Safaricom and Equity Earnings

East Africa’s largest telco and largest bank by total assets reported earnings this week

Welcome to the Baobab Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.

This week, we cover earnings releases from East Africa’s largest telco and largest bank by total assets.

Our newsletter this week is brought to you by:

Mwango Capital. Mwango Capital provides A+ quality analysis and research on the East African capital markets. Follow us on Twitter, join us on Telegram, check out our website. If you would want to sponsor our weekly newsletter and Twitter Spaces, contact us via email at hello@mwangocapital.com

Safaricom H1 FY 2022 Results

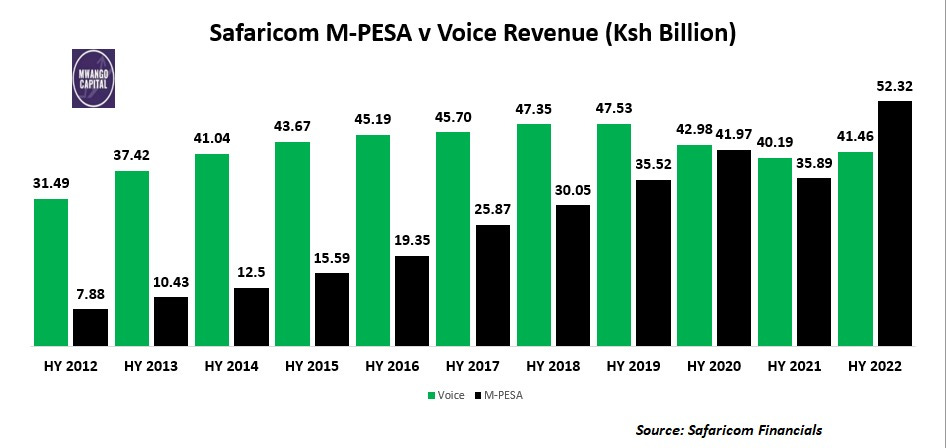

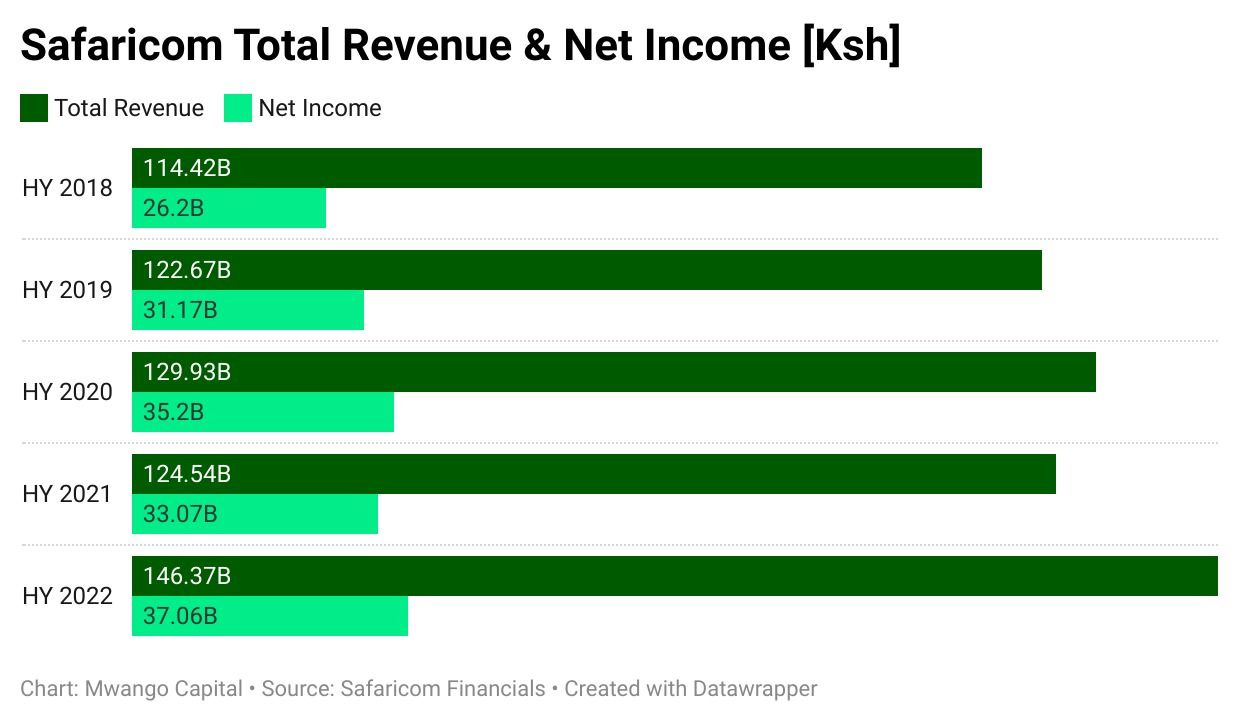

Service revenue recovers: Service revenue posted 16.9% growth to Ksh 138.4B from Ksh 118.41B in HY 2021. This was driven by 45.8% growth in M-PESA revenue to Ksh 52.3B following reinstatement of charges for transactions below Ksh 1,000 in January 2021.

