Welcome to the Baobab Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.

This week we cover H1 2021 earnings as we continue our coverage of Kenyan banks’ half-year results. We also cover half-year results of Nation Media Group, Jubilee Holdings among others.

We launched our podcast this past week and episode 1 is out. It is a recording of an interview we had with the Centum CEO James Mworia. Here is the transcript of the podcast.

The podcast is available on Spotify, Amazon Music, Apple Podcasts, Google Podcasts and in other platforms.

ABSA’s profitability surges 846%

9x growth in PAT: Profit after tax for the first half of the year rose to Ksh 5.57 billion from Ksh 588.9 million driven by a 63.9% drop in loan loss provisions. The lower provisions contributed the most to operating expenses dropping 27% percent to Sh9.8 billion. (Compare this to H1 2019 profits of 5.71 billion)

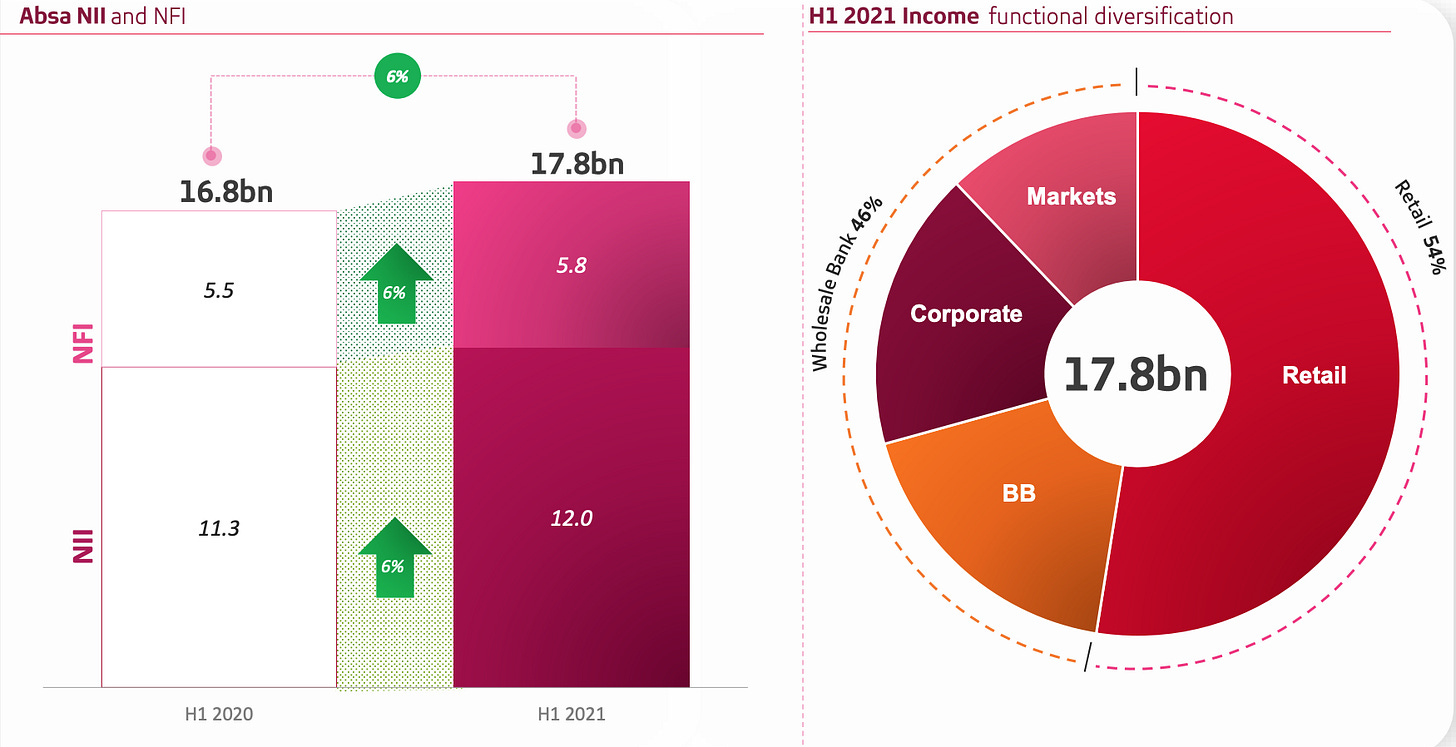

Marginal growth in income: Both net interest income and non-interest income (non-funded income) grew by a thin 6% margin.

Other highlights:

Total assets up 1.6% to Ksh 398 billion

Customer deposits up 6.1%

Loan book up 8.4%

Interest income [loans] up 1.3%

Interest income [government securities] down 5.1%

No interim dividend

Gross NPLs up 7.8% to Ksh 18.3 billion

Standard Chartered profitability grows by 50.9%

Reduced provisions, higher NFI boost PAT: Profit for the half year ended June was up 50.9% to Ksh 4.8 billion from Ksh 3.2 billion the previous period mainly driven by 60.7% reduction in loan loss provisions and 13.5% rise in non funded income.

“Our first half of 2021 was one of recovery. Lockdowns, both locally and globally of various forms have come and been relaxed affecting economic activity. While containment has been effective in controlling the spread of COVID-19, the timeline to full economic recovery and social opening will be longer as country vaccination programs vary”

Kariuki Ngari CEO Standard Chartered Bank Kenya

Other highlights:

Total assets up 5.6% to Ksh 345B

Customer deposits up 8.5%

Loan book down 3%

Net interest income down 3%

Interest income [loans] down 9.6%

Interest income [government securities] down 2.8%

Gross NPLs up 9.4% to Ksh 22.9 billion

No interim dividend

Other banks’ earnings reports this week and our analysis can be found in the links below:

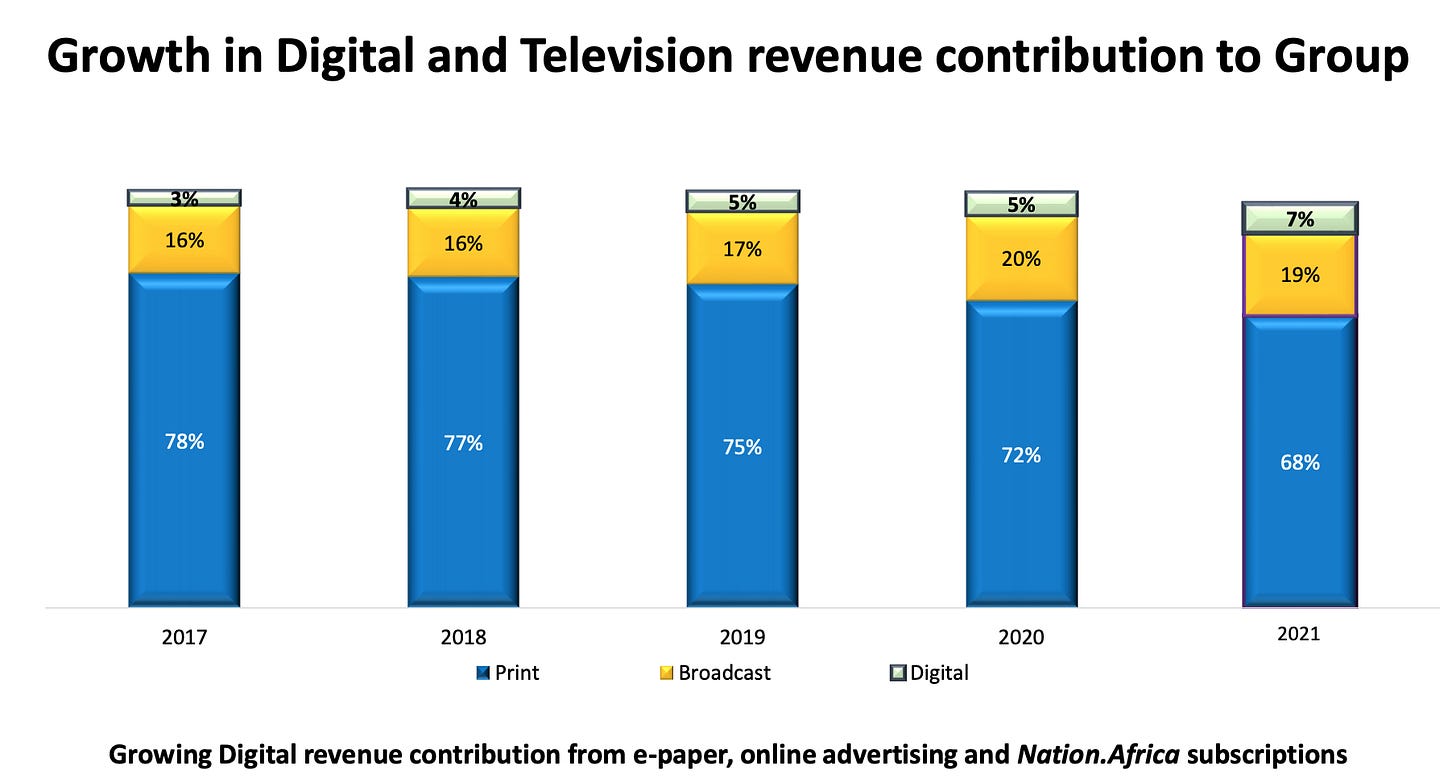

NMG bounces back to profitability

Growth in revenue: Total revenue was up 14% to Ksh 3.7 billion driven by 40% television revenue growth, 28% ePaper subscription revenue growth, 23% online advertising revenue growth and 18% print advertising revenue growth.

Profitability: Profit for the first half of the year came in at Ksh 285.2 million compared to a Ksh 375.3 million loss recorded in a similar period last year.

“I can tell you the worst is over. We are focusing on recovery and growth. The only risk we have in the future is COVID”

Nation Media Group CEO Stephen Gitagama

Other highlights:

Total assets up 18.3% to Ksh 12.3 billion

Gross profit up 22%

Working capital up 12%

Operating costs down 5%

Share Buyback status: 80.9% uptake (16.77 million shares) as at 23 August 2021. Buyback offer will close the earlier of 100% uptake or 24 September 2021.

