Family Bank Bond Oversubscribed

Corporate bonds market gets a jolt with the Family Bank issuance

Welcome to the Baobab, a capital markets newsletter that provides a succinct summary of key business news items from East Africa. Send us your feedback to mwangocapital@gmail.com and on Twitter at @MwangoCapital

This week we cover activity at the NSE’s bond market as Family Bank’s MTN is oversubscribed, developments from the Finance Bill 2021 & Safaricom’s launch of its ‘’new’’ M-PESA App.

Corporate Bonds Action

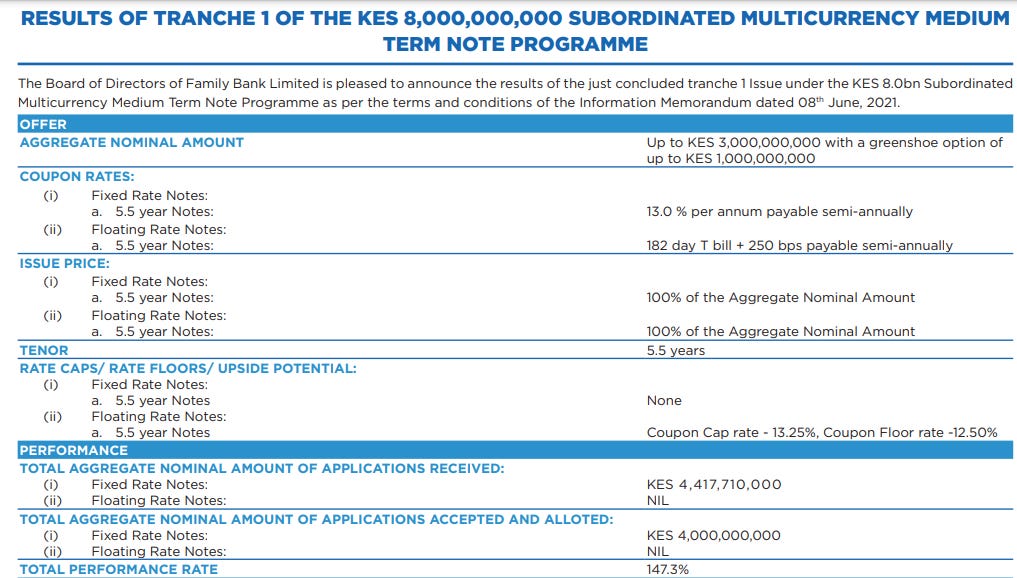

What happened? The first tranche of Family Bank’s Multicurrency Medium Term Note received bids worth Kshs. 4.417 billion against an advertised amount of Kshs. 3 billion, recording an oversubscription of 147.3%. Subsequently, Kenya’s Capital Markets Authority granted approval to the bank to take up a greenshoe option of Kshs. 1 billion. The note will commence trading on the Nairobi Securities Exchange on 30th June 2021.

Mwango Capital Explainer

A greenshoe option is a provision that allows the issuer to sell investors more shares or bonds than initially planned by the said issuer if they find out that the demand for that security is higher than anticipated. The name greenshoe comes from the fact that the first company to issue this option was called the Green Shoe Manufacturing Company (now a part of Wolverine World Wide) back in 1919.

Looking ahead: The performance of the Family Bank MTN is a welcome move towards reviving the rather sleepy Kenyan corporate bond market, which has witnessed more redemptions than issuances in the recent past and which has been reeling from the impact of the high profile defaults from companies like Nakumatt.

Beyond Kenya: Energicotel, an Independent Power Producer, became the first company to receive regulatory approval to issue and list a corporate bond on the Rwanda Stock Exchange. The bond will be issued in two tranches:

Tranche 1: RWF 3.5 billion with a tenor of 10 years to be issued on Wednesday 23rd June 2021

Tranche 2: RWF 3 billion will be issued in the near future with a specified tenor.

The listing and trading on the Rwandan Stock Exchange will commence on Monday 26th July 2021.

“Moving to the capital markets is an essential step towards showcasing additional avenues for capital formation and providing a platform for investors to participate in the ENERGICOTEL transition to the development of sustainable renewable energy solutions. We are excited to continue on our trajectory of dynamic growth within the renewable energy space with our core business of power generation and engineering consultancy”

— Ferdy Turasenga-Executive Director

Want to Learn more about Bonds? Join us on 3rd July for our first ever online bond class. Also, join us on Twitter Spaces on Friday, 2nd July, where we chat with Family Bank’s CEO and her team on their new corporate bond.

The Finance Bill 2021

The Kenyan Parliament’s Departmental Committee on Finance and National Planning invited several stakeholders to consider the Finance Bill 2021. Several amendments have been made and here are some of the major highlights:

Winners:

Disposable syringes & other syringes, infant milk: Imposition of VAT rejected.

New taxes on bread, flour & motorcycles rejected.

Proposal to exempt exported taxable services from VAT rejected.

Proposed removal of the role of Parliament in the scrutiny of VAT regulations rejected.

BAT Kenya: Excise duty on nicotine pouches reduced to Ksh 1,200 per kg from Ksh 5,000 proposed by the Treasury.

Introduction of a 90-day timeline to hear and determine Capital Markets Tribunal appeals retained.

Losers:

20% excise duty on loan-related fees & commissions retained.

Reinstatement of 16% VAT on LPG retained.

Proposal to increase tax audit from five years to seven years rejected.

Betting: Excise duty on winnings raised to 30% against the 20% initially proposed in the bill.

Looking Ahead: The bill will be tabled to the main house for further deliberations. It is the committee's recommendation that the bill is approved with amendments.

