Welcome to the Baobab Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital market and business news items from East Africa.

This week, we cover key themes from Kenya’s banking sector Q3 2021 results.

Our newsletter this week is brought to you by:

Mwango Capital. Mwango Capital provides A+ quality analysis and research on the East African capital markets. Follow us on Twitter, join us on Telegram, check out our website. If you would want to sponsor our weekly newsletter and Twitter Spaces, contact us via email at hello@mwangocapital.com

Banking Sector Q3 2021 Results

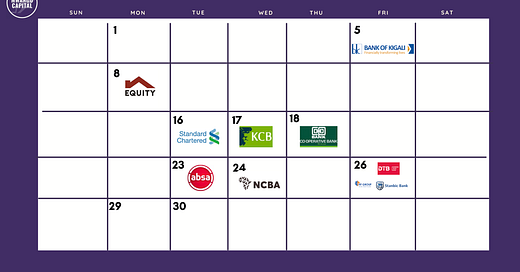

It’s been a busy November as Kenyan banks’ reported their Q3 2021 results. The listed banks that have reported include; BK Group, Equity Group Holdings, KCB Group, Co-operative Bank of Kenya, NCBA Group, Diamond Trust Bank Kenya, Absa Bank Kenya, Standard Chartered Bank Kenya, Stanbic Bank, and HF Group.

I&M Group, which reports next week, will conclude the release of Q3 2021 results from the eleven listed lenders. Special mention to Equity Group, the first Kenyan bank to report its earnings.

We have a few charts to highlight the key themes that shaped the banking sector’s performance in Q3 2021.

Expanded Balance Sheets: Equity, KCB, and Co-op lead the pack with double-digit growth while Stanbic and HF Group contracted.

Loan book growth remained muted: Only Equity, KCB, and Stanbic recorded double-digit growth.

Customers saving more: Customer deposits for these nine banks increased 12.8% to KES 7.4T.

Increased lending to the Government: Treasuries remained a sweet spot for banks as opposed to loans to customers.

Slashed provisions boosted profits: DTB and Co-op, however, bucked the trend.

National Bank of Kenya: The counter exited the exchange this week following its acquisition by KCB Group [Nairobi Securities Exchange].

On Mwango Capital Podcast this week, we released episode 7:

African Markets this Week

In East Africa, Kenya recorded a 2.17% fall in the Nairobi Securities Exchange All Share Index. The index closed the week at 164.77, down from last week’s 168.43. Tanzania’s DSE ASI was down 0.86% to close at 1,857.26 while Uganda’s USE ASI recorded a 2.06% drop to close at 1,431.65.

Across Africa: The BRVM Composite Index recorded a 1.08% rise to close at 195.8. BRVM is a regional stock exchange serving several West African Economic and Monetary Union countries.

Zimbabwe Stock Exchange’s All Share Index fell 8.05% to close at 10,712.88.

What Else Happened This Week?

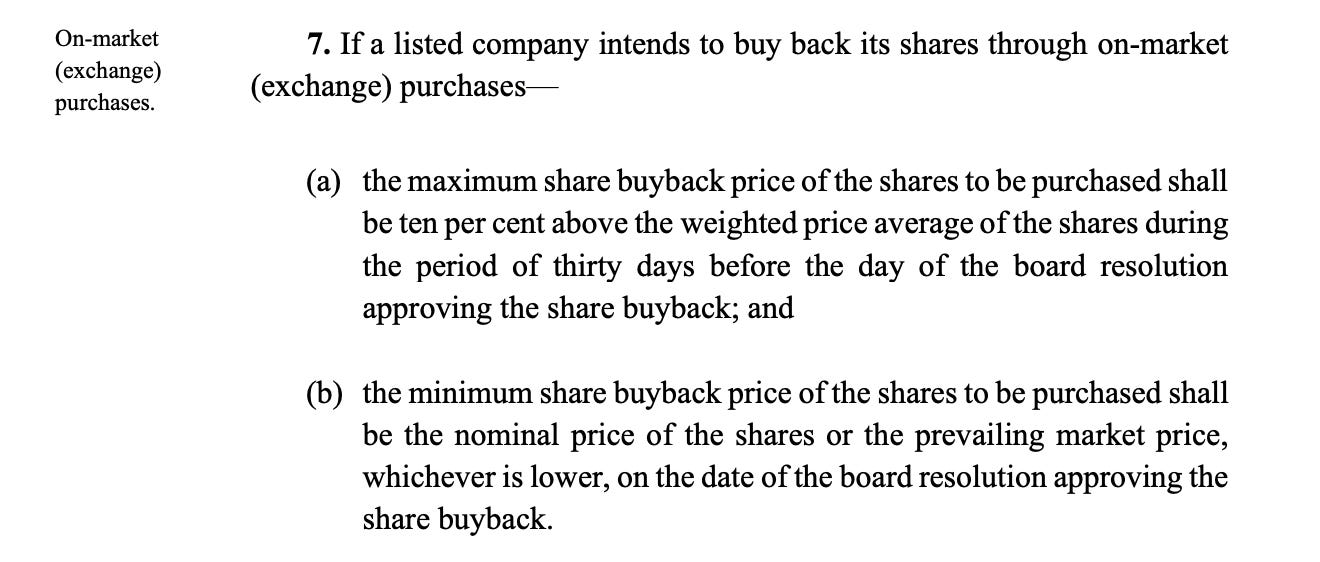

Share buybacks: The Capital Markets Authority (CMA) has published guidelines for listed companies that want to do share buybacks. Restrictions on the maximum price a company can pay for the buyback decision struck us as odd:

December 2021 Treasury Bonds sale: The CBK is inviting bids to raise KES 40B from two papers, FXD 4/2019/10 (which has 8 years to maturity) with a coupon rate of 12.280% and FXD 1/2018/20 (16.4 years to maturity) with a coupon rate of 13.20%. The period of sale will be between 22/11/2021 to 07/12/2021 with trading in the secondary market commencing on the 15th of December 2021 [Central Bank of Kenya].

Changes at Britam: Group MD Tavaziva Madzinga is set to exit in April 2022 after only 10 months in charge. There were 3 other executive appointments [Britam Holdings].

Digital currencies in Tanzania: The Tanzanian Central Bank is planning to introduce its own digital money, following in the footsteps of Nigeria with the eNaira.

“To ensure that our country is not left behind the adoption of central bank digital currencies, the Bank of Tanzania has already begun preparations to have its own CBDC” - Tanzanian Central Bank Governor Florens Luoga

Kengen: The Auditor General issued a Qualified Audit opinion for KenGen for the FY 2021 results based on non-valuation of PPE and capital works in progress that may have stalled. Find the full Auditor General’s report and KenGen’s response.

Here’s an excerpt from the International Standard On Auditing 705 on a qualified opinion:

SCOM at sub 40: Safaricom’s share price was trading at sub-KES 40 this week. The stock is 13% down in the last 3 months but 11% up Year to Date.

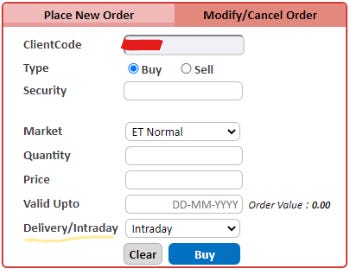

Day trading at the Nairobi Stock Exchange: The long-awaited day trading at the NSE went live on 22 Nov 2021. We wait to see its impact on trading volumes.

Pan African Airline?: Kenya Airways and South African Airlines, two struggling airlines, signed a strategic partnership framework this week. This is aimed at “both airlines work together to increase passenger traffic, cargo opportunities, and general trade by taking advantage of strengths in South Africa, Kenya, and Africa” [Kenya Airways].