Articles of Association to enable the insurer buy back its shares.

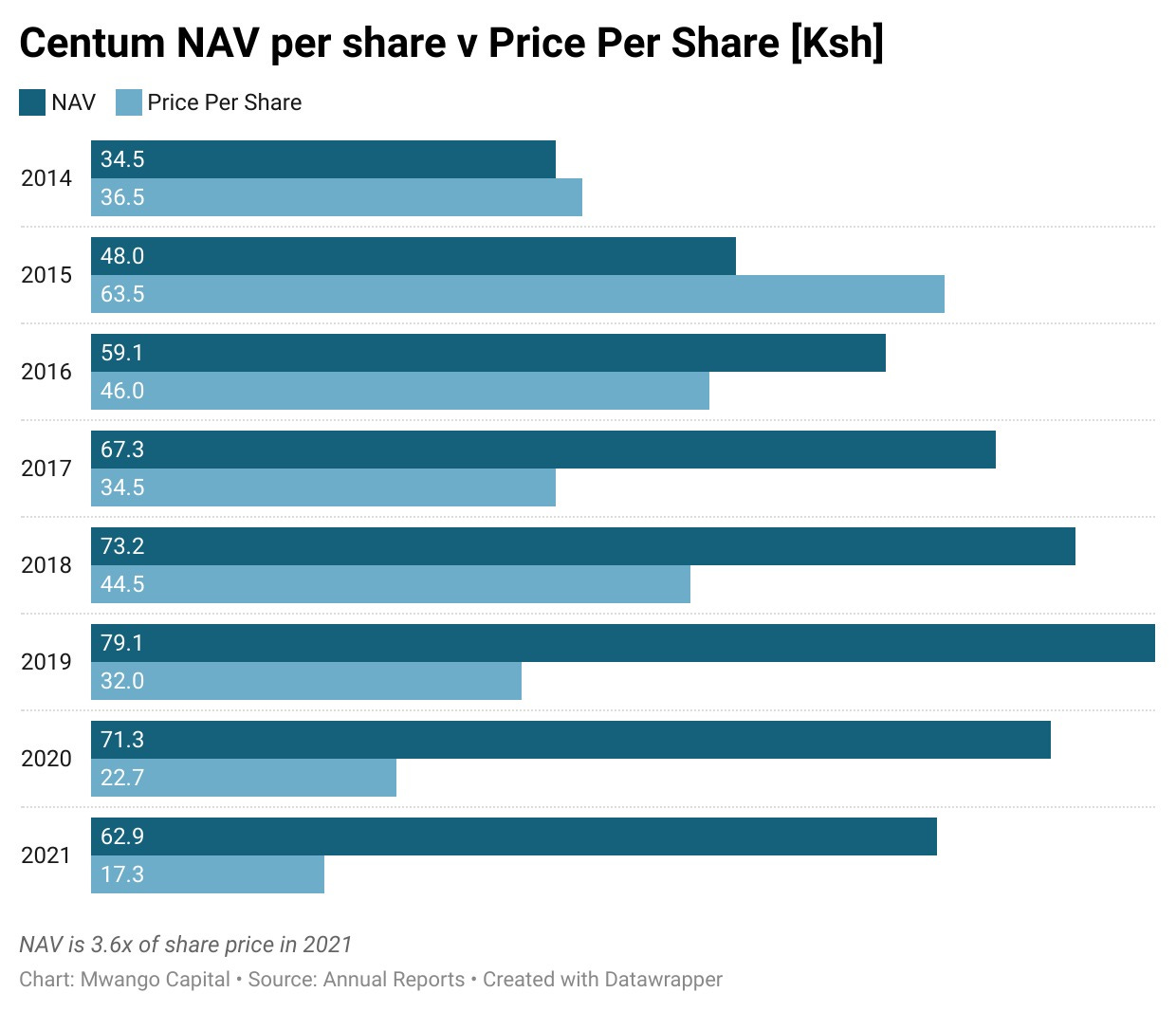

Investments company Centum, from whom the buyback conversation first emanated, already has in place the mandate to do a buyback following earlier amendments to its articles in 2016.

Unga Group profits off cutting finance costs

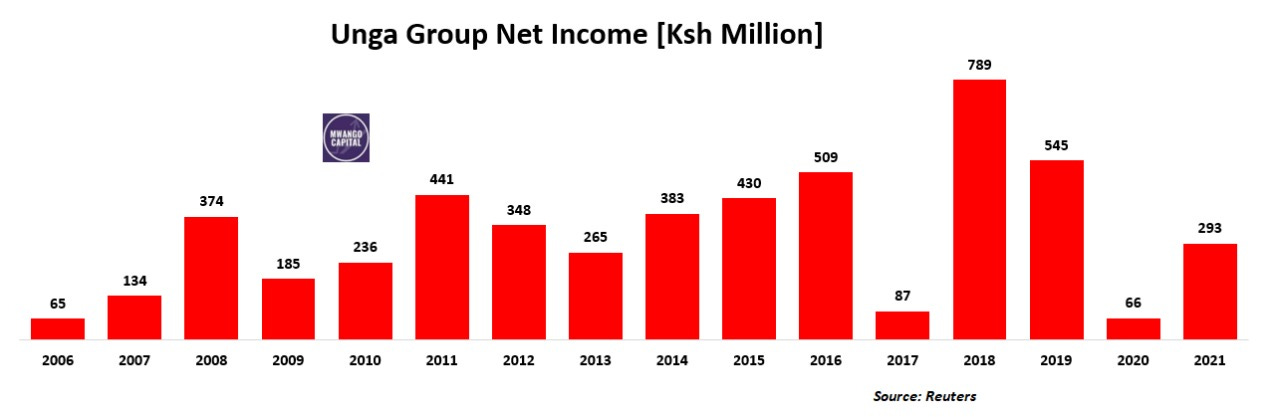

Marginal growth in revenue: The Group’s top line rose 1.4% to Ksh 17.8B in the period from Ksh 17.6B previously.

