👋 Welcome to the Baobab Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.This week, we cover the key takeaways from the Kenyan capital market in Q4 2021 and the East Africa treasury bond market. Our newsletter this week is brought to you by:

Mwango Capital. Mwango Capital provides A+ quality analysis and research on the East African capital markets. Follow us on Twitter, join us on Telegram, check out our website.

If you want to sponsor our weekly newsletter, memes, or Twitter Spaces, reach us at hello@mwangocapital.com.

First off, here is our weekly business news in memes:

Highlights from CMA Q4 2021 Bulletin

The Capital Markets Authority of Kenya released its statistical bulletin for the quarter ended December 2021.

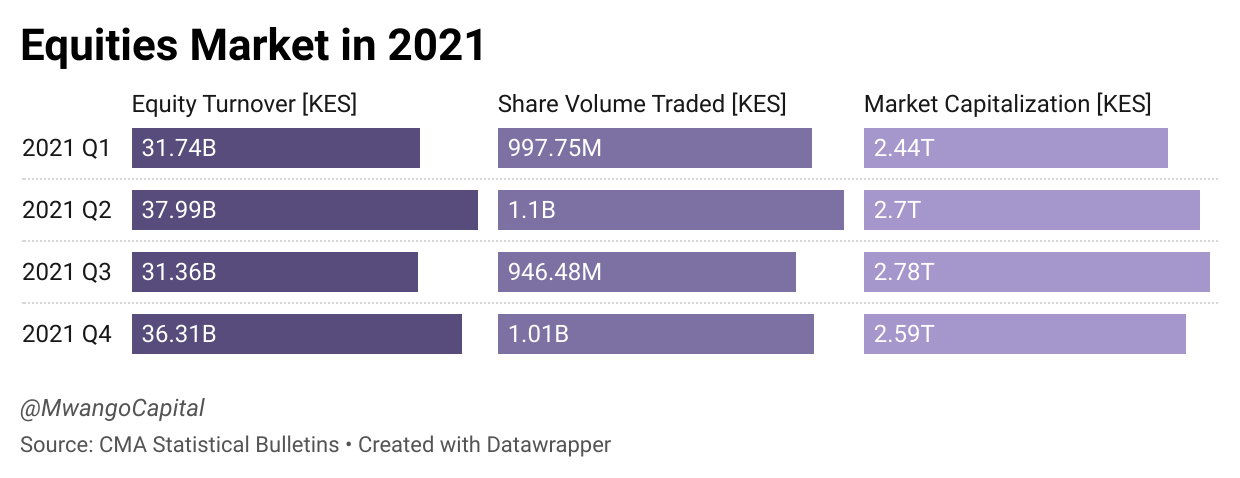

Equities: Equity turnover was up 15.78% from the previous quarter to KES 36.31B while the volume of shares traded up 6.41% to KES 1B. Market capitalization was down 6.68% to KES 2.59T. The NSE 20 and NSE 25 indices were down 6.33% and 6.65% from the previous quarter to 1902.57 and 166.46 points respectively.