Service revenue mix: M-PESA now accounts for 37.8% of total service revenue from 30.3% in HY 2021. Voice comes second at 29.9%. Data is a distant third at 17.1%.

Voice v M-PESA: M-PESA displaced voice for the first time earning Ksh 52.3B compared to voice at Ksh 41.5B. The two revenue drivers were tied at Ksh 83B in FY ended March 2021.

Profit after tax for HY 2022 reported at Ksh 37.06B, up 12.1% from Ksh 33.1B in HY 2021, translating to a profit margin of 25.3%

Other highlights:

Mobile data revenue +6.3% to Ksh 23.6B

Messaging revenue -18.3% to Ksh 5.8B

Fixed data +22.9% to Ksh 2B

Capex +0.3% to Ksh 22.8B

Free cash flow +45.8% to Ksh 34.4B

EPS +12.1% to Ksh 0.92

More: Here are links to the Investor Presentation, Results Booklet, Press Release, and Earnings Call Transcript (with relevant graphics).

Ethiopia: Management remains bullish as it looks into equity, DFIs, and local borrowing as funding sources for Ethiopia. Capital expenditure in Ethiopia is estimated at between $1.5B- $2.0B over the next five years.

“We are very hopeful that the combination of the development finance institutions that we’re working on will be able to close pretty quickly, ahead of any requirement for funds"

Safaricom CFO Dilip Pal

“The opportunities outweigh the risks in our view and the uncertainties largely because the telecom market revitalization has been unquestionably positive and of value for countries across the world”

Safaricom CEO Peter Ndegwa

Equity Bank Q3 2021 Results

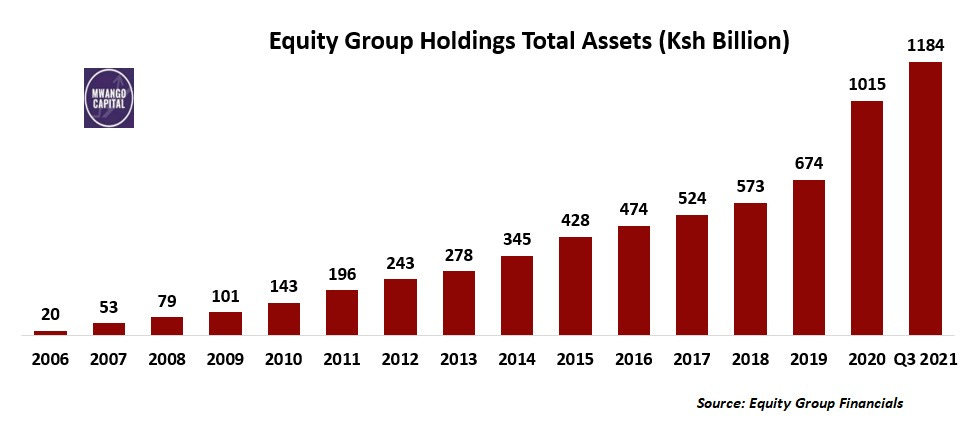

1T balance sheet: Total assets grew 27% to Ksh 1.18T driven by 62% growth in government securities holdings and 23% growth in net loans. Customer deposits grew by 27% in the period.

“Equity’s greatest asset is its people. They are believers. They are doers. You can beat equity in thinking but you can't beat equity in execution. We don't claim a monopoly of intelligence because that is given by God but the desire to do is personal and we are very enthusiastic and passionate in executing our plans. Equity is a creation of passion and enthusiasm”

Equity Group CEO Dr James Mwangi

Interest Income: The Group earned almost as half from government securities as from loans in Q3 2021. In Q3 2015, only 11% was earned from government securities as from loans.

Subsidiaries: Equity Bank Kenya’s contribution to deposits stands at 58% compared to the subsidiaries’ total contribution at 42%. Equity BCDC recorded 51% YoY deposit growth.

Profit for the period rose 79% to Ksh 26.9B as loan loss provisions came down 68% and total income went up 25%.

Other highlights:

Net interest income +23% to Ksh 48.5B

Non-funded income +29% to Ksh 31.4B

Operating expenses -3.2% to Ksh 43.8B

Profit before tax +85% to Ksh 36.6B

EPS +78% to Ksh 7.0

Full results here

This week, we released podcasts based on our Twitter Spaces engagements with Acorn Holdings and BK Group.

African Markets this Week

In East Africa, Kenya recorded a 0.31% rise in the Nairobi Securities Exchange All Share Index, closing the week at 171.47, up from last week’s 170.94. Tanzania’s DSE ASI was up 0.27% to close at 1,873.25 up from last week’s 1,868.15, while Uganda’s USE ASI recorded a 0.76% rise to close at 1,477.60.

Across Africa: Zimbabwe’s ZSE ASI recorded the highest increase in returns this week, up 5.03% to close at 12,442.42.

Charts of the Week

Safaricom

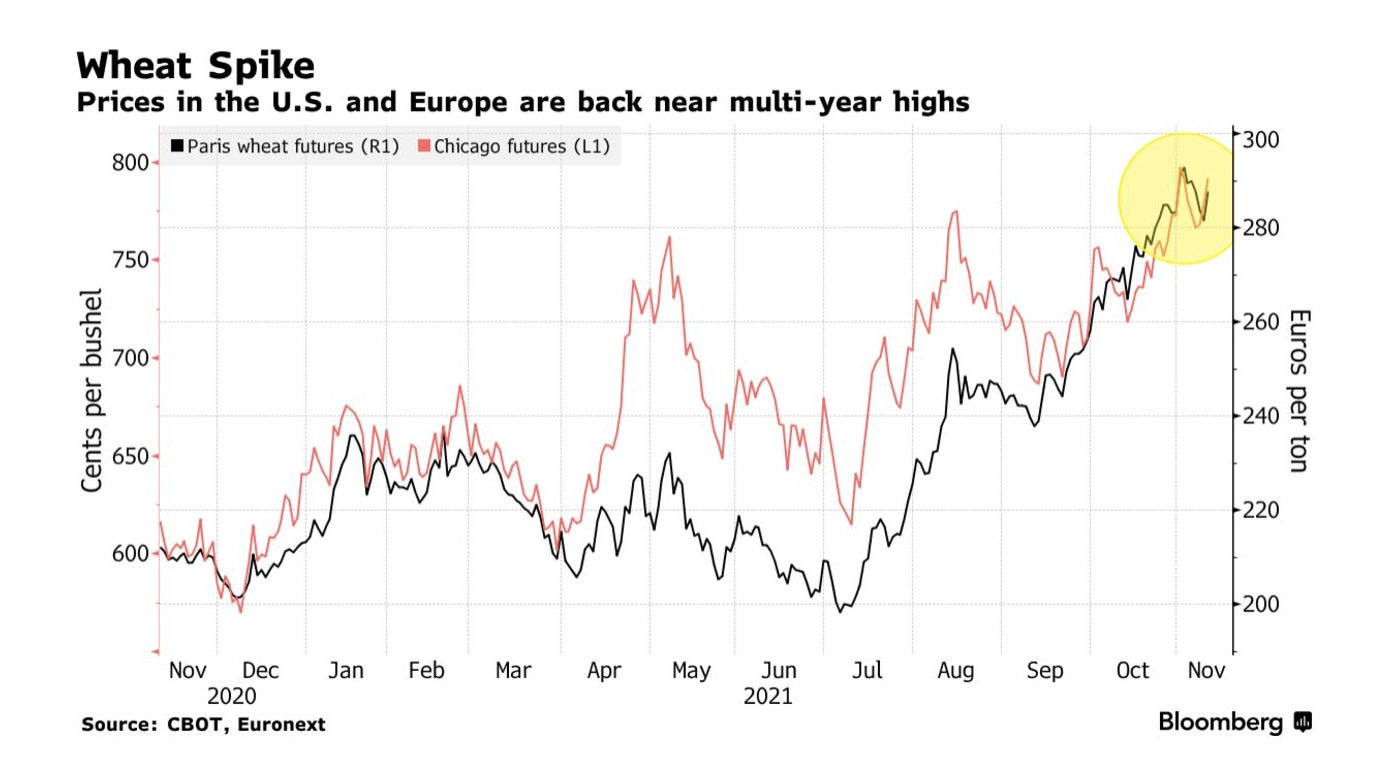

Global Wheat Prices

What Else Happened This Week?

GDP data: Kenya’s economy grew by 0.7% in Q1 2021 and 10.1% in Q2 2021. Full report here.

CRB suspension effected: CBK effected a 12-month moratorium of listing in CRBs for loans less than Ksh 5 million [Central Bank of Kenya + Mwango Capital].

Kenya Power 2021 annual report: We made a thread about the various things we noted from the report including a 12-page report by the Auditor General.

November Treasury Bonds sale: Investors bid Ksh 84B against the Ksh 50B targeted. Only Ksh 69.5B accepted [Central Bank of Kenya].

Online forex trading: HFM Investments Ltd & Windsor Markets (Kenya) were licensed as non-dealing foreign exchange brokers [Capital Markets Authority].

HF Group: Lender invites strategic investors to acquire a stake [Julians Amboko].

KenGen: CMA is set to punish the firm for failure to issue a profit warning [Nation]. The company has also completed a second geothermal well in Ethiopia [Business Daily].

KRA’s social media trap: Taxman eyeing rich tax cheats from social media posts [Business Daily].

If you like our newsletter, please share it: