Welcome to the Baobab Weekly where we bring you a succinct summary of key business news from East Africa. This week is all about Twitter coming to Ghana.

Twitter comes to Africa

Twitter has announced plans to set up shop in Ghana. The firm announced it is actively building a team in Ghana as part of its growth strategy. Ghana’s recent appointment to host The Secretariat of the African Continental Free Trade Area made it the country of choice in Africa for Twitter. We would have preferred it be East African though.

“As a champion for democracy, Ghana is a supporter of free speech, online freedom and the Open Internet, of which Twitter is also an advocate”

NSE Q1 2021 performance

Bonds traded more volume than equities for the first quarter of 2021 as investors looked to preserve their capital in a tough economic environment occasioned by the pandemic. These are the highlights of trading activity at Kenya’s Nairobi Securities Exchange(NSE) for the first quarter of 2021:

Ksh 199.4billion worth of bonds traded [Q1 2020: Ksh 150.4billion]

Ksh 31.8billion worth of equities traded [Q1 2020: Ksh 43.6billion]

Ksh 59.4million worth of derivative contracts traded [Q4 2020: Ksh 10million]

The NSE 20 Index fell by 3.6% in March 2021 from February 2021

Market capitalization dropped by 4.1% from Ksh 2,541 billion in February to Ksh 2,437 billion in March 2021.

Danish firm plans Kenya listing

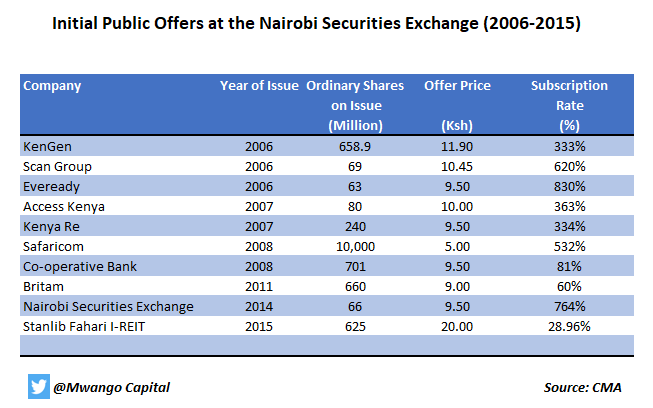

Danish hair products firm Africanhair PLC is planning to list on Kenya’s Nairobi Securities Exchange in a bid to raise capital for regional expansion. The firm’s shareholders have approved the planned listing and Kenyan Standard Investment Bank appointed the lead transaction adviser. This is a welcome move given that Kenya’s bourse has lacked listings over the years, with the last IPO listing happening in 2015

Launch of Absa Asset Management

Absa Bank Kenya has launched an asset management subsidiary that will offer investment management services to institutional, individual, and high net worth investors.

“Through Absa Asset Management Ltd, we will enable our customers to invest in key investment asset classes cutting across listed stocks, treasury and corporate bonds, private equity, property and offshore investments among others’’

- ABSA Kenya Chief Strategy Officer Moses Muthui

More 2020 results

Insurance companies Liberty Kenya Holdings & Jubilee Holdings are the latest listed insurers in Kenya to announce their FY 2020 results. Jubilee Holdings performed rather well in 2020.

Away from insurance, Flame Tree also released its 2020 results, I&M bank held its investor meeting and Kenya Airways and KPLC released their 2020 reports. Links to these reports can be found on our website (Here and Here).

Jubilee Holdings

Gross premiums up 1% to Ksh 29.9 billion

Total Income up 1% to Ksh 33.1 billion

Group profit up 2% to Ksh 4.08 billion

EPS up 2% to Ksh 50.06

Final dividend of Ksh 8.0 recommended

Liberty Holdings

Total income down 14% to Ksh 9.9 million

Total earnings down 2% to Ksh 675, 946

EPS of Ksh 1.23[2019: Ksh 1.21]

No dividend recommended

We also have a list of upcoming AGMs you should keep track of:

Other noteworthy items:

Kenyan telecoms have until March 2024 to ensure at least 30% local ownership of their firms as the Kenyan government seeks more local ownership of ICT firms. Kenyans own more than half of telco giant Safaricom while India’s Bharti Airtel fully owns Airtel Kenya. The Kenyan government owns 40% of Telkom Kenya.

Sameer Africa swung from a Ksh 1.1 billion loss in 2019 to post a Ksh 43.5 million profit for the year ended 31 December 2020. The firm is set to return to tyre business in a new growth strategy.

Kenya’s Central Bank has appointed Kenya Deposit Insurance Corporation(KDIC) as the liquidator of Chase Bank.

A survey done by Kenya’s Central Bank has revealed that a majority of CEOs believe that high costs of doing business and taxes pose bigger threats to their businesses over the next year.

Kenya’s Mansa X fund has posted an average net return of 4.19% in Q1 2021 growing its AUM to Ksh 4.3 billion as at 31 March 2021. The fund is operated by Standard Investment Bank, licensed as an Online Forex Money Manager.

The Kenya shilling strengthened against the dollar during the week hitting highs of 107.

Across the borders, shares of the Nigerian Exchange Group(NGX) have been admitted for trading on Nigeria’s OTC Exchange(NASD). This comes after the Nigerian Stock Exchange completed a demutualization process and a new operating company, NGX, was created.