Welcome to the Baobab Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.

This week, we look at the key takeaways from Capital Markets Authority Q3 Statistical Bulletin and the Absa Africa Financial Markets Index 2021 and

Our newsletter this week is brought to you by:

Mwango Capital. Mwango Capital provides A+ quality analysis and research on the East African capital markets. Follow us on Twitter, join us on Telegram, check out our website. If you would want to sponsor our weekly newsletter and Twitter Spaces, contact us via email at hello@mwangocapital.com.

Highlights from the CMA Q3 Bulletin

The Capital Markets Authority released its statistical bulletin for the quarter ended September 2021.

Collective Investment Schemes: CIC asset management boasts 40.16% market share, managing assets worth Ksh 47.3 billion out of the industry’s 117.8 billion as at June 2021.

Nabo Capital registered the highest increment of funds at 37.52% while Amana Unit Trust registered the highest decline of funds by 40.35%. The period also saw decline of funds managed from Cytonn Unit Trust, Apollo Unit Trust & Equity Investment Bank

Other highlights:

Equities:

Equity turnover down 17.45% to Ksh 31.36 billion.

Market capitalization up 2.83% to Ksh 2,778.65 billion.

NSE 20 & NASI indices up 5.38% and 2.75% respectively.

Fixed income:

8 Treasury Bonds issued in the period raising Ksh 304.39 billion compared to Ksh 245 billion targeted.

Outstanding corporate debt issues down by 21.6% to Ksh 16.83 billion following redemptions of Family Bank, Acorn & EABL MTNs

Bond turnover increased 11.04% to Ksh 301.10 billion [Q2 2021: Ksh 271.24 billion]

Learning Point:

Highlights from the Absa Africa Financial Markets Index 2021

Aim of index: The fifth edition of the Absa Africa Financial Markets Index was launched on Monday. AFMI has become a great tool to gauge countries’ performance across a host of indicators important for financial market development.

“The report highlights the importance of developing domestic markets and the role that domestics play in supporting and sustaining growth”

Anthony Kirui, Head of Global Markets at Absa Bank Kenya

Notable developments: Ethiopia is well on its way towards launching a securities exchange. The Egyptian exchange launched a treasury bonds index and South Africa is reforming its regulatory framework for OTC derivatives.

Overall scores: AFMI measures performance of 23 markets (scale of 10-100) across the continent based on 6 pillars; market depth, access to foreign exchange, market transparency, tax & regulatory environment, capacity of local investors, macroeconomic opportunity and enforceability of financial contracts.

South Africa, Mauritius & Nigeria lead the pack but with drops in scores relative to 2020. Ghana & Uganda are up two and five places respectively relative to 2020. Only four countries (Ghana, Uganda, Malawi & Angola) improved their ranks.

Pillar four: One of the main highlights from the index is local investor capacity based on the size of the pension fund market.

Namibia tops this pillar owing to the country’s deep pension market relative to the size of its population with 51.8% of pension AUM held in listed equities last year. Should Kenya’s Ksh 1.399 trillion pension industry, with only 15.59% allocated to equities, be more aggressive?

Pillar one: Weaker market liquidity is also another highlight from the index as market activity across most countries in the index continued to be adversely impacted by the Covid-19 pandemic.

On average, countries’ scores dropped by 1 point when compared to last year with low equity turnover playing a significant role in this deterioration

Kenya’s efforts around sustainable products is a bright spot in the index. Kenya and Morocco score highest in this indicator for having green or sustainable bonds, equities and mutual funds in their markets.

Want to dig deeper? Read more on the other pillars here. Absa Bank Kenya also held a panel discussion on AFMI that can be accessed here.

Markets this Week

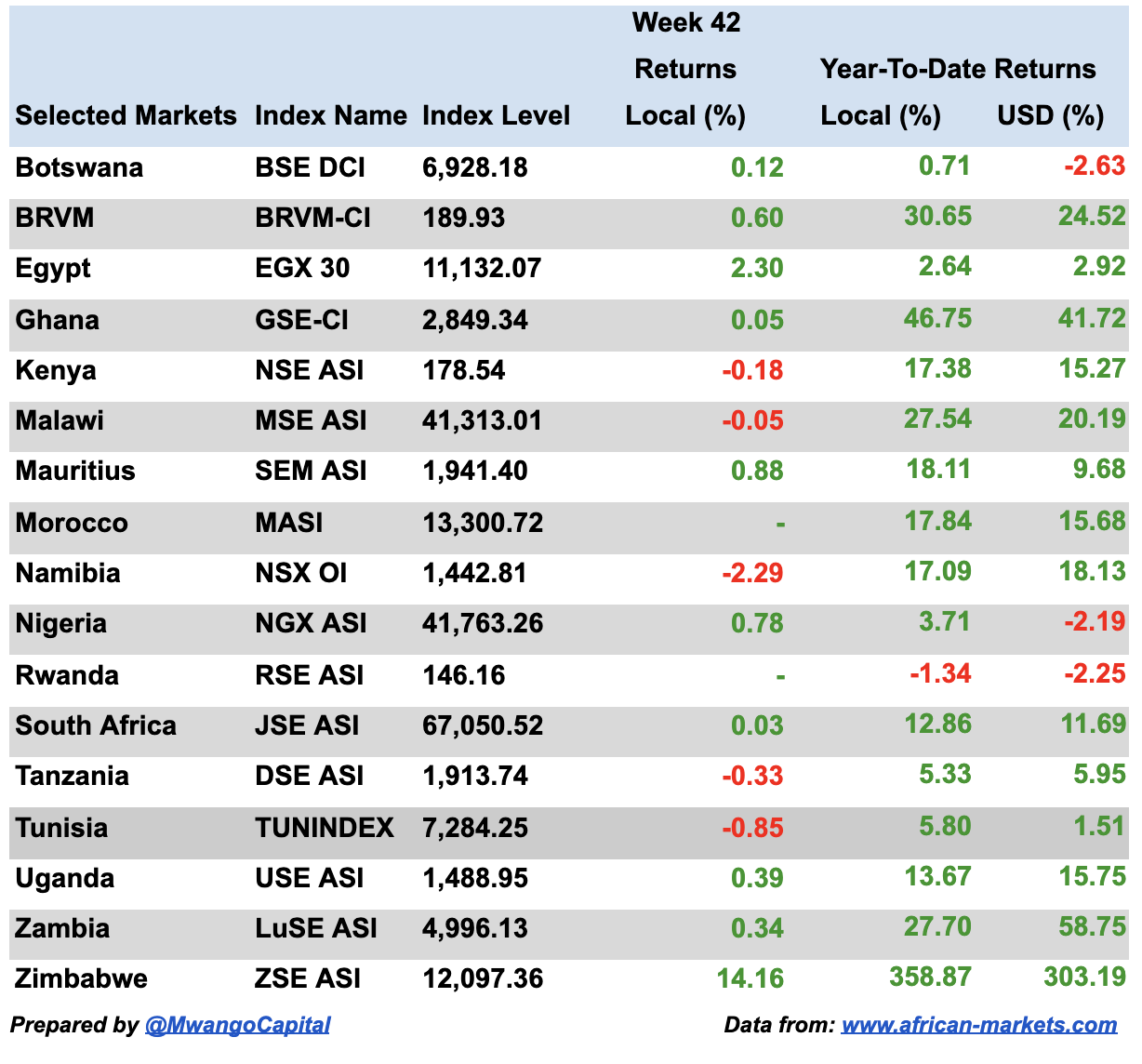

In East Africa, Kenya recorded a 0.18% drop in the Nairobi Securities Exchange All Share Index, closing the week at 178.54, down from last week’s 178.86. Tanzania’s DSE ASI was down 0.33% to close at 1,913.74 down from last week’s 1,926.98, while Uganda’s USE ASI recorded a 0.39% rise to close at 1,488.95.

Across Africa: Zimbabwe’s ZSE ASI recorded the highest increase in returns this week, up 14.16% to close at 12,097.36.

What Else Happened This Week?

Mashujaa Day: President Uhuru Kenyatta unveiled a third financial stimulus program. Noteworthy is the suspension of CRB listing upto September 2022 of loans below Ksh 5 million defaulted from last October [Business Daily + Mwango Capital]

Ratings downgrade:

IMF has downgraded Kenya’s economic growth forecast to 5.6% [Julians Amboko]

Moody’s has downgraded Ethiopia’s rating to Caa2; outlook negative [Mwango Capital]

Conclusion of transaction: Nairobi Business Ventures completed its Ksh 3 billion acquisitions in Delta Automobile Ltd, Delta Cement Ltd, Air Direct Connect Ltd & Aviation Management Solutions Ltd [Trading Room]

M&A activity:

Kuwait based National Aviation Services set to acquire 51% stake in Siginon Aviation Ltd [National Aviation Services]

Adenia Partners acquired a majority stake in Altilands SA, the parent company of Red Lands Roses [Adenia]

HF Group:

SMEs participating in government tenders can now get real time unsecured bid bonds of up to Ksh 10 million via a web-based system [HF Group]

Prof. Olive Mugenda appointed Chairperson of the Board [Julians Amboko]

Self listing: Nigerian Exchange Group (NGX) listed 1.964 billion shares on the main board of Nigerian Exchange Ltd [NGX Group]

Charts of the Week

Here we will be compiling the best charts we come across each week.

Performance of select African currencies: Ethiopian Birr has lost 18% this year.

Growth in Sub-Saharan Africa is expected to lag the rest of the world.