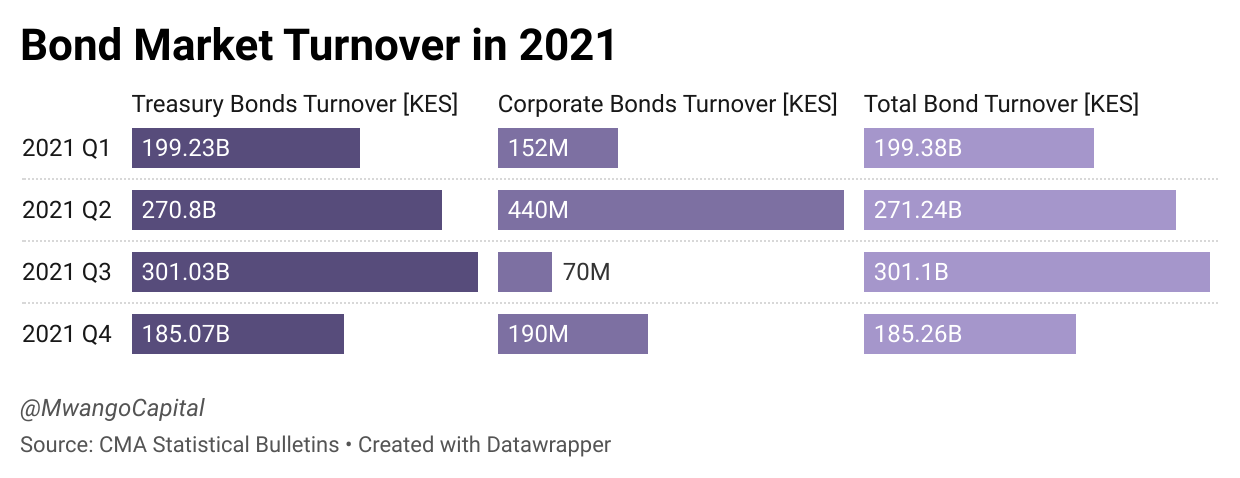

Fixed income: Eight treasury bonds were issued in Q4 2021 raising KES 159.38B from the KES 150B targeted. Outstanding corporate debt issues were up 0.89% to KES 16.98B as at September 2021. Bond turnover was down 38.48% q/q to KES 185.25N.

Collective Investment Schemes: CIC Unit Trust boasts 41.41% market share managing assets worth KES 52.19B out of the industry’s KES 126.05B assets as at September 2021. Coop Unit Trust registered the highest increment of assets of 45.68% recording KES 2.19B. Genghis Unit Trust saw its assets decline 17.87% to KES 561.59m, the highest decline as at Sept 2021.

The Mwango Explainer:

Collective Investment Schemes aka ‘investment funds’, ‘mutual funds’, or simply ‘funds’ invest in assets, such as bonds, equities, or cash. The collective assets owned by the fund are managed by a professional fund manager. The money is invested in a range of assets.

Your investment in a fund is divided into units; the number of units held represents your proportionate ownership of the fund’s overall assets, and the income and capital growth that those assets may generate. The prices of these units fluctuates because the underlying value of the assets will rise and fall.

[Source: BlackRock]

East Africa Treasury Bond Market

(with Churchill Ogutu)

Tanzania: Tanzania's first long-term treasury bond auction in 2022 was ~5X oversubscribed receiving TZS 656.0B (USD 284.5m) versus the offered amount, TZS 133.0B (USD 57.7m). This was a 25 year-bond whos coupon rate was fixed at 15.95%.

Of the bids received, the Central Bank accepted the amount on offer representing a bid-to-cover ratio of 4.9x. More than 1,136 bids were received for this bond whos auction took place on 19th January.

Kenya: In the second auction of 2022, the Kenyan Treasury raised a combined KES 34.9B from the reopened 10-year bond (FXD2/2018/10) and reopened 20-year bond (FXD1/2021/20) against the KES 30B targeted. Investors threw bids worth KES 38.4B to the two papers.

What Else Happened This Week?

⚠️ 2022 profit warnings: Sanlam issued a profit warning for its FY ended 31 Dec 2021 results. A profit warning signifies that a company’s net profit will decline by more than 25% compared to the prior year. The insurer joins Kakuzi and Limuru Tea as the only listed firms to issue profit warnings so far [Sanlam Kenya].

💡 Innovation in the capital markets: Capital Markets Authority admitted Sycamore Capital to its Regulatory Sandbox to test a mobile-based unit trust investments application named Cashlet App for six months. The sandbox allows developers of innovative products and services relevant to Kenya’s capital markets to conduct live tests in a tailored regulatory environment [Capital Markets Authority of Kenya].

💰KRA’s pursuit: The taxman is demanding KES 677m from Car & General that has accrued over the last six years [Business Daily]. Keroche Breweries is also under the cosh following default on a tax repayment plan [Business Daily].

🏦Banking: Equity Bank introduced “Pay with Equity” that enables mobile subscribers to pay for goods and services easily and conveniently to one merchant Till Number [Equity Bank Kenya]. I&M has rolled out unsecured loan facilities upto a maximum of KES 3m to its customers [Capital Business].

🚍 Kenya’s first EV bus: Swedish-Kenyan startup Opibus introduced Kenya’s first all-electric bus. This is a major step towards the company's vision to provide a locally designed and developed electric bus that can be mass-produced for the pan-African market by the end of 2023 [Opibus + TechCrunch].

🏍️ Car & General: Is the run over? The counter was up only 18.10% at the end of this week compared to a 56.55% rise at the end of last week [Mwango Capital].

⚡KenGen: The power producer will make an application to EPRA on 29 Jan 2022 for an electric power generation licence for Eburru Hill Geothermal. The plant has an installed power generation capacity of 2.44 megawatts [Mwango Capital].

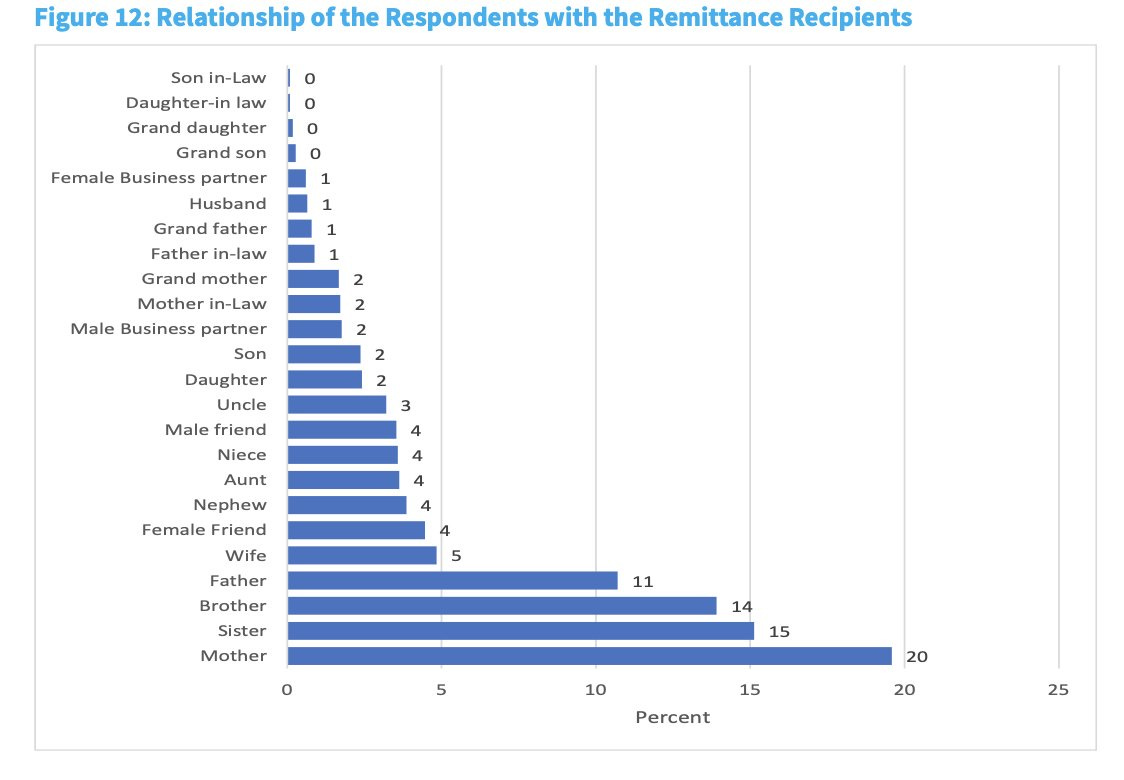

🧾 Diaspora Remittances Survey: Find our thread on the survey by the Central Bank of Kenya here. The most surprising thing for many was who gets the money:

Charts of the Week:

📈 DPS v DY correlation from our 2021 NSE Review

🚀 The KES touched 113.53 vs the Dollar

African Markets this Week:

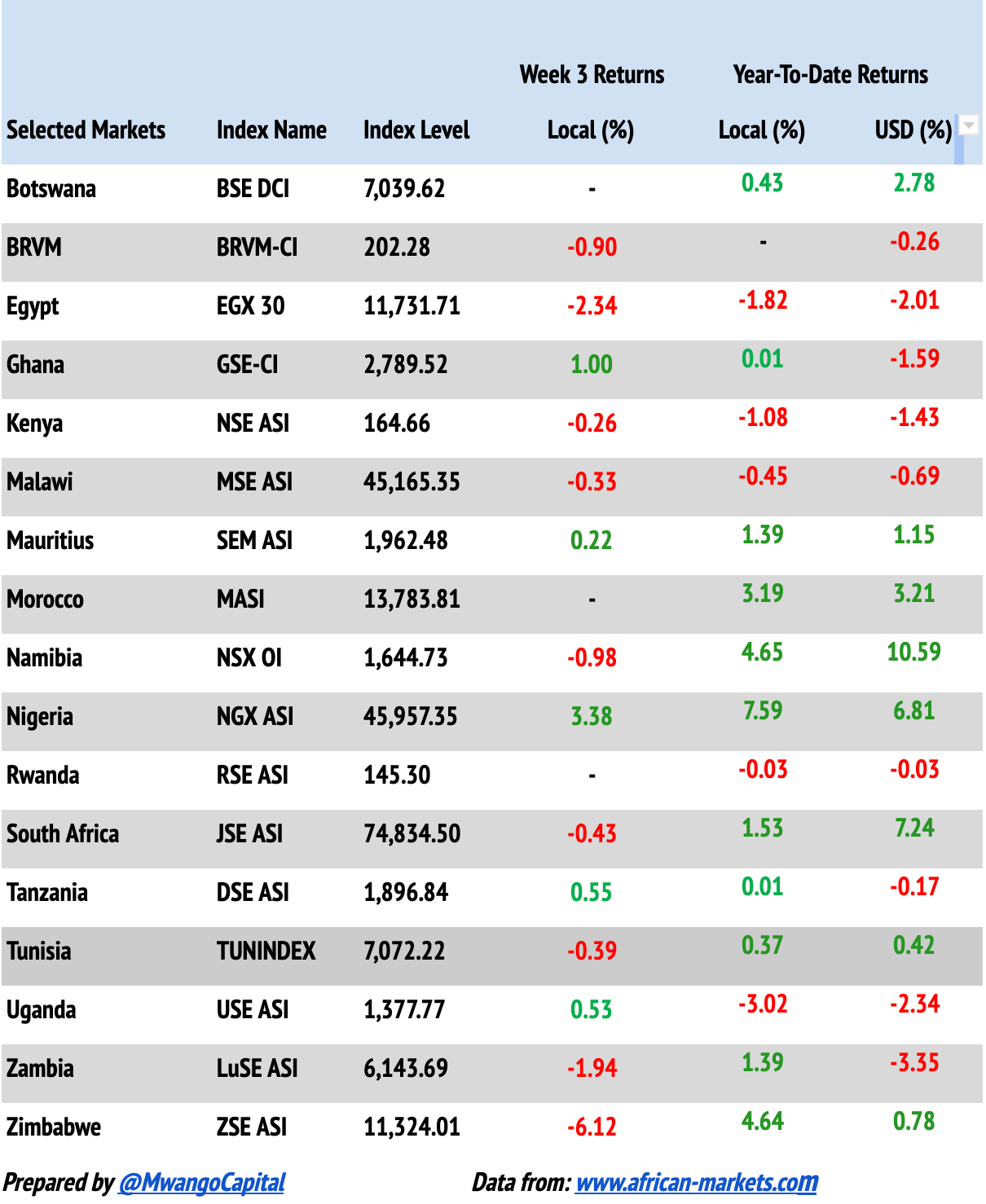

In East Africa, Kenya recorded a 0.26% decrease in the Nairobi Securities Exchange All Share Index, closing the week at 164.66, down from last week’s 165.09. Tanzania’s DSE ASI was up 0.55% to close at 1,896.84 up from last week’s 1,873.25 , while Uganda’s USE ASI recorded a 0.53% rise to close at 1,377.77 from last week’s 1,477.60.

The rest of Africa:

If you enjoyed our newsletter, share and subscribe: