Talking Points from Our Twitter Spaces

What did we learn from Centum CEO James Mworia and Standard Chartered Head of Wealth Management Paul Njoki?

Welcome to issue 26 of the Baobab Weekly where we bring you a succinct summary of key capital market and business news from East Africa.

This week on our Twitter Spaces, we had Centum CEO Dr James Mworia to unpack the seemingly misunderstood Centum business model. We also had a session with Standard Chartered Head of Wealth Management Paul Njoki for a discussion on personal finance and the wealth management space in East Africa. We change things slightly this week as we bring you insights and nuggets of wisdom we picked from the two conversations.

We will be releasing the audios for the two events on our Twitter Spaces next week.

Our newsletter this week is brought to you by:

Mwango Capital. Mwango Capital provides A+ quality analysis and research on the East African capital markets. Follow us on Twitter, join us on Telegram, check out our website and drop us an email at mwangocapital@gmail.com for any engagements.

Understanding Centum with James Mworia

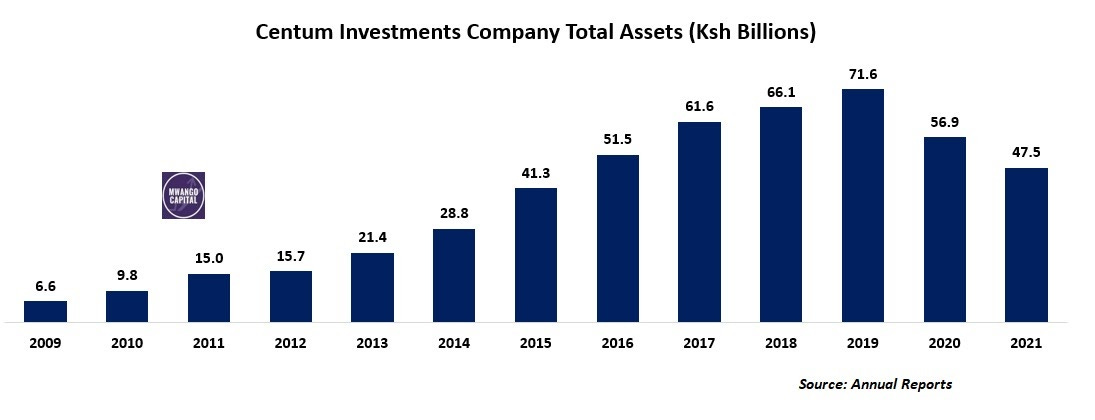

His rise to the top: James started as an intern at Centum despite being overqualified at the time. He would go on to be appointed CEO of Centum in October 2008 at the young age of 30. He credits his rise in corporate Kenya to lessons from his mentors that included focusing on your circle of influence and being a problem solver. During his time at the helm, he has managed to grow Centum’s assets.

How Centum works: Centum is an investment company that identifies great opportunities, deploys capital to create value and ultimately seeks to monetize the value created. Not a conglomerate. It is in the business of buying and selling other businesses.

On returns to shareholders and investments: The business model has largely been funded through debt over the years, stifling returns. Existing minority shareholders didn't want to dilute hence they have not raised more capital.

"If initially we had equity capital, then cash flows used in interest/debt repayment would have flown to shareholders"- James Mworia

Going forward, they intend to make some share buybacks as a way to return cash to shareholders. They will be seeking to amend the articles of association to allow for these following in the well-trodden paths of Nation Media Group and Jubilee Insurance.

On the current strategy: The company is currently implementing Centum 4.0 where the focus is on deleveraging the balance sheet, that is, repayment of all debt obligations. As at March 2021, Ksh 13B has been retired, which is 81% of targeted Ksh 16B of debt by March 2024. The aim is to move the company more towards PE investments. They did not intend to have the portfolio as it currently is- heavily tilted towards real estate.

On new investments and making mistakes: They have been busy during the pandemic having looked at over 150 companies which they screened for investment but have chosen not to invest in them. Centum is exercising caution owing to exit risk.

“If you get it wrong, getting out is very difficult”- James Mworia

He gave an example of Amu Power, a coal power plant in Lamu, one of their investments that didn't go to plan, owing to environmental risks and a fall in power demand.

On financial reporting: He admits that the company’s financial statements require work to understand but he pointed Company financial statements should be the focus. Consolidated statements are prepared as a requirement by the Companies Act and IFRS.

“The set of numbers that tell you how we’re doing as investment company is the company’s P&L” - James Mworia

Wealth Management with Paul Njoki

On some key pointers to wealth creation: Don't delay the decision to invest. Start now!. You don't need huge amounts to start investing. Start with what you have. Finally, learn to associate yourself with the investment-minded people.

On mistakes: Don't get into certain industries/businesses if you don't know the loops and hoops. Paul got into the seemingly profitable PSV (matatu) business without prerequisite knowledge of the industry. A few months later he lost his initial investment.

Next Saturday: We have a primer session on investing at the Nairobi Securities Exchange. Sign up and let’s learn.

East African Business Nuggets this week:

Digital lending regulation in Kenya inches closer: Parliament’s Finance & National Planning Committee approved for tabling to the main house its report on the Central Bank of Kenya (Amendment Bill) 2021 that seeks to bring digital lenders under the regulatory arm of Central Bank of Kenya. Of interest is that the Committee proposed that “CBK determines the parameters to be used in credit pricing” in relation to pricing of digital loan rates. Find the full report by the Committee here

Ethiopian telecom licence: The MTN Group confirmed it will not be participating in the second telecoms license (mobile money inclusive) bid in Ethiopia citing the growing Tigray conflict [Developing Telecoms].

Safaricom hitting new highs: Safaricom’s share price is hitting new all-time highs even as analysts become more skeptical of its move into Ethiopia. Bloomberg has collected data from analysts who have an average 12-month target price of Kshs 38.61. In the Financial Times, 10 analysts have a median 12 month price target of Kshs 39.41 [High: Kshs 44; Low: Kshs 31.00]. The median estimate represents a -8.35% decrease from the last closing price of Kshs 43.

Inflation biting in Kenya: From 1st October 2021, prices of several goods will increase following adjustment of excise duty rates to take into account the rate of inflation. Amongst the goods set to increase are beer, bottled water and juice. [Kenya Revenue Authority]

Row between fund manager & regulator: In the latest round of Cytonn v CMA saw the fund manager issue a cease and desist notice to CMA CEO Wycliffe Shamiah [Mwango Capital]

Human rights advocacy: Kakuzi became the first local firm to establish an independent Human Rights Advisory Committee to its board. The committee will be chaired by former Attorney General Prof. Githu Muigai. The company has been having some issues with its human rights track record so this is a welcome move. [Mwango Capital]

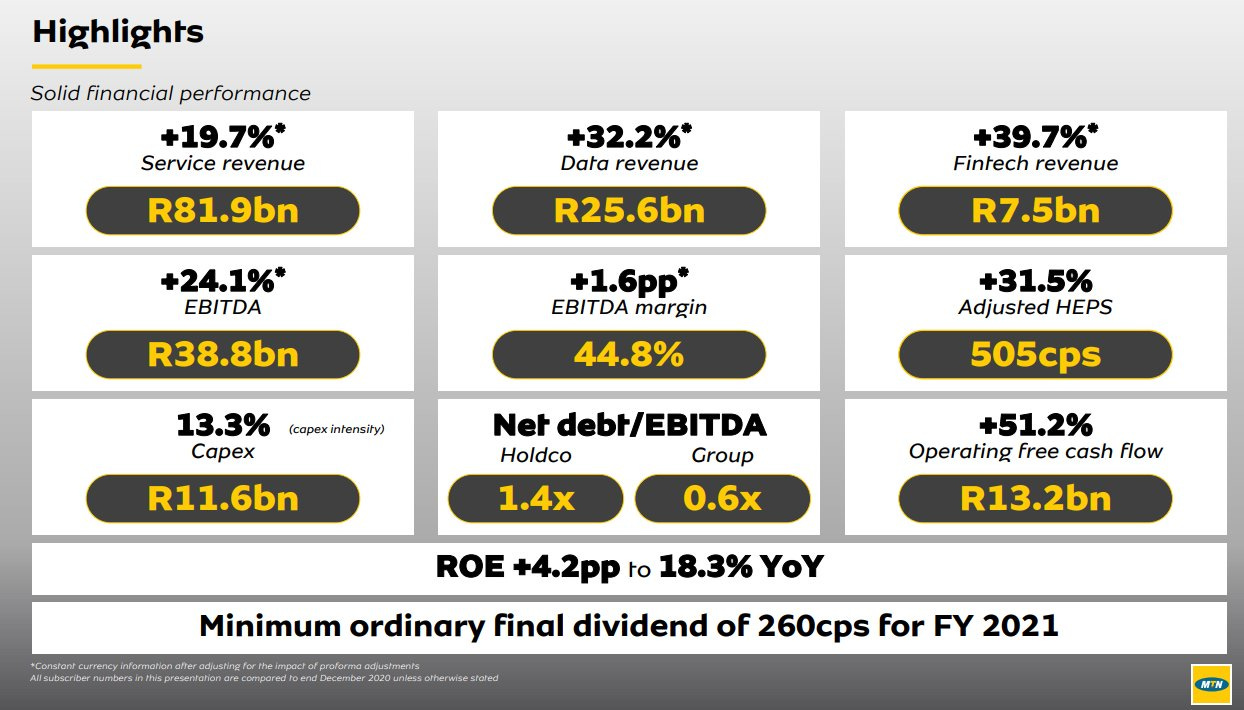

More half year results: Stanbic Holdings, MTN Group & CIC Group all reported this week. Here is a highlight from MTN:

