Welcome to the Baobab Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.

Our newsletter this week is brought to you by:

Mwango Capital. Mwango Capital provides A+ quality analysis and research on the East African capital markets. Follow us on Twitter, join us on Telegram, check out our website. If you would want to sponsor our weekly newsletter and Twitter Spaces, contact us via email at hello@mwangocapital.com.

This week, we cover the High Court ruling on Minimum Tax in Kenya, the Kenya Shilling’s depreciation, and Centum Real Estate.

The Depreciating Kenyan Shilling

Nine month low: This week saw the Kenyan Shilling slip to 110 against the dollar, the lowest valuation for the local unit since January this year. The local currency ended the week quoted at 110.3765 against the greenback.

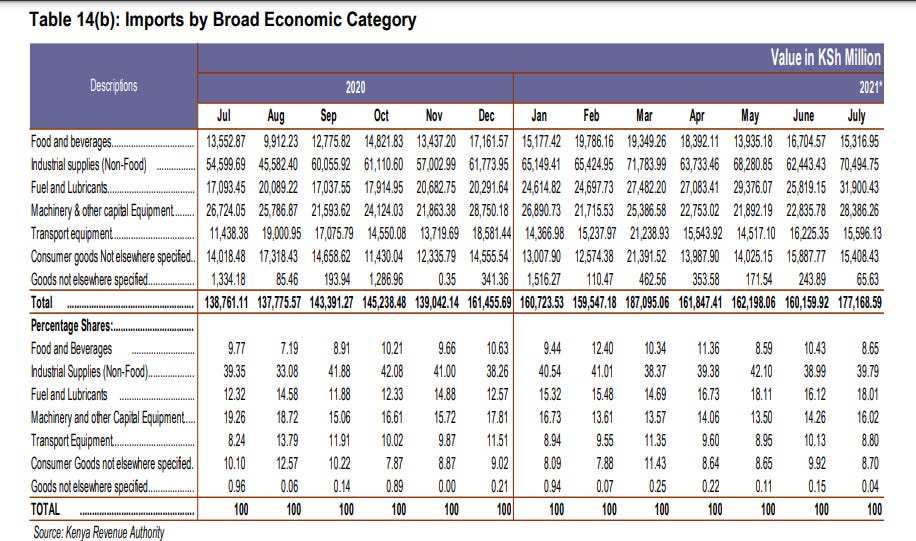

Dollar demand: Pressure on the shilling continues to emanate from importers’ dollar demand resulting from rising crude oil prices. The price of crude oil in August 2021 rose to $72.34 per barrel from $66.70 in July 2021. The depreciation piles pressure on importers who will have to use more Kenya Shillings to import oil.

“I think that sentiment will be more important than anything else in the coming months. With expectations of continuing dollar denominated debt, there is likely to be some firepower in the medium term.

However, in the event of adverse developments in the run up to the 2022 General Elections, and even without such developments, I expect significant downside pressure.”

Kenya’s import bill for the month of June 2021 rose 10.6% to Ksh 177.2B from Ksh 160.2B in June 2020, with fuel and lubricants accounting for 18.01% of the import bill.

No Minimum Tax (For Now)

Unconstitutional: Justice George Odunga, in a High Court ruling in Machakos, declared Section 12D of the Income Tax Act which introduced minimum tax as unconstitutional. Justice Odunga cited double taxation and inequity. The judge also restrained the Kenya Revenue Authority from further implementing provisions of Section 12D.

“The minimum tax has not only the potential to subject the people to double taxation but also unfairly targeting people whose businesses, for whatever reason, are in loss making position.”

Justice Odunga

Provisions of the Constitution require the burden of taxation to be shared fairly.

Source: Constitution of Kenya, 2010

Finance Act 2020: Minimum Tax came into the fold effective January 1st 2021 via the Finance Act 2020 through introduction of a new section 12D to the Income Tax Act. The tax sought to charge businesses a rate of 1% of their gross turnover.

On Centum Real Estate

Stake sale in real estate unit: Centum Investments Company (CICP) may reduce its stake in 100% owned subsidiary Centum Real Estate Ltd (Centum RE) which has breached the single asset limit exposure. The subsidiary accounts for 45% of CICP’s Ksh 47.5B total assets, contrary to CICP’s asset allocation policy.

“In accordance with CICP Asset Allocation Policy, Centum may seek to reduce its interest in Centum RE over the next 3 years of the Centum 4.0 strategy period to rebalance its investment portfolio in compliance with its policy.”

Centum RE

Investment grade asset: With Centum RE, CICP has created a viable real estate company well positioned for sale:

Centum RE floated a 3-year, zero coupon bond worth Ksh 4B that listed on the Nairobi Securities Exchange.

Centum RE has A2 (KE) credit rating issued by GCR.

Centum RE returned Ksh 4.5B representing 58% of Ksh 7.8B invested by CICP.

Centum RE has sold Ksh 2B worth of development rights of which, Ksh 1B is distributable to CICP.

