Here are the top business news we covered this week:

Kenyan Banks’ 2020 Results

Kenyan banks are all expected to report their 2020 results by 31st March. We eagerly await the results especially of Equity bank which reports on Monday morning. Banks are usually a good indicator of how the economy is doing and so far things do not look good. Loan loss provisions are way up suggesting that lenders might see more defaults coming.

This past week, a few of them posted their 2020 results. Here is how the listed ones aka Standard Chartered Bank Kenya, Diamond Trust Bank, and Absa Bank Kenya performed:

Absa Bank Kenya:

Net interest income up 2%

Loan loss provisions are up by more than 100%

Normalized Profit After Tax down 23%

Exceptional items in the income statement went up 109%

No dividend [first bank to withhold dividend] breaking an incredible track record of paying dividends consistently.

Standard Chartered:

Net interest income down by 2% to Ksh 19.1B

Operating Expenses up 21% to Ksh 20B

Profit down 39% to Ksh 5.4B

Loan loss provisions were up 6.7 times.

Assets under management up 90% to Ksh 129B

Dividend of Ksh 10.50 proposed[vs Ksh 12.50 in 2019]

Diamond Trust Bank

Total assets up by 10% to Kshs 425B

Net interest income down modestly by 3%

After-tax profits down by 51% to Kshs 3.5B

Provision coverage ratio at 43% vs 33% a year earlier.

No dividends

Centum Issues Profit Warning

The listed investment company expects its profits for the year ending 31 March 2021 to be at least 25% lower than the year before. This is on account of COVID-19 impact on Private Equity business, no gains on disposal this year, and revenue recognition in the Real Estate business.

Notably, Centum-owned Sidian Bank reported its 2020 annual results and they were not pretty to look at:

Net interest income is up ~16.5%

Loan loss provisions are down ~54%

Total operating income down ~8.3%

Profit after tax down ~83%

Significant movement in deferred taxes

5G Network in Kenya

Kenya’s telecommunication giant, Safaricom, announced the launch of the 5G network in Kenya. The service will be available in Nairobi, Kisumu, Kisii & Kakamega and is set to be expanded to 150 sites over the next 12 months delivering speeds of up to 700 Megabits per second. Nokia and Huawei are the two technology partners in the rollout of the network. This is an incredible fete for Safaricom as the first regional company to launch this.

Here is how Safaricom’s broadband technology has developed over the years:

2000 - 2G

2007 - 3G

2014 - 4G[94% coverage]

2021 - 5G

“We therefore view 5G as being critical in delivering new solutions that will address economic development, healthcare, manufacturing, infrastructure and even delivery of government services’’

