👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.

This week, we cover the President's visit to the NSE and some companies that reported earnings last week. More banks report earnings this week also. First off, enjoy a dose of our weekly business news in memes:

Review of Bank EarningsPresident Ruto at the NSE

Highlights: On his second visit in 5 months to the Nairobi Securities Exchange (NSE) since his inauguration, President William Ruto last week officiated the listing of the Local Authorities Pension Trust (LAPTRUST) Income - Real Estate Investment Trust (I-REIT). This is the first listing of an I-REIT issued by a pension fund at the NSE. The issuer of the I-REIT, CPF Financial Services, has a net fund value of KES 100B with a gross membership exceeding 500,000 members.

Potential Listings: In his first visit to the NSE in October 2022, the President pointed out that his government was looking forward to listing 5 to 10 mature companies through the period to October 2023. These were his comments on the efforts around the privatisation of State-Owned Enterprises:

“Again, as I made a commitment when I came to this Securities Exchange, last year, I made a commitment that the government is going to divest so that we can democratize our wealth and allow more Kenyans to own a piece of what is Kenya, and currently entities that Kenyan-owned. When we went to run that exercise, we found that the law that existed was actually the biggest impediment to any privatisation. It is a law that has been there for the last 15 years and it is a law that has made it impossible for any divestiture to happen and for any democratization of what is owned by the government to be undertaken. Yesterday in the Cabinet we approved a new law that will provide mechanisms for Kenyans to own part of what is Kenya.”

President of Kenya, William Samoei Ruto

Dollar Shortages

Kenya’s Forex Code: Last week, the CBK published the Kenya Foreign Exchange Code, effective 23rd March 2023, aimed at facilitating better functioning of the wholesale foreign exchange market. The CBK has outlined various reports on compliance with the FX Code that commercial banks are supposed to submit. Under the Code:

Banks will be required to submit to the CBK a report on the level of compliance with the FX Code by April 30 2023,

Banks will be required to report on a compliance implementation plan that is approved by the Board of Directors by June 30 2023,

Banks will be required to report on the level of compliance with the FX Code within 14 days after the end of every calendar quarter. The first report is due by July 14, 2023.

Here is a link to the entire document.

Ruto on $ Availability: This is what the President had to say about the dollar market in his visit to the NSE.

Interbank Market: President Ruto pointed out that the Government was also working with the CBK to reinstate the interbank forex market.

“We through the Central Bank, are having conversations to reinstate the Interbank Exchange market that has since not worked, and I am happy that the players in that sector including our banks are coming forward and they are participating and working with the Central Bank so that we can again take charge of our market and that it is not allowed to be distorted by brokers.”

President of Kenya, William Samoei Ruto

Here is what the Energy CS had to say on the spread between the CBK quote and the quote being offered by banks.

“The Interbank trading, which is almost not available today, we do not know what the true value of the shilling to the dollar is. The Central Bank publishes 125, but you go to the market and buy it at 142. Even for the dollars that are available in the country, it is not helping the situation. If I have got dollars today and I know the price would go up by almost 3,4,5 bob tomorrow, I am willing to withhold my dollars for speculative purposes.”

Energy CS, Davis Chirchir

No Dollars to Pay IPPs: According to Kenya Power’s Finance General manager, the scarcity of U.S. dollars has impacted how the company pays its power suppliers.

“The challenge is that due to the unavailability of US dollars, we are not paying IPPs as per schedule. You may have noted that in our half-year report, we had quite some liquidity not because we have excess money but because we have not been able to get the forex to pay these obligations.”

Kenya Power Finance General Manager, Stephen Kinadira

Ormat not Spared: Among the independent power producers is Ormat Technologies, a vertically integrated company in geothermal energy which has power projects in various countries, and in Kenya through its subsidiary OrPower 4 Inc. In the fiscal year ended December 2022, Kenya Power contributed to 14.4% of Ormat Technologies' gross revenues. The amount overdue from Kenya Power as at the 2022 year-end totalled $27M, out of which, $15.2M was cleared in January and February 2023. $11.8M (43.7%) remains outstanding.

“In Kenya, the tax asset is recorded in Kenyan Shillings ("KES") similar to the tax liability, however any change in the exchange rate in the KES versus the U.S. dollar has an impact on our financial results. Risks attributable to fluctuations in foreign currency exchange rates can also arise when the currency denomination of a particular contract is not the U.S. dollar. Substantially all of our PPAs in the international markets are either U.S. dollar-denominated or linked to the U.S. dollar except for our operations on Guadeloupe, where we own and operate the Bouillante power plant which sells its power under a Euro-denominated PPA with Électricité de France S.A.”