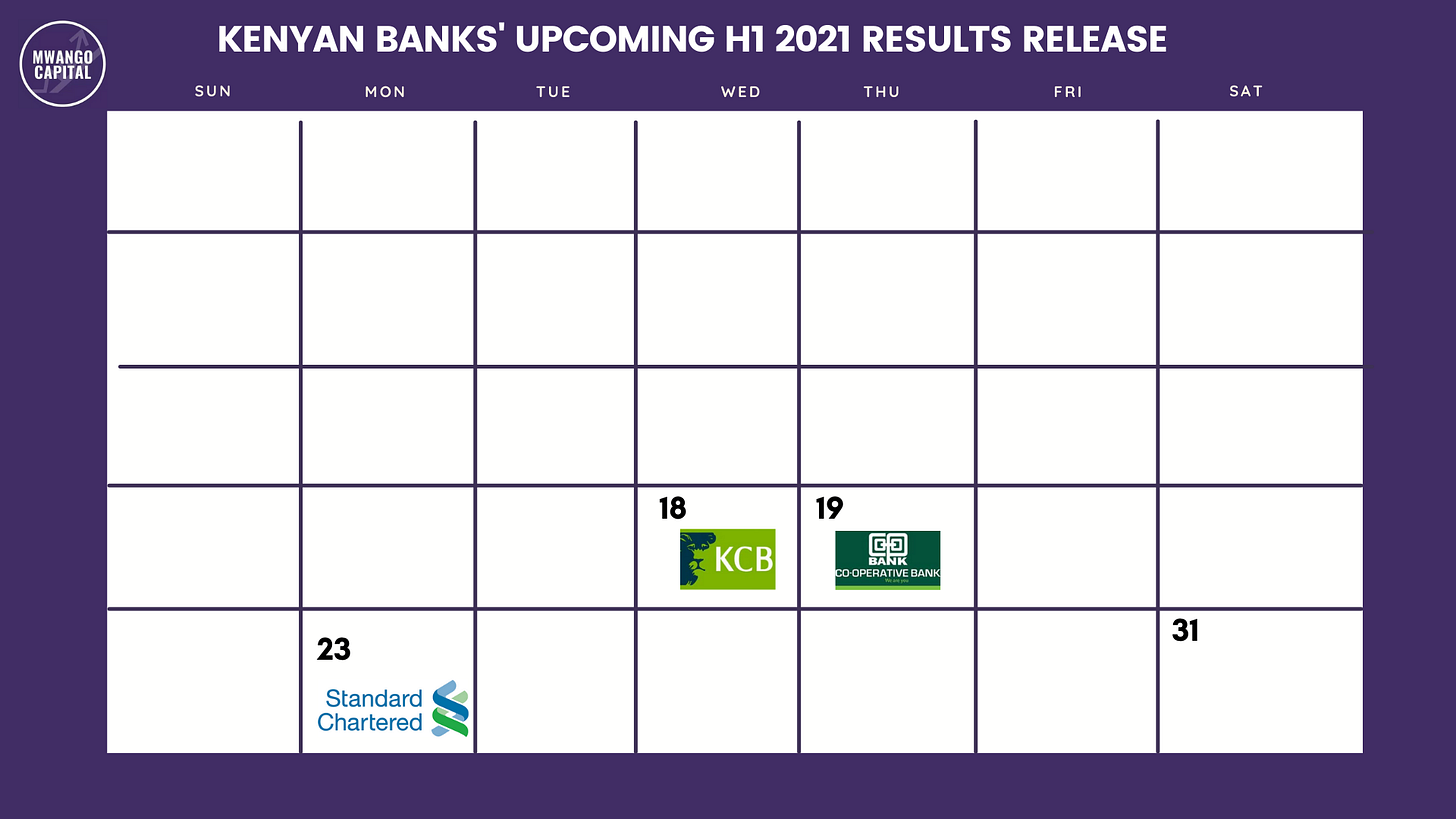

We are looking forward to next week as Kenyan banks report their H1 2021 results. Here are a few of those we know.

Kenya debt Market: The Central Bank of Kenya reopened ten & twenty year and new twenty year treasury bonds received bids worth Ksh 104B against an advertised Ksh 60B. [Central Bank of Kenya]

Digital and agency banking: Absa Bank in Kenya launched its Whatsapp Banking while Equity Bank’s Equitel rolled out its 4G service. In Tanzania, Leading Tanzanians lender CRDB Bank is leveraging state-run Tanzanian Posts Corporations' nation-wide network of outlets to provide agency banking.

How many Bonga points do you have?: Safaricom customers can now use their accrued bonga points to buy shares at the Nairobi Securities Exchange. [Safaricom]

Markets this Week

In East Africa, Kenya recorded a 0.55% rise with the Nairobi Securities Exchange All Share Index closing the week at 178.50, up from last week's 177.52. Tanzania’s DSE ASI was down 0.12% to close at 1,998.42 from last week’s 2,000.92 while Uganda’s USE ASI recorded a 0.77% drop to close at 1,527.21 from last week’s 1,539.12

Across Africa, Malawi’s MSE ASI recorded the highest increase in returns last week, up 3.58% to close at 37,800.79.

See you next week!

I really enjoyed this one. Also, keep up the consistency on the weekly emails. I get so much value out of it. Kudos.