-Safaricom Board Chair Michael Joseph

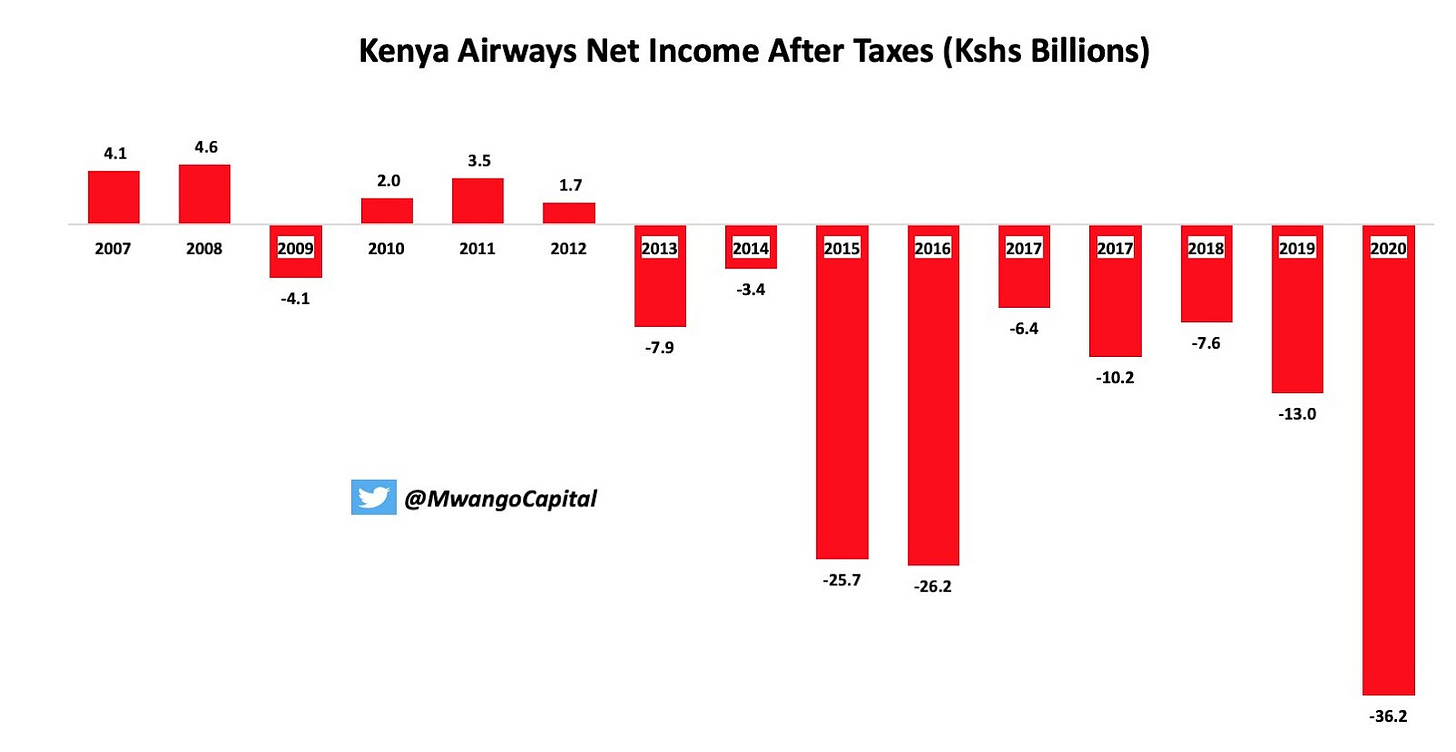

Kenya Airways 2020 Results

Kenya’s national carrier released its disappointing FY 2020 results. Here are the key highlights:

Revenues down 58.8%

Total comprehensive loss of Kshs. 46B

Took an impairment of leased assets of Kshs. 7B

70% of passengers they flew were in the first 3 months of 2020 (30% for the rest of the year!)

In an interview with Spice FM, KQ Group MD Allan Kilavuka says the airline needs $500 million (greater than its loss in 2020) this year to survive.

Insurers Post Losses

Insurers Sanlam Kenya Plc & CIC Insurance Group have both sunk into losses. Sanlam posted a Ksh 78 million loss on account of higher claims. CIC posted a first loss in 13 years of 296.8 million on the back of higher taxation and reduced premiums.

Other noteworthy items:

Kenya’s security exchange NSE announced its 2020 results:

Revenues down by 5% to Ksh. 577.1M

Total income down 6% to Ksh. 669.9M

Net profits up 109% to Ksh. 167.9M

EPS of Ksh 0.65 (vs 0.30 in 2019)

Dividend of Ksh. 0.53 proposed (vs 0.08 in 2019)

Umeme Ltd expects a more than 60% decline in net profits for the year ended 31 December 2020 attributable to the effects of the COVID-19 pandemic. The company is the largest electricity distributor in Uganda and is listed at the Nairobi Securities Exchange.

Kenya’s Central Bank announced the expiry of emergency measures on the restructuring of loans for bank borrowers. The measures ended on March 2 2021. Notably, since March 2020, loans amounting to Ksh 1.7 trillion were restructured by end of February 2021 accounting for 57% of the banking sector’s gross loans.