Foreign Contractors to Quote in KES?: A Member of Parliament is preparing a bill that will see foreign contractors working in the country quote contracts in the local unit rather than in U.S. dollars.

“A bill will be coming, and members here will support me. I’m doing a bill that will ensure that any contractor that comes to the country from outside must quote in Kenya Shilling. They are supposed to buy the Kenya Shillings so that the dollars stay here.”

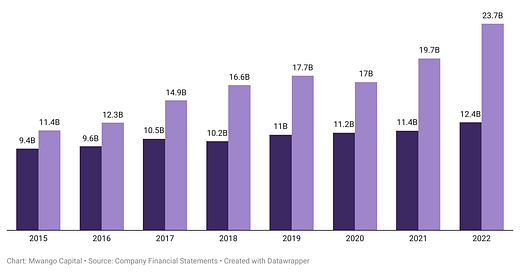

Banks FX Income Up: Amid the current shortage of US dollars, banking operations in Kenya witnessed record growth in income from FX operations in FY 2022 as compared to FY 2021. In total, the listed and non-listed banks that have reported results so far have recorded KES 74.5B in FX trading income in 2022 [FY 2021: KES 47.5B], a 57% growth.

Good to Know: Last week, the USD-KES quote provided by the CBK breached the KES 130 mark for the first time. Commercial banks and forex bureaus have, however, been exchanging the dollar for more than 130 units for the better part of 2023.

Insurers Report FY 2022 Results

CIC Insurance Group and Liberty Holdings are the only listed insurers that have so far reported their results for FY 2022.

Revenue Performance: CIC’s Gross earned premiums grew by 20.2% to reach KES 22.7B, while those of Liberty Holdings were up by 8.3% to KES 12B. On a net basis, the premiums inched higher by 18.8% and 9.4% to reach KES 17.5B and KES 7.4B, respectively. When adjusted for other revenue lines, CIC’s total income expanded by 17.4% to KES 22.5B while that of Liberty Holdings fell by 4.1% to KES 10.5B. The fall in Liberty’s Total Income is on account of a 58.5% decrease in fair value adjustments to assets held at fair value through the income statement.

Cost Structure: CIC’s net claims and policyholders' benefits payable rose by 10.8% to reach KES 11.7B, equivalent to 66.8% of net earned premiums [FY 2021: 71.6%]. Liberty’s net claims edged lower by 12.5% to KES 7.2B, equivalent to 97% of net earned premiums [FY 2021: 121.9%]. CIC’s operating expenses crossed the KES 5B mark to reach KES 5.5B, a growth of 24.6%.

Asset Base: CIC’s total assets were up 12.4% to reach KES 46.7B, while Liberty’s assets grew by 3.8% to reach KES 42B. In terms of allocation, disaggregated FY 2021 numbers in CIC’s FY 2021 annual report showed at least 37.1% of the balance sheet was invested in securities, as compared to 55.1% at Liberty. Without a decomposed balance sheet, the equivalent value for CIC is unavailable for FY 2022, but Liberty’s securities holdings as a share of the balance sheet remained unchanged at 55%.

Profitability: Both CIC and Liberty doubled their pretax profits - CIC up 115% to KES 2B, Liberty up 113.6% to KES 665.6M. CIC reported a net profit of KES 1.1B, up by 63.6%, while that of Liberty rose by 144.4% to KES 67.7M. The earnings per share for CIC stood at KES 0.4, up 73.9%, while that of Liberty edged higher by 313.3% to reach KES 0.62.

Dividends: CIC paid a dividend of KES 0.13 per share [FY 2021: Nil], translating to a dividend yield of 6.7%. Liberty did not announce any dividends for the year.

“Taking into consideration the current Kenya economic and business outlook the Board remains cautious around liquidity and capital resilience. Therefore, the Board has not recommended a 2022 final dividend.”

Share Price Performance: Over the last year, CIC Insurance's stock price is down 4.4% to KES 1.97 while Liberty Holdings is down 17.9% to KES 4.76.

Here is a link to CIC’s and Liberty Holdings’ financial results.

