Rising Communication Costs

Across East Africa, higher taxes mean higher costs for airtime and data

Welcome to the Baobab Weekly by Mwango Capital, a capital markets newsletter that brings you a succinct summary of key business news items from East Africa.

Contacts: Follow us on Twitter, join us on Telegram, and check out our website. Also drop us an email at mwangocapital@gmail.com

This week we cover excise duty changes on communication services across East Africa, Safaricom’s appointment in Ethiopia, and performance at the Nairobi Securities Exchange in June.

On our Twitter Spaces this week we discussed tech in Africa with Mario Gabriele and others. Next week on Friday from 9 pm Kenyan time, we talk all about renewable energy in Africa with Tim Kipchumba and David Wachira. We will explore the opportunities, challenges, and key players in this space. Don’t miss it!

Also, our Saturday Reads this week, where we compile some good content for you to read, was done by NTV journalist Julians Amboko.

Communication Prices Up Across East Africa

What happened? Kenyan telcos raised their prices to reflect the new excise duty changes on data and airtime services. The Finance Bill 2021 signed into law by President Kenyatta on 29th June 2021 amended the Excise Duty Act, 2015 to raise excise duty rates on telecommunication services from 15% to 20%. Interestingly, this proposal was missing from the Treasury-backed Finance Bill 2021.

Airtel Kenya was first: The telco announced on 2nd July 2021 that its voice service would now cost Kshs 2.78 per minute [up from Kshs 2.00] to reflect the new excise duty rates. It however maintained data and voice bundles at current prices.

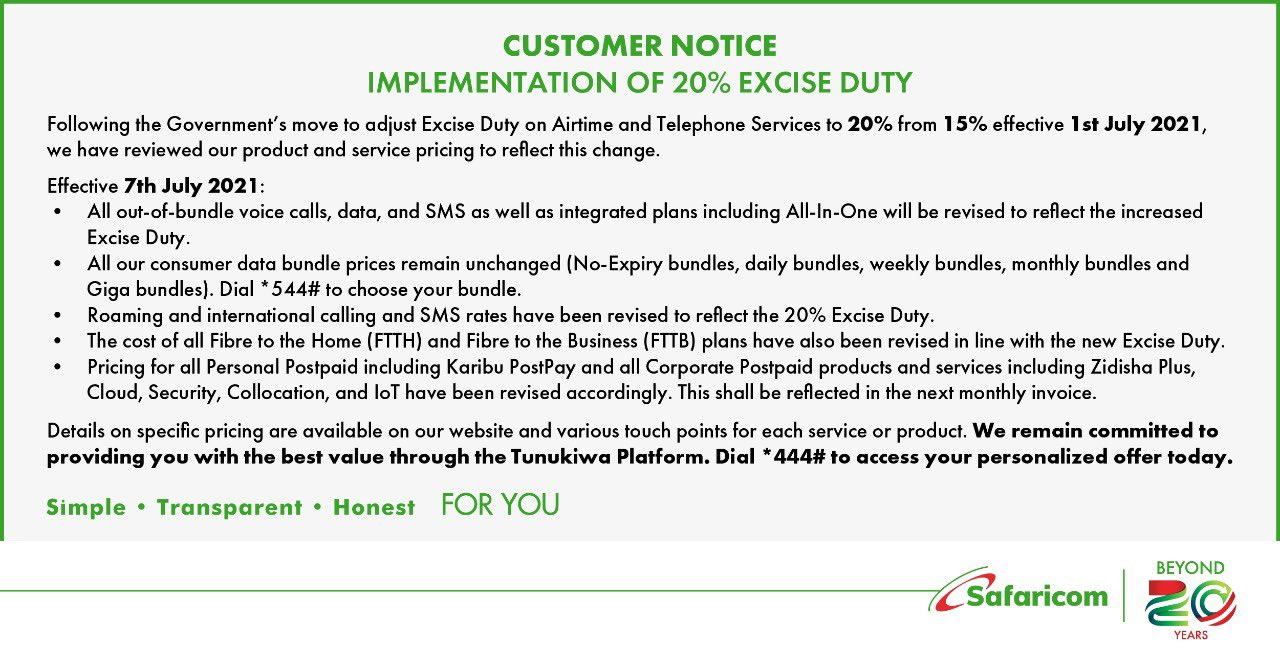

Safaricom followed: This week, the telco announced a revision of its out-of-bundle voice calls, data, and SMS prices. It however maintained its data bundle prices at the current rate:

Telkom’s revisions: Voice [Pay-As-You-Go] increased to Kshs 2.78, voice [Pay-As-You-Go off net] increased to Kshs 4.30, SMS increased to Kshs 1.15, and Mobile data [Pay-As-You-Go] increased to Kshs 4.50.

