👋 Welcome to the Baobab Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.This week, we cover dividends from Safaricom and Stima Sacco, the Russian invasion, and the results of the KMRC bond.

Our newsletter this week is brought to you by:

Mwango Capital. Mwango Capital provides A+ quality analysis and research on the East African capital markets. Follow us on Twitter, join us on Telegram, and check out our website. To sponsor our weekly newsletter, memes, or Twitter Spaces, reach us at hello@mwangocapital.com.

First off, our weekly business news in memes brought to you by Share Hub:

Safaricom Makes it Rain

Dividends: On Friday, Safaricom announced that the board had approved the payment of an interim dividend of KES 0.64 (equivalent to a KES 25.64B in total) for HY1 FY22. The payout is equivalent to 69.6% of Profit After Tax for the half-year. It will be payable to the shareholders on record as at March 17, 2022, and the actual payment will be on March 31, 2022.

The announcement came just in time for Safaricom which had been down on Thursday given the Russian-Ukraine war. KES 92B in market value was wiped off the Nairobi bourse on Thursday as investors got jittery, with Safaricom registering the largest decline in market cap as it shed close to KES 82B. The stock was up 3.18% on Friday on the dividend news.

Ethiopia telecoms space: Safaricom Ethiopia recently launched a $100M prefabricated data center in the capital Addis Ababa, as the telco looks to launch commercial operations in April. The outlay expended in the setup is part of $300M earmarked for core tech infrastructure investment in the country in 2022. The telco notes that more data centers will be rolled out to cover Adama, Dira Dawa, and further out in the country.

After telecoms, now banking: Prime Minister Abiy this week said that Ethiopia will drop restrictions on foreign banks, allowing them to launch subsidiaries, and roll out fully-fledged banking operations. Kenyan banks KCB, Equity, and Cooperative have been eyeing Ethiopia with KCB and Equity maintaining representative offices.

Results of the KMRC Bond Auction

Oversubscribed! The first tranche of the KMRC KES 10.5B Medium-Term Note Programme recorded 480% oversubscription. The mortgage refinancier issued a KES 1.4B note and received bids worth KES 8.1B. The corporate bond has a fixed interest rate of 12.5% - an attractive rate that has seen investors pile in funds in the issuance. To put this performance into perspective, the first phase of the MTN Programme received bids worth 77% of the entire amount on offer on the MTN program.

“The success of this first issue represents a resounding validation of our business model and strategy by investors. The cash raised will enable us to blend our inventory of concessional funds and therefore substantially scale up our operations, as we seek to refinance more home loans and make them affordable and within reach for more Kenyans” - KMRC CEO Johnstone Oltetia.

Revival times: For Kenya’s corporate bond market, recent data shows that 2022 might be the year it bounces back after five straight years of decline. Recent issuances and their performance at least indicate ample liquidity faced with a dearth of instruments.

Higher premiums: Higher yields offered by corporate bonds compared to government bonds are what attract investors to these bonds. This premium in corporate bond yields relative to government bonds reflects the risk that comes with holding riskier corporate debt.

Vs IFBs: Recently issued 19-year IFB1/2022/019 was oversubscribed by 76% and the accepted bids’ rate came in at 12.965%. While the KMRC bond has a shorter maturity than the IFB, the 12.5pc yield is only 0.425 percentage points shy of the IFB’s yield. This is the market communicating that there is a low supply of these instruments relative to the liquidity available.

Russia Invades Ukraine

What happened? On Thursday at 6 am, Moscow local time, Russia's President Vladimir Putin ordered troops to invade Ukraine to demilitarize the country. Russian troops had amassed at the border for more than a month in the build-up to the invasion.

Reaction: Various Western countries have condemned the military action and sanctions have been rolled out against various individuals, state-owned and private entities, Russia’s sovereign debt, and up to 80% of the country’s banking assets. On the first day of the invasion, energy prices soared with Brent Crude Oil reaching $105 (8-year high). Equities and crypto fell while gold gained reflecting its status as a safe haven.

NSE sell-off: NSE shed KES 92B in market value on Thursday, the largest single-day drawdown since Covid-19 started. Safaricom shed KES 82.13B alone, with KCB, Equity, EABL, and Coop Bank witnessing a cumulative draw-down of slightly over KES 7B.

What's at stake: Russia and Ukraine contribute a combined 29% of the global wheat supply. Russia is the third-largest oil producer globally and the largest supplier of gas to Europe - supplying about 35% of its total supply. Current events might impact trade flows, disrupt supply chains, and add more upward pressure to commodity prices in an already inflationary environment.

What else happened this week?