Markets this Week

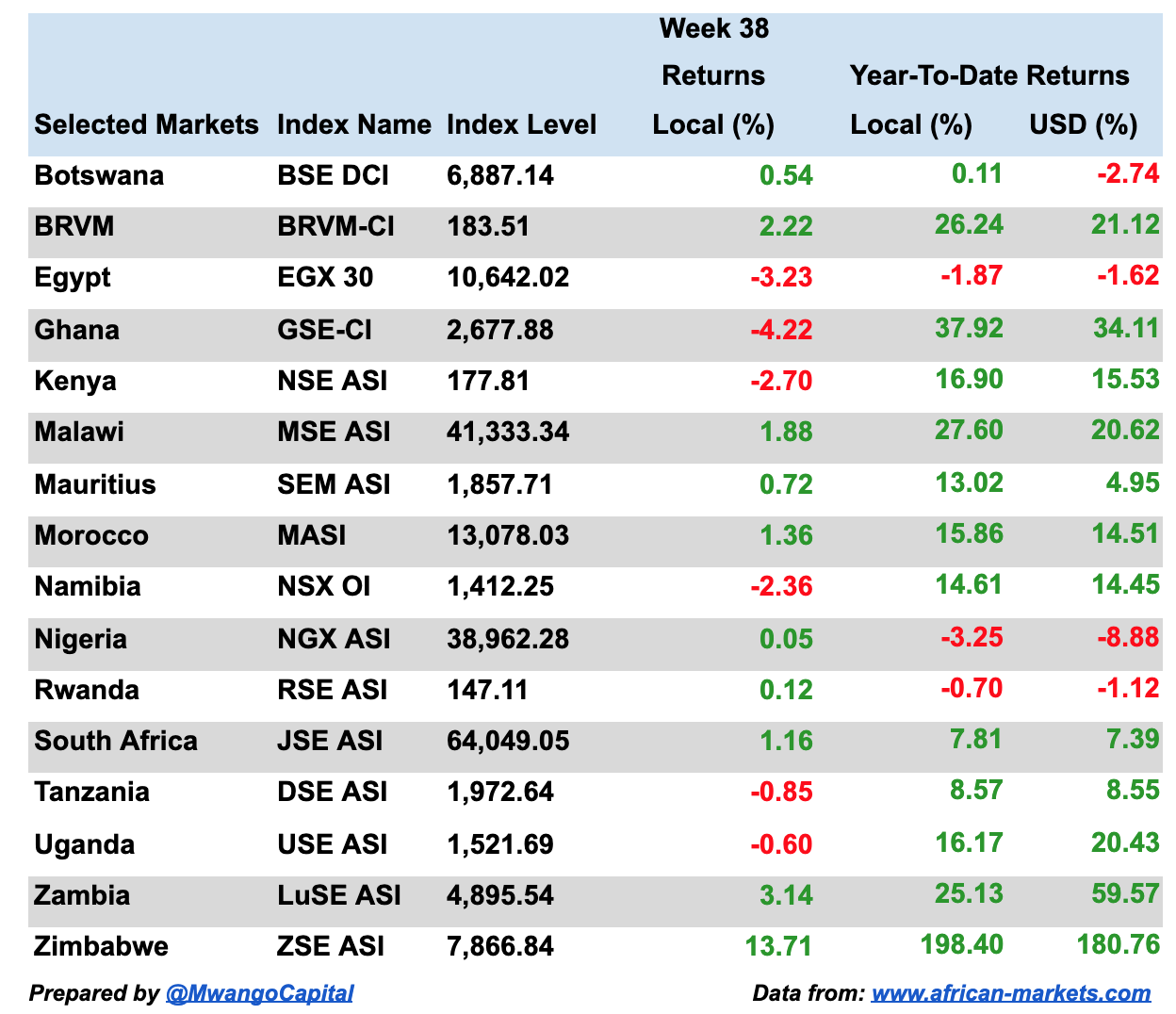

In East Africa, Kenya recorded a 2.70% drop in the Nairobi Securities Exchange All Share Index, closing the week at 177.81, down from last week’s 182.75. Tanzania’s DSE ASI was down 0.85% to close at 1,972.64 from last week’s 1,989.64, while Uganda’s USE ASI recorded a 0.60% drop to close at 1,521.69.

Across Africa: Zimbabwe’s ZSE ASI recorded the highest increase in returns this week, up 13.71% to close at 7,866.84.

What Else Happened This Week?

Debt Market Developments:

Acorn completed transfer of partnership interests to Acorn D-REIT. The developer has also upsized its MTN programme to Ksh 7.5B.

Kenya’s Treasury is seeking Ksh 60B in its October treasury bonds sale. Two 15-year and one 25-year bonds are on offer [Central Bank of Kenya].

Safaricom Ethiopia: Vodacom Group is in talks with UK’s CDC Group to acquire the development finance institution’s 10.9% stake in the Ethiopian unit for $1.74B [Business Insider Africa].

Green financing: Co-operative bank obtained a Ksh 750m loan for SME lending for green energy and solar installation projects [African Guarantee Fund].

Retreat from tariffs rise: Kenya Power has withdrawn its bid to increase tariffs [Business Daily].

If you like our newsletter, share it with your friends and colleagues