👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover Kenya’s inflation in February 2024, KenGen PLC, Unga Group PLC and East African Portland Cement Company HY 2023/24 Results, and EU Parliament’s approval of the EU - Kenya Economic Partnership Agreement.This week's newsletter is brought to you by:

Co-operative Bank of Kenya. Get access to proper healthcare and prioritize your family's well-being through Co-op Bancassurance Intermediary.

February Inflation Down

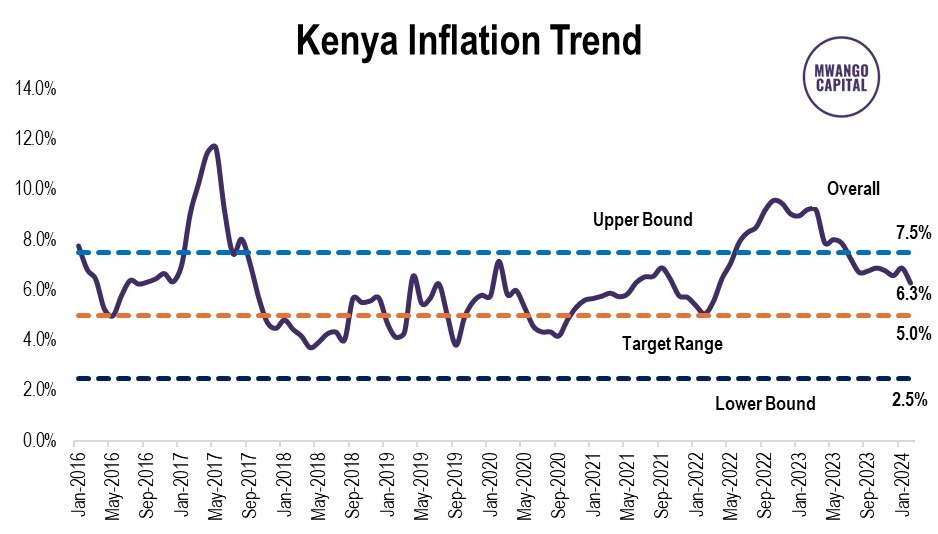

Inflation Cools: In February 2024, the annual inflation rate declined by 60 basis points (bps) and 2.3 percentage points month-on-month and year-on-year, respectively to 6.3%. This marks the 7th consecutive month inflation has stayed within the Central Bank of Kenya’s (CBK) prescribed target range of 2.5% - 7.5%.

Sticky Elevated Transport: Across indices, the transport index (weighting: 9.6%) recorded the highest year-on-year change at 10.8%, followed by the alcoholic beverages, tobacco and narcotics index (weighting: 3.3%) at 8.7%, and the food and non-alcoholic beverages index (weighting: 32.9%) at 6.9%. The transport index has remained persistently elevated over the last one year recording double-digit year-on-year changes on account of higher fuel prices as compared to the same period a year ago.

Across Commodities: 50 kWh of electricity recorded the highest year-on-year change at 42.7%, and apart from 1 Kilogram of carrots and sugar at 40.7% and 30.2%, respectively, the other significant increases recorded were energy-related. Notably, kerosene edged higher by 32.1%, 200 kWh of electricity at 31.8%, diesel at 20.4% and petrol at 16.2%. Month-on-month, 50 kWh and 200 kWh of electricity fell by 11.0% and 9.3%, while kerosene, diesel and petrol declined by 0.5% given the reduced pump prices in the month.

Kenya Shilling Depreciation Impacts Half Year Earnings

KenGen Net Profit Dips 9%: In H1 2023/24, net revenues grew by 7.8% year-on-year to KES 24.7B on the back of improved operational efficiency and generation, with electricity units generated rising by 0.3% to 4,211 GWhs. The depreciation of the Kenya Shilling impacted operating and maintenance costs, resulting in a 16% surge in operating expenses to KES 8.7B. As a result, operating profit fell by 9% to KES 4.4B while the tax expense rose by 26% on account of an increased tax burden from the impact of disallowable currency losses. Net profit fell 9% to KES 2.96B, and margins contracted, with operating and net margins standing at 17.9% [2022: 21.3%] and 11.9% [2022: 14.2%], respectively. The Board of Directors did not declare an interim dividend.

Unga Deeper in Loss Territory: H1 2023/24 revenues rose by 3.5% to KES 12.4B on account of higher sales volumes and price adjustments implemented in the operating period. The firm reduced its operating loss position to KES 32.2B from KES 107.5B in H1 2022/23 as a result of improved cost management strategies. While finance income grew by 4.8% to KES 43.5B, finance costs were up 4.4X to KES 492.3B occasioned by the depreciation of the Kenya Shilling coupled by high interest rates. On the bottom line, the firm recorded a KES 341.6M net loss, up 2.6X from H1 2022/23.