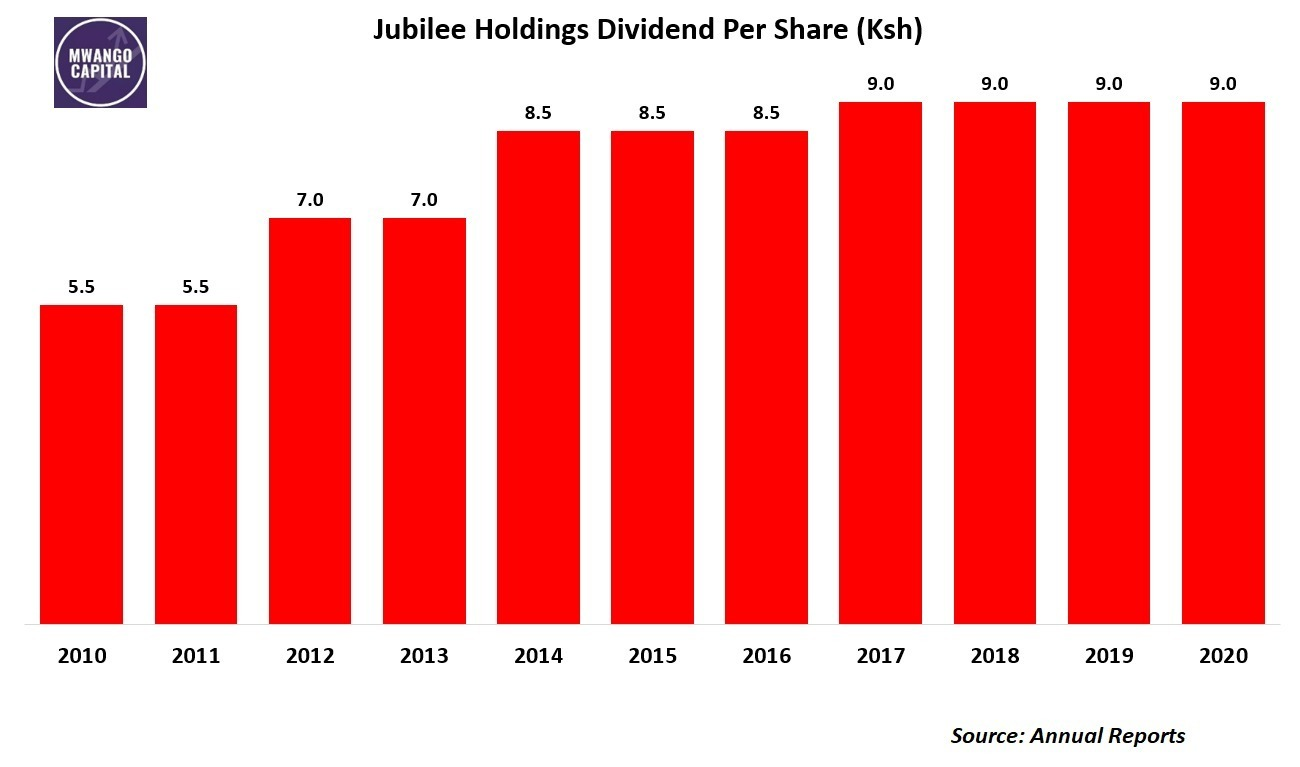

Jubilee Holdings records 146% profit rise

Sale of Jubilee General Insurance: Ksh 2.07 billion gained from the disposal of Jubilee General Insurance to Allianz which in turn propelled net profit to Ksh 4.5billion compared to Ksh 1.83 billion in June 2020.

Other highlights:

Gross written premiums +10%

Net benefits & claims +42%

Interim dividend Ksh 1.00.

Dig Deeper: Other half year earnings reports this week and our analysis can be found in the links below:

Acorn admitted into CMA regulatory sandbox

Acorn to test “Vuka”: Acorn Investment Management has been admitted into Capital Markets Authority’s regulatory sandbox where it will test its Vuka investment platform. Vuka will allow retail investors to invest in the student housing market through a Real Estate Investment Trust (REIT). Before, this investment opportunity was only available to institutional investors.

Find a full presentation on Vuka here

About CMA regulatory sandbox: Launched in 2019, CMA’s sandbox allows live testing of innovative solutions under less regulations and is expected to attract fintech companies and capital markets licensees to test the application of technology on financial services.

Aside from Acorn, CMA has admitted seven other firms into the regulatory sandbox. These include: Pezesha Africa, Innova Ltd, Genghis Capital Ltd, Central Depository & Settlement Corporation (CDSC), Pyyppl Group Ltd, Belrium Kenya Ltd & Four Front Management (division of Standard Investment Bank)

More on Acorn: Acorn D-REIT & I-REIT both listed on the Unquoted Securities Platform (USP) recorded a turnover of Ksh 46M this week.

Markets this Week

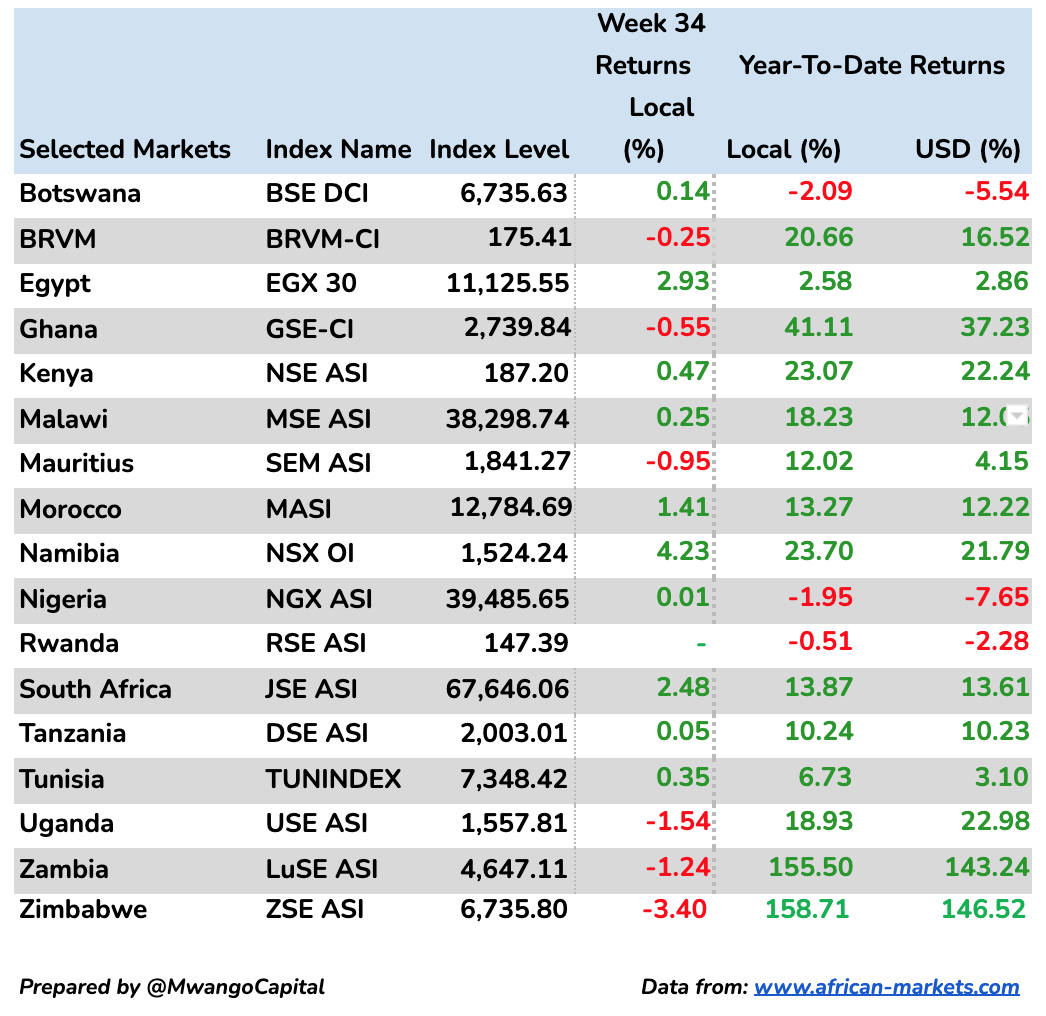

In East Africa, Kenya recorded a 0.47% rise with the Nairobi Securities Exchange All Share Index closing the week at 187.20, up from last week’s 186.33. Tanzania’s DSE ASI was up 0.05% to close at 2,003.01 from last week’s 2,001.98 while Uganda’s USE ASI recorded a 1.54% drop to close at 1,557.81.

Across Africa, Namibia’s NSX OI recorded the highest increase in returns this week, up 4.23% to close at 1,524.24.

What Else Happened This Week?

BPR a done deal: KCB Group completed its 76.7% acquisition of Banque Populaire du Rwanda (BPR). BPR will be merged with KCB Rwanda to create one banking entity in Rwanda to be named BPR Bank. [KCB Group]

Moderna in Kenya: Kenya received its first shipment of 880,000 doses of Moderna vaccines from the US as part of 1.7 million doses that America promised to donate to Kenya. [Nation]

IMF support: East African states received $3.17 billion from IMF as part of $650 billion Special Drawing Rights (SDRs) aimed at supporting the countries from the COVID-19 impact. Kenya, Tanzania & Uganda received $740 million, $540 million, $490 million respectively [The East African]

Do you shop at Carrefour?The French supermarket opened a new store at Southfield Mall, Embakasi in its latest expansion drive. [Business Daily]

Appointments at Telkom Kenya: The telco announced four new appointments to its management team geared towards better efficiencies and more proactive collaboration. [Mwango Capital]

Co-op, South Sudan JV: Co-operative bank extended its joint venture with the South Sudan government for three years. Both parties co-own the lender’s subsidiary in Juba. [The East African]

Cross border trade: Kenya and Tanzania have set December as the target time to lift trade barriers affecting both countries. [The East African]

KNBS statistics: The Kenya National Bureau of Statistics released the leading economic indicators for the month of June 2021. Find our coverage here.

RwandAir also eyeing Goma: RwandAir has introduced flights to Goma to compete with Jambojet that is awaiting its inaugural flight to Goma next month. [Business Daily]

Appointment at Vodacom Tanzania: Sitholizwe Mdlalose is the new Managing Director of Vodacom Tanzania replacing Hisham Hendi who tendered his resignation [Daily News]