Vodacom [+ Safaricom] vs MTN in Ethiopia

The two are set to square off in Ethiopia for market share should they get the two licenses they bid for

Welcome to the Baobab Weekly where we bring you a succinct summary of key business news from East Africa. This week, we cover Vodacom consortium and MTN’s bids for Ethiopian licenses, more financial year 2020 results, and tKenya’s budget estimates & finance bill 2021.

It’s Vodacom [+ Safaricom] vs MTN in Ethiopia

The Ethiopian Communications Authority has announced that only two bidders qualified for the award of two full-service telecommunications licenses. Qualified bidders were Global Partnership for Ethiopia [Vodafone, Vodacom, Safaricom, Sumitomo & CDC Group] and MTN International (Mauritius) Ltd. Here’s how the two multinationals compare:

Source: The East African

Ethiopia has pledged to allow prospective owners of the new telecom licenses to offer mobile banking services at some point after entering the market.

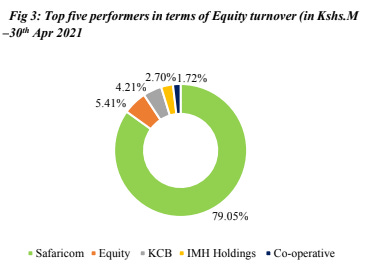

Meanwhile, Safaricom’s share price rallied to a historic Ksh 40 during the week following news on the telco’s possible entry into the Ethiopian market. The counter also accounted for 79.05% turnover at Kenya’s Nairobi Securities Exchange during the week.

Source: NSE

More FY 2020 results

FY 2020 results continued to stream in during the week as listed media companies Nation Media Group & Standard Group, insurer Britam Holdings and entertainment company Homeboyz released their FY 2020 results.

Britam Holdings reported a Ksh 9.1 billion loss occasioned by fair value losses, property impairments, and a Ksh 5.2 billion provision to support its Wealth Management business, as disclosed in an investor call during the week. Nation Media Group’s performance in 2020 was greatly impacted by the pandemic as advertising revenue drastically declined with the revenue numbers going back to the 2006/2007 levels. Standard Group reported a loss before tax of Ksh 434 million, a 36% decline from Ksh 684 million loss before tax in 2019. Homeboyz, which listed in December 2020 via introduction, reported a loss before tax of Ksh 22.5 million.

Nation Media Group:

Revenue down 25% to Ksh 6.8 billion

Profit after tax down 94% to Ksh 47.9 million

Earnings Per Share Ksh 0.2 [2019: Ksh 4.5]

No dividend recommended [2019: 1.5 (Interim)]

Britam Holdings:

Gross Premiums up 4.06% to Ksh 28.2 billion

Loss of Ksh 9.1 billion [2019: Profit of Ksh 3.5 billion]

EPS Ksh -3.62 [2019: Ksh 1.41]

Operating & other expenses up a whopping 53%

No Dividend recommended [2019: Ksh 0.25]

Standard Group:

Revenues down 29% to Ksh 2.9 billion

Operating costs down 31%

Loss before tax down 36% to Ksh 434 million

Cash from operations down 68% to kshs 162.6 million

Negative working capital of 1.3 billion

No dividend

Homeboyz Entertainment:

Revenue down 66% to 106 million

Gross profit down 76.7% to Ksh 44 million

Loss before tax Ksh 22.5 million [2019: KES 36.6 million profit]

Cash flow from operating activities down 146%

EPS Ksh -0.51 [2019: Ksh 0.91]

Elsewhere, listed firms Crown Paints, East African Cables & Home Afrika have announced delays in publication of results for the year ended 31 December 2020.

Kenya’s Budget Estimates & Finance Bill 2021

Kenya’s Treasury Cabinet Secretary has tabled to Parliament Ksh 3.63 trillion budget estimates for FY 2021/2022 alongside the Finance Bill 2021. The 3.63 trillion budget is set to focus on the COVID-19 recovery and the President’s Big Four Agenda. With decreased tax revenue occasioned by the pandemic, it remains to be seen how Kenya’s Treasury will finance this budget.

The Finance Bill 2021 is seeking to amend the Income Tax Act, VAT Act, Excise Duty Act, Tax Procedures Act, Miscellaneous Fees & Levies Act, Capital Markets Act, Central Depositories Act, Kenya Revenue Authority Act, Insurance Act & Retirement Benefits Act in a bid to meet the budget proposals. With these amendments, Kenyans are most likely to pay more taxes in July.

“In preparing the estimates we have been very alive to the current challenges of the ongoing pandemic, while ensuring that we continue on a steady path of economic recovery by investing Ksh 26.6 billion on the post COVID-19 Economic Stimulus Programme and Ksh 135.3 billion on the President’s Big Four Agenda covering universal healthcare, food and nutrition, manufacturing and affordable housing”

Treasury Cabinet Secretary, Ukur Yatani

Liaison Group to List in Kenya

Liaison Group is planning to list on Kenya’s Nairobi Securities Exchange to raise funds for expansion in Africa. The company operates in five countries (including Uganda, Tanzania, Rwanda & South Sudan). If listed, it would be the first risk advisory company at the Nairobi Securities Exchange.

This is a welcome for the Kenya bourse as it has lacked IPO listings over the years:

Uganda’s Worrying Public Debt

Uganda says it is contemplating approaching its major creditors [including China and World Bank] over a possible suspension of loan repayments. The country’s public debt has surged 35% to $18 billion as of December 2020. The East African country is also currently negotiating with China for a $2.2 billion loan to finance a Standard Gauge Railway.

Other noteworthy items:

Central Bank of Kenya & E4Impact Foundation have entered into a Memorandum of Understanding to support Kenyan fintech companies through access to customized capacity building, linkages to investors, markets & ecosystem partners.

The value of avocado exports was up 93% to Ksh 4.26 billion in Q1 2021. Listed agricultural firm Kakuzi PLC exports avocados.

Kenya is set to manufacture semiconductors after launching a semiconductors technology plant in Nyeri. The plant is a Public Private Partnership (PPP) between Dedan Kimathi University of Technology and American nanotechnology firm 4Wave Inc.

Digital mobile lenders in Kenya will have six months to be licensed by Kenya’s Central Bank should Parliament adopt the Central Bank (Amendment) Bill 2020. Currently, there is no state regulation for lenders, and the proposed law if passed will bring digital and mobile lenders under the watchful eye of the Central Bank of Kenya.

Kenya’s inflation rate in April 2021 was 5.8% [March: 5.90%; February: 5.78%]

Source: Central Bank of Kenya