Kakuzi Reports

Operational Performance: For the fiscal year ended December 2022, Kakuzi’s gross revenues increased by 34.5% year-on-year to reach KES 4.4B. Profit before taxes was up 2.59X to reach KES 1.2B while the net result for the year expanded by 164.5% to reach KES 845.8M, translating to a net profit margin of 19.1% [FY 2021: 9.7%].

Dividends: The Board of Directors announced a dividend per share of KES 24 [Dividend Yield: 10%], up 9.1% from FY 2021.

“Kakuzi shareholders will enjoy an 8% per share dividend paid at Shs 24 rate as recommended by the board, up from the Kshs 22 payout the previous year. The enhanced dividends shall be paid on 30th June 2023 to the shareholders on the members register as at the close of business on Wednesday 31st May 2023.”

Share Price Performance: In last week’s trading action on Wednesday the 22nd, Kakuzi dropped by 37.5% to KES 240 with the day’s trading volume standing at 2K shares. On a year-to-date basis, the stock is down 37.7%, and most of the share price losses were accrued in last week’s trading action.

Here is a link to the financial results.

Weekly Capital Markets Wrap

The NSE: In Week 12 of 2023, Safaricom was the top gainer, up 15.6% week-on-week to KES 18.9, while Kakzui was the top loser, down 37.5% to KES 240, a level last recorded in June 2017. The NSE 20 and NSE 25 indices fell by 2.2% and 4.5% to 1,564.2 and 2,829.1 points, respectively while the NSE All Share Index gained 7.2% to 110.9 points. Equity turnover was up 947.1% to KES 30.6B on account of a block trade of 112M EABL shares worth KES 21.5B with respect to the completion of the Diageo Tender Offer. Bonds turnover rose 177.7% to KES 51.6B.

T-Bills: In the short-term public debt markets, the weighted average interest rate of accepted bids for the 91-Day, 182-Day, and 364-Day instruments were 9.829%, 10.344%, and 10.787% respectively. The total amount on offer was KES 24B with the CBK accepting KES 11.5B of the received bids. The aggregate performance rate was 49.16% and the acceptance rate was 47.9%. Investors piled in the 91 Days paper which had a 179.4% performance rate.

Eurobonds: Last week, the yields were mixed on a week-on-week basis across all 6 outstanding papers.

KENINT 2024 recorded the most significant rise, up by 59.6 basis points (bps) week-on-week to 14.462%, while KENINT 2048 recorded the largest drop at 23.1 bps to close at 12.067%. The average increase was by 15.45 bps compared to 147 bps last week.

All instruments were up on a year-to-date basis. KENINT 2028 was up the highest at 262.6ps to 12.938% while KENINT 2048 expanded the least, rising by 124.3 bps.

KENINT 2048 led price losses year-to-date, declining 10% to 70.057 while KENINT 2024 recorded the least price depreciation, by 0.9% to 91.637. On a week-on-week basis, KENINT 2048 was down the most, by 1.9%, while KENINT 2028 and KENINT 2034 were down by 0.3%, the least across all instruments.

Other Market Gleanings

🫴🏾 | EABL Closes Tender Offer | Diageo’s second and closing offer announced in October 2022 to acquire 118.4M shares in EABL [14.97% of total issued share capital] at a price of KES 192 per share closed on 17th March 2023. The aggregate amount of shares Diageo acquired from 1,697 shareholders totalled 143.5M, 21.2% above the target. The completion of the offer raises Diageo’s shareholding to 65% [514M shares] up from 50.03%. At the Stock Exchange last week, there was an execution of a block trade of 112M EABL shares EABL worth KES 21.5B with respect to the offer transaction.

🛢️ | ADNOC Nominates Local OMC | ADNOC, one of the International Oil Companies (IoCs), nominated alongside Saudi ARAMCO for the government-to-government oil arrangement, has nominated Gulf Energy Limited as the counterparty to handle the logistics around importing petroleum products. Under the framework, as per the arrangement, Gulf Energy will open a 180-day line of credit and an escrow account where buyers will pay for their product in Kenya Shillings which will later be converted to US Dollars for purposes of settling the transaction. Delivery of JET A-1 and AGO cargoes amounting to 250K MT is expected from 10th to 30th April.

👨💼 | Management Changes at Bamburi | Mr Mohit Kapoor has been appointed the new Bamburi Cement CEO effective 1st April 2023 subject to regulatory approvals. He succeeds Mr Seddig Hassani whose five-year tenure is set to end on 21st March 2023. The firm also announced the appointment of 2 new non-executive directors effective 1st April 2013.