💳 Payments Strategy launch: The CBK launched the National Payments Strategy 2022 - 2025, and there was a lot to unpack. Read a further breakdown of the report here. 3 notable items:

On remittances: The CBK plans to implement measures to facilitate the growth of remittances in the country whilst ensuring safety, cost reduction, increased transaction speeds, and transparency.

From cheques to digital: Cheque volumes and values as a share of GDP have fallen in the last decade from 57% (KES 1.8T) of GDP in 2010 to 22% of GDP in 2021 given increased usage of other electronic payment instruments including KEPSS and mobile money.

On transaction costs: The CBK aims at reducing transaction costs within the EAC because sending money from Tanzania to Kenya and from Tanzania to Uganda constituted the five most expensive corridors.

🏦 Interest Rate Watch: The Bank of Botswana changed its anchor policy rate from the official Bank Rate to the 7-day Bank of Botswana Certificate Yield. The new anchor policy rate will be known as Monetary Policy Rate. Get more info from Bloomberg.

In Kenya, the interest rates on Treasury bills in Kenya climbed to a two-year high on higher bid acceptance by CBK. The Bank is on course to roll over significant upcoming short-term maturities in the current quarter.

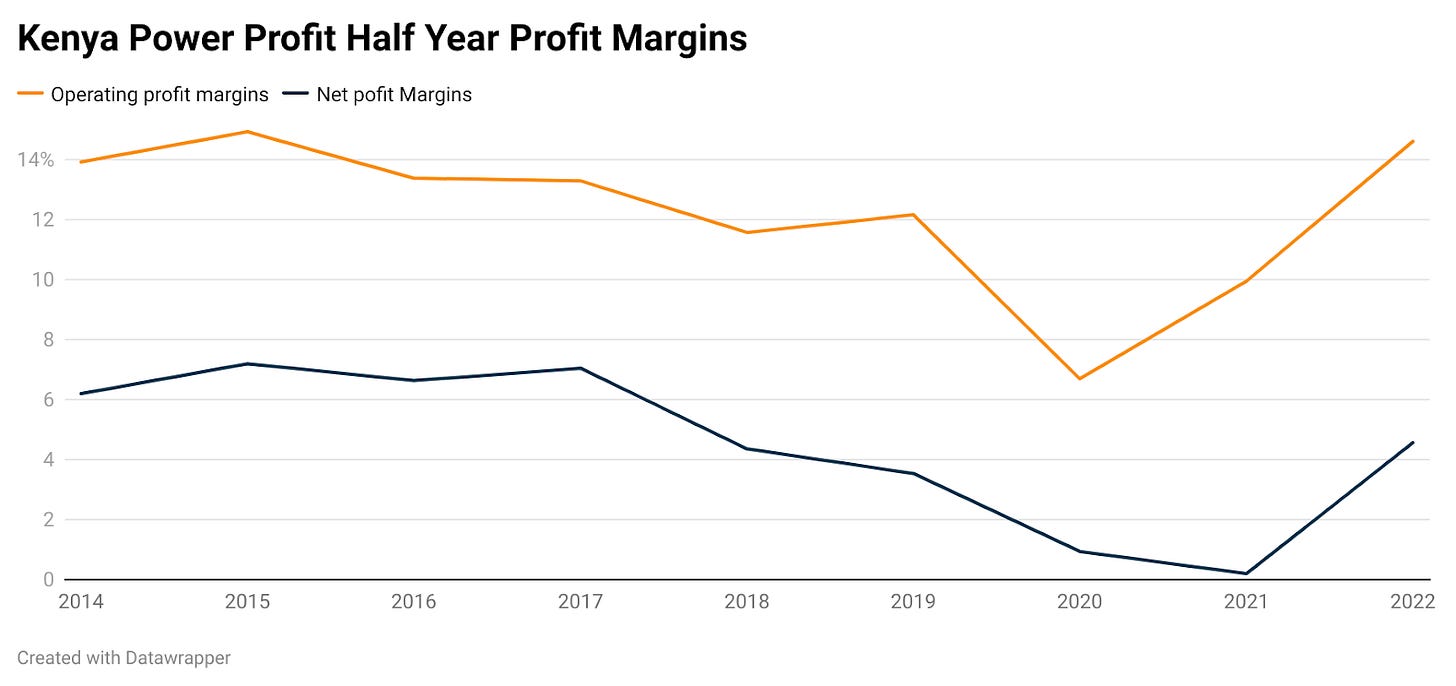

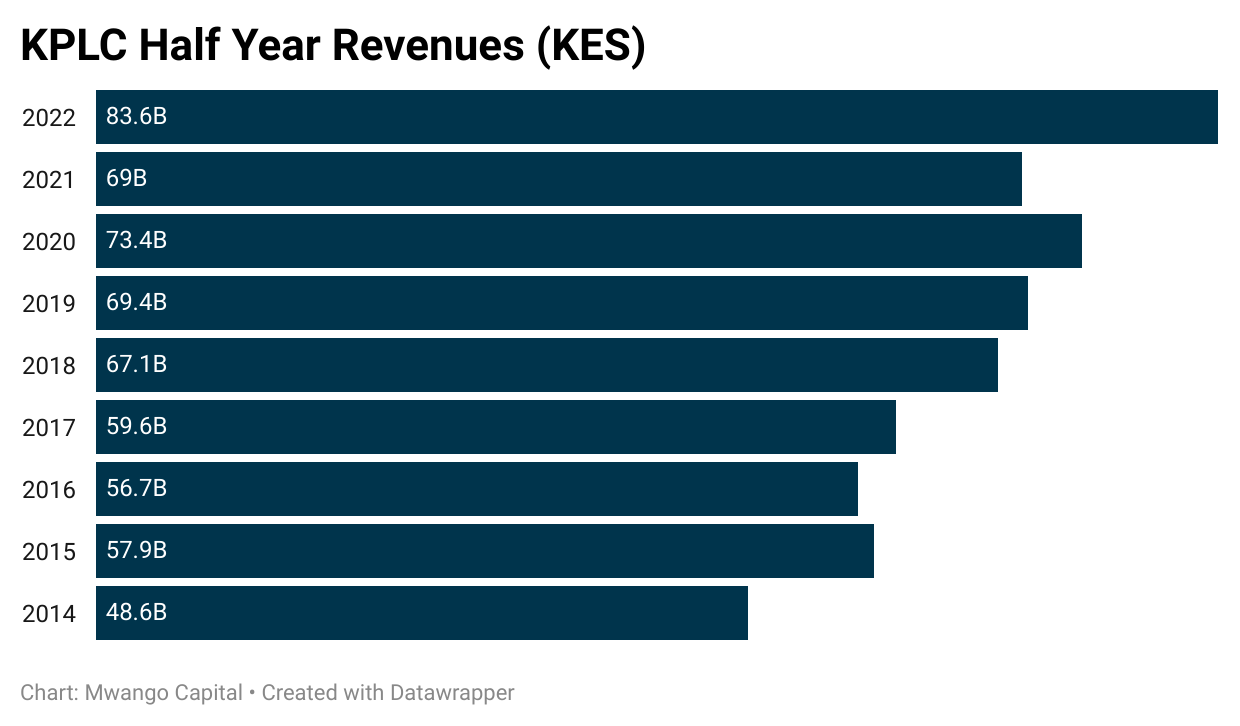

⚡ Kenya Power half-year results: Kenya’s power utility released their trading results for the six months to Dec 2021. Electricity Sales were up 8.7% to 4,562GWh while revenues were up 21.1% to KES 83B. The most surprising thing was the net profits which were up a whopping 2,664.5% to KES 3.2B. 2021/22 seems like an inflection year for the utility as its operating margins and net profit margins rebounded in what could be a good sign for the company.

🏗️ EA Portland Cement still in the Red: The cement company released its results for the six months ended 31 December 2021 and losses for the review period were reduced by KES 129M to reach KES 907.1M. Revenues shrunk by 30.4% or KES 422M compared to the same period in the previous year.

🧑🍳 Unga Group Results: Revenues came in 9% lower compared to the same trading period on account of reduced sales. This affected operating profits which dropped 63.5%. Were it not for a tax credit, Unga would have made a loss. The feeds manufacturer also issued a profit warning for 2021 Full Year results.

💸 Stima Sacco Results: Stima Sacco, Kenya’s second-largest SACCO by assets, released its results for the 2021 financial year. The asset base grew KES 5B to reach KES 46B, while Profit After Tax grew 39.4% to KES 1.4B. The Sacco's net margin was 24%. Sacco members - who grew 10% to 154K over the year - will receive a dividend per-share value of 14% and 10% interest on deposits.

🚬 BAT Uganda: The cigarette manufacturer’s gross revenue reduced 42% on a YoY basis, which pushed profit from operations -47.8% and ultimately PAT came in at -45.8%. Despite the double-digit percentage drop in these operating metrics, the firm is paying out 99.5% of its Net Income in dividends. In contrast, BAT Kenya grew its revenue 3% to KES 40B, which buoyed profit from operations by +23%. At 82.5% Dividend Payout Ratio out of a KES 6.483B Net Income that grew 17% YoY, BAT Uganda is more aggressive in returning earnings to shareholders compared to its Kenyan counterpart.

🌍 NSE this week:

📊 Our charts of the Week:

If you enjoyed it, share it with your friends: