More Q3 Earnings from Kenyan Banks

We continue our coverage of the banking sector’s Q3 2021 results.

Welcome to the Baobab Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital market and business news items from East Africa.

This week, we cover Q3 2021 results from KCB Group, Co-operative Bank, and Standard Chartered Bank.

Our newsletter this week is brought to you by:

Mwango Capital. Mwango Capital provides A+ quality analysis and research on the East African capital markets. Follow us on Twitter, join us on Telegram, check out our website. If you would want to sponsor our weekly newsletter and Twitter Spaces, contact us via email at hello@mwangocapital.com

On Mwango Capital Podcast this week, we released episodes 5 and 6:

KCB: Impressive Quarter + Interim Dividend

1T balance sheet: Total assets increased by 16% to KES 1.12T following the acquisition of Banque Populaire du Rwanda (BPR) in Rwanda. Net loans grew 13% to KES 651.8B while customer deposits grew 11% to KES 859.1B.

“This is the strongest quarter for us since the COVID-19 pandemic struck 20 months ago, with clear signs of economic recovery across key sectors. While we are cautiously optimistic of the prospects, especially due to the dynamic nature of the healthcare crisis, we project that the worst is behind us.”

KCB Group CEO Joshua Oigara

Income Growth: Operating income grew by 16% to KES 79.9B on account of a 16% growth in total interest income to KES 73.5B and a 10% growth in total non-interest income to KES 23.5B. Interest income from loans and from government securities grew by 17% and 12% respectively.

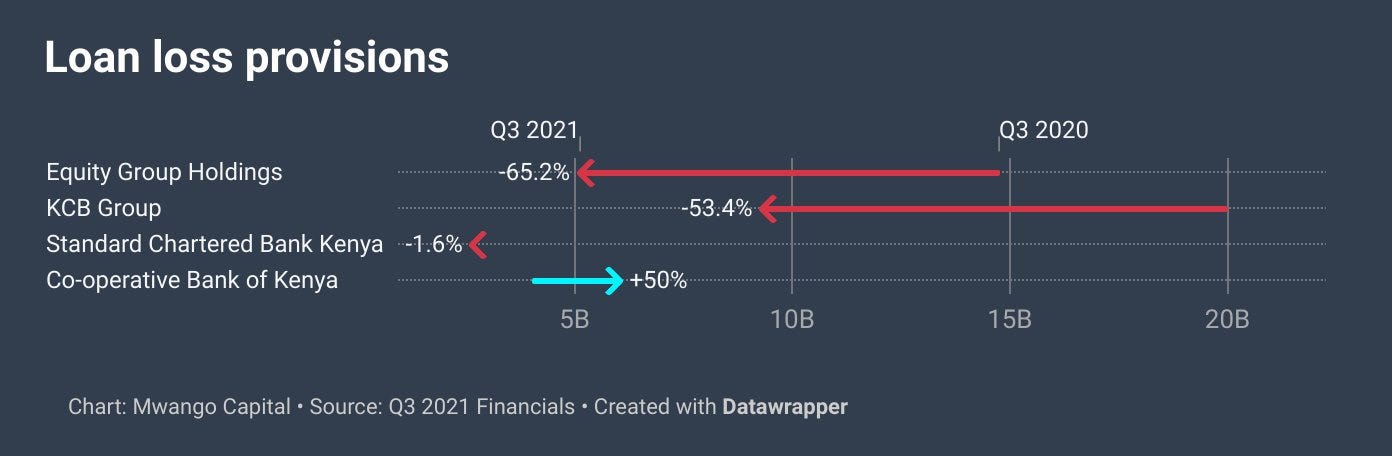

Profit after tax for the period rose 131% to KES 25.2B largely helped by a 53% decline in loan loss provisions to KES 9.3B.

Other highlights:

Net interest income +18% to KES 56.4B

Total operating expenses -15% to KES 44.1B

Gross NPLs +1.2% to KES 98.1B

NPL ratio 13.7% [Industry NPL ratio: 13.9%]

Ksh 1.00 interim dividend declared

EPS +92% to KES 9.92

National Bank of Kenya, a subsidiary of KCB Group, recorded a twelve-fold increase in profit for the period to KES 1.1B. This was on the back of a 14% growth in operating income to KES 7.7B. Total interest income grew by 23% to KES 8.9B.

Going Green: Bloomberg reported that KCB Group is going green with a plan to issue Kenya's first green bond by a commercial lender in 2022. It also plans to make its loans for climate-friendly projects account for 25% of its total loan book by the end of 2024.

“A green bond is one of the key actions we are looking at in our market. We are probably the most ready institution to move in that direction in the coming year.”

KCB Group CEO Joshua Oigara

More: Business Redefined host Julians Amboko sat down with KCB Group CFO Lawrence Kimathi to discuss the bank’s Q3 numbers. Listen in here.

KCB have their analysts call next week on Monday.

Looking ahead, we look forward to hosting the KCB Group team for a Twitter Space chat in the near future.

Coop Bank: Eating up Treasuries, No Dividend

Ramp up on treasuries: Investments in government securities grew 36% to KES 193.3B compared to net loans which grew by 8% to KES 306.3B.

Bucking the trend on provisions: Co-op bank increased its provisions by 50% to KES 6B as gross non-performing loans rose 23% to KES 49.4B. This is in contrast to KCB & Equity who slashed provisions boosting their bottom lines.

Profit after tax rose 19% to KES 11.6B on the back of a 19% growth in operating income to KES 44.4B. Total interest income grew 22% to KES 39.6B while total non-interest income grew 16% to KES 15.7B. Interest income from loans and from government securities grew 14% and 40% respectively.

Other highlights:

Total assets +16% to KES 592.9B

Customer deposits +12% to KES 420.4B

Net interest income +21% to KES 28.7B

Total operating expenses +19% to KES 28B

EPS +19% to KES 1.98

StanChart Kenya: Good Quarter + Interim Dividend

Sluggish growth in the balance sheet: Net loans grew by a paltry 0.1% to KES 131.7B while investment in government securities fell 8% to KES 94B. Customer deposits grew 6% to KES 258.4B.

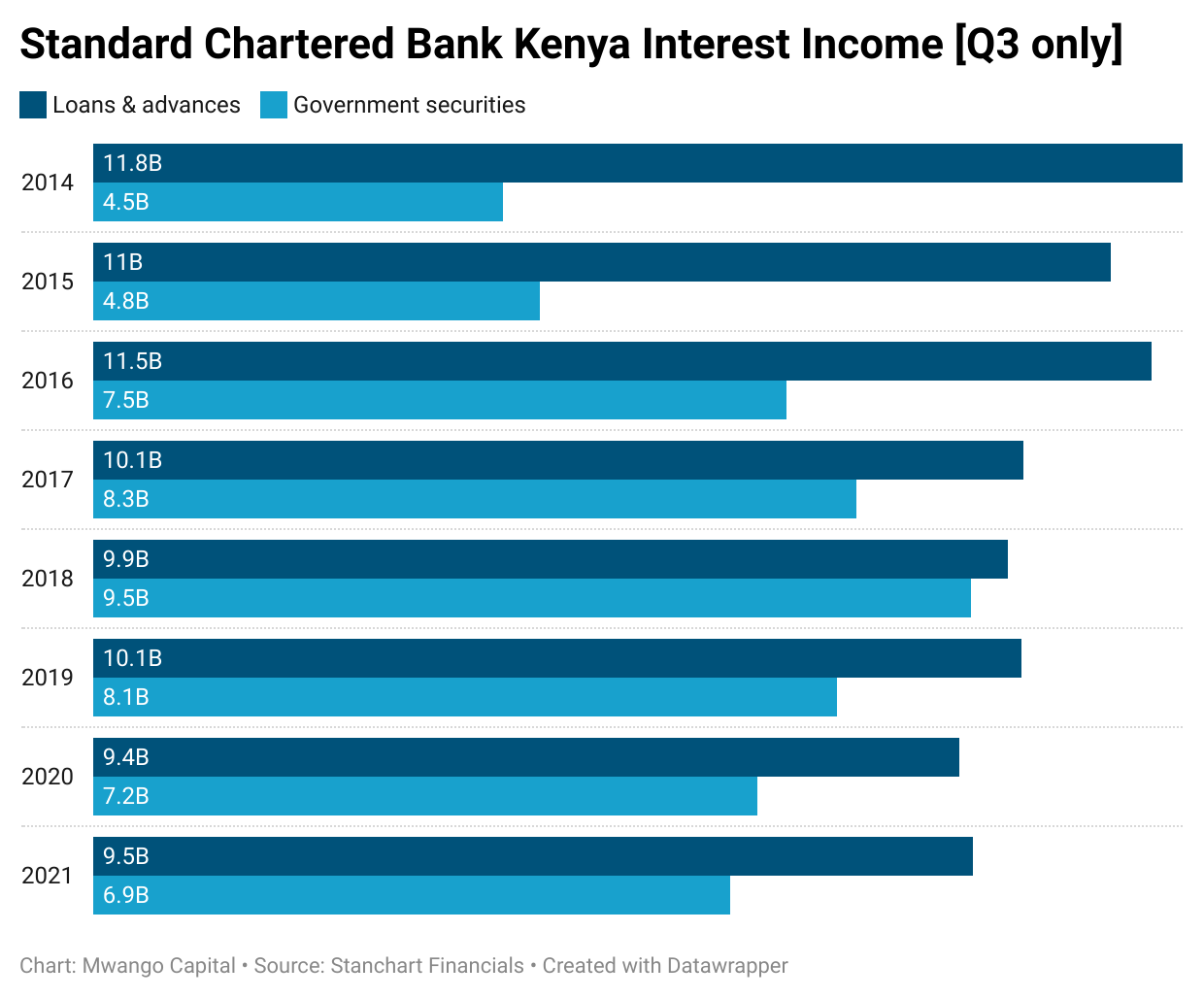

Interest income remains depressed: Total interest income fell 2.5% to KES 17.5B on the back of a paltry 1.6% rise in interest income from loans and a 4% drop in interest income from government securities. Non-interest income however remains a sweet spot for the bank as it grew by 19%.

Interim dividend: A KES 5.0 interim dividend declared. Here’s a look at the bank’s dividend per share history:

Profit after tax for the period stood at KES 6.4B from KES 4.3B a year ago, a 47% increase driven by the higher non-interest income.

Other highlights:

Total assets +5% to KES 330.7B

Net interest income +3% to KES 14.7B

Total operating expenses -5% to KES 13.4B

Gross NPLs +5% to KES 23B

EPS +48% to KES 16.49

Looking ahead, we will release our Twitter Space conversation with the StanChart Group’s wealth management team as a podcast next week.

Find links to the full results from the 3 banks below:

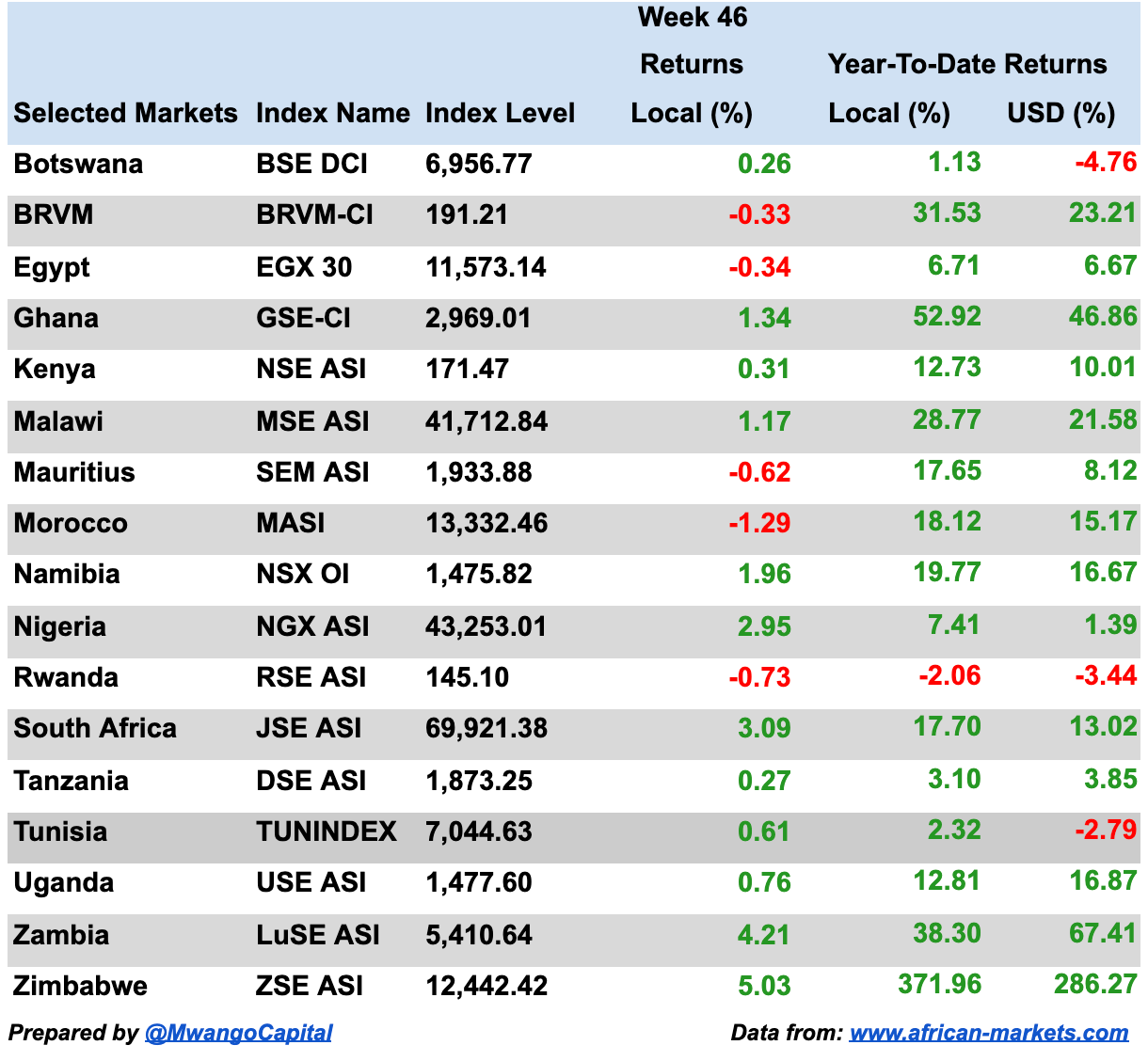

African Markets this Week

In East Africa, Kenya recorded a 0.31% rise in the Nairobi Securities Exchange All Share Index, closing the week at 171.47, up from last week’s 170.94. Tanzania’s DSE ASI was up 0.27% to close at 1,873.25 up from last week’s 1,868.15, while Uganda’s USE ASI recorded a 0.76% rise to close at 1,477.60.

Across Africa: Zimbabwe’s ZSE ASI recorded the highest increase in returns this week, up 5.03% to close at 12,442.42

Charts of the Week:

KES vs USD

Listed Kenyan banks’ past one-year share price performance:

What Else Happened This Week?

Draft Budget Policy Statement: Treasury is projecting a KES 3.31T budget for FY 2022/2023. Find full report here.

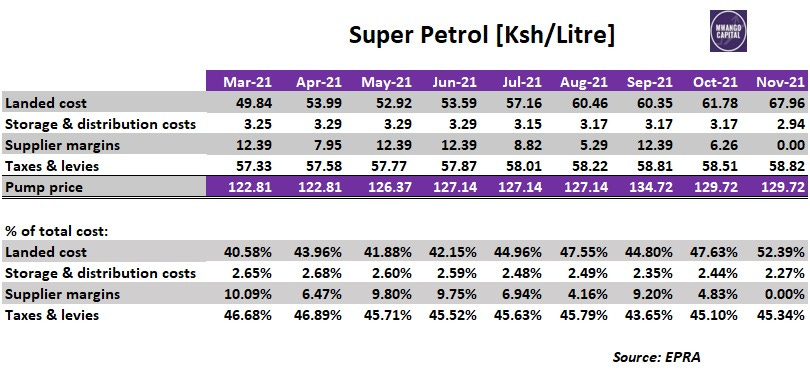

Fuel prices: Prices of Petrol, Diesel, and Kerosene remained unchanged in the Nov/Dec review [EPRA]. Here’s the super petrol price trend from March this year:

Share buybacks: Regulator caps firms’ buyback price at 10% [Business Daily].

Unga Group: Shareholders to approve joint venture companies at the AGM on 3rd Dec 2021 [Unga Group].

Centum: CEO James Mworia spoke to The East African about the firm’s prospects. Q&A here.

Fixing Kenya Power: Labour court temporarily halts lifestyle audit [The Star + Nation].

Digital lending: Credit freeze following CRB listing directive [Business Daily + The Star].

Tanzania: IMF Executive Board approved USD 372.4M credit facility to address COVID-19 pandemic [IMF].