👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover the devaluation of Ethiopia's birr, Kenya’s downgrade by Fitch Ratings, and financial results from EABL, Centum, and Nation Media Group.Ethiopia’s Week to Remember

Birr on the Move: On July 28th, the Ethiopian Prime Minister announced a comprehensive macroeconomic reform initiative, marking a significant shift in the country's economic strategy. The reforms include moving to a market-based foreign exchange rate regime and an interest rate-based monetary policy to curb inflation and improve banking efficiency. The Ethiopian birr depreciated sharply, with the Commercial Bank of Ethiopia quoting it at 57.49/58.64 the previous Friday and dropping to 83.94/85.62 by last Friday. Awash Bank quoted it at 90.00/94.50.

Bloomberg reported the Prime Minister urging banks to align the official exchange rate with the parallel market rate, which stands at 118 birr per US dollar, stressing, "We told you to unify the official rate with the parallel market rate, but you are crawling." These reforms could significantly reshape Ethiopia's economic landscape, affecting foreign investment and trade dynamics if fully implemented.

“The Ethiopian government has made the painful but necessary step to liberalize its exchange rate. It removes a patronage-based exchange system that has festered for quite some time and replaces it with significant reforms to encourage exports and formal remittances. These moves will give investors greater confidence in Ethiopia’s medium and long-term outlook.”

African Bamboo Chief Investment Officer, Sam Rosmarin

Financing Unlocked: Following the announcement of the reforms, Ethiopia secured a four-year USD 3.4B loan from the IMF under the Extended Credit Facility (ECF), equivalent to 850% of its quota. The deal includes an immediate USD 1B disbursement to address the balance of payments and budget needs. This loan is part of a larger USD 10.7B package that combines loans, grants, and debt re-profiling efforts. According to Ethiopia’s State Minister of Finance Eyob Tekalign, the IMF agreement sets the stage for Ethiopia to complete its long-delayed debt restructuring within 3-6 months.

A day after securing the IMF loan, Ethiopia signed a USD 1.5B financial package with the World Bank through the First Sustainable and Inclusive Growth Development Policy Operation. The package includes a USD 1B grant and USD 500M in concessional credit from the International Development Association, further bolstering the country's reform agenda. In sum, the financing received in the last week from the IMF and the World Bank was USD 5B.

“Supportive macroeconomic policies, including the elimination of monetary financing of government deficits, monetary policy tightening, and prudent fiscal management, will need to be sustained to keep inflation in check, ensure a successful implementation of the market-determined exchange rate, and durably address exchange rate shortages.”

IMF Deputy Managing Director and Acting Chair, Ms Antoinette Sayeh

"Successful implementation of these reforms can help the country reach its full potential so more Ethiopians can thrive. Importantly, there is a strong emphasis on protecting poor and vulnerable people from the costs of economic adjustment and expanding opportunities for them to participate in the economy."

World Bank Country Director for Ethiopia, South Sudan and Sudan, Maryam Salim

Impact on Safaricom Ethiopia: We asked Davis Githinji, an analyst at Sterling Capital, to articulate what this all means for Safaricom Ethiopia and this is what he had to say:

“Ethiopia’s shift from a fixed to a market-based exchange rate system is likely to have far-reaching effects on the nation. The devaluation may have varying outcomes. Similar to devaluations done by Nigeria and Argentina, costs may surge dramatically across the board as the official rate converges to the parallel market rate. Alternatively, a situation similar to that which occurred in Egypt may transpire. Egypt’s importers largely conducted business at the parallel market rate and passed the inflated cost of doing so to consumers which led to higher inflation. When the devaluation occurred, dollar accessibility improved and consumer demand declined – trends that forced importers to reduce their prices to sell goods and reduce inventory carry costs. Ethiopia may find itself in a similar situation given that most imports were already occurring at the black-market rate. This doesn’t mean that there won’t be an uptick in inflation, merely that it may not be for a prolonged period or across all items.”