Blow to National Treasury: The bill sought to propose new taxes in a bid to meet budget proposals, but legislators have shot down some of these measures.

Remember!: The deadline for filing taxes for 2020 is this coming Wednesday, 30th June 2021.

IMF Approves a Further $ 407m Disbursement

IMF making it rain: The International Monetary Fund’s (IMF) Executive Board’s allowed for an aggregate immediate disbursement of $ 407m to Kenya. This followed Wednesday’s completion of the first review of the 38-month Extended Arrangement under the Extended Fund Facility (EFF) and the 38-month arrangement under Extended Credit Facility (ECF) for Kenya. This brings Kenya’s total disbursements for budget support under the arrangements to about $ 714.5m.

“The Kenyan authorities continue to demonstrate a strong commitment to their fiscal reform agenda during this unprecedented global shock. Performance under the EFF/ECF arrangements has been broadly satisfactory despite a challenging environment.”

— IMF Deputy Managing Director and Acting Chair, Antoinette Sayeh

IMF also said that the program was subject to notable risks that include uncertainty about the path of the pandemic and potential pressures from the upcoming political calendar. It however noted that Kenya’s medium-term prospects remained positive. The IMF on April 2 2021 approved a $ 2.34B three-year financing package with Kenya aimed at supporting programs to address debt vulnerabilities, support the response to the COVID-19 crisis and enhance governance.

The Mwango Capital Explainer:

Extended Fund Facility (EFF): This is an IMF facility that provides assistance to countries experiencing serious payment imbalances because of structural impediments, slow growth, and a weak balance-of-payments position. An EFF provides support for policies needed to correct structural imbalances over an extended period.

Extended Credit Facility (ECF): This is an IMF facility that provides financial assistance to countries with protracted balance of payments problems. The ECF is the Fund’s main tool for providing medium-term support to low-income countries (LICs) economic programs aimed at moving toward a stable and sustainable macroeconomic position consistent with strong and durable poverty reduction and growth.

Relief: The Kenyan treasury received debt service relief of Kshs 16.8B from China's Exim Bank and commercial debt creditors for Eurobonds.

A Busy Week at the NSE

This week: Standard Group, BOC Gases, Diamond Trust Bank, Equity Group Holdings, Total Kenya, Kenya Airways & Nation Media Group (NMG) all held their virtual Annual General Meetings this week.

Buybacks: The main takeaway from the Nation Media Group was the approval of their Buyback program, a first in Kenya. The shareholders formally approved the share buyback program which will start on Monday 28th June 2021 and close on the earlier of when they buy up to 10% of the issued share capital or at 3 pm on 24th September 2021.

Here are some of the other notable highlights of the resolutions passed:

Standard Group:

Election of directors: Christopher Kulei, Robin Sewell & James Boyd Mcfie.

Appointment of PwC Kenya as the company’s external auditor

Diamond Trust Bank:

Election of directors: Ismail Mawji, Shaffiq Dharamshi, Irfan Keshavjee & Pamela Ager.

Appointment of KPMG as the company’s external auditor.

Equity Group Holdings:

Election of directors: Dr Hellen Gichohi & Vijay Gidoomal.

Appointment of PwC as the company’s external auditor.

Approval of a resolution to amend the Articles of Association to allow shareholders with over 12.5% of the company’s issued shares the right to nominate one director.

Total Kenya:

Election of directors: Joseph Karago, Margaret Shava.

Appointment of Ernst & Young as the company’s external auditor.

Approval of company name change from Total Kenya to PLC to TotalEnergies Marketing Kenya PLC.

Kenya Airways:

Election of directors: Michael Gichangi

Appointment of PwC as the company’s external auditor.

Nation Media Group:

Election of directors: Dennis Aluanga, Stephen Dunbar Johnson & Louis Otieno

BOC Gases:

Election of directors: A. Kamau, M. Kruger & S. Maina.

More on the NSE: Umeme Ltd & Total Kenya closed their books on Friday for dividends of Ush 12.20 and Ksh 1.57 respectively. Payment dates are slated for 19 July 2021 & 30 July 2021 respectively.

This coming week: Jubilee, Serena Hotel, CIC, and Kenya Re will hold their AGMs next week.

Other noteworthy items:

Safaricom launched the M-PESA Super App with the following features: Send to many, face & fingerprint recognition, tracking of expenditure, frequently used till numbers, request money, personalized app [profile pic, GIFs, emojis], offline mode, and some 7 working Mini Apps with a promise of more to come.

Safaricom will be seconding its staff to run its operations in Ethiopia. They also aim at building a high-quality mobile network as opposed to just competing on price.

Fusion Capital raised Kshs. 800 million to complete Greenwood city mall in Meru, a follow-up from the original $4.3 million investment.

Members of the Kenya Bankers Association elected NCBA CEO John Gachora as the incoming Chairperson for the 2021/2022 period. Family Bank CEO Rebecca Mbithi was elected Vice-Chairperson.

Liberty Holdings is seeking to acquire more shares in Liberty Kenya via a private transaction.

Britam partnered with fintech KOA to offer its customers access to low-risk investment opportunities.

The Central Bank of Kenya opened a tap sale on FXD1/2019/20 & FXD1/2012/20. The amount on offer is Kshs. 50 billion.

Tanzania's Central Bank is working on President Samia Suluhu Hassan's directive to prepare for cryptocurrencies.

Some aggrieved investors in the Cytonn High Yield Solutions (CHYS) fund put up an ad on the Daily Nation this week saying they intend to file a class action suit and are inviting others to join their cause.

Knight Frank reported that Q1 2021 monthly prime office rents in Kenya remained subdued at $12 per square meter. Lockdown restrictions expected to further dampen demand.