Kenyan Banks' Profits Keep Soaring

Strong bank earnings in H1 24 underscore resilience in Kenya's financial sector, with rising profits even amidst challenging economic conditions

👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover the H1 2024 results for Equity Group, Co-operative Bank of Kenya, and other financial institutions, along with changes at Kenya's Treasury.Subsidiaries Support Equity Earnings

Lacklustre Asset Base Growth: Equity Group’s asset base in H1 2024 expanded by 6.2% year-on-year to reach KES 1.75T. The loan book shrunk by 3.9% or KES 26.1B to reach KES 791.1B to represent 45.31% of the asset base [H1 2023: 49.66%]. The loan books contracted as customers stayed away from highly priced loans given the high interest environment in the macro environment. Investment securities fell by KES 26.4B, or 5.44% to reach KES 459.2B, with the Group opting to increase its holdings of investment securities held to maturity by KES 10B, and reducing those held at fair value by KES 36B, or 7.92% to KES 423.5B. Here is what the Group Chief Executive Officer had to say about the drop in lending.

“Entrepreneurs are rational. They came from borrowing at 13%. The Central Bank started offering 17%, 18%. So we were competing for deposits with the public sector at 17, 18. So banks increased interest rates to 18%, 20%, 24% to match the market conditions. And of course, what entrepreneurs do is to postpone borrowing and that explains why Kenya is down specifically 7%, but the Group is 3% because the other economies, particularly DRC and Rwanda are on an upward trend in terms of borrowing.”

Equity Group Chief Executive Officer, Dr. James Mwangi

Impact of Interest Rates on Earnings: Albeit the contraction of the loan book registered in the period under review Interest income from loans and advances edged higher by 19.6% [H1 2023: 26.9%, H1 2022: 20.8%] to reach KES 53.5B. This was mostly on account of the higher interest rate environment that saw general increases in lending facilities, hence underpinning the growth in the interest income from loans in H1 2024. The other part of the double-edged sword that is higher interest rates is that interest expenses surged by 30.14% to KES 30.5B. When the interest expenses are juxtaposed to interest income, the ratio closed H1 2024 at 35.91% as compared to 33.535 in H1 2023.

Interest income from government securities totaled KES 28.3B, up 24.78%, and in sum, interest income was KES 84.8B, up 21.5%. When adjusted for interest expenses, net interest income was KES 54.4B. Non-interest income was up 17.3% [H1 2023: +41.2%] to reach KES 42.8B, and the slower growth was driven by a 22% dip in FX trading income to KES 6.6B.

Loan Loss Provisions and Rising NPLs: Loan loss provisions amounted to KES 10.5B, up 48.3%, bringing the cost of risk to 1.3%, up 46 basis points relative to H1 2023 (cost of risk = loan loss provisions/loan book). The stock of gross Non-Performing Loans (NPLs) edged higher by 22.9% to reach KES 119.9B, representing 15.2% of the loan book [H1 2023: 11.9%]. Net NPLs were KES 49.5B, up 11.5%, equivalent to 6.25% of loans as compared to 5.43% in H1 2023.

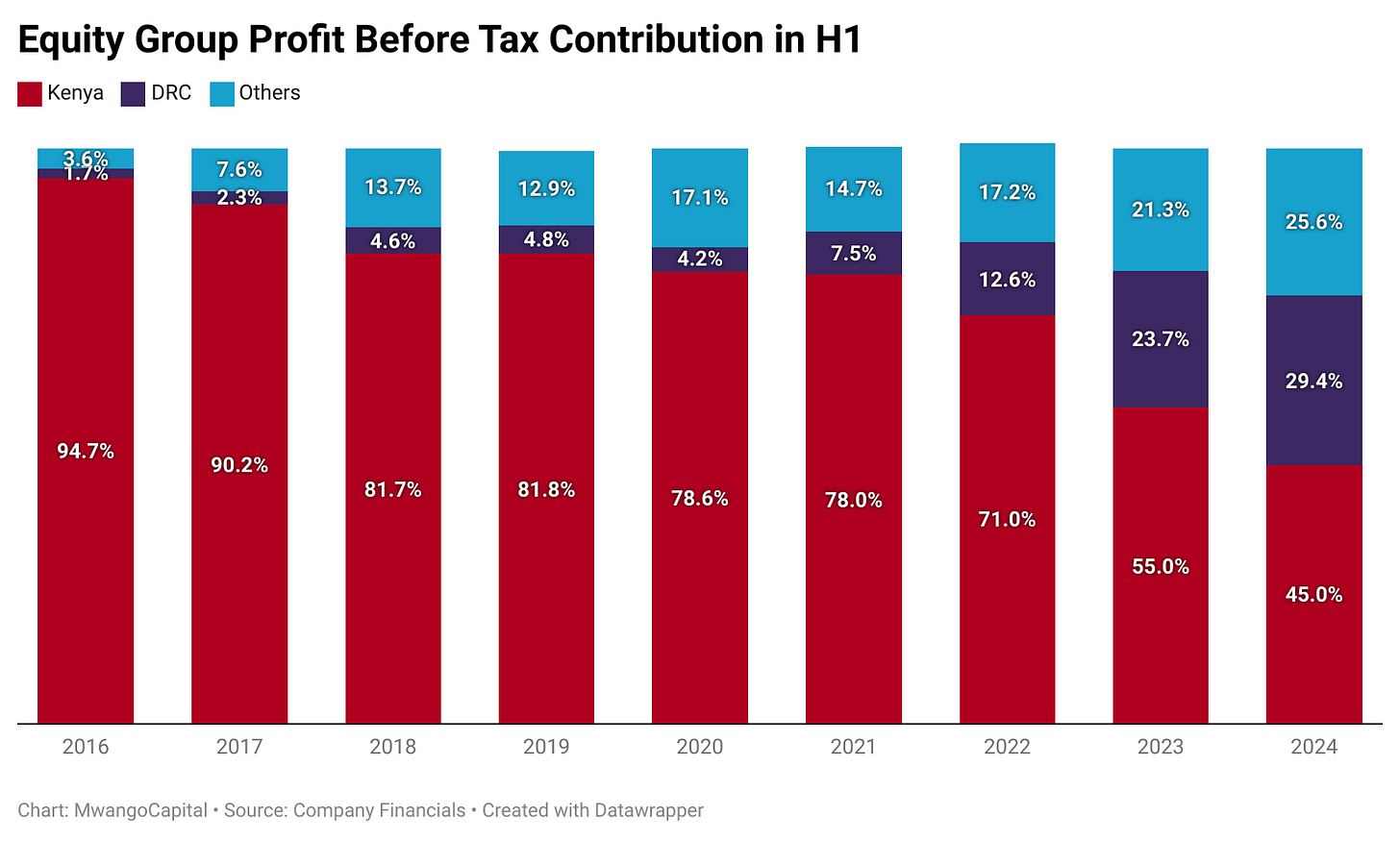

DRC Doing Well: Even as numbers cratered for the main subsidiary Equity Bank Kenya Limited (EBKL), Equity Bank DRC (Equity BCDC) and the other regional subsidiaries recorded robust performance, thereby anchoring the overall Group performance at a much-needed juncture.

“DRC continues to be one of our promising subsidiaries. If you want to understand the performance of DRC, which is largely a dollar-based balance sheet, DRC by itself grew 22% year-on-year. That tells you the strength of that balance sheet with 18% growth in profitability, year-on-year. The best way to measure that [the impact of the dollar exchange rate on the DRC performance] then is based on constant currency and I’ll give you a few numbers so that they help you. If you look at DRC deposit growth on a dollar-by-dollar basis that was 25%. Loan book growth by 14%. When you look at that, when translated to Kenya shillings, then DRC is measured having grown 15% deposits and 6% on dollar. So with the exchange rates moving from what we translated then in December at 157, to what we are translating at half year at 129, then the impact of DRC shrinks our overall Group balance sheet, but on a standalone, DRC continues to outperform our expectations.”

