👋 Welcome to the Baobab Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.This week, we cover the Flutterwave raise, earnings from BAT and Longhorn, and the Bank of Uganda's court loss.

Our newsletter this week is brought to you by:

Mwango Capital. Mwango Capital provides A+ quality analysis and research on the East African capital markets. Follow us on Twitter, join us on Telegram, and check out our website. To sponsor our weekly newsletter, memes, or Twitter Spaces, reach us at hello@mwangocapital.com.

First off, our weekly business news in memes brought to you by Share Hub:

Flutterwave Sets a High Mark

Raise your glasses: With its latest Series D funding round raising $250M, Flutterwave’s valuation hit $3B (3X the $1B valuation it hit less than a year ago). The round was led by B Capital Group with participation from Alta Park Capital, Whale Rock Capital, and Lux Capital with existing investors participating too.

Growth!: With the new funding, the company will seek to ambitiously expand to Egypt and Morocco and to the Middle East and Latin America via organic and acquisitive growth and to offer a wider variety of products.

What is Flutterwave?: Flutterwave is an African fintech startup that provides payment infrastructure for merchants and payment service providers across Africa through an API. Flutterwave is live in more than 34 countries in Africa partnering with the likes of M-Pesa and Airtel Money. Launched in 2016, the startup has processed over 140M transactions worth $9B+. Some of the company’s international clients include Booking.com, Flywire, Alibaba’s Alipay and Uber.

“We’re becoming what we wanted to be: the infrastructure for any kind of payments. There’s no sector you look at today in Africa that you wouldn’t see Flutterwave taking a piece of that and enabling merchants and consumers to grow and scale….It was deliberate from us because we saw the opportunity in the SMB space, and how they require the same technology pie the Ubers and Netflixes of this world use. Some of this is evident is how we expanded the Flutterwave Store, which allows small businesses anywhere in Africa to create an e-commerce shop online at zero cost scale.” - CEO Olugbenga “GB” Agboola

Big deal? At $3B, the startup is worth more than the largest bank in Nigeria and makes Flutterwave the highest valued startup in Africa. Might this be the definitive moment for African startups? We are on the way to the first decacorn.

Infrastructure Bond Results

Performance: The 19-year infrastructure bond was massively oversubscribed by 76%, with CBK receiving bids worth KES 132B against an offer of KES 75B. This points to massive liquidity and a high appetite for IFBs because of their tax treatment (tax-free) and attractive rate of return. The last IFB issued in 2021 - IFB/2021/021, was oversubscribed by 101.67%.

Market Pricing: The bond’s weighted average rate of accepted bids came in at 12.965% vs market-weighted 13.036%.

ILAM Fahari I-REIT's Profit Warning

Another one! ILAM Fahari I-REIT became the latest NSE firm to issue a profit warning based on assessments projecting a 25% drop in 2021 net earnings compared to those for 2020.

“The expected lower than prior year earnings are mainly attributable to the revaluation losses recorded by the REIT properties against the backdrop of the Covid-19 pandemic whose impact continues to be a material valuation uncertainty in the short to medium term. In addition, there was loss of revenue from the anchor tenant at Greenspan Mall for a period of seven months during the year under review.”

Not all is gloom though:

“On the positive side, the REIT Manager on-boarded Naivas Limited as the replacement anchor tenant with rental income accruing from August 2021”

The REIT becomes the fifth firm to issue a profit warning in 2022, with others including:

Bank of Uganda Court Loss

A huge L: The bank lost a 5-year legal fight in the Supreme Court. In 2016, a month before defunct Crane Bank Limited was placed under statutory management, it had applied for $41M in emergency financial support to the regulator. BoU placed Crane Bank under statutory management in September 2016 after an audit revealed shrinking liquidity ratios, increasing loan defaults, and insufficient capital levels - with financials showing a $14.31M profit in 2014 and a $877.03M loss in 2015. As of 2016, Crane Bank was Uganda’s third-largest bank and had 46 branches and about 500,000 customers.

Litigation: Four months post-statutory management, BOU transferred certain Crane Bank assets and customer deposits to DFCU Bank in a $56B transaction concluded in Jan 2017. BoU and Crane Bank Limited initiated legal action against Crane Bank founder - Sudhir Ruparelia, who owned a 48% stake - on grounds of siphoning $111.8M in a 3-year period. BoU lost at the High Court, Court of Appeal and has now lost in their final appeal at the apex court.

Implications: The judgment could influence ongoing court proceedings in a case filed by former owners of Crane Bank against DFCU bank in a European court. Further, the outcome is likely to bring to the fore BoU treatment of struggling banks as reflected in a Parliamentary Committee on Statutory Agencies, Commissions and Enterprises 2020 report.

What else happened this week?

🚀 The Dividend Machine: BAT reported impressive results for the year ended Dec 31, 2021. Profit After Tax grew 17% YoY to KES 6.48B. Out of this, the firm is paying KES 5.35B in dividends (a Dividend Payout Ratio of 82.5%). With the interim dividend of KES 3.50 already paid, investors await the KES 50 Dividend Per Share approval by shareholders at the May 24th 2022 AGM.

📚 Back to Profits for Longhorn: Book publisher Longhorn turned a profit for the six months ended 31 December 2021 compared to the comparative period in the previous year. Revenues jumped 233% YoY to KES 960.099M from KES 288.515M in the previous period. Cash Flows from operations hit KES 301M compared to Outflows of KES 167M in the previous period. This helped lift the firm out of a KES 145M loss to a KES 15M profit.

🔎 Interest Rate Watch: Central bank actions in Rwanda and Namibia saw rates increase by 5% and 0.0025%. Rwanda’s last rate hike was in May 2012, while in Zimbabwe, whose interest rate, 60%, is the highest globally, monetary authorities have warned of a rate increase. Authorities in Zambia and Uganda left rates unchanged at 9% and 6.5%.

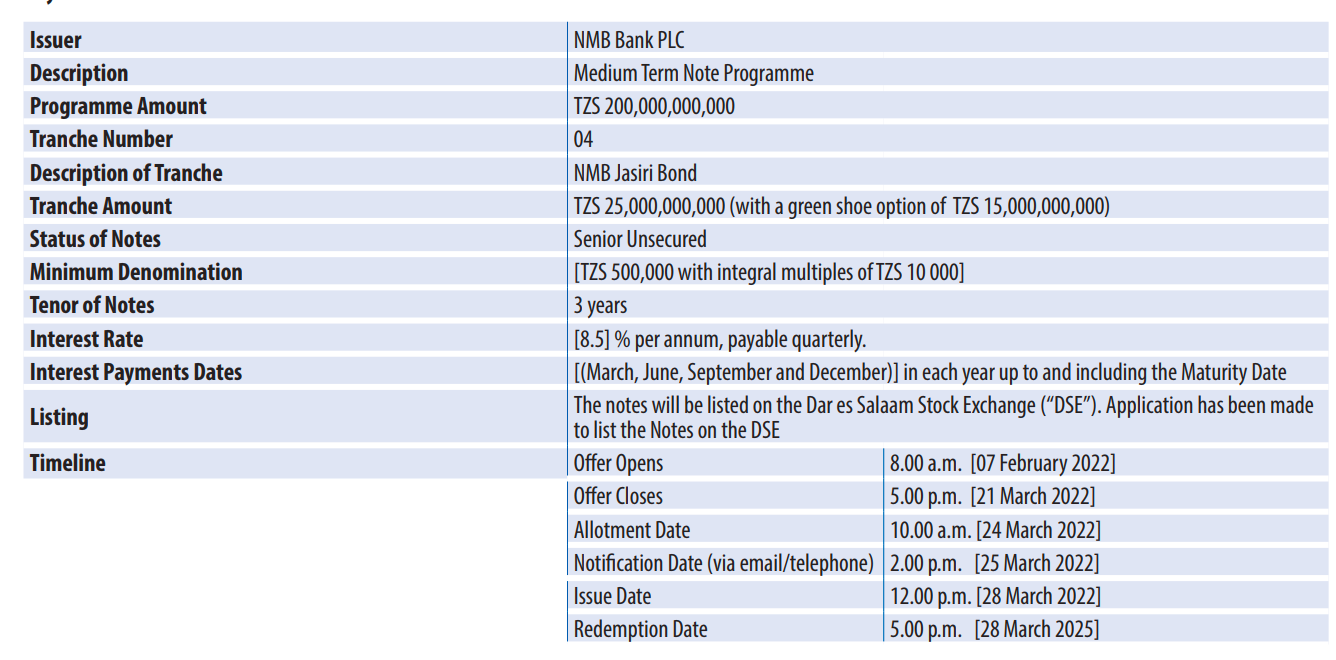

🆕 NMB Bank 3-year TZS 25B Bond: NMB Bank, the second-largest bank by assets in Tanzania, issued a medium-term bond worth TZS 200B paying 8.5% interest per annum payable quarterly. The bond has a green-shoe option of TZS 15B.

📱 Wealth Tech in Kenya: There were two new entrants into the wealth tech space in Kenya with the launch of Pawa ya Shilingi by StanChart and Chumz App by Nabo + Chumz.

