Half Year Results Rolling in

Several companies across East Africa are releasing their H1 2021 results

Welcome to the Baobab Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.

This week we cover half year results from across East Africa, Ethiopia’s second telecoms license and Tanzania’s SME focused “Endeleza” initiative. We also take a look at the African Exchanges Linkage Project (AELP)

Our newsletter this week is brought to you by:

Mwango Capital. Mwango Capital provides A+ quality analysis and research on the East African capital markets. Follow us on Twitter, join us on Telegram, check out our website and drop us an email at mwangocapital@gmail.com for any engagements.

Half Year Results Rolling in

Stanbic Bank Uganda Holdings: The bank released its half year results for the year ended 30 June 2021 posting a 21.5% rise in profits: Driven by 11.6% increase in non-interest income (fees & commissions) and a 30% reduction in loan loss provisions. Other performance indicators were net loans and advances (+9.8%), customer deposits (+9.5%), total assets (+14.4%) and total income (+10.2%). Find the full results presentation here.

Sameer Africa: Their revenues were down 27% but efficient expenses management (operating expenses down 54.5%) ensured that they posred a net profit of Kshs 154M [2020: Loss of Ksh 58M]. More on these results here

Kenya Re had a brutal H1 2021 even though gross written premiums were up 6% to Kshs 9.59B. The claims incurred were up 22% to Kshs 6.3B and with opex up 11% to Kshs 1.06B, the EPS down was pushed down 66% to 0.19. More on the results here

From Rwanda, Bralirwa and MTN Rwanda had brilliant H1s.

Bralirwa’s revenues soared ~20% to Rwf 53.5B on volumes that were also up 13.2%. Continued deleveraging reduced its net finance costs by 8.8%. Earnings per share was up a staggering 64.2% to Rwf 6.28.

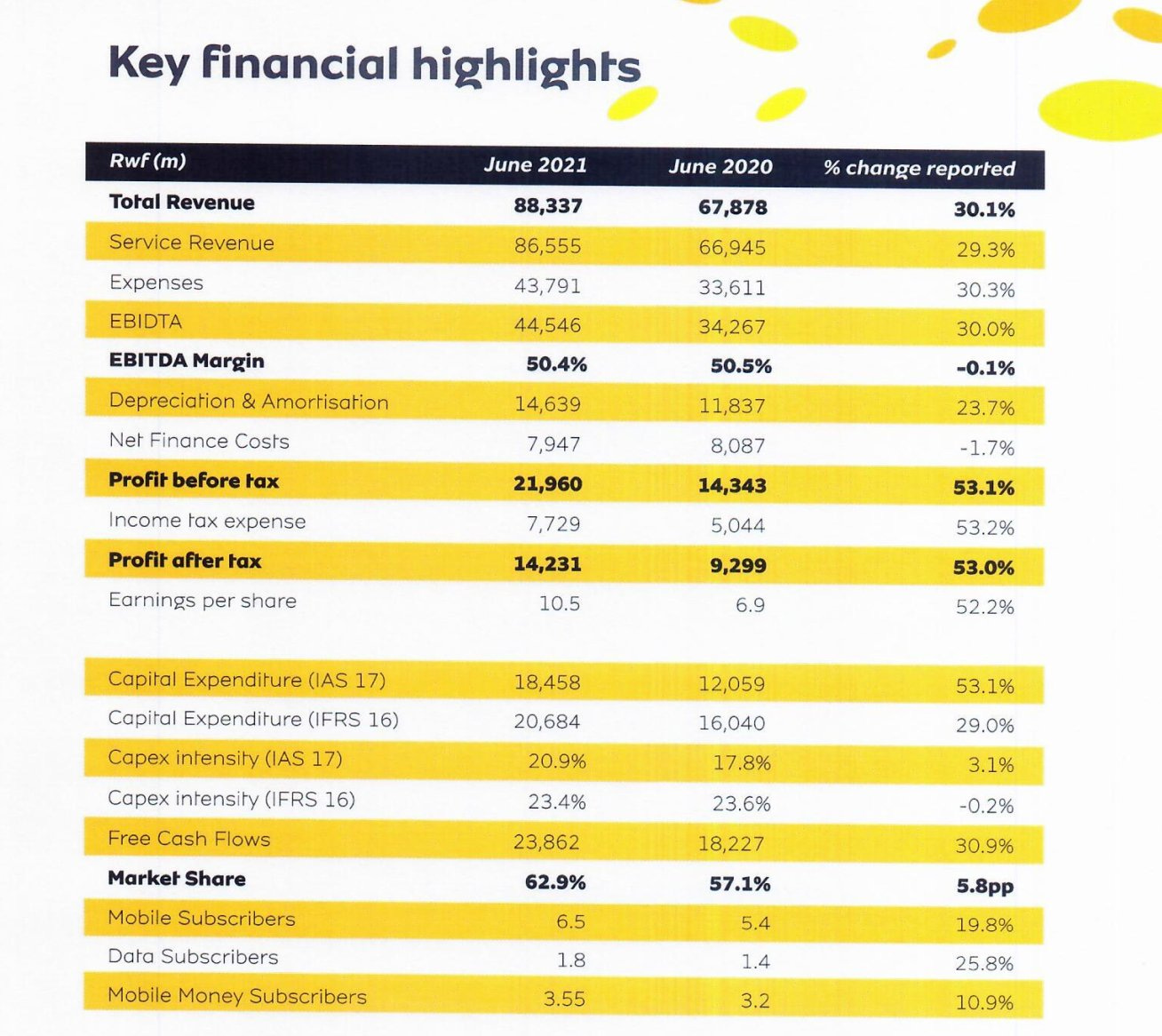

MTN Rwanda’s reported it’s first results since going public earlier this year with revenues of Rwf 88.3B [+30% YoY] and net income of Rwf 14.3B [+53% YoY]. More on their results here and here.

Might be time to head over to Rwanda to buy some shares there!

MTN Rwanda results.

We expect more East African banks’ half year results next week.

We have a premium channel on Telegram where you can get access to our best ideas and analyses on capital markets in East African and US markets:

East African Debt Markets

Rwanda Eurobond 2.0: In the country’s only second visit to the international bond market, Rwanda’s 5.5%, 10 year debt issue raised $620M from $1.6B of orders. Proceeds of the bond will go towards payment of the country’s existing $400M Eurobond which matures in 2023 and also fund economic recovery programs.

Tanzania records historic subscription: The East African country’s 15.95%, 25 year Treasury bond attracted bids worth TShs 585B against an advertised amount of TShs 133B. Tanzania’s Central Bank opted to accept bids worth TShs 133B leaving the rest on the table.

Ethiopia second telecoms license

Officials confirm second bidding: According to senior government officials, bidding for the second license will take place this month. Ethiopian government has also included mobile money in the second license in an effort to increase its valuation

“We have made some changes that can uplift its value, for instance mobile financial service”

Ethiopian Communication Authority Director General, Balcha Reba

MTN Group may not bidding: Early reports suggest MTN Group isn't likely to submit a bid for the second license.

First license: Global Partnership for Ethiopia consortium composed of Vodafone Group (UK), Vodacom Group (South Africa), CDC Group (UK), Sumitomo Corporation (Japan) and Safaricom (Kenya) won the first license with a winning bid of $850M. South Africa’s MTN Group also submitted a bid but came up short. Read more here about the first license.

New development: Ethiopian authorities told Business Daily that Safaricom’s license will be upgraded to include mobile money once bidding for the second license is complete. Good news for Safaricom shareholders.

Tanzanian exchange targets SMEs for listing

Launch of “Endeleza” initiative: The Dar Es Salaam Stock Exchange launched a pre-listing program aimed at positioning SMEs for eventual listing in Tanzania’s capital markets. The program profiles SMEs on aspects such as corporate governance, compliance, financial reporting which are some of the prerequisites for accessing capital markets and investors.

First admissions: Eight SMEs have already been admitted to the program namely: Selcom, Raha Beverages Company, AKM Glitters Company, Victoria Finance Plc, FINCA Microfinance Bank, AML Finance Ltd, Techno Image and Reni International Company.

IBUKA in Kenya: The Nairobi Securities Exchange also runs a pre-listing incubation and acceleration program for SMEs dubbed “IBUKA” where it has admitted over 20 firms.

Pan African trading inches closer

Seven exchanges team up: The African Securities Exchanges Association (ASEA) signed a contract to roll out an African Exchanges Linkage Project (AELP) that will enable cross border trading between brokers in 7 African securities exchanges.

Investors will be able to trade different securities listed on the participating exchanges and sponsoring stockbrokers provide access.

About ASEA: Established in 1993 ASEA is a premier association of 27 African Securities Exchanges that have come together with the aim of developing member exchanges and providing a platform for networking. The CEO of the BVRM Exchange is the President of ASEA.

“We are excited with this big step towards free movement of investments across Africa and free flow of capital.

ASEA President Dr. Felix Edoh Kossi Amenounvé

Software: DirectFN won the contract to supply the software that will enable the cross border trading amongst the seven exchanges. DirectFN is a global IT firm experienced in capital markets solutions across the Middle East and emerging and frontier markets.

Looking ahead: The initiative once complete will broaden pan-African capital flow and also boost liquidity in Africa’s capital markets.

Also check out: Our Founder Erick Mokaya was on Arise Tv Africa this week discussing more about this exchange. Check out the video here.

Markets this Week

Results delay: WPP Scangroup and Nairobi Business Ventures announced delays of publication of their financials.

Cautionary Announcement: Unga Group will partner with Nutreco International in two joint venture deals in Kenya & Uganda

In East Africa, Kenya recorded a 0.55% rise with the Nairobi Securities Exchange All Share Index closing the week at 178.50, up from last week's 177.52. Tanzania’s DSE ASI was down 0.12% to close at 1,998.42 from last week’s 2,000.92 while Uganda’s USE ASI recorded a 0.77% drop to close at 1,527.21 from last week’s 1,539.12

Across Africa, Malawi’s MSE ASI recorded the highest increase in returns last week, up 3.58% to close at 37,800.79.

What Else Happened This Week?

Kenya Power Managing Director resigns: Bernard Ngugi resigned and was quickly replaced by Rosemary Oduor appointed in acting capacity. We also learned about the deep financial crisis that Kenya Power is facing. Also, The Kenyan Ethics and Anti-Corruption Commission has launched investigations into the board of Kenya Power over alleged interference in the management’s work as well as award of tenders. It’s not raining but pouring at Kenya Power.

Another round of Cytonn v CMA: In the latest row between these two, the regulator has directed the fund manager to change its name or stop onboarding clients [Capital Markets Authority]

In aviation news, Kenya Airways is to wait another 30 days for resumption of flights to India, one of its key routes, following extension by KCAA [Business Daily]. Jambojet will start flights to Lamu four times a week and Goma (DRC) two times a week from September

Chinese debt: Kenyan treasury opts not to seek debt relief beyond July from the Chinese government [Business Daily]

Startups & SMEs: UAE based firm Investera launched operations in Kenya seeking to link foreign investors to promising startups and entrepreneurs in Kenya [All Africa]