Welcome to the Baobab Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.

This week, we cover raising capital in the securities market: (i) MTN Uganda’s upcoming IPO listing and (ii) EABL’s Medium Term Note (MTN) offer.

Our newsletter this week is brought to you by:

Mwango Capital. Mwango Capital provides A+ quality analysis and research on the East African capital markets. Follow us on Twitter, join us on Telegram, check out our website. If you would want to sponsor our weekly newsletter and Twitter Spaces, contact us via email at hello@mwangocapital.com.

The MTN Uganda IPO

Going public: MTN Uganda will sell 20% of its shares to the public through an Initial Public Offering (IPO) after receiving requisite approval from Uganda’s Capital Markets Authority and Uganda Securities Exchange. MTN Uganda is 96% owned by MTN Group. The valuation being sort is around $1.4B. This follows MTN’s IPO of its subsidiaries in Nigeria, Ghana, and Rwanda.

More details on the offer will be unveiled when the Information Memorandum is released in due course.

Mwango Explainer: An IPO involves a company issuing shares for the first time while listing on an official securities exchange. This will result in a new set of shareholders from the public buying the shares at a specified share price and hence the company raising capital from the exercise.

Compliance: The listing is part of the regulatory requirement for telecom operators in Uganda to float 20% of their shareholding on the Uganda Securities Exchange as articulated in the National Broadband Policy (2018).

“Over the last 23 years, the people of Uganda have embraced MTN as their own and given us the legitimacy to operate throughout this country. We are reciprocating by inviting Ugandans to share in the ownership of the success that we have built together.” - MTN Group Vice President for Southern and East Africa, Yolanda Cuba

Starved of regular listings: The Uganda Securities Exchange is a small bourse with 16 companies with 9 cross listings from Kenya. Its last listing came in 2018 in pharmaceutical manufacturer Cipla Uganda, six years after the previous listing, Umeme.

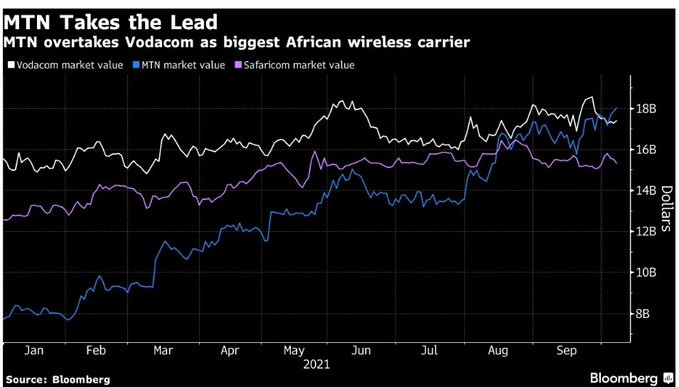

Keep in mind: MTN Group is now Africa's biggest wireless carrier by market cap.

EABL Returns to the Corporate Debt Market

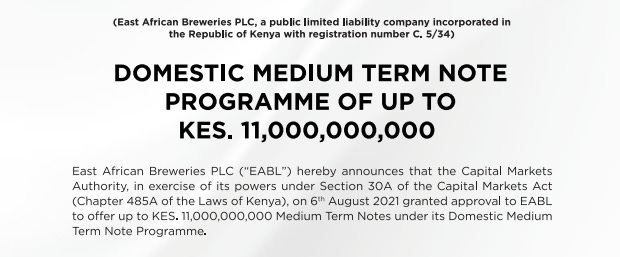

Second issuance: East African Breweries PLC is back in the corporate debt market about four months after the early redemption of its Ksh 6B initial issue.

This time the brewer is seeking Ksh 11B by floating a 5 year, 12.25% (fixed rate) issue for purposes of repaying certain borrowings taken in the ordinary course of business. The offer closes on 21 October 2021 with the note set to be listed on the Nairobi Securities Exchange on 1 November 2021.