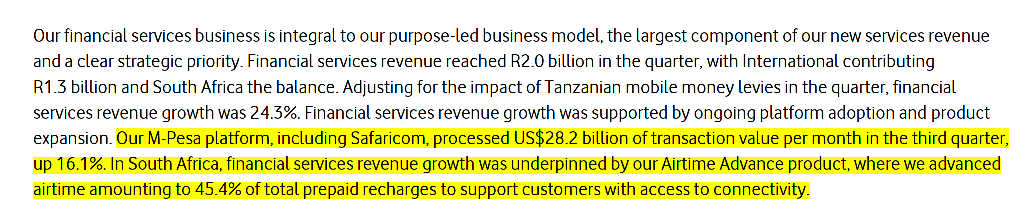

💸 M-pesa Dominance in Mobile Money: In the latest Vodacom Group Trading Update for the quarter ended December 2021, it was revealed that the M-pesa platform processed USD 28.2B of transactions per month in Q3 2021, which is a 16.1% increase over the same period the previous year.

African Markets this week

East African Bonds Watch with Churchill Ogutu

Primary market (T-Bills): Kenya sold KES 26.1Bn (USD 229.2Mn) in the week’s T-Bill auction. The subscription rate at 111.5% was better than the prior week’s 83.5%. Yields declined on the 91D and 182D tenors, while edged up on the 364D tenor. Rwanda sold RWF 10.8Bn (USD 10.5Mn) from the 28D tenor only, with no bids on the 91D, 182D and 364D tenors. Yield on the 28-day rose to 5.97%, up from 5.30%. Uganda sold UGX 215.2Bn (USD 61.3Mn) in the T-Bill auction held in the week. Interest was on the 91D tenor, as seen with a higher bid-to-cover ratio (bids tendered to bids sold) of 2.94x against the average of 2.0x in the 182D and 364D tenors.

Coming Week primary auctions:

KE: T-Bills on 24th Feb. KES 24.0Bn (USD 211.2Mn) in 91D, 182D and 364D tenors

RW: T-Bills on 24th Feb. RWF 10.8Bn (USD 16.5Mn) 28D, 91D, 182D and 364D tenors

TZ: T-bonds on 23rd Feb. TBA

UG: T-Bonds on 23rd Feb. UGX 500.0Bn (USD 142.7Mn) re-opening of ’23 (10.0% coupon rate) and ’32 (16.375% coupon rate)

Our charts of the Week:

The growing importance of M-Pesa to Safaricom:

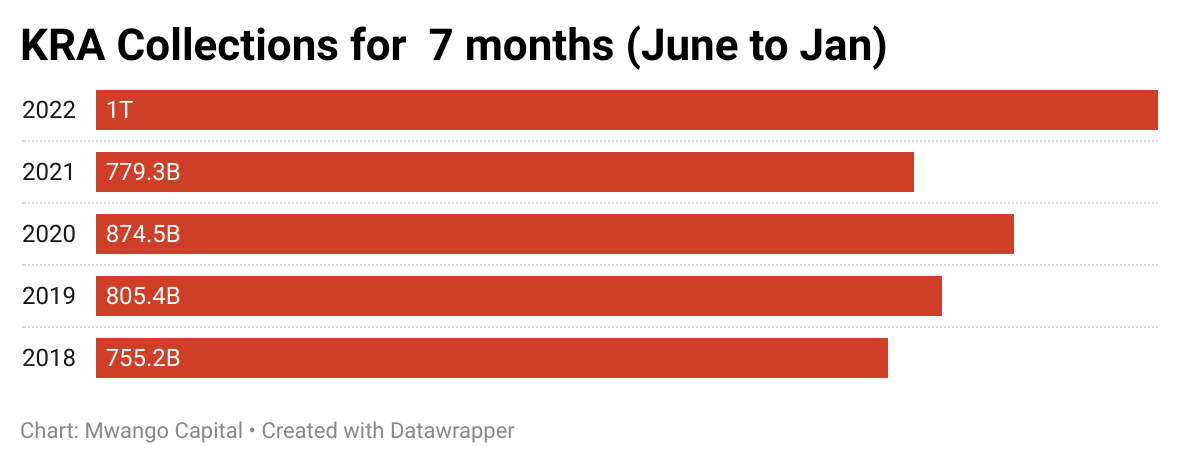

KRA collections for the first 7 months of 2021/22:

If you enjoyed our newsletter, please share it.

Nothing happened on the Kenyan #bitcoin and #cryptocurrency front that week.