Equity Group Chief Finance Officer, Moses Nyabanda

Find our analysis here, and the results here.

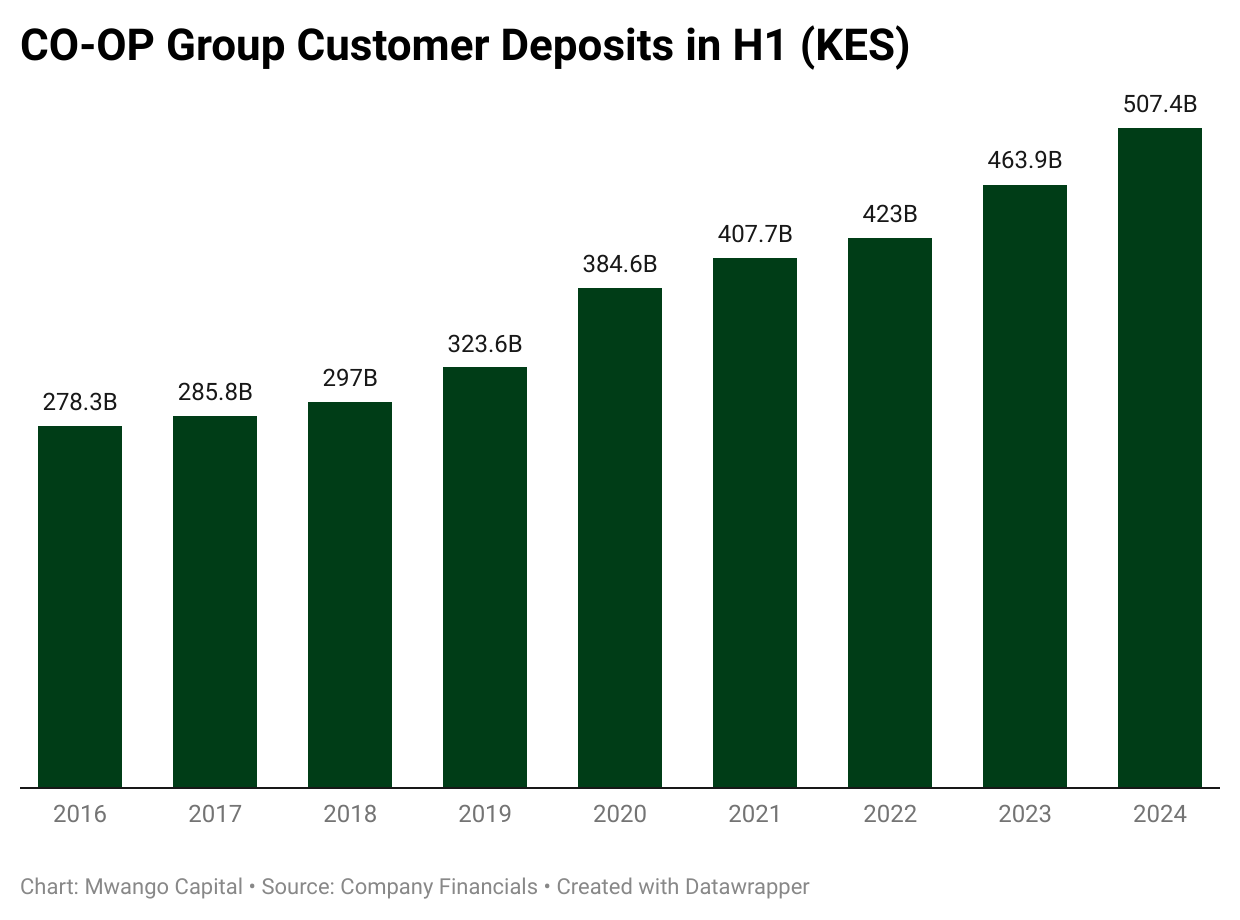

Co-op’s Deposit Base Surpasses KES 500B

Asset Base Expanded by 8% in H1: The asset base grew by 7.8% year-on-year to reach KES 716.9B, with the loan book growing by 2.8% to KES 375.6B, accounting for 52.4% of the loan book as compared to 54.9% in H1 2023. The total stock of investment securities held on the balance sheet closed at KES 203.9B, up 7.2% to account for 28.5% of the asset base [H1 2023: 28.6%]. On how the balance sheet was funded, the customer deposit base expanded by 9.4% to reach KES 507.4B - equivalent to 70.8% of the balance sheet as compared to 69.8% in H1 2023.

Profitability and Earnings: Interest income from loans and advances recorded the quickest growth in data going back to 2016, surging by 21.91% to reach KES 25.6B while from government securities, the Group earned KES 12.6B in interest income, representing a growth of 19.5%. Total interest income earned was KES 39.8B up 24.4%. Interest expenses outpaced interest income growth, surging by 52.6% to reach 15.9B - equivalent to 40% of total interest income [H1 2023: 32.6%].

Net interest income totaled KES 23.9B, up 10.73%, while non-interest income was up 11.22% to KES 15.3B. Across the listed banks that have so far reported earnings, the Group has bucked the trend in terms of FX Trading Income, which has grown by 50.1% to KES 2.6B. Pre-tax profits edged higher by 10.7% to reach KES 18.2B, and on a net basis, the profit was KES 13B, up 7.00%. Earnings Per Share stood at KES 2.21, up 6.3%.

Find our analysis here, and the results here.

Other Earnings Wrap

Sanlam Bounces Back to Profit: For the six months ended 30th June 2024, Sanlam Kenya PLC generated KES 3.5B in insurance revenue, a 5.4% year–on-year decline. Insurance service expenses however surged by 22.4% to reach KES 3.2B, which when added to reinsurance contract expenses, brings the insurance service result for the year to KES 86M [H1 2023: KES 490.9M]. Investment return grew 4.2X to KES 2.3B, and when all income lines are consolidated, the firm recovered from a pre-tax loss of KES 54.7M in H1 2023 to a profit position of KES 494.5M. Net income for the period under review was KES 282.2M as compared to a KES 171.9M net loss in H1 2023, with Per Share Earnings amounting to KES 1.88 [H1 2023: KES -1.40].

Finance Income Buoys Sameer’s Earnings: In H1 2024, Sameer Africa PLC revenue dipped by 4.2% year-on–year to reach KES 192.8M. The operating profit was KES 72.4M, down 42.3%, but KES 56.8M in net finance income helped the firm record a 120% bump in profit before tax at KES 135.3M. The firm recorded KES 108.8M in net income, up 4.5X.

Kenya RE’s PAT Down 10%: Insurance service revenue grew by 20% year-on-year to reach KES 10.3B, with the insurance service result growing by 388% to KES 606.6M. The net profit for the operating period declined by 10% to KES 1.05B, and Earnings Per Share stood at KES 0.38 as compared to KES 0.42 in H1 2023.

Find the results for Sanlam here, Sameer here and Kenya RE here.

This week's newsletter is brought to you by The Kenya Mortgage Refinance Company. First-time homebuyer? Confused about repayments? KMRC can help! Get the info you need to navigate homeownership finances with confidence. Learn more: KMRC website.

Markets Wrap

NSE: In Week 33 of 2024, Liberty led the market, rising 9.65% to KES 5.34, while TP Serena was the worst performer, dropping 10.0% to KES 13.50.The NSE 20 rose by 0.6% to 1,643.8 points, while the NSE 25 dropped by 0.1% to 2,740.4 points and NASI index rose by 0.4% to 102.5 while the NSE 10 remained unchanged at 1,062.6 points. Equity turnover fell by 59.2% to KES 783.14M, while bond turnover dropped to KES 6.9B from KES 10.6B the previous week.

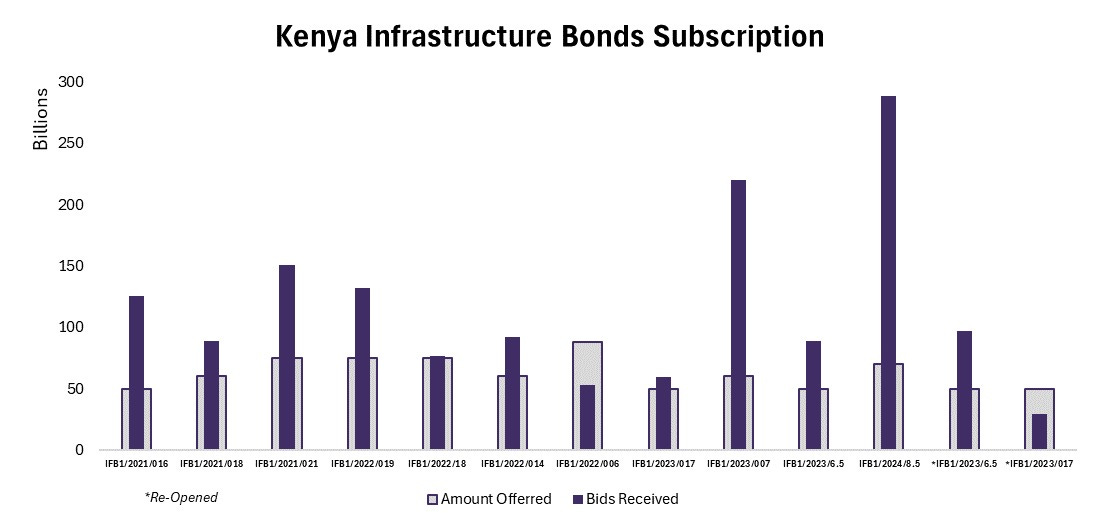

Treasury Bills and Bonds: The weighted average interest rate of accepted bids for the 91-day, 182-day, and 364-day were 15.81%, 16.71%, and 16.87% respectively. The total amount on offer was KES 24B with the CBK accepting KES 25.6B of the KES 25.7B bids received, to bring the aggregate performance rate to 107.25%. The 91-day and 364-day instruments recorded 262.93% and 41.85% performance rates, respectively.

Eurobonds: In the week, yields rose week-on-week across the 5 outstanding papers with KENINT 2028 rising the most, up 42.20 bps to 11.260%, followed by KENINT 2031 at 29.40 bps to 11.319%. KENINT 2048 recorded the least week-on-week growth at 18.60 bps to 11.425%, and the average week-on-week change stood at 26.52 bps.

Market Gleanings

🏦| Changes at Kenya’s Treasury | During the handover ceremony to the new Treasury Cabinet Secretary, the immediate former holder of the office Professor Njuguna Ndung'u delivered a candid and pointed farewell speech, highlighting the significant challenges and pressures he faced during his tenure. He reiterated his critique of the current tax policy, emphasizing that the belief in high tax rates leading to increased revenue is flawed and advocating instead for the optimization of tax instruments. Ndung'u alluded to external pressures on taxation but refrained from naming the forces behind them. In contrast to President William Ruto’s push for higher taxes, Ndung'u stressed the need for a more predictable and less distortionary tax policy to foster economic growth:

“This notion that high tax rates will raise high tax revenue, the reality is the opposite. I don't want to mention who drives us there,...Because high taxes cannot bring you high tax revenue, what do we need to do? We need to study how we can optimize each tax instrument"

📊| More Listed Firms Added to MSCI Index | The Co-operative Bank of Kenya has been added to the MSCI Frontier Markets Index, increasing the total number of Kenyan companies in the index to five. The MSCI August 2024 review also saw four other Kenyan companies—British American Tobacco Kenya, Diamond Trust Bank Kenya, Kenya Electricity Generating Company PLC, and Kenya Reinsurance Corporation—included in the MSCI Frontier Markets Small Cap Index.

🔴| Sasini Issues Profit Warning | Sasini PLC has issued a profit warning, anticipating a 25% decline in net earnings for the year ending September 30, 2024, compared to the previous year. The company attributes this to higher production costs, depressed commodity prices, and supply chain disruptions caused by global economic challenges, geopolitical tensions, and the Suez Canal closure. Sasini expects a steady recovery and stronger performance by 2025.

💸| HF Announces Rights Issue | HF Group PLC has announced a proposed rights issue to offer up to 1,499,995,255 new ordinary shares with a par value of KES 5 each, including a 30% green shoe option. The offer will be available to shareholders on the register as of the book closure date, allowing them to purchase up to three new shares for every share held. This transaction is pending approval from shareholders, the Capital Markets Authority, the Nairobi Securities Exchange, and a "No Objection" from the Central Bank of Kenya.

📡| Safaricom’s 5G Network in Kenya Keeps Growing | Safaricom has expanded its 5G network to cover all 47 counties in Kenya, with over 1K sites now live. The network, which now reaches 14% of the population, includes 1,114 active sites across 102 towns, providing faster internet access to businesses, homes, and individuals. Safaricom reports that more than 11K enterprise customers are using its 5G services, and the number of active 5G smartphones on the network has grown to over 780K. Safaricom first launched the service in Kenya in October 2022.

⛽| Kenya’s Aug/Sept Pump Prices Unchanged | The Energy and Petroleum Regulatory Authority (EPRA) has maintained fuel prices for the August/September pumping cycle by tapping the price stabilization fund. The prices are set at KES 188.84 for Super Petrol, KES 171.60 for Diesel, and KES 161.75 for Kerosene. EPRA noted the prices were inclusive of the 16% Value Added Tax (VAT) in line with the provisions of the Finance Act 2023 despite the recent Appellate Court ruling that nullified the Act. Additionally, the road maintenance levy remains unchanged at KES 25.

🤝🏽| Mergers, Deals and Acquisitions |

B Commodities Acquires Lipton Teas: The Competition Authority of Kenya (CAK) has approved B Commodities ME (FZE)'s acquisition of a 98.56% stake in Lipton Teas and Infusions Kenya PLC, ensuring the retention of all 9,715 employees of Lipton Teas and 405 employees of Limuru Tea under their current terms. This acquisition will increase B Commodities' market share to 10.7%. Despite this growth, the CAK determined that the transaction will not significantly lessen competition, as the market remains dominated by other players like KTDA, Eastern Produce Kenya, and Williamson Tea.

Mobius Gets Lifeline: Mobius Motors Kenya announced an undisclosed buyer acquired 100% of its shares on August 14, 2024, with the transaction expected to close within 30 days. This follows the company's voluntary insolvency announcement on August 5, 2024, when stakeholders decided to place Mobius under liquidation. The creditors' meeting scheduled for August 15, 2024, has been postponed, with a new date to be announced later. KVSK Sastry had been appointed as the liquidator to oversee the winding up of the company.

Invesco Under Statutory Management: The Insurance Regulatory Authority (IRA) has placed Invesco Assurance Company Limited under statutory management effective August 14, 2024. The Policyholders Compensation Fund (PCF) has been appointed as the statutory manager and will compensate affected claimants. Consequently, Invesco Assurance is not authorized to enter into new insurance contracts from this date. Existing policyholders are advised to seek alternative coverage from other licensed insurers to ensure continuous protection.

Privatization Authority invites EoIs for acquisitioin of KHEAL & KWAL: The Privatization Authority of Kenya is re-advertising its invitation for Expressions of Interest (EOIs) for the acquisition of government shareholding in KWA Holdings (E.A.) Limited (KHEAL) and Kenya Wine Agencies Limited (KWAL). This includes 43.77% of the government’s stake in KHEAL and 0.0000125% in KWAL. KHEAL is involved in the procurement, production, packaging, and marketing of a wide range of alcoholic and non-alcoholic beverages, and it owns approximately 99.9% of KWAL. Interested bidders must be willing to acquire the entire GOK shareholding in both companies and provide a bid security of KES 10M or the US dollar equivalent at the CBK prevailing exchange rate on the date of the EOI advertisement. The deadline for submission is 26th August 2024.

💼| Leadership Changes |

EBKL’s New Acting CEO: The Group in the week announced the early retirement of EBKL’s Chief Executive Officer (CEO) Gerald Warui, with Moses Nyabanda, the current Group Chief Finance and Strategy Execution Officer, taking over in acting capacity, pending regulatory approval by the CBK.

Changes at StanChart Kenya Board: Standard Chartered Bank Kenya Limited has announced the appointments of Mrs. Beverley Spencer-Obatoyinbo as an Independent Non-Executive Director and Ms. Edith Chumba as an Executive Director, pending approval from the Central Bank of Kenya and the Capital Markets Authority. Mrs. Spencer-Obatoyinbo, previously served as Managing Director of British American Tobacco (BAT) Kenya. Ms. Chumba, has been with Standard Chartered since 2015,and is currently the Head of Wealth and Retail Banking and has played a significant role in transforming the WRB business.

KAM Gets New Acting CEO: The Kenya Association of Manufacturers (KAM) has announced the resignation of CEO Anthony Mwangi after two years of service. The Board expressed gratitude for his contributions to the Manufacturing sector and the association during his tenure. Chief Operating Officer Tobias Alando will serve as Acting CEO while the Board recruits a new CEO.

📈| Debt Surge | Kenya's total public debt soared to KES 10.56 trillion by June 2024, marking a 22.4% increase over the two-year period since June 2022. The government increasingly relied on both external and domestic borrowing to fund its fiscal deficit amid challenging economic conditions. This significant rise underscores the growing pressure on Kenya's fiscal sustainability and the need for prudent debt management.

On the external front, Kenya's debt climbed by 2.6% year-over-year to $39.7 billion, with a notable shift towards multilateral financing. Multilateral debt now accounts for 53.9% of Kenya's external obligations, up from 48.7% in June 2023, driven by substantial increases in loans from the IMF, ADB, and IDA/IFAD. Conversely, bilateral debt declined, particularly with major creditors like China and Japan, signaling a rebalancing of Kenya's international financial relationships.

Domestically, Kenya's debt landscape expanded significantly, with domestic debt increasing by 24.9% over the two-year period to KES 5.41 trillion. Non-bank institutions have emerged as the largest holders of domestic debt, controlling 54.1% of the total, while commercial banks hold 42.1%. This growing reliance on both domestic and external borrowing highlights the critical importance of managing Kenya's debt sustainability amid global economic uncertainties and exchange rate volatility.

Separately, in the 2023/2024 financial year, the government serviced guaranteed debt on behalf of Kenya Airways amounting to KES 17.43B, with principal amounting to KES 14.3B and interest KES 3.1B.

🇳🇬| Nigeria’s Dollar-Denominated Bond |Nigeria's Federal Government is set to make history next week by issuing its first-ever dollar-denominated domestic bond, aiming to raise $500 million from local and foreign investors. This bond sale, opening on Monday, is part of efforts to stabilize the naira and attract dollars held by Nigerians abroad as well as international investors. The government hopes to double its initial offer, targeting USD 1B in total subscriptions.