Safaricom wins Ethiopian License

The total license fee paid by the winning consortium was $850 million

Welcome to the Baobab Weekly, where we bring you a succinct summary of key business news from East Africa.

This week we cover Safaricom’s award of a telecom license in Ethiopia, Kenyan banks’ Q1 2021 results and rights issues at the Nairobi Securities Exchange.

Safaricom gains entry into Ethiopia

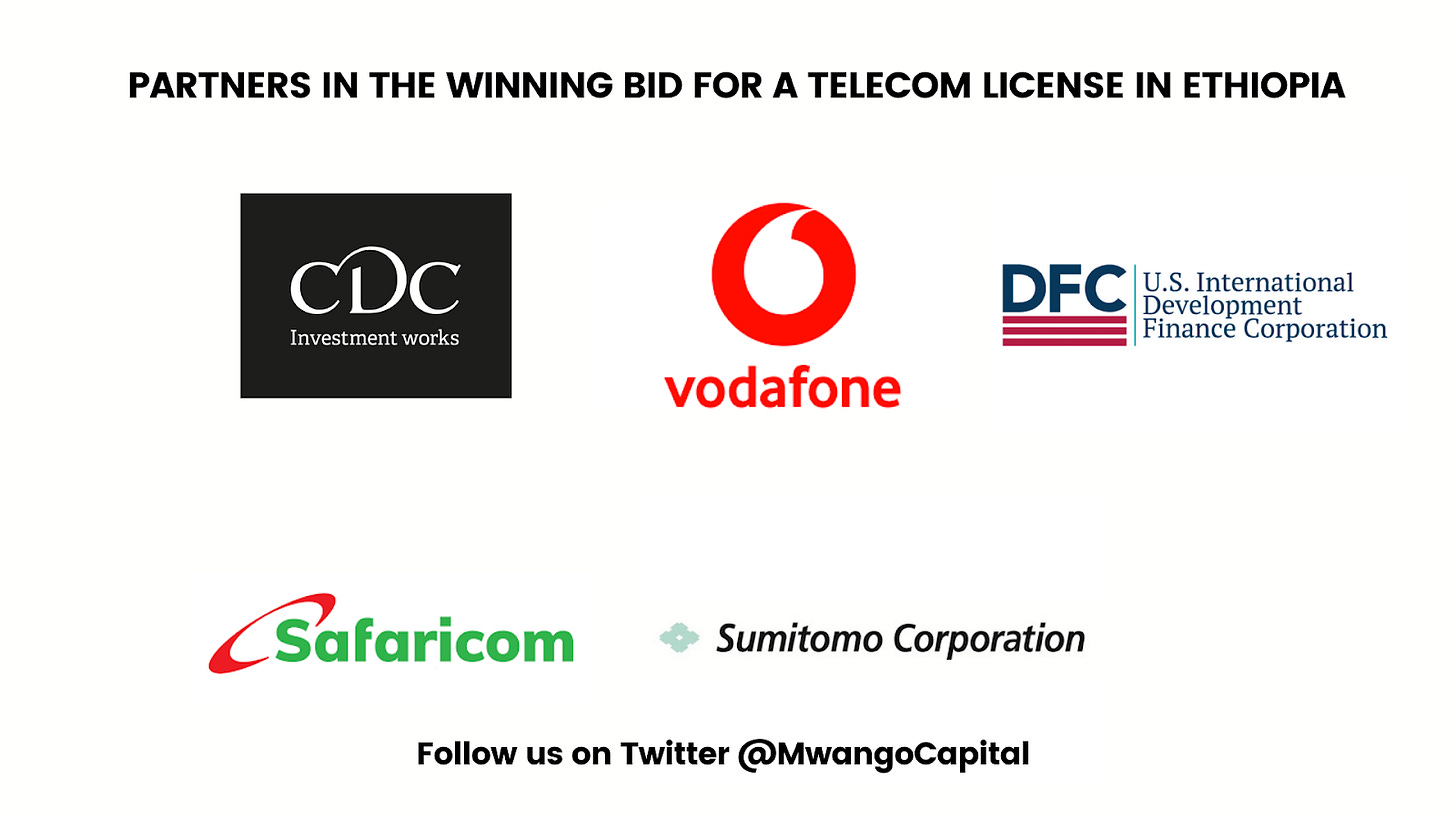

The Ethiopian government has awarded one telecom license to the Global Partnership for Ethiopia which is composed of Vodacom Group (South Africa), Vodafone (UK), CDC Group (UK), Sumitomo Corporation(Japan), Development Finance Corporation and Safaricom (Kenya). The total license fee paid by the consortium was $850 million. Safaricom recently raising its controlling stake in the Global Partnership for Ethiopia from 51% to 56%. The rest of the stakes are Japan’s Sumitomo with 25% , CDC with 10%, Vodacom 6%, and 10% by the UK sovereign investment fund. MTN Group from South Africa had also bid for the telecom license, putting in a $600 million offer meaning the Global Partnership for Ethiopia paid more by ~42%.

Until now, Ethio Telecom has been the country’s sole mobile operator. The publicly owned national telecom company launched its mobile phone-based financial service earlier this month. Ethiopian authorities had earlier indicated that new licensees may be allowed to operate mobile money services in 1-3 years after entering the market. Licensees are expected to build their own infrastructure. We wish Safaricom well in Ethiopia. We did a back-of-the-envelope comparison in voice and data rates and we see that Safaricom may need to reduce rates to be competitive in Ethiopia:

Kenyan Banks’ Q1 2021 Results

Bank’s Q1 reports have started to follow in with Stanbic Bank Holdings, Co-operative Bank Group and ABSA Group releasing their report this week. Here are a few highlights:

Stanbic Bank [vs Q1 2020]:

Net interest income up 6.67%

Loan loss provisions decreased marginally by 1.2%

Customer deposits up 11.8%

Loans & advances to customers down 2.4%

Profit after tax up 26.7%

Co-operative Bank [vs Q1 2020]:

Net interest income up 31%

Loan loss provisions up more than 153%

Customer deposits up 16%

Loans & advances to customers up 8%

Profit after tax down 2%

Absa Bank [vs Q1 2020]:

Total interest income down 0.28%

Customer deposits up 17%

Loan book up 8%

Loan loss provisions up 17%

Profit after tax up 23.7%

Rights Issues

TransCentury is planning a rights issue that seeks to raise two billion new shares at five shares for every two, subject to requisite approvals from the Capital Markets Authority. This is part of the special business in the company’s AGM slated for 10th June 2021.

Elsewhere, Crown Paints has received the Capital Market Authority’s green light to raise 711 million through a rights issue and subsequently list 71 million new ordinary shares at the NSE. The issue is aimed at bringing the Group’s indebtedness to a more sustainable level and to position it to take advantage of long-term growth opportunities. We compiled a list of past rights issues at the Nairobi Securities Exchange:

Mergers and Acquisitions

Kenya’s Microfinance space saw another acquisition this week after the Central Bank of Kenya announced the 100% acquisition of Uwezo Microfinance Bank by Djibouti lender Salaam African Bank. Salaam African Bank completed the transaction on 25 March 2021 after CBK’s approval on 24 December 2020. Uwezo was licensed as a microfinance institution on 08 November 2020 and has one branch in Nairobi.

Digital lender Branch International has also recently announced its 84.89% acquisition of Century Microfinance Bank. Century MFB was licensed in 2012. The Central Bank of Kenya regulates 14 microlenders:

Car & General Half-Year Results

Car & General, East Africa’s leading supplier of a wide range of international reputable brands in power generation, automotive and engineering products, released its half year results this week. Profit after tax was up 180% to Ksh 460 million due to higher sales in consumer business in Kenya and Tanzania specifically 2 and 3 wheeled vehicles. Other highlights from the results:

Revenue up 29.5%

Gross profit up 41%

Operating and administrative expenses up 15%

Profit before tax up 191%

EPS Ksh. 11.49 [2020: Ksh. 4.12]

No interim dividend

Other Noteworthy Items:

Ascent Capital, a PE firm has raised $100M from the International Finance Corporation, CDC Group, Dutch Development financier FMO and French Development finance institution Proparco for acquiring stakes in local companies across Eastern Africa. Here is an interview on NTV relating to this.

Rwanda has issued a 15 year bond with a total value of RWF 20 billion to develop its capital market.

Kenya’s Treasury has exempted Japanese firms, contractors and consultants from income tax in the country.

Remittances to Kenya up 23.3% year over year in the period January to April 2021.

Vodacom Tanzania results for the year ended 31 March 2021:

Revenue down 5.6%

Operating profit down 48.4%

Profit before tax down 89.5%

CAPEX down 20.8%

Loss per share Tzs 13.44

Kakuzi, I&M and Stanbic held their virtual Annual General Meetings during the week. Here is a list of other upcoming AGMs for the month of May 2021:

.