👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.This week, we cover we cover Kenya’s debut sukuk bond and Ruto’s push for debt relief.This week's newsletter is brought to you by:

Co-operative Bank of Kenya, the Gold Winner in the "SME Financier of the Year Africa" category!

Kenya’s Debut Sukuk Bond Gets Greenlight

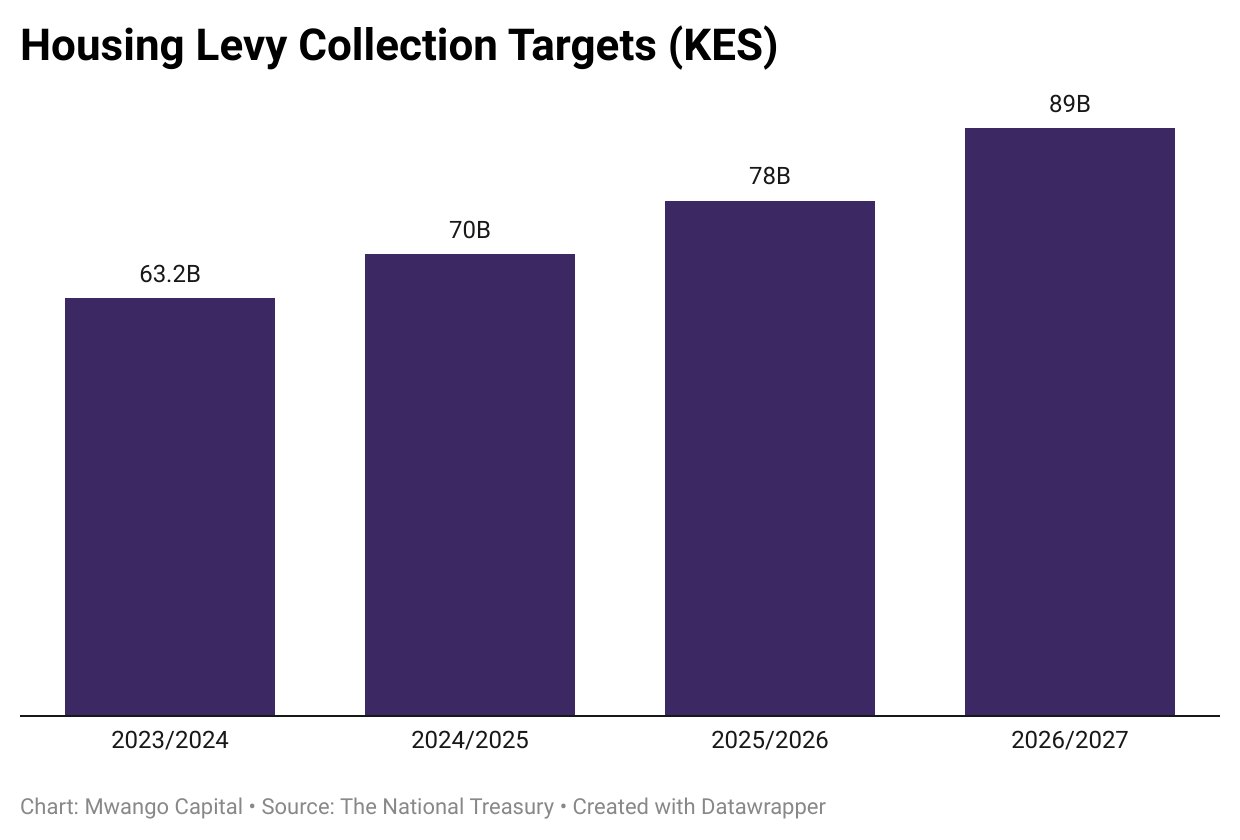

Housing Initiative: In the week, the Capital Markets Authority (CMA) approved Kenya’s maiden Sukuk bond floated by Linzi Finco Trust. The bond, dubbed “Linzi Sukuk”, is seeking KES 3B from the capital markets and has an 11.13% internal rate of return. The funds will be directed towards the development of 3,069 institutional housing units.

“Unfortunately what the government can do through this tenant purchase program is only maybe 50,000 or so. So there's still a gap of almost 200,000 homes that need to be built. And we at the Capital Markets Authority have been trying to find solutions to this issue. And I think this is the beginning of what the solution the market can provide in terms of Sukuk.”

CMA Chairman, Ugas Mohamed

The Mwango Explainer: Sukuk bonds are Shariah-compliant financial instruments that represent ownership of underlying assets. While conventional instruments have interest payments/coupons, holders of Sukuk bonds instead receive cash flows in the form of profit sharing with income derived from the underlying assets based on contractual agreements.

Market Development: The issuance of the debut Sukuk bond sets a precedent in Kenya’s capital markets which could open up opportunities for more issuances by other players. Whether Linzi Sukuk will be listed on the Nairobi Securities Exchange (NSE) is yet to be determined.

Across the Region: In 2021, Imaan Finance Limited issued Tanzania’s maiden Sukuk bond worth TZS 2B with a greenshoe option of TZS 2.72B. The bond was oversubscribed by 36% and the issuer activated the greenshoe option, thus accepting all received bids worth TZS 2.71B. The latest issuance this year was one by Egypt in February 2023 at an 11% yield with $1.5B on offer.

Ruto’s Debt Relief Push

Longer Grace Period: Kenya’s President William Ruto continued his call for debt relief for low-income countries. At the United Nations General Assembly in New York, President Ruto proposed an extension of the tenor of sovereign debt and increased concessional loans to the tune of USD 500B by international financial institutions. Here are also President William Ruto’s remarks regarding debt distress at the Bill and Melinda Gates Foundation Goalkeepers 2023 Forum.

“The global community must therefore develop a debt restructuring initiative that does not wait for nations to plunge over the cliff. The new sovereign debt architecture should extend the tenor of sovereign debt and provide a 10-year grace period.”

“The second financing intervention relates to concessional financing. It is time to support international financial institutions to provide more concessional loans to the tune of $500B and to provide increased liquidity support through Special Drawing Rights (SDRs) with a minimum target of $650B.

President of Kenya, William Samoei Ruto

Credit Rating Agencies: While at the United Nations General Assembly, President William Ruto also took on credit rating agencies, proposing an overhaul of their methodologies. Credit rating agencies have been on the spot recently after Moody’s termed Kenya’s buyback option of its upcoming USD 2B Eurobond as default. Here are President Ruto’s pronouncements regarding credit rating agencies at the Global Africa Business Initiative.

“The entire system of risk assessment and the opaque methodologies employed by credit rating agencies and risk analysis need to be overhauled at the minimum. We must all recall the miscalculation of subprime mortgage risks by these agencies 2 decades ago which precipitated a financial crisis whose effects reverberate to date. And ask the following question: on what basis should we believe that their methodologies are better at assessing risk in faraway frontier markets like ours that are far much more complicated to measure objectively than in assessing the value of financial assets in the markets where they actually operate?

President of Kenya, William Samoei Ruto

Yields Rise: Following President William Ruto's comments regarding debt relief for low-income countries, yields on Kenya’s KENINT 2024, closed the week at a 4-month high of 18.382%, up 503.5 basis points (bps) week-on-week.

Markets Wrap

NSE: In Week 38 of 2023, Boc Kenya was the top-performing stock, up 13.3% to KES 85.0. Longhorn was the worst-performing stock, down 21.2% to KES 2.01. The NSE 20 index fell by 0.8% to 1,519.3 points, the NSE 25 fell by 1.5% to 2505.7 points, and the NASI index fell by 2.2% to 96.8 points. Equity turnover went up 17.7% to KES 1.3B while bond turnover went down 3.5% to KES 14.2B.

Treasury Bills: The weighted average interest rate of accepted bids for the 91-day, 182-day, and 364-day were 14.7866%, 14.9399%, and 15.2214% respectively. The total amount on offer was KES 24B with the CBK accepting KES 18.79B of the KES 20.18B bids received, to bring the aggregate performance rate to 84.07%. The 91-day and 364-day instruments recorded 401.67% and 25.27% performance rates, respectively.

Treasury Bonds: The reopened 2-year FXD1/2023/02 and the 10-year FXD1/2016/10 recorded performance rates of 51.47% and 45.70% respectively attracting bids worth KES 18B and KES 15.9B respectively, against a cumulative KES 35B sought. The CBK accepted KES 15B and KES 6.16B respectively and the market-weighted average rates were 17.6% and 18.5%, respectively. In aggregate, the performance rate was 97.17%, with KES 21.6B of KES 34B accepted.

Eurobonds: In the week, yields rose across the 6 outstanding papers on a week-on-week basis.

KENINT 2024 rose the most, up by 503.5 basis points to 18.382%, while KENINT 2048 rose the least, appreciating by 91.1 bps to 12.299%. The average week-on-week change stood at 192.35 bps.

KENINT 2024 rose the most on a year-to-date (YTD) basis, appreciating by 577.9 bps while KENINT 2048 rose the least at 147.5 bps.

Prices were down on a week-on-week and YTD basis. Week-on-week, KENINT 2048 recorded the most losses at 7.3% to 68.848, while KENINT 2024 recorded the lowest price depreciation at 3.3% to 92.281. YTD, KENINT 2034 fell the most at 13.7%, while KENINT 2024’s price has depreciated the least at 0.2%. The average price change week-on-week and YTD was -8.0% and -6.0%, respectively.

Market Gleanings

🛢️ | Kenya Extends G2G deal | Kenya has extended its fuel supply deal with 3 state-owned Gulf firms, namely Saudi Aramco, Emirates National Oil Co., and Abu Dhabi National Oil Co., for another year until the end of December 2024. The deal allows Kenya to purchase petroleum products on credit and defer payments for 6 months. The deal’s extension will shield Kenya from paying both spot prices for fuel and accumulated amounts due under the existing agreement in January 2024. Kenya also renegotiated an agreement to pay lower freight and premiums for the cargo starting this month. The first payment under the deal is due on 25th September 2023 amounting to USD 82M with payments of USD 405M due by the end of October. The deal is expected to ease pressure on Kenya’s foreign exchange reserves.

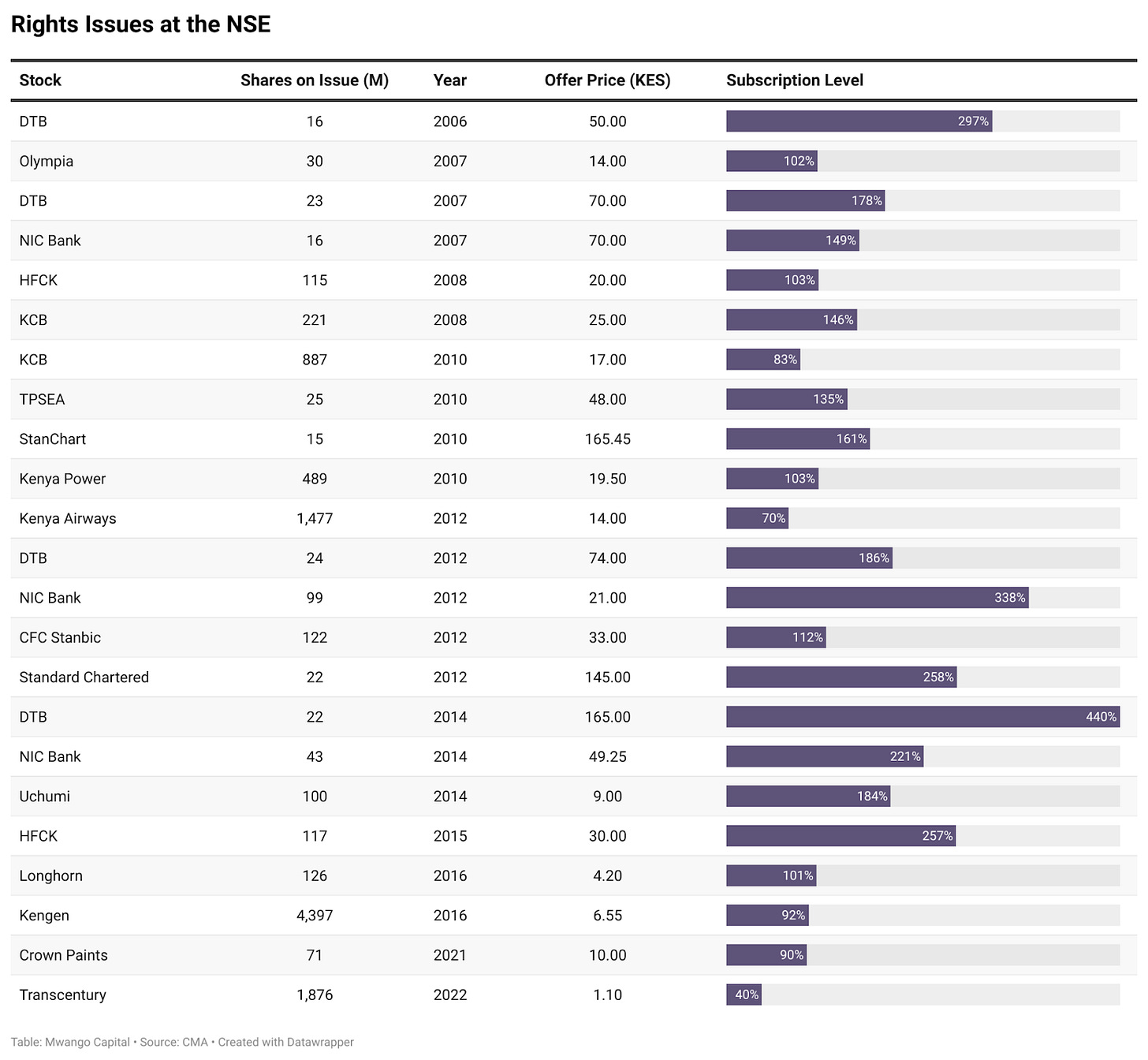

🏦 | Family Bank to Raise Capital | Family Bank will hold an Extraordinary General Meeting (EGM) of shareholders on Wednesday 18th October 2023. The purpose of the meeting will be to consider and if thought fit, to pass resolutions to increase the share capital of the company by KES 800M from KES 1.5B to KES 2.3B. The directors will also be seeking approval to offer and allot up to 800M shares at KES 1 each to shareholders on a pro-rata basis.

🧾 | Sale of Javahouse | Actis, a British private equity firm, is selling Java House, a casual dining business in East Africa. It has hired Flamingo Capital partners to help gauge interest from potential buyers. Java House operates in 14 cities across Kenya, Uganda and Rwanda. Actis is pivoting towards sustainable infrastructure and power assets. The sale of Java House is in the early stages and there’s no certainty that a transaction will materialize.

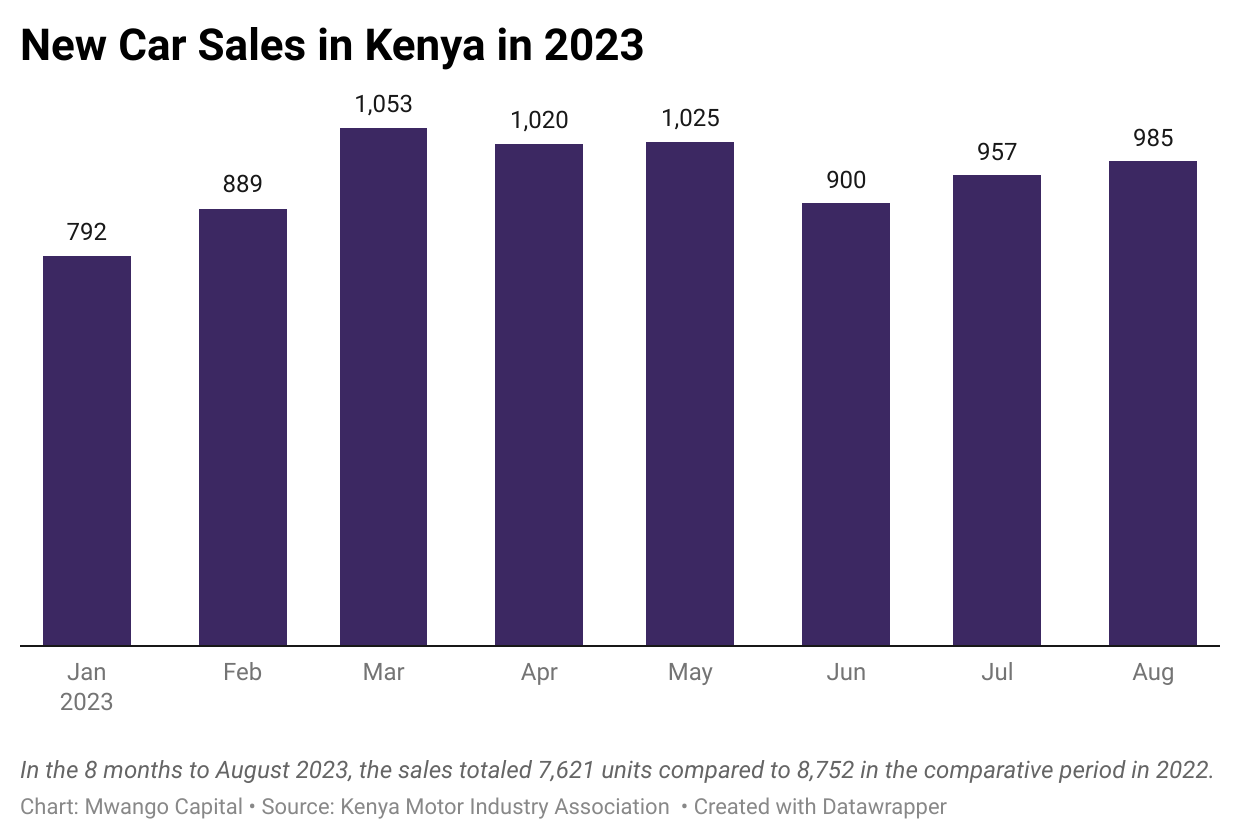

🚗 | New Car sales in August | According to data by the Kenya Motor Industry Association, car sales rose by 2.9% month-on-month to 985 units in August 2023. In the first eight months of 2023, new car sales totalled 7,621 units, down 12.9% compared to the same period in 2022.

⏱️ | KRA Reminder | The Kenya Revenue Authority (KRA) is reminding all non-resident providers and suppliers of digital services of their VAT and Digital Service Tax (DST) obligations under the VAT Act, 2013 and the Income Tax Act, respectively. Non-resident providers and suppliers of digital services who have not yet complied are expected to do so within 30 days from 22 Sep 2023 by registering through iTax.

🤝 | Equity-Mastercard Agreement | Equity Bank and Mastercard have signed a Customer Business Agreement to offer customers a broad range of benefits from Mastercard payment solutions including cross-border remittance, e-commerce payments, QR and Tap on phone solutions. The partnership will see Equity Bank offer modern payment capabilities across all of its subsidiaries. The two companies will also collaborate and co-create innovative payment solutions.

📱 | MPESA Transaction Limit Up | Safaricom has increased M-Pesa’s transaction limit to KES 250K per transaction. The move comes after the CBK approved the increase of the daily limit on MPESA transactions to KES 500K per day on 14 Aug 2023. The new transaction limit will also see a new transaction band of KES 151K to KES 250K with the current maximum transaction fees applying for the new band.

🧾 | Aspira-Hotpoint Collaboration | Aspira, a financial solutions provider, and Hotpoint have partnered to offer a 24-month Buy Now, Pay Later (BNPL) plan for home appliances and electronics in Kenya. The new plan aims to make high-end products more accessible to Kenyans and allows consumers to spread the cost of their purchases over a more extended period, aligning with the lifespan of many durable appliances.

🤝 | Watu Credit-Arc Ride Partnership | Watu Credit, an asset financing company, and ARC Ride, a Battery-as-a-Service provider have partnered to manufacture 1,000 electric vehicles (EV) and establish over 300 battery swap stations in Nairobi by the end of 2024. Customers can replace their batteries in under a minute for as low as KES 350 per day, for unlimited swaps.

👨💼 | Appointments |

Last week, Eveready PLC announced the appointment of Ms. Winnie Chepkemoi as its Managing Director and Chief Executive Officer. Ms Winnie took over from Mr. Thomas Mongare who has been the Acting Managing Director since 10th Mar 2021.

The Standard Group announced the resignation of Juliana Rotich as an independent non-executive director of the company effective from 18 Sep 2023. She is the head of fintech solutions at M-Pesa. Following her resignation, she was appointed a member of the AI and Ethics board of the Bill & Melinda Gates Foundation.