Beyond Kenya:

Uganda’s Ministry of Finance increased excise duty rates on airtime and data services to 12%, which is in addition to the 18% VAT rate. MTN Uganda charges Ush 4 per second for calls, Ush 60 for SMS, and Ush 0.5 per KB for data.

Excise duty on airtime in Tanzania is at 17% in addition to the 18% VAT. Vodacom Tanzania charges Tsh 0.67 per second for calls, Tsh 20 per SMS, and Tsh 0.0078 per KB for data.

Excise duty in Rwanda stands at 10%. MTN Rwanda charges Rwf 4 for local calls and Rwf 12 per SMS to other MTN networks.

Safaricom Appoints CEO for Ethiopia

What happened? Mr. Anwar Soussa was appointed as the Managing Director of the Global Partnership for Ethiopia (GPE). Before this appointment, Anwar was the Managing Director of Vodacom DRC and Chairperson of Vodacash. In his new post, he will report to the GPE Board and Safaricom CEO Peter Ndegwa. In him, they get someone knowledgeable about African markets and mobile money.

His track record: Anwar has cemented Vodacom DRC as the largest Vodacom operation outside South Africa. The company crossed the $500M service revenue mark for the first time in 2020 under his tutelage. The Greek national holds a Bachelor’s degree in Business Administration from the American College of Greece and a Master’s degree in Marketing from Concordia University in Canada. Before joining Vodacom, Anwar served as CEO of Airtel in Uganda and Chad.

More on GPE: Following the award of a telecommunication license in Ethiopia to a consortium led by Safaricom, GPE was formed as a holding company in the Netherlands. GPE is 61.9% owned by SPV (another holding company incorporated in England). Sumitomo Corporation and CDC Group (other partners in the consortium) also own GPE.

What next? Safaricom moves full steam ahead into Ethiopia where it will be battling the incumbent Ethio Telecom which has made some decent moves lately in the money transfer business trying to entrench itself with a headstart before Safaricom sets up.

We also eagerly await the Safaricom AGM slated for 31st July 2021 where the shareholders will approve the Safaricom shareholding in GPE. We anticipate a lot of questions on the entry into Ethiopia.

Source: Safaricom

KRA Beats Revenue Target

The Kenya Revenue Authority collected Kshs 1.669T in revenues for the FY 2020/21 ended June 2021. This represented a 3.9% revenue growth from the Kshs 1.607T collected in FY 2019/20 and marked the first time in 8 years that the Authority has surpassed its revenue targets. The amount of revenue raised exceeded the Kshs 1.652T target for the period by Kshs 16.808B, representing a 101% performance rate.

In this period, the Domestic Taxes Department collected Kshs 1.039T while Customs and Border Control collected Kshs 624.77B against a Kshs 606B target. Taxes from petroleum taxes grew 34.5% to Kshs 226.680B while non-oil revenue grew 16.4% to Kshs 398.089B.

During the financial year, KRA also recorded a milestone after revenue collection more than doubled in the last 10 years from Kshs 707B in FY 2011/12 to Kshs 1.669T in FY 2020/21 representing a growth of 136% in the last ten years.

Kenya Revenue Authority Commissioner General, Githii Mburu

Key Performances:

Corporation tax grew 3.7% despite a reduction from 30% to 25% in the first half of the year. The increase was mainly driven by increased growth in remittances from energy (222.7%), agriculture (33.1%), and construction (31.9%) sectors.

PAYE saw a 9.3% reduction due to a decline in employment as a result of the Covid-19 pandemic. A reduction in the top PAYE rate from 30% to 25% in the first half of the year and a 100% tax relief for persons earning below Ksh. 24,000 per month also led to a decrease in this tax head.

Withholding Tax grew 3.8%, a drop from the 18.2% recorded last year, mainly due to reduced economic growth caused by the Covid-19 pandemic.

Domestic Excise Duty grew 12.0% in comparison to a 6.4% decline in the last financial year due to the gradual reopening of the economy and extended operating business hours.

Domestic VAT declined 7.9% due to the COVID-19 pandemic, and a reduction of the VAT rate from 16% to 14%.

Looking Ahead: KRA targets to collect Kshs 6.831T by the end of FY 2023/2024. The Authority is banking on taxpayers’ support, a projected economic recovery growth rate of 6.6 % in 2021, progressive tax policy frameworks, and a robust tax compliance mechanism to achieve this target.

Kenyan Markets Performance in June

The Nairobi Securities Exchange released its monthly barometer bulletin that highlights the performance of equities, bonds, and derivatives at the bourse. Here are some highlights for the month of June:

Market Performance: Capitalization rose by 2% to settle at Kshs 2.7T in June. The NSE-20 Index rose by 3% in June 2021 from May 2021.

Equities: Equity turnover was down by 1.5% in June 2021 from Kshs 14.2B to Kshs 13.95B. Safaricom, Equity, NCBA, and EABL led in turnover accounting for 41.09%, 16.69%, 12.38% & 12.14% of total turnover in June. Nairobi Business Ventures led the pack in gains recording 92.5% in June. Eaagads recorded the highest loss of -26.6%

Derivatives: Turnover at the derivatives market (NEXT) rose by 56.19% in Q2 2021. On 18th June 2021, the Exchange launched mini NSE 25 index futures contracts with lower initial margin requirements in a bid to boost liquidity at the derivatives market.

Bonds: Turnover decreased by 9.6% from Kshs 106.9B to Kshs 96.6B.

More on the NSE: Investment bank EFG Hermes launched its “One Trading App’’ that offers investors seamless account opening and trading of shares at the NSE through their phones. Check here for other trading apps.

Learning Point: The NSE 20 is a price-weighted index covering the top 20 best performing counters.

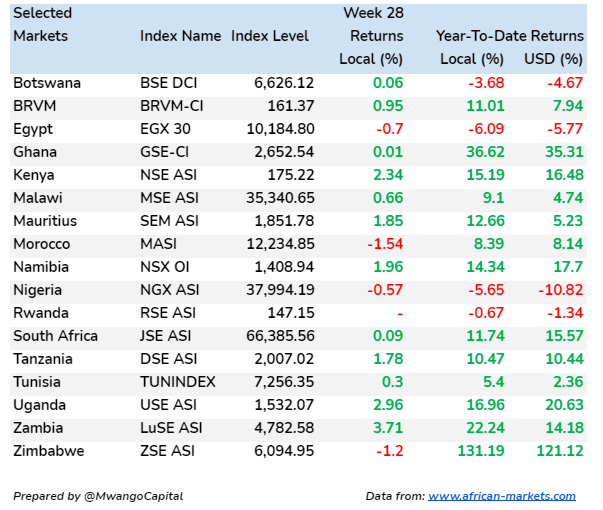

Markets this Week

In East Africa, Kenya recorded a 2.34% increase with the Nairobi Securities Exchange All Share Index closing the week at 175.22, up from last week's 173.97. Tanzania’s DSE ASI showed a 1.78% increase to close at 2,007.02 while Uganda’s USE ASI had a 2.96% increase to close at 1,532.07. The two all-share indexes closed the week at 1,983.13 and 1,504.90 respectively.

Fixed income markets in Kenya had a total of Kshs 24B worth of T-bills on offer during the last week. The results of that auction held on 8th July 2021 are as follows:

91-day and 182-day T-bills were oversubscribed with performance rates of 282.7% and 194.1% respectively.

The 364-day T-bill was under subscribed recording a performance rate of 43.2%.

The CBK accepted Kshs 11.31B, Kshs 11.67B, and Kshs 4.28B of the 91-day, 182-day, and 364-day T-bills bids on offer respectively, accepting a total of Kshs 27.25B.

Across Africa, the Lusaka Securities Exchange in Zambia recorded the highest increase in returns last week jumping 3.71% to close at 4,782.58. The Moroccan All Shares Index recorded the largest decline of 1.54% to close the week at 12,234.85.

What Else Happened This Week?

Mobile money services in Uganda have been detached from the Ugandan Communications Commission and will now be under the scope of the Bank of Uganda. [The Independent]

Executive appointments at Diamond Trust Bank, Kenya Re-Insurance Corporation, and CIC Insurance Group.

Ethiopia announced it will be closing several embassies including the one in Kenya in a bid to save costs [Mwango Capital]

Insurer Jubilee Holdings has increased its stake in Uganda’s hydroelectric power plant, Bujagali, to 40.9% by pumping in Kshs 4.4B [Business Daily]

Kenya acquired an additional 3.9% stake in Shelter Afrique for Kshs 1B.

Kenyan banks announced changes to loan-related fees and commissions to reflect new excise duty changes [KCB Bank, Equity Bank]

Chris Kirubi’s son-in-law, Andrew Musangi, was appointed to the board of Centum Real Estate, a wholly-owned subsidiary of Centum Investment PLC [Mwango Capital]

Liquid Intelligent Technologies and Facebook are partnering to lay down 2,000km of fibre in the Democratic Republic of Congo that is expected to improve internet access for more than 30M people and help meet the growing demand for regional connectivity across Central Africa.

Olympia Capital released its FY ended 28th February 2021 results posting a 1.1M loss.

Online forex money manager Standard Investment Bank’s flagship product Mansa X posted an annualized net return of 13.6% in the first half of 2021. The performance was 1.66% lower than in the first half of 2020 [Standard Investment Bank]

Kenya returned to the Global Fund for Kshs 3.3B [$31.1 m] to boost its Covid-19 response. The Fund has so far approved Kshs 7.44B in grants to support Kenya under its Covid-19 Response Mechanism (C19RM) programme.