EAPCC Cuts Loss by KES 81M: For H1 2023/2024, East African Portland Cement Company revenue grew by 22.8% year-on-year to KES 1.8B on account of improvement in cement production owing to plant refurbishment. The depreciation of the Kenya Shilling coupled with elevated energy costs drove the cost of sales higher by 22.8% to KES 2.2B, resulting in a gross loss position of KES 319.1M compared to that of KES 260M in H1 2022/2023. The net result for the operating period was a KES 720.8M loss, which was KES 81M lower than that incurred in H1 2022/2023.

Markets Wrap

NSE: In Week 9 of 2024, E.A Cables was the top-performing stock, up 9.4% to close at KES 1.05. TransCentury was the worst-performing stock, down 20% to close at KES 0.40. The NSE 20 gained 0.2% to close at 1,539.2 points, the NSE 25 rose by 0.7% to close at 2,493.3 points, and the NASI index increased by 0.5% to close at 93.3 points. Equity turnover rose by 23% to KES 1.5B from KES 1.2B the prior week while bond turnover closed the week at KES 52.6B compared to the prior week’s KES 173B.In February, the top three performers were E.A Cables, up 17.78%, Kenya Power, up 15.97%, and E.A Portland Cement, up 12.50%. The top three worst performers were Standard Group, down16.49%, BK Group, down 13.38%, and Britam Holdings, down 12.26%. Year-to-date, the top three performers were Liberty Kenya Holdings, up 49.1%, Eveready, up 23.1%, and Equity Group, up 20.2%. The top 3 worst performers were NBV, down 20.7%, Standard Group, down 16.3%, and Trans-Century, down 15.4%.

Treasury Bills: The weighted average interest rate of accepted bids for the 91-day, 182-day, and 364-day were 16.6218%, 16.7849%, and 16.9722% respectively. The total amount on offer was KES 24B with the CBK accepting KES 22.8B of the KES 23.9B bids received, to bring the aggregate performance rate to 99.47%. The 91-day and 364-day instruments recorded 306.50% and 95.76% performance rates, respectively.

Eurobonds: In the week, yields rose across the 7 outstanding papers.

KENINT 2028 rose the most week-on-week, up by 15.90 bps to 9.316% while KENINT 2024 rose the least, appreciating by 5.80 basis points to 8.306%. The average week-on-week change stood at 8.93 bps.

KENINT 2034 rose the most on a year-to-date (YTD) basis, appreciating by 27.50 bps while KENINT 2024 rose the least at -422.40 bps.Prices were mixed across the board week-on-week, with KENINT 2024 remaining flat at 0.0% while other papers registering declines.

KENINT 2034 and KENINT 2048 declined the most at 0.7%. Year-to-date, KENINT 2034 fell the most, depreciating by 1.6% to 79.153, while KENINT 2027 rose the most at 2.2% to 96.220.

Deals, Mergers and Acquisitions

EU Parliament Approves EU - Kenya EPA: Kenya is close to finalizing the Economic Partnership Agreement (EPA) with the European Union (EU) that will give Kenyan exports continued duty-free access to the EU market while gradually opening Kenya to European imports and investments. This agreement, approved by the European Parliament, ensures Kenyan goods can enter the EU freely, while Kenya will slowly lower duties on European goods over 25 years. This agreement is a modification of a stalled deal between the EU and the East Africa Community, but other members could not agree on it.

Phoenix Acquires African Originals Stake: The Competition Authority of Kenya (CAK) has unconditionally approved the proposed acquisition of a minority stake in African Originals by Phoenix Beverages Limited. African Originals, the ultimate owners of the KO brand of alcoholic and non-alcoholic beverages and controllers of Savannah Brands in Kenya, are set to sell a 28.15% stake to Phoenix Beverages. Despite being based in Mauritius and not operating directly in Kenya, Phoenix Beverages exercises indirect control in the country through its affiliate, Naivas Limited. This transaction will grant Phoenix Beverages minority controlling rights in African Originals.

KCB - MasterCard Collaboration: KCB Bank Kenya and Mastercard have entered into a 5-year strategic collaboration to enhance payment across East Africa. This partnership will offer customers a variety of Mastercard payment solutions such as premium World and World Elite cards, youth pre-paid, and corporate cards, enabling e-commerce payments, cross-border remittances, QR, and Tap on phone transactions. The collaboration aims to create innovative payment solutions and marketing initiatives, accelerating financial inclusion in the region.

Meru Wind Farm Funding Secured: During his recent state visit to Japan, President William Ruto secured KES 15B for the Meru Wind Farm Energy project. This development is expected to stimulate economic growth and pave the way for other projects, including the Lamu Port South Sudan-Ethiopia Transport (Lapsset) corridor in northern Meru.

Africa Oil exit from Turkana Delayed: Africa Oil Corporation says its earlier announced plans to pull out of the Turkana oil project have hit fresh headwinds following delayed State approvals. Africa Oil last year announced its decision to withdraw from the Kenya Oil project along with Total Energies.

Eldoret - Kampala - Kigali Pipeline: Kenyan President William Ruto last week announced progress on resolving petroleum flow issues with Uganda after meeting with President Yoweri Museveni. This comes after Uganda accelerated negotiations with Tanzania to use the Dar es Salaam port as an alternative import route. The two nations also discussed the urgent need to design and construct the Eldoret-Kampala-Kigali refined petroleum product pipeline.

Jambojet’s Zanzibar - Mombasa Service: Jambojet, a Kenyan low-cost airline, has expanded its network to include Zanzibar, its 8th destination. The airline plans to launch direct flights between Mombasa and Zanzibar starting July 1st, 2024. The airline was motivated by increasing demand in the region and aims to foster connections within underserved routes. Flights will operate four times weekly with one-way tickets starting from USD 113.

Market Gleanings

📄| SACCOs FY 2023 Results | Remittances to SACCO’s from employers have halved from KES 5B to KES 2.4B since 2022, according to CS Simon Chelugui. He also highlighted over KES 3.5B in outstanding dues from government agencies, while acknowledging a record year for SACCO’s with member deposits exceeding KES 1T for the first time. Meanwhile, more SACCO’s reported their results in the week:

Imarisha SACCO: Revenue grew 14% to KES 2.1B with the net interest income rising 11.5% to KES 1.5B and assets increasing 10% to KES 21.7B. Interest on member deposits was 11.05% [2022:11.41%], while the dividend rate was 14.06% [2022:14.04%].

Mhasibu SACCO: Total revenue increased by 15.5% to KES 1.1B, with the total interest income increasing by 20.9% to KES 1B. Interest on member deposits increased slightly from 8.25% in 2022 to 8.6% in 2023, the dividend rate stood at 15.5% [2022: 15%].

IG SACCO: Net interest income increased by 0.6% to KES 879.3M and the Total assets grew 13.9% to KES 14.1B. The interest on member deposits remained consistent at 12.2% with the dividend rate holding at 17%.

💰| Hustler Fund Update | As of the latest update, the Hustler Fund has disbursed loans totaling KES 46.3B. The fund has reached a customer base of 21M, with repayments amounting to a 76% repayment rate. The fund’s reach has expanded to include 100K groups.

🏛️| NSE Updates Yield Curve Methodology | The Nairobi Securities Exchange (NSE) has introduced an update to its yield curve methodology, aiming to provide a more reliable tool for market participants to mark-to-market their bond portfolios. The updated methodology now bases the yield curve on weekly traded yields, with a particular focus on trades exceeding KES 50M. These trades are then volume-weighted to establish a reference point for the yield curve. To tackle liquidity challenges, the NSE has implemented a strategy of aggregating and averaging quotes from trading participants when not all bonds are traded within a week.

📜| Tax Amnesty Programme Update | The Tax Amnesty Programme, introduced by the Finance Act, 2023, allows taxpayers to waive penalties and interest on outstanding taxes up to December 31st, 2022, by fully paying their principal taxes by June 30th, 2024. As of 20th February 2024, the Kenya Revenue Authority (KRA) reports that 227,071 taxpayers have benefited from this programme, with waivers amounting to KES 209B, having paid a total of KES. 14.5B in principal taxes.

⛽| LPG Distribution and Consumption | Kenya’s LPG consumption dropped to 6.8 kg per capita in 2023 from 8 kg in 2022 due to rising fuel costs, according to Davis Chirchir, the cabinet secretary in the Ministry of Energy and Petroleum. The country’s dependence on imported LPG and a weaker shilling led to a surge in retail prices, pushing low-income households towards alternatives like firewood and kerosene. To combat the decline in LPG usage, a subsidy of KES 2.4B has been allocated for 4.5 million low-income households to purchase LPG cylinders. The aim is to boost per capita LPG consumption to 10 kg by 2026.

👨💻| Data Centers taking root in Africa | Nasdaq-listed data center giant, Equinix Inc., is investing USD 390M over the next five years to expand its operations in South Africa and West Africa, with additional plans to explore opportunities in East Africa. Similarly, Airtel Africa recently announced plans to develop a data center in Nairobi, following its plans for a 36MW data center in Lagos, Nigeria. In parallel, Meta’s 2Africa subsea cable, spanning 45K kilometers, has reached the shores of Lagos State and Akwa Ibom State in Nigeria. This deep-sea cable project will connect 32 other African countries, directly supporting economic development in Africa.

🇳🇬 | Nigeria Hikes Rates |The Monetary Policy Committee of the Central Bank of Nigeria last week raised the benchmark interest rate by 400 basis points to 22.75%. This policy shift also includes adjustments to other key parameters; the asymmetric corridor around the Monetary Policy Rate (MPR) has been widened to +100 to -700 basis points, a substantial increase from the previous range of +100 to -300 basis points. Furthermore, the Cash Reserve Ratio (CRR) has seen an increase from 32.5% to 45%, while the Liquidity Ratio remains unchanged at 30%.