Profits up 343.6%: Full year profit to June 2021 grew three fold to Ksh 293.5m from Ksh 66.2m. This was enabled by a 24.8% cut in finance costs to Ksh 150.6m following restructuring of banking facilities.

Cash rich: Net cash from operating activities went up 73.3% to Ksh 1.05B helping the company finish the year with a solid Ksh 1.52B [FY 2020: Ksh 661.5m]. Surprisingly the board did not recommend payment of a dividend.

Find a link to the full results here.

Upcoming transactions: Unga Group entered into investment agreements with Nutreco to form two joint ventures. The company also entered into an agreement to sell its bakery business to Big Cold Kenya. Both transactions are expected to be closed in the first half of 2021/2022.

Scangroup bounces back to profitability

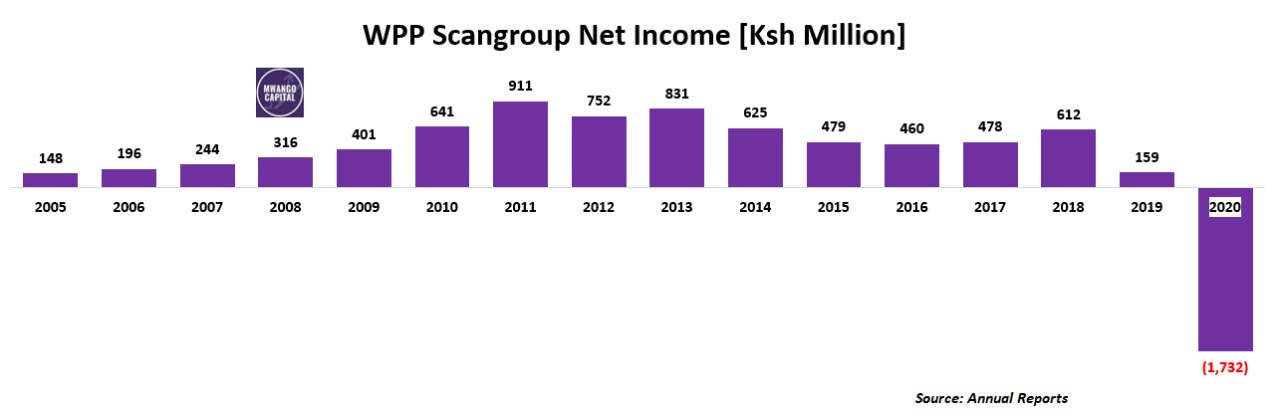

Late release: Scangroup released its half year results which were delayed by a month. The company had also delayed the release of its FY 2020 results by four months.

Marginal growth in revenue: Net sales in the period improved by 2% to Ksh 1.1B.

Bitter-sweet profits: Profit for the half year ended June 2021 came in at Ksh 31.4m, an improvement from Ksh 532m loss posted in the prior year. The bounce to profitability was helped by 92.3% reduction in provisioning for bad debts and a 153.9% rise in interest income. The company has however issued a profit warning for its full year results for the period ended 31 December 2021.

Find the full results here

Update from AGM: Scangroup shareholders, during the company’s AGM held on Thursday, 30th September 2021, approved creation of a merger reserve account to absorb past and future impairments of subsidiaries.

Markets this Week

In East Africa, Kenya recorded a 1.92% rise in the Nairobi Securities Exchange All Share Index, closing the week at 181.23, up from last week’s 177.81. Tanzania’s DSE ASI was down 1.17% to close at 1,949.48 from last week’s 1,972.64, while Uganda’s USE ASI recorded a 0.17% rise to close at 1,517.28.

Across Africa: Zimbabwe’s ZSE ASI recorded the highest increase in returns this week, up 10.84% to close at 8,719.53.

What Else Happened This Week?

Inflation: Kenya’s September 2021 inflation rate rose to 6.9% from 6.6% in August 2021 driven by prices of food and fuel. The Monetary Policy Committee has in its September 2021 meeting indicated elevated inflation pressures in the near term [All Africa + CBK].

Cheaper electricity?: The task force on review of power purchase agreements submitted its report to President Uhuru Kenyatta. Of note, is the task force's recommendations towards possible reduction of electricity costs by a third [Office of the President].

KQ, SAA ink deal: Kenya Airways and South African Airways have partnered with a longer term view to form a Pan African airline. Sustainable? [Kenya Airways].

Courts v KRA: High Court halted KRA’s planned 4.97% increase in excise duty tax to align with inflation. Last week minimum tax was declared unconstitutional [Business Daily + Julians Amboko].

Update from Centum’s AGM: The investment company’s board says it will address undervaluation of the company’s shares [Business Daily + Centum].

“The share price does not reflect the value of the share that you are holding”- Centum Vice Chair-Dr Laila MachariaSecond telecom license in Ethiopia: Ethiopian Communication Authority is inviting bidders for a second new full-service telecommunications license inclusive of mobile financial services [Ethiopian Communication Authority].

World Bank support: Tanzania is seeking support towards mitigating effects of Covid and access to vaccines [The East African].

If you like our newsletter, share it with your friends and colleagues: