Welcome to the Baobab Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.

This week, we cover the MTN Uganda IPO. We also take a look at the domestic debt market in Tanzania.

Our newsletter this week is brought to you by:

Mwango Capital. Mwango Capital provides A+ quality analysis and research on the East African capital markets. Follow us on Twitter, join us on Telegram, check out our website. If you would want to sponsor our weekly newsletter and Twitter Spaces, contact us via email at hello@mwangocapital.com.

MTN Uganda IPO Opens

Offer: MTN Uganda opened its UGX 895.56 billion [~$248 million] IPO offer on Monday 11 October 2021. 4.47 billion shares (20% of total ordinary shares) are on offer at a price of UGX 200 per share (~$0.055).

The minimum number of shares is one can purchase 500. East African investors also have a chance to get upto 213.2 millon free shares, a move meant to encourage application for more shares. The offer will close on 22 November 2021. Secondary listing of the shares on the Uganda Securities Exchange is slated for 6 December 2021.

“We congratulate MTN Uganda upon taking this step up the financing escalator which now increases the company's financing options. This is a clear sign of the confidence our private sector has in the economy and in Uganda’s capital markets”

Keith Kalyegira - CEO CMA Uganda

Open to EAC: The IPO is open to Ugandan investors as well as citizens of Kenya, Tanzania, Rwanda, and Burundi.

Want to apply? Check Section 18 of the prospectus for the application procedure.

We are keen on holding a discussion on the MTN IPO soon so if you have any suggested authoritative speakers on this topic and questions, send them to us on hello@mwangocapital.com.

Strong Appetite for Tanzania’s Sovereign Bond

4x oversubscription: Tanzania’s latest 15.95% 25-year treasury bond sought Tzs 133.5 billion [$57 million] but investors tendered Tzs 636.6 billion [$276 million] representing an oversubscription of more than Tzs 500 billion. Tanzania’s central bank accepted Tzs 182.34 billion [$79 million].

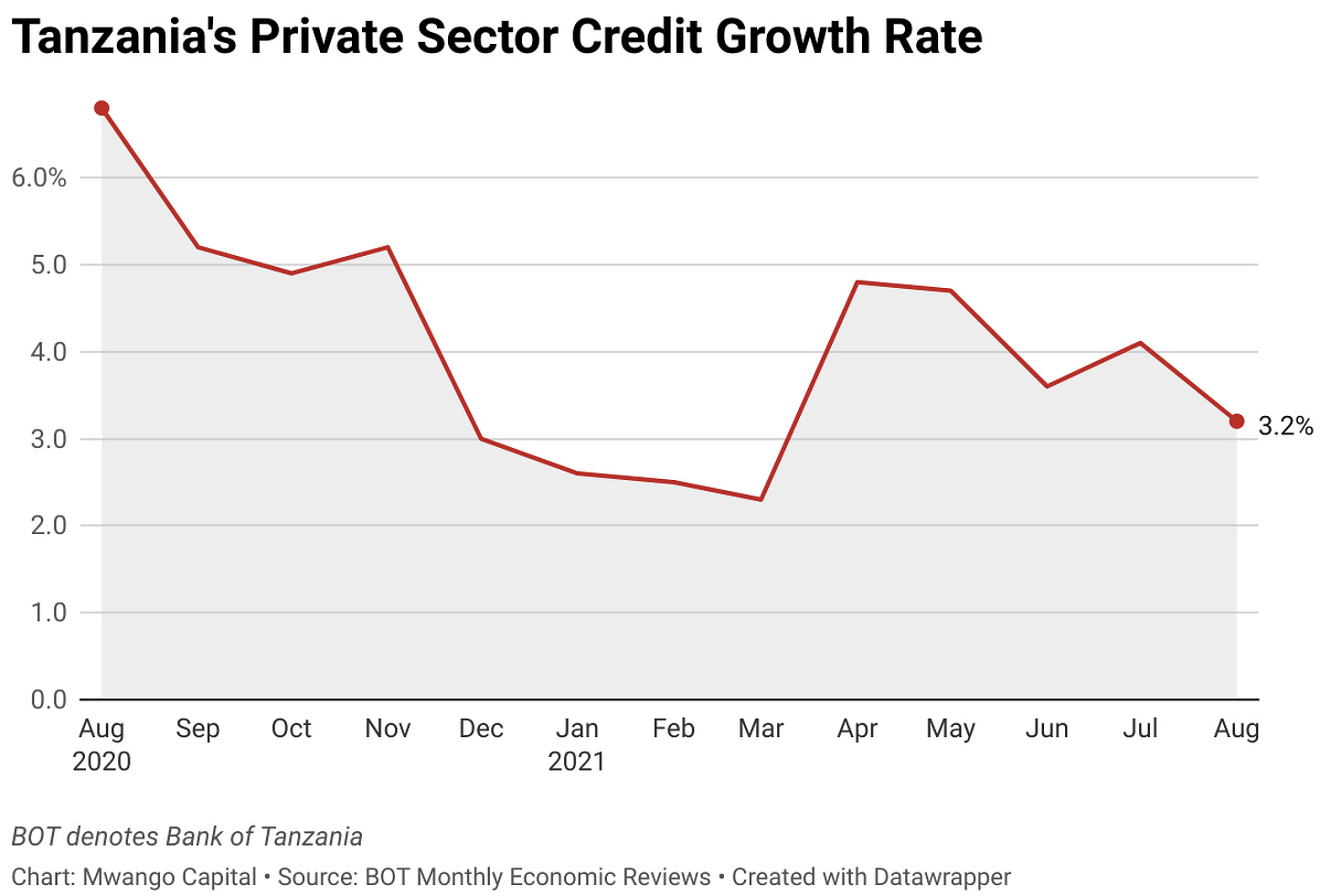

Crowding out? Lending to the government remains a sweet spot for banks in Tanzania. Private sector credit growth slowed down to 3.2% in August 2021 from 4.1% in July 2021 and 6.8% in August the previous year. Commercial banks in Tanzania accounted for 34% of domestic creditors in August 2021.

Looking ahead: Tanzania’s central bank is scheduled to offer five more treasury bond sales by the close of this year.

The Mwango H1 2021 Bank Earnings Note

In our latest banks’ earnings note, we look at the half year performance of the banking sector of the Nairobi Securities Exchange. Find a link to the note here.

We welcome your feedback.

Subscribe to the Baobab newsletter:

Markets this Week

In East Africa, Kenya recorded a 1.73% rise in the Nairobi Securities Exchange All Share Index, closing the week at 178.86, up from last week’s 175.82. Tanzania’s DSE ASI was down 0.36% to close at 1,920.13 from last week’s 1,926.98, while Uganda’s USE ASI recorded a 0.12% drop to close at 1,483.10.

Across Africa: Zimbabwe’s ZSE ASI recorded the highest increase in returns this week, up 10.73% to close at 10,596.85.

What Else Happened This Week?

Kenya’s loss at sea: ICJ delivered its decision on the Kenya-Somali maritime dispute. Kenya is however adamant about ceding an inch of its territory. Here’s commentary by journalist Ramah Nyang on the decision.

Fuel:

Oct/Nov prices: Super Petrol and Diesel down by Ksh 5 to stand at Ksh 129.72 & Ksh 110.60 respectively. Supplier margins cut by Ksh 6.13 & Ksh 6.86 for Petrol & Diesel respectively [EPRA].

Reduction in fuel prices: Among the recommendations by the Finance & Planning Committee to lower pump prices is halving of VAT on fuel to 4% [Julians Amboko + Mwango Capital].

Human rights advocacy: Mrs. Gina Din-Kariuki has been appointed to Kakuzi’s now fully-constituted Independent Human Rights Advisory Committee chaired by former Attorney General Prof. Githu Muigai [Kakuzi].

Leasing of Mumias Sugar: Businessman Julias Mwale and steel tycoon Narendra Raval amongst top bidders [Business Daily].

NHIF & Safaricom partner: All NHIF customers can now access services through the M-PESA Super App [Safaricom].

Renewable energy: GridX Duara Holdings’ Ksh 770 million investment into Two Rivers Development Ltd’s (TRDL) subsidiary [Centum RE]

Charts of the Week

Here, we will be compiling the best charts we come across each week:

Diamond Trust Bank lags its peers on Return to Equity vs Price to Book. During an investor engagement session this week, Finance Director Alkarim Jiwa said the bank expects ROE to go back to previous levels of 13%-14%, according to highlights from financial expert, Mihr Thakar, who attended the session.

Nine countries have introduced products that can be classified as green or sustainable. Green bonds are the most popular instrument being at investors' disposal in seven countries.

Source: Absa Financial Markets Index

Ethiopia is now part of a club of 9 countries whose dollar bonds trade at a spread of more than 1,000 basis points over U.S. Treasuries

If you like our newsletter, share it with your friends and colleagues.