“Regardless, the devaluation will materially impact companies such as Safaricom which conduct business at the official market rate. Safaricom Ethiopia’s functional currency is Ethiopian Birr which is different from the parent’s presentation currency which is the Kenyan Shilling. Because of the devaluation, Safaricom will have to translate revenues, assets, liabilities, net income, and shareholder’s equity at a lower rate, effectively leading to significant FX losses at the parent level. Safaricom will have to increase prices to cope with the hyperinflationary environment – a reality that will likely dampen demand for its products as consumers prioritize basic goods. This will likely result in the telecom pushing its breakeven period forward from 2026. Also, funding costs are likely to increase dramatically as the National Bank of Ethiopia raises benchmark rates to battle inflation – a trend that will further reduce the telecom’s bottom-line profits. The saddest part of all, however, will be the impact of all this on the Ethiopian people. In the long run, all this should be positive in that it will unlock funding for the nation and avail more dollars into the system but in the short run, the pain will be deep and widespread.”

As a side note, when Nigeria devalued the Naira in 2023 as part of the country’s efforts to converge the official rate and the black market rate, foreign companies operating in the market recorded significant FX losses as a result. The Central Bank of Nigeria implemented the measures on 14th June 2023, plunging the Naira by more than 60% by the end of June 2023. The currency has plunged by more than 240% since then and is currently exchanging for 1,620 units to the US Dollar.

This week's newsletter is brought to you by The Kenya Mortgage Refinance Company.

First-time homebuyer? Confused about repayments? KMRC can help! Get the info you need to navigate homeownership finances with confidence. Learn more: KMRC website.

Kenya: Downgrades and Uncertainty

Another Rating Downgrade: Almost a month after Moody's downgraded Kenya to Caa1 from B3 (negative outlook), Fitch Ratings has now downgraded Kenya's Long-Term Foreign-Currency Issuer Default Rating to 'B-' from 'B', highlighting escalating risks to the country's fiscal health. The revision reflects concerns over Kenya's public finances, particularly following the government's reversal of key revenue measures in the Finance Bill, 2024 amid violent protests and growing political instability.

Rising domestic debt costs, combined with greater challenges in securing external financing due to increased borrowing costs and depleted foreign exchange reserves, further complicate the outlook. Despite these challenges, Fitch maintains a stable outlook, anticipating that strong support from official creditors will help Kenya navigate its immediate liquidity pressures. Fitch has become the second rating agency to downgrade Kenya, and the next ratings focus for Kenya is S&P Global, which is due on 23rd August.

“The downgrade reflects heightened risks to Kenya's public finances after the government backtracked on revenue measures in the Finance Bill 2024 in response to violent social protests, the increased risk to political stability, and rising domestic debt costs, even as the authorities embark on expenditure cuts. Fitch also sees a moderately greater risk to external financing, partly reflecting elevated external commercial borrowing costs in the context of foreign-exchange reserves that are below the 'B' median.”

Finance Act 2023 Turmoil: In a move that poses significant risks to the country's fiscal framework, Kenya's Court of Appeal last week invalidated the Finance Act 2023, citing insufficient public participation as a critical flaw. In response, the National Treasury's request for a stay of the ruling was denied by the Supreme Court, though the court has marked the case as urgent and will hear it during the August recess. The next procedural step is for the Treasury to serve the notice of motion by August 5th, after which respondents will have five days to submit their responses. This legal uncertainty could have substantial implications for Kenya’s revenue collection and economic stability. Given the vexing issue of public participation that cost the government many cases in court, the government is working on a bill to fix this issue.

"The National Treasury has not yet secured stay orders from the Supreme Court following the nullification of Finance Act 2023. This complicates the 2024/25 fiscus because what was an initial KES 346.7B funding gap (owing to the withdrawal of the Finance Bill, 2024) now widens even further by Kes 164.0B by Treasury's count. This means that cumulatively, we are staring at a KES 510.7B funding gap in 2024/25 & it's highly likely the spending plan for the current financial year will have to be subjected to further cuts post-Supplementary Budget I."

Business Redefined Host, Julians Amboko

Inflation and Month Ahead: Kenya's inflation rate edged closer to the Central Bank of Kenya's (CBK) lower inflation target, registering at 4.3% in July 2024, down from 4.6% in June. This decline comes ahead of the CBK's Monetary Policy Committee (MPC) meeting this week, where hopes are rising for an interest rate cut, though we anticipate another hold. Meanwhile, Kenya awaits the conclusion of the IMF's prolonged seventh review. In a significant development, the IMF Board of Governors has approved the creation of a 25th Chair on the Executive Board to enhance Sub-Saharan Africa's representation, effective November 1, 2024.

Earnings RoundUp

EABL Revenue Rises, Profits Fall: East African Breweries Limited (EABL) reported a 13.2% year-on-year increase in net revenue to KES 124.1B for the fiscal year ending June 30, 2024, driven primarily by price adjustments, as volumes grew only 1%. However, the company's financial performance was adversely affected by a significant rise in foreign exchange losses, up 84.3% to KES 3.9B, and net financing costs, which increased by 49% to KES 8.2B. These factors contributed to a decline in profit before tax by 10.4% to KES 16.8B and a net profit drop of 11.8% to KES 10.9B. Earnings per share decreased by 17.4% to KES 10.3. Despite these challenges, EABL declared a final dividend of KES 6, bringing the total dividend to KES 7, a 27.3% increase year-on-year, indicating strong shareholder returns amidst financial pressures.

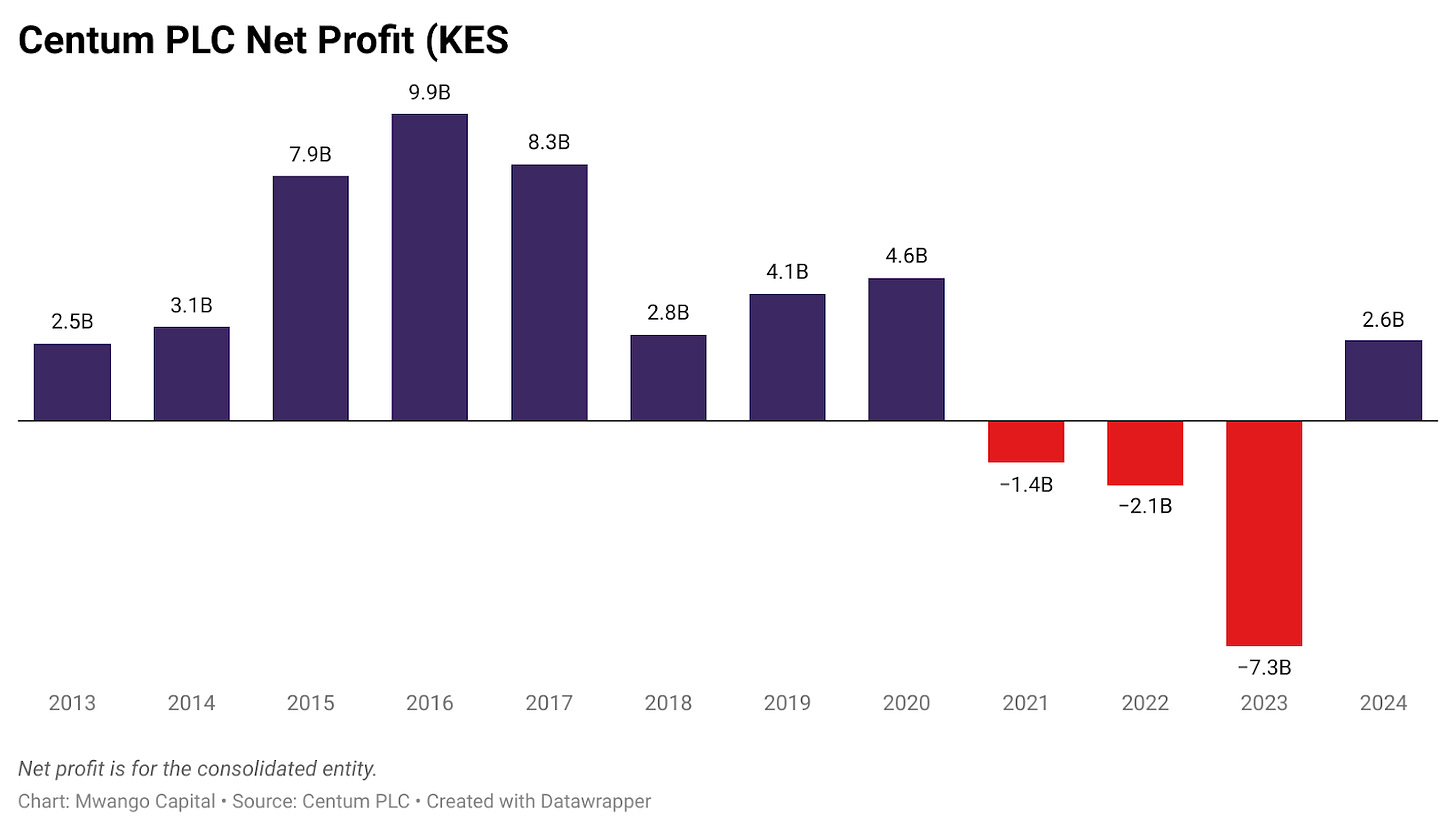

Centum Turns a Profit: Centum reported a net profit of KES 2.6B for the fiscal year ending March 31, 2024, a significant turnaround from the KES 7.3B loss in the previous fiscal year. This recovery was driven by a 157.6% increase in consolidated investment income to KES 607.4M, despite a 16.9% rise in operating expenses to KES 556.9M. At the company level, operating profit surged by 34% to KES 277.6M, with a net profit of KES 5.5B compared to a KES 4.9B loss in FY 2023. However, investment income fell by 46% to KES 1.15B. The company declared a reduced dividend of KES 0.32 per share, down from KES 0.60 last year, while executing a buyback of 9.7M shares, representing 24% of the traded volume.

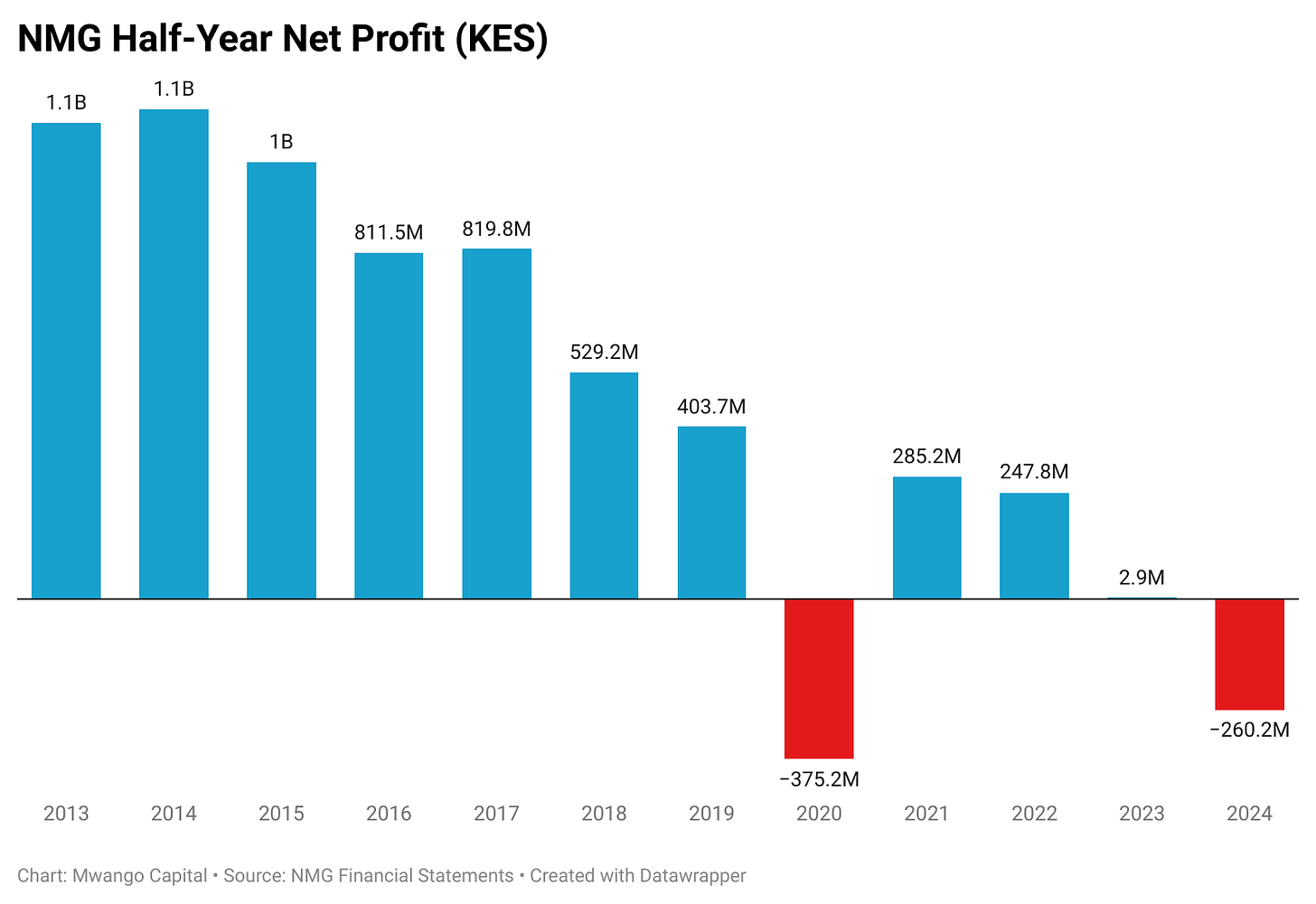

NMG Swings to Losses: For the half-year period ended 30th June 2024, Nation Media Group’s turnover declined by 10.0% year-on-year to reach KES 3.175B. Despite a 14.5% decline in the cost of sales to KES 737.2M, the gross profit edged lower by 3.2% to reach KES 2.4B, bringing the gross margin to 23.2% as compared to 24.4% in H1 2023. The firm recorded KES 345.8M in pre-tax losses as compared to KES 10.8M profit in H1 2023, and the pre-tax loss in the operating period included KES 119M expended on the Group’s staff restructuring program. The Board of Directors did not recommend the payment of an interim dividend for the operating period. Separately, the company’s second share repurchase scheme that started in July 2023 closed on 12th June, with the program realizing 100% of the maximum 19,029,516 (10% of its adjusted issue share capital) shares targeted for purchase. Meanwhile, its main competitor, Standard Group, has disclosed that it will be laying off close to 300 employees.

CRDB, NMB H2 24 Performances: For the half-year period ended 30th June 2023, CRDB Bank recorded TZS 15T in total assets, up 7.2% quarter-on-quarter. The loan book expanded by 7.1% to TZS 9.5T, and the deposit base stood at TZS 9.4T, up 5.9%. In the same operating period, NMB Bank’s asset base edged higher by 4.1% to TZS 13T, with the loan book and deposit base growing by 3.4% and 6% to TZS 8.1T and TZS 8.9T, respectively. In terms of earnings, CRDB’s net interest income and non-interest income grew by 34.7% and 23.6% year-on-year, to reach KES 530.6B and KES 256.5B, respectively. For NMB, these income lines grew by 13.6% and 28.7% to KES 513.8B and KES 280.5B, respectively. The banks recorded TZS 275B and TZS 450.7B in profit after tax, up 52.8% and 20.4% year-on-year, respectively.

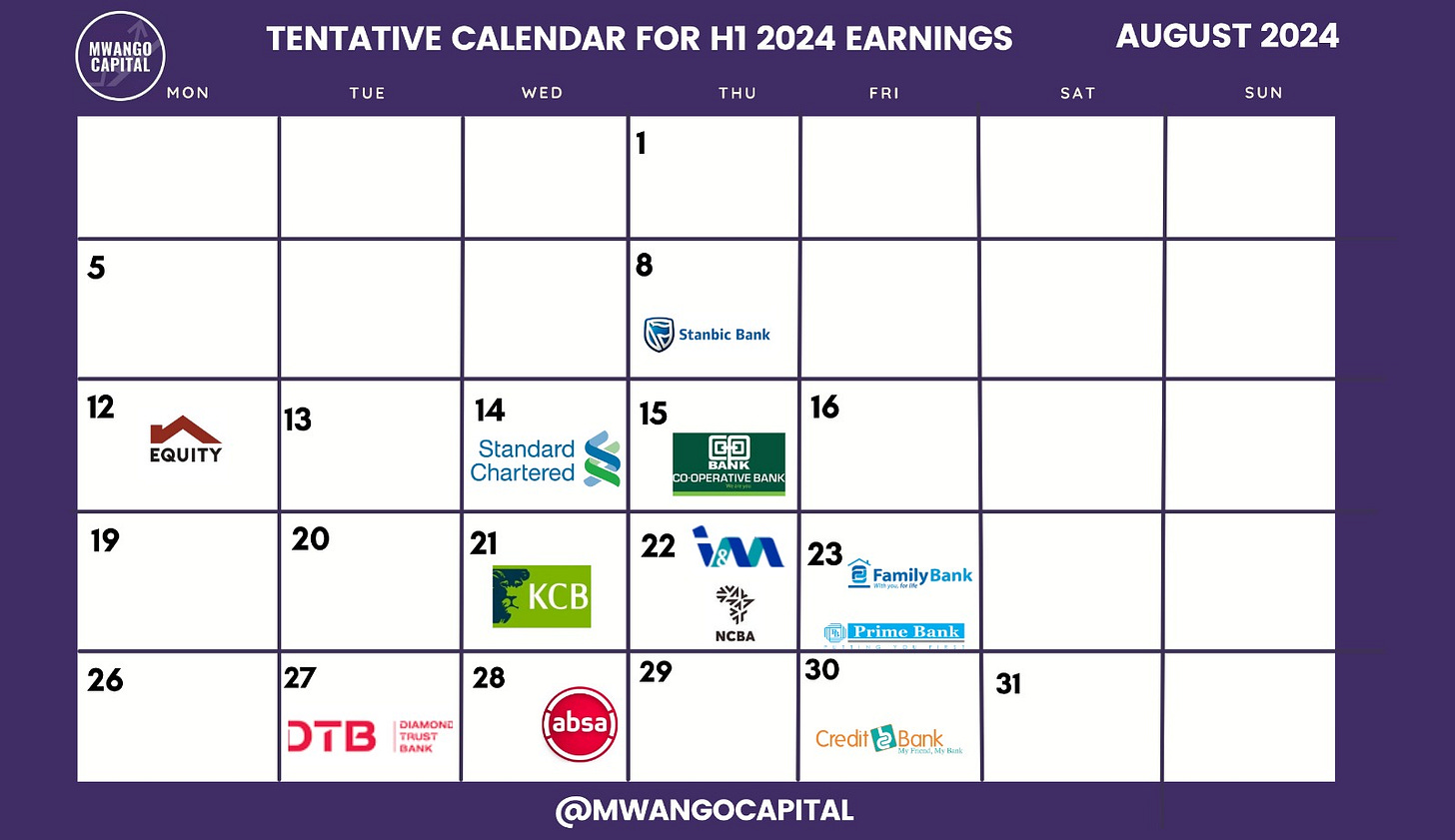

Earnings Month: Stanbic Holdings kicks off bank earnings season next Thursday when it reports its H1 24 results.

Find EABL’s results and analysis here, Centum’s here, NMG’s here, CRDB’s here, and NMB’s here.

Markets Wrap

NSE: In Week 31 of 2024, Sanlam led the market, rising 5.6% to KES 6.40, while Total Energies was the worst performer, dropping 13.9% to KES 17.40. All indices were red with the NSE 20, NSE 25, NSE 10, and NASI falling by 0.9%, 1.0%, 1.0%, and 0.9% to close at 1,659.0, 2,770.1, 1,077.2, and 103.3 points, respectively. Equity turnover dropped by 23.8% to KES 1.2B, while bond turnover dropped to KES 21.92B from KES 28.3B the previous week.

July 2024 Performance: Bamburi Cement was the top-performing stock, surging by 48.33% to KES 62.00 followed by E.A. Portland Cement and Longhorn Publishers at 47.49% and 19.14% to KES 7.36 and KES 2.49, respectively. The worst-performing stock was Flame Tree Group Holdings, which shed 20.31% of its value to KES 1.02, followed by Total Energies Marketing Kenya and TPS Eastern Africa which lost 19.53% and 16.07% to KES 17.30 and KES 11.75, respectively.

Year-to-Date: Bamburi Cement was the top performer, edging higher by 72.94% to KES 62.00, followed by Liberty Kenya and Kenya Re at 47.43% and 40.43% to KES 5.44 and KES 1.32, respectively. Trans-Century was the worst performer, after falling by 30.77% to KES 0.36, followed by TPS Eastern Africa and Car & General at 28.57% and 22.00% to KES 11.75 and KES 19.50, respectively.

Treasury Bills and Bonds: The weighted average interest rate of accepted bids for the 91-day, 182-day, and 364-day were 15.98%, 16.85%, and 16.92% respectively. The total amount on offer was KES 24B with the CBK accepting KES 22.9B of the KES 31.65B bids received, to bring the aggregate performance rate to 131.86%. The 91-day and 364-day instruments recorded 645.26% and 16.88% performance rates, respectively.

Eurobonds: In the week, yields rose week-on-week across the 5 outstanding papers with KENINT 2028 rising the most, up 41.90 bps to 10.788%, followed by KENINT 2034 at 33.70 bps to 10.862%. KENINT 2027 recorded the least week-on-week growth at 18.10 bps to 9.210%, and the average week-on-week change stood at 30.75 bps.

Market Gleanings

💼| Kenya’s Treasury CS Nominee’s Plans | Kenya’s Treasury Cabinet Secretary nominee John Mbadi was before the vetting committee in Parliament last week and highlighted various approaches to managing public finances including not raising taxes. He, however, did not mention any planned expenditure cuts.

Here are some more high-level takeaways:

Emphasized the need for a stronger, more well-funded KRA to enhance tax administration efforts. He suggested a potential revamp of the iTax system and no new tax increases are expected.

Indicated that some favorable provisions from the previously rejected Finance Bill 2024 will be reintroduced in Parliament.

Plans to focus on raising funds through Public-Private Partnerships (PPPs) and tapping into climate change financing as alternative revenue sources.

Stressed the importance of better communication from the Treasury to rebuild public trust and convey government financial strategies.

Said that current domestic interest rates, which can be as high as 16%, are unsustainable and expressed the need for discussions with banks to address this issue.

On debt management, he aims to reduce commercial debt to 5% of the external debt portfolio, with a target of 75% in multilateral debt and 20% in bilateral debt. As of June 2023, the external debt portfolio stood at ~24% commercial debt, ~50% multilateral debt, and ~24% bilateral debt

Proposed reforms to ensure that pending bills are prioritized and paid in a first-in, first-out manner, and suggested criminalizing the failure to pay pending bills to enforce accountability.

Highlighted the complexity of current tax laws as a barrier to compliance and suggested simplifying the tax code to make it easier for taxpayers to understand and meet their obligations.

💰| KRA’s Amnesty Program | The Kenya Revenue Authority (KRA) collected KES 43.9B from its tax amnesty programme, which ended on June 30, 2024, involving 1,064,667 taxpayers. The programme, introduced by the Finance Act 2023, allowed taxpayers to apply for amnesty on penalties and interest on tax debts for periods up to December 31, 2022. Between September 2023 and June 30, 2024, KRA waived penalties and interest amounting to KES 507.7B, benefitting 3,115,393 taxpayers. The highest collection was recorded in June 2024 with KES 15.1B.

📄| Linzi Sukuk Listing | The Nairobi Securities Exchange (NSE) officially launched Kenya’s first Shariah-compliant bond, the Linzi Sukuk, on the NSE’s Unquoted Securities Platform (USP) on July 31, 2024. The security was initially floated in 2023 raising KES 3B and is set to finance the development of 3,069 affordable housing units with a maturity period of 15 years and an internal rate of 11.13%..

⚡| JICA Extends Grant to Kenya Power | Kenya Power’s Last Mile Project (LMCP) has received a KES 1.85B grant from the Japan International Cooperation Agency (JICA), which will facilitate the connection of 9,121 households in Nakuru, Kilifi, Kwale and Nyandarua counties under Phase V of the project. The initiative aims to provide universal electricity access in Kenya, with the targeted households expected to be connected by January 2025. The project has so far connected 746,867 households for KES 51.1B (0.3% of GDP).

🤝🏽| Mergers, Deals, and Acquisitions |

Indirect Control of Base Titanium: The Competition Authority of Kenya (CAK) has unconditionally approved the proposed indirect control of Base Titanium limited by EFR Australia PTY limited. The transaction involves acquiring 100% of Base Resources Limited’s shares in exchange for shares in Energy Fuels Inc. aimed at diversifying EFR PTY’s mining business.

Kim-Fay East Africa Secures Funding: I&M Burbridge Capital Limited has advised Kim-Fay East Africa Limited on securing debt financing from Norfund and I&M Bank for the construction of a new recycled paper manufacturing facility in Tatu City, Ruiru. The facility is expected to be operational by 2025. Kim-Fay is a manufacturer and distributor of hygiene, tissue, and home care products in East Africa.

Centum Doubles Stake in Akiira: Centum Investment Company has acquired a 37.5% stake from the UK renewable energy fund DI Frontier Market & Carbon Fund in Akiira Geothermal Limited, doubling its stake to 75%. This move aims to enhance value creation in Kenya's green energy sector and maximize opportunities in the geothermal industry. Centum had initially invested KES 1.97B in Akiira Power in 2016 for a 37.5% stake.

Great Recap and Nice Summary