Welcome to the Baobab, a capital markets newsletter that provides a succinct summary of key business news items from East Africa.

Send us your feedback to mwangocapital@gmail.com and on Twitter at @MwangoCapital

This week, we cover Kenya’s new Eurobond, Kune’s $1m in pre-seed raise, and Cytonn’s funds seem to be in trouble.

Kenya’s New Eurobond Raises $1B

What happened? The Kenya National Treasury this week raised $1B through issuing a 12-year Eurobond in the international financial markets, following a 3-day virtual roadshow. In a press release on Thursday, the National Treasury said that the bond had been oversubscribed, with investors offering over $5.4B (a 5.4X oversubscription!) showcasing the search for yield that is out there. Of note was that the government did not have a greenshoe option to mop up some of the local liquidity:

“We went to the market seeking to raise US$ 1 billion and stuck to the discipline of our target amount despite the oversubscription and competitive pricing”

— Director-General of the Public Debt Management Office, Dr. Harun Sirima

“We were mixed on Kenya. Some are sceptical on the name because they've failed to deliver on some fundamentals, but in my opinion they have a good relationship with the IMF and that gives me confidence.”

— A portfolio manager with exposure to Kenya

The initial pricing was between 6.75% and 6.875% but a 6.3% pricing was settled on [for comparison, Senegal sold a €775m 5.375% June 2037 bond at par earlier this month]. This is the fourth sovereign debt that Kenya has floated since 2014, the last one being in 2019 when it sold a $2.1B bond in two tranches [$900m 7% May 2027 and $1.2bn 8% May 2032]. The final maturity for this issue is June 23, 2034, with the principal repayment being in two equal installments on June 23, 2033, and June 23, 2034. The issue was rated B by S&P and B+ by Fitch, and will be listed on the London Stock Exchange main market.

The key players: Citi and JP Morgan were the joint book-runners for the dollar-denominated sovereign bond issue with I&M Bank and NCBA Group as co-managers. This is the first time that local banks have been involved in the process. The entire process, including the roadshow which started on Monday this week, was conducted online, also a first.

Context: This was a much needed raise as Kenya has a budget deficit of Kshs. 929.7B in FY 2021/2022 that it needs to plug. The challenge, however, is that the country’s debt servicing costs will keep rising. The Kenyan government is also set to rebase GDP which would make the debt to GDP ratios appear better. We are inclined to think that Kenya will be in the market again for another Eurobond given the interest that was shown in this one.

Beyond Kenya: The African Development Bank also launched a AUD600M ($463.9M) 5.5-year Kangaroo social bond in Australia. (A Kangaroo bond is a foreign bond, denominated in Australian currency, issued in the Australia by non-Australian firms.)

Fun fact: JP Morgan and Citi are the top 2 bookrunners in international emerging markets for debt capital this year (positions unchanged year over year):

Source: Global Capital

Heat in the Kitchen as Kune Raises $1m

Money! Money! Money!: Techcrunch this week reported that Kune, a Kenyan food-tech startup, made history having closed a $1 million pre-seed round to fund its on-demand food service. The startup was founded in December 2020 by CEO Robin Reecht and plans to deliver freshly made ready-to-eat meals after running a successful pilot on their launch in November 2020. The pre-seed round was led by Launch Africa Ventures, a frontier Pan-African fund.

“Leveraging the cloud kitchen model and owning the entire supply chain provides a massive growth and scaling opportunity for Kune Africa. We are looking forward to seeing the business take off and grow.”

— Member of the Board & Investment Committee Launch Africa, Baljinder Sharma

The heat: The raise has generated a lot of heat and debate on social media. At issue is the amount of money raised in what many see as a weak thesis, and some points in the article that several Kenyans on social media thought were an inaccurate representation of the situation on the ground.

Big picture: They say all publicity is good publicity, right? Our Twitter Spaces guest this week, Soud Hyder, did tell us that despite the heat Kune is getting, this raise might actually be a good thing overall for the ecosystem. It puts Kenyan on the map. Consider this: just earlier this month, a less than year-old Cairo-based fintech MoneyHash raised $5m pre-seed to build a super API for payments.

All said, none of us are privy to the investment pitch deck that Kune gave investors and there are many factors that go into making an investment decision. We can only but wish them well.

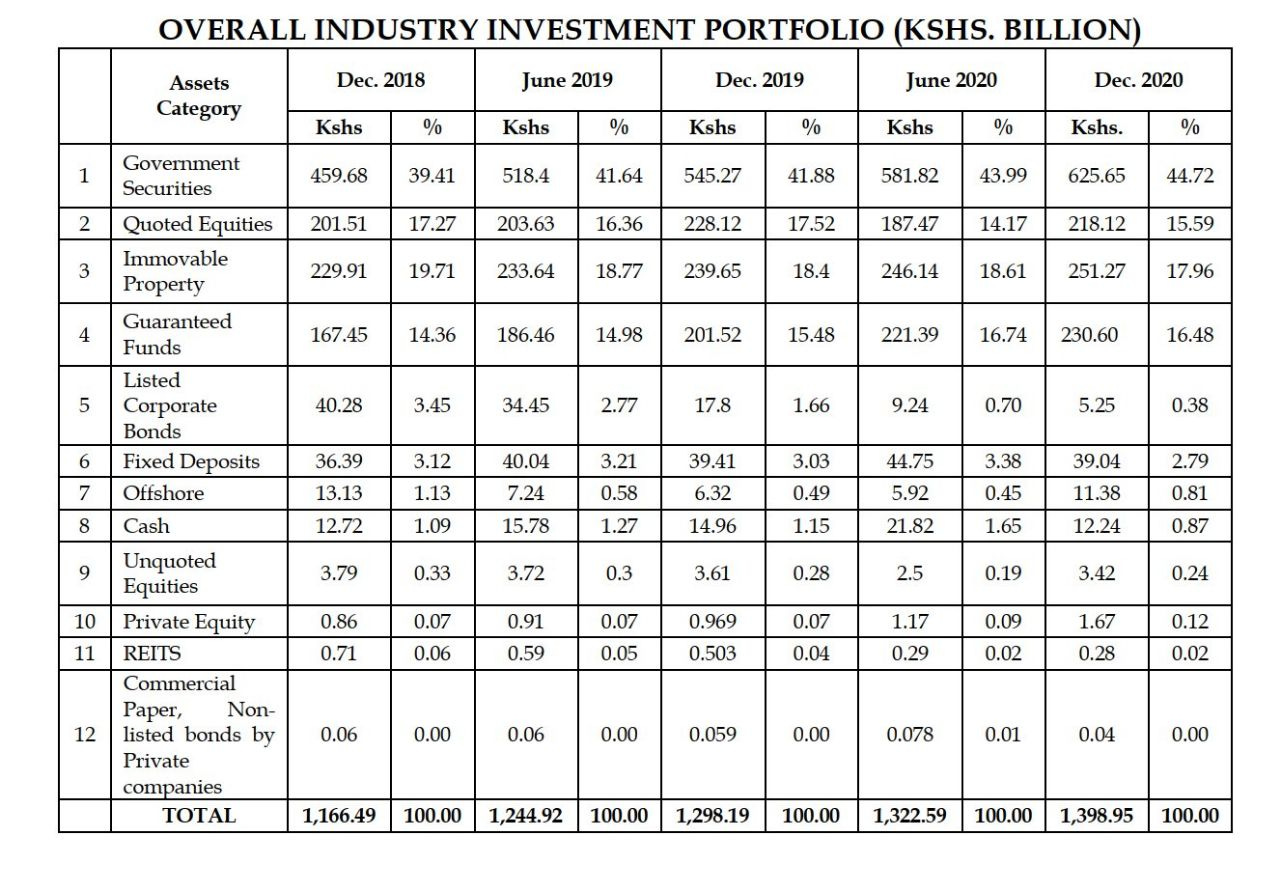

Meanwhile, Kenyan pension funds had Kshs 1.4T ($13B) in AUM in Dec 2020 and appeared to be very conservatively invested with ~45% of AUM in government securities, 16% in quoted securities, 18% in properties, and 16% in guaranteed funds. Less than 1% is in Private Equity & unquoted securities. Is this cash that could be better invested in local startups?

Cytonn’s Fund on the Spot

Cytonn Investments this week found itself on the hot spot once again following a notice it issued to investors in its in Kshs. 13.5B Cytonn High Yield Solutions product that they would not be able to withdraw their invested funds. Lynn Ngugi, one of the investors, took to Instagram and Twitter to express her frustrations on the development, leading to uproar on social media.

CMA rejoinder: Following the public outcry, The capital Markets Authority (CMA) issued a statement cautioning investors against investing in unregulated products and those promoted by unlicensed firms. The authority noted that there would be no recourse afforded under the capital markets regulatory framework to those who incur losses from such investments:

“The Authority confirms that Cytonn Investments is not a licensed and approved entity…The Capital Markets Fraud Investigation Unit (CMFIU) is currently investigating the issue for criminal violations for investors in the Cytonn High Yield Solutions (CHYS)”

CMA Chief Executive, Wyckliffe Shamiah

CMA confirmed that it had, however, licensed Cytonn Asset Management Limited as a Fund Manager running the following funds for which it had not received any complaints: Cytonn Money Market Fund, Cytonn Balanced Fund, Cytonn Equity Fund, Cytonn Africa Financial Services Fund, Cytonn Money Market Fund (USD), and Cytonn High Yield Fund.

Cytonn responds: In response, Cytonn issued a press statement stating that CHYS was structured as a private offer after consultations with CMA. Cytonn said that its investments were very safe but illiquid, and inferred malice in the authority’s statement. Appearing on CNBC Africa, CEO Edwin Dande said the allegations by CMA were baseless and his firm would “confront them at the appropriate venue”.

“The statement appears malicious and an attempt to distance itself from a real estate fund that has operated for over 8 years, and like other real estate funds globally, has had liquidity challenges given that real estate is a long-term asset and in this case is financed by short-term obligations.”

Cytonn

What next? The investors in the funds are stuck and will not get a payment any time soon until liquidity improves. Cytonn and CMA will continue sparring and this time it will likely be in court. Our desire is that investors be cautious when investing in products whose underlying assets are illiquid, no matter how attractive the yield is.

What to be a savvy investor? We have compiled a few Twitter threads on the need to conduct due diligence and the importance of prudent investing habits: Wallace Kantai, RookieKE, and Wanjiru Natasha.

Other noteworthy items:

Tanzania's Finance Bill 2021 has some provisions that seek to subject 3 of Tanzania's most profitable public firms to tighter government control.

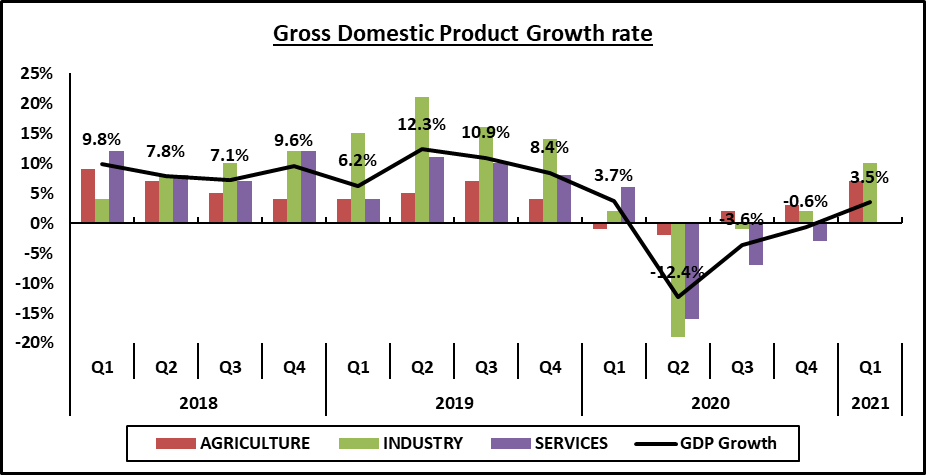

Rwanda's GDP was up 3.5% after 3 consecutive quarters of decline.

The main drivers were food crop production (+7%), manufacturing (+8%), and construction (+14%).The Kenyan Energy and Petroleum Regulatory Authority increased the price of super petrol by Kshs. 0.77 for the period starting June 15, 2021, to July 14, 2021. The prices for diesel and kerosene remained unchanged.

Bamburi cement shareholders approved a first and final dividend of Kshs. 3 during its AGM. They also approved changing the company’s name from Bamburi Cement Limited to Bamburi Cement plc.

The NSE-listed firm Car & General has invested Kshs. 393.5m in a new motorcycle helmet plant in Ruiru. The plant has a production capacity of 768,000 helmets per year, with plans to increase production to 1.2m by 2022.

Kenswitch Kenya appointed Karimi Ithau as its Managing Director. Ms. Ithau joins Kenswitch from Interswitch where she served as the Head of Sales Network supporting the East Africa Region.

NSE formally launched the mini NSE 25 index futures contracts aimed at retail investors due to its lower initial margin requirements following CMA’s approval.

The Ministry of Finance in Ethiopia issued an Expression of Interest for the sale of a 40% stake in Ethio Telecom.

Pesapal Limited received authorization from The Central Bank of Kenya as a Payment Service Provider (PSP) to carry out Payment Gateway Services.

The Salaries and Remuneration Commission (SRC) froze salary increments for all civil servants for two years starting July 2021. The Kshs 82B salary increment freeze follows a deal with IMF where Kenya agreed to freeze pay to June 2025.

Tanzanian president, Samia Suluhu, asked The Bank of Tanzania to learn more about cryptocurrencies. Might we see a TanzaniaCoin soon?