Welcome to the Baobab Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.

This week, we cover the results from EABL’s Ksh 11B corporate debt issue. We also take a look at half-year results ended June 2021 from Kenya Power & East African Portland Cement.

Our newsletter this week is brought to you by:

Mwango Capital. Mwango Capital provides A+ quality analysis and research on the East African capital markets. Follow us on Twitter, join us on Telegram, check out our website. If you would want to sponsor our weekly newsletter and Twitter Spaces, contact us via email at hello@mwangocapital.com.

Mwango Capital Podcast Episode 2 is out:

Strong Appetite for EABL’s Corporate Bond

3x oversubscription: The brewer’s 5-year, 12.25% Medium Term Note (MTN) attracted bids worth Ksh 37.9B against Ksh 11B targeted, representing a 345% oversubscription. The brewer resorted to only taking up Ksh 11B. Listing of the note is slated for 1 November 2021

“I would say we were surprised by the 345% oversubscription but as I say again, I think it's just testament to the kind of company that we are and our track record. We’ve been in the market before, we’ve paid out and our demonstrated results support the outcome” - EABL CFO Risper Ohaga speaking to Business Redefined Host Julians Amboko

Revival times? Kenya’s corporate debt market is buzzing with renewed investor confidence.

"We went out in COVID times where the economy is struggling and you know...we had to do a lot of work to make sure that this was viable and again very encouraging to see that investors are very savvy around good pickings and so the market is hungry for corporates to go out and raise such funding." - EABL CFO Risper Ohaga

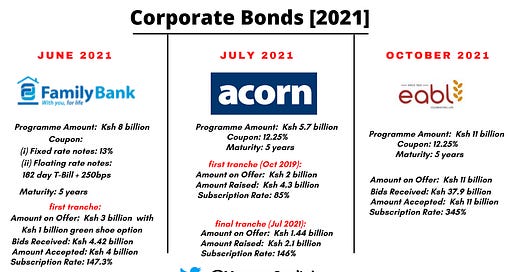

After a three-year issuance hiatus characterized by legacy defaults from Imperial Bank, Chase Bank, and Nakumatt, Acorn, Family Bank, and EABL seem to have revived the debt market with their oversubscriptions this year.

More on Kenya’s debt market:

Mortgage refinance firm KMRC is seeking to raise Ksh 10B through a bond by December [Business Daily + Julians Amboko]

Treasury is seeking Ksh 50B through FXD1/2021/5 & FXD1/2019/20 [Central Bank of Kenya]

KPLC Swings into Profit

Revenue up 2% closing at Ksh 144.1B. Cost of sales reported at Ksh 94.2B [+7.7%] translating to gross profit of Ksh 50B [+9.1%]. Transmission, distribution & administration costs down 16.7% translating to operating profit of Ksh 17.1B [+221.6%]

Interest income declined 32.5% to Ksh 163m while finance costs declined 27.5% to Ksh 9.1B.

Net cash from operating activities up 37.8% translating to a solid Ksh 6B [+58.9%] in cash and cash equivalents at close of the year.

Profit after tax reported at Ksh 1.5B [2020: Ksh 939m loss] on Ksh 6.8B tax expense on profit before tax of Ksh 8.2B [2020: Ksh 7B loss]

Full results here

EAPC Posts Profit off Fair Value Gain, Tax Credit

Revenue up 11.63% closing at Ksh 2.7B. Cost of sales reported at Ksh 3.6B [+8.57%] translating to gross loss of Ksh 820.5m [2020: 825.4m] While there was a marginal reduction in Administration & Selling expenses, loss from operations plateaued at Ksh 3.2B.

Interest income declined 89.7% to Ksh 149,000 while finance costs increased 6.28% to Ksh 835.7m. Fair value gain on investment property was reported at Ksh 5.8B [+418%]

Profit after tax reported at Ksh 1.9B [2020: Ksh 2.8B loss] on Ksh 151.6m tax credit on profit before tax of Ksh 1.7B [2020: Ksh 2.8B loss].

Full results here

Fun fact: EAPC, KPLC, Unga & Longhorn have 30 June full-year ends.Other Results: Our analysis of Airtel Africa, MTN Rwanda, and KenGen results can be found in the links below:

Next week, we are hosting Acorn on Twitter Spaces:

Markets this Week

In East Africa, Kenya recorded a 0.32% drop in the Nairobi Securities Exchange All Share Index, closing the week at 177.96, down from last week’s 178.54. Tanzania’s DSE ASI was down 1.01% to close at 1,894.44 down from last week’s 1,913.74, while Uganda’s USE ASI recorded a 1.57% drop to close at 1,465.55.

Across Africa: Egypt’s EGX 30 recorded the highest increase in returns this week, up 3.36% to close at 11,506.63.

Charts of the Week

Here, we compile the best charts we come across each week.

Zambia’s debt

Zambia’s inflation

What Else Happened This Week?

MTN Uganda IPO: Kenya’s Capital Markets Authority approves MTN Uganda IPO offering in Kenya [Dyer and Blair].

At the NSE:

Day trading to go live on 22 November 2021 [Nairobi Securities Exchange].

Konza eyeing partnership with the exchange [Capital Business].

NSE, CMA, and KEPFIC sign MoU [Nairobi Securities Exchange].

Inflation: Kenya’s inflation rate retreats to 6.5% in October 2021, from 6.9% in September 2021 [Central Bank of Kenya].

Diaspora remittances: Kenyans abroad sent home $309.8m [Ksh 34.4B] in September 2021 from $312.9m [Ksh 43.8B] in August 2021 [Central Bank of Kenya].

Revocation: Mobile Pay Ltd (Tangaza) license revoked [Central Bank of Kenya].

Takeover of Tanga: Twiga Cement’s parent firm to acquire Tanga Cement [Dar es Salaam Stock Exchange].

Nigeria forges ahead with digital currency: The West African nation became the first African nation to launch a digital currency- the eNaira. Here’s a short video explaining the eNaira [Central Bank of Nigeria].

If you like our newsletter, please share it: