Welcome to the Baobab Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.

This week, we share key highlights from banks’ half-year earnings. I&M Group, NCBA Group, and BK Group reported, concluding the release of the results from the twelve listed lenders. We also cover WPP Scangroup’s long-awaited FY 2020 earnings.

Our newsletter this week is brought to you by:

Mwango Capital. Mwango Capital provides A+ quality analysis and research on the East African capital markets. Follow us on Twitter, join us on Telegram, check out our website and drop us an email at mwangocapital@gmail.com for any engagements.

Key Bank’s H1 21 Results

I&M Bank

Lending to the government was a major boost to the bank’s profits. Interest income from government securities increased 93% earning the lender Kshs 4.1B. Interest income from loans and advances dropped 3.6% leading to a 28.1% overall increase in net interest income.

Increased profits: Profit for the half-year ended June 30, 2021, rose 33.2% to Kshs 4.2B, up from the Kshs 3.2B recorded in a similar period last year.

Other highlights:

Total assets up 12.3% to Kshs 383B

Customer deposits up 9.6%

Loan book up 10.8%

Loan loss provisions up 2.1%

Gross NPLs up 3.8% to Kshs 22.9B

EPS Kshs 2.44 [2020: Kshs 1.85]

NCBA

A 19.7% increase in net interest income and a 22.4% decrease in loan loss provisions helped the company book a Kshs 4.7B profit after tax, a 77% increase from last year. The company however recorded a 16.5% increase in gross non-performing loans that rose to Kshs 45B.

Dividend declared: The company is set to pay an interim dividend of Kshs 0.75 based on these results.

Other highlights:

Total assets up 5.6% to Kshs 542B

Customer deposits up 12%

Loan book down 3.5%

Non-interest income up 6.2%

WPP Scangroup’s FY 2020 Results, Finally

The long-awaited results for the marketing and communication group were finally released on August 31, 2021, after numerous delays. In the period, the group made a Kshs 1.7B loss, compared to a Kshs 158m profit the previous year.

Gross misconduct: Investigations into allegations against the firm’s former CEO, Bharat Thakrar, and former CFO, Satyabrata Das, did not identify any items of material nature that required adjustment to the Group’s results.

“I founded Scangroup and have always had its best interest at heart”- Former CEO, Bharat Thakrar commenting on Twitter

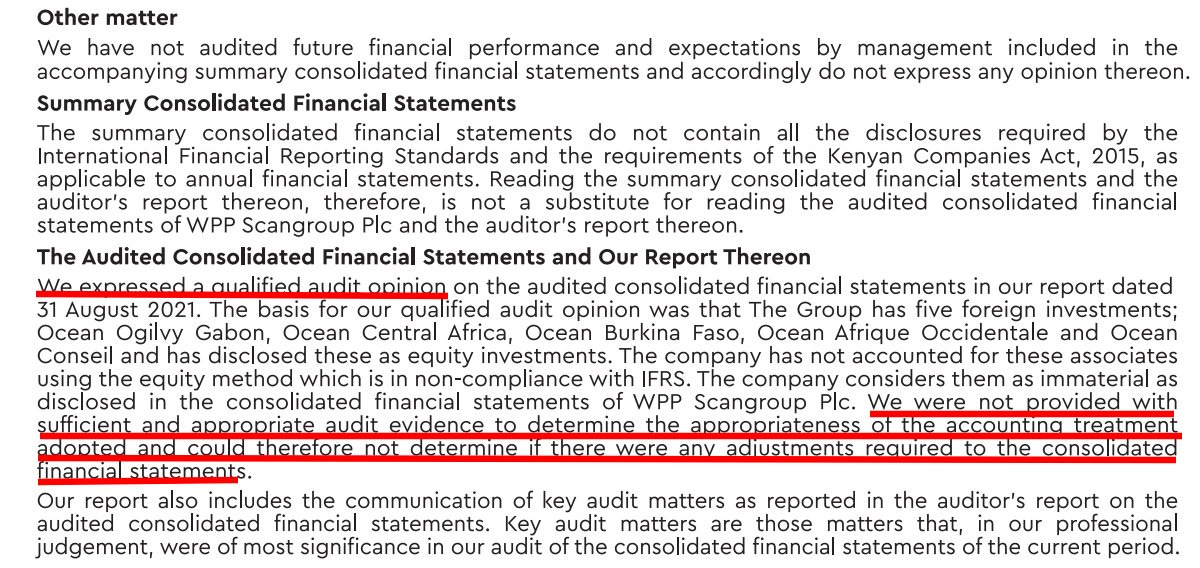

Of note: The firm’s auditor, Deloitte & Touche, expressed a qualified audit opinion on the audited financial statements. The auditor cited insufficient audit evidence to determine the appropriateness of the accounting treatment adopted for the Group’s five foreign investments which were disclosed as equity investments.

Our analyses of other NSE-listed firms that reported earnings this week can be found on the links below:

Safaricom in Ethiopia

Safaricom’s CEO, Peter Ndegwa, visited Ethiopia for the introduction of the leadership team to head the Ethiopia operations. In gearing up for the commercial launch, a recruitment drive targeting Ethiopians was launched and a 3-year Graduate Management Trainee programme for Ethiopian university students were announced.

Safaricom got the license to operate in Ethiopia earlier in the year and is gearing up for a commercial launch in 2022.

The competition: Ethiopia is finally experiencing the power of 4G as Ethio Telecom partners with ZTE to launch 4G services with an aim of reaching 100+ cities in 3 years.

In other news: From September 1st, Ethiopia has doubled banks’ reserve ratio requirements to 10% . Banks are also required to transfer 50% of their forex holdings to the Central Bank (up from the current 30%). These forex restrictions are part of the challenges we have previously highlighted that Safaricom will have to contend with as it sets up operations.

Markets this Week

In East Africa, Kenya recorded a 4.13% drop in the Nairobi Securities Exchange All Share Index, closing the week at 179.47, down from last week’s 187.20. Tanzania’s DSE ASI was down 1.23% to close at 1,978.46 from last week’s 2,003.01, while Uganda’s USE ASI recorded a 2.51% drop to close at 1,530.91.

Across Africa: Zambia’s LuSE ASI recorded the highest increase in returns this week, up 3.35% to close at 4,802.81.

What Else Happened This Week?

Inflation rises: Kenya’s year-on-year inflation rate in August 2021 surged to an 18-month high of 6.57%. The increase was driven by a rise in the prices of food (10.7%), transport (7.93%), and fuel (5.07%). [KNBS, Bloomberg]

Profitable premiums: Insurance firms, Britam and UAP Holdings, swung into half-year profitability after announcing losses in a similar period last year.

Game over: Massmart, the South African mega-retailer that operates Game Stores plans to exit the Kenyan market by selling its three stores. [Business Daily]

Student loans: Kenyan legislators have opposed a bill seeking to cut the interest rate charged on HELB loans to 3% and also increase the grace repayment period to 5 years. [Business Daily]

New high: Market value at NEXT, NSE’s derivatives market, hit an all-time high of Kshs 22.8m. [Nairobi Securities Exchange]

Pay me in equity: Nairobi Business Ventures will pay its advisers through shares and not cash for their advisory work in the proposed acquisition of four companies. [Business Daily]

Regulation changes: The Bank of Uganda proposes a 6X increase in paid-up capital for commercial banks. [Daily Monitor]

Travel tests:Uganda Airlines now requires passengers arriving at Entebbe Airport are required to have a negative PCR test done 72hrs before travel. On arrival, travelers are required to take a mandatory test at their own cost.

Devolved debt? Laikipia County is set to float a Kshs 1.16B 7-year infrastructure bond to be priced at 12%. It will be the first county to issue an infrastructure bond. [The Nation]

If you enjoyed our newsletter, please share it with your friends