Source: EABL

Need for longer term funding:

“In looking at the structure of our debt portfolio, we felt the need to lengthen the tenor, and also keep the mix that we’ve had of having some debt with the capital markets and some debt with the banks” - EABL CFO Rispah Ohaga in a chat with Business Redefined host Julians Amboko

Want to dig deeper? Find a link to the Information Memorandum here:

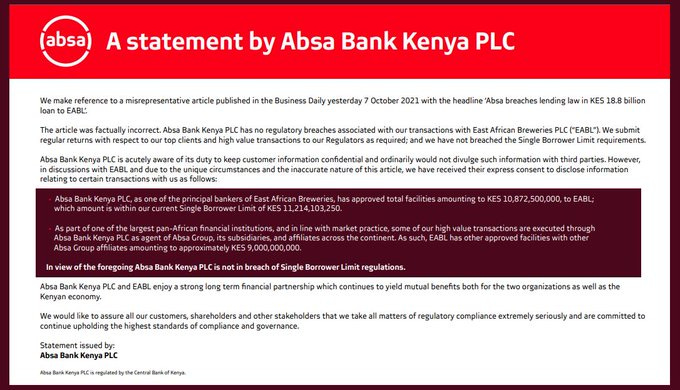

In more EABL news: EABL was in the news this week after a Business Daily article cited ABSA Bank Kenya’s apparent breach of lending laws over Ksh 18.8B worth of loans to the brewer. We did a thread on the story:

Absa Bank Kenya responded with a statement on this:

Highlights from Twitter Spaces

This week we hosted Jubilee Holdings Regional CEO Dr Julius Kipng’etich for a discussion on Kenya’s insurance industry. Here are a few highlights from the conversation:

Conservative/prudent approach: The company boasts of its very conservative approach to managing risk and investments with 85% of its investments placed in government securities.

Partnership with Allianz Group: The partnership with Allianz was backed by a need to compete at global level given Allianz’s international outreach. The CEO also welcomed learning from a global player in Allianz.

Is the insurance sector better served by consolidation?: The CEO backs having fewer, stronger insurance companies. “We need to encourage consolidation. And that’s how we grow,” he said.

Share buyback: Buyback exercise to be undertaken when necessary. “We will not exercise that now,” he said.

On the low uptake of insurance: He sees that one of our biggest competitors is 'Harambee' (Kenyans rallying around each other when there is a need) so they are thinking about how to come up with a wonderful product or platform that marries insurance and harambee [@Bankelele].

Don't miss! Are you familiar with brands such as Roto tanks, Jojo tanks, Zoe beauty products, Happy’s Golden snacks or Nature’s Own spices?

These are part of the brand portfolio of leading regional manufacturer Flame Tree Group. Next week we host long serving CEO Heril Bangera on our Twitter Spaces to help us understand the company better.

Markets this Week

In East Africa, Kenya recorded a 2.99% drop in the Nairobi Securities Exchange All Share Index, closing the week at 175.82, down from last week’s 181.23. Tanzania’s DSE ASI was down 1.15% to close at 1,926.98 from last week’s 1,949.48, while Uganda’s USE ASI recorded a 2.13% drop to close at 1,484.95.

Across Africa: Zimbabwe’s ZSE ASI recorded the highest increase in returns this week, up 9.75% to close at 9,570.05.

What Else Happened This Week?

New chairperson at CMA: Former IBM General Manager (East Africa) Nick Nesbitt appointed on a 3-year term [The Trading Room].

Voluntary administration: Cytonn High Yield Solution (CHYS) and Cytonn Project Note (CPN) placed under court-appointed administration in an application filed by CEO Edwin Dande [Cytonn + The Trading Room + Citizen].

Fixing Kenya Power: The utility firm declared a “special project” and an inter-ministerial team set up to carry out its forensic audit [Office of the President].

October Treasury bonds results: Three tranche October bonds raised Ksh 55.47B from Ksh 60B targeted amount [Central Bank of Kenya].

Late publication of results: East African Cables reported its FY 2020 results (yes FY 2020 results!) posting a loss of Ksh 753.2m from a Ksh 630.9m profit the prior year.

Cost cutting at Centum: Shared services division Centum Business Solutions shut down to align with objectives of Centum 4.0 strategy [CICP].

M-AKIBA: Kenya’s Treasury shifts issuance of the mobile bond from the Nairobi Securities Exchange to Central Bank following its underperformance [The East African].

Charts of the Week:

Financial services companies in Kenya have some heavy exposure to property of Ksh 4,687B ($42.9B). This is 81% of the combined assets of these companies (Kshs 5,808B or $53.2B) and 43% of Kenya’s 2020 GDP ($99.3B).

Longest serving CEOs at the Nairobi Securities Exchange:

If you like our newsletter, share it with your friends and colleagues: