👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover Kenya’s FY 2024/2025 budget, Kenya’s inflation in April 2024, and FY 2023 results from BOC Kenya, WPP ScanGroup, Homeboyz Entertainment, Car and General, Crown Paints, and Express Kenya..This week's newsletter is brought to you by:

Co-operative Bank of Kenya. Pay to any Paybill & Till with MCo-opCash and stand a chance to be among the 100 daily winners of Ksh 1,000.

FY 2024/2025 Budget Estimates

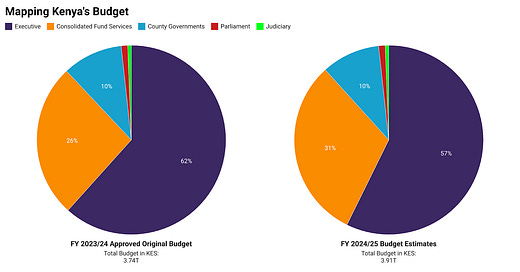

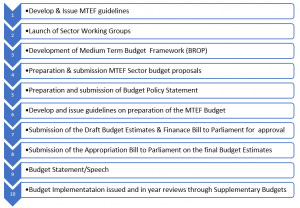

Budget Process: The preparation of the budget starts with the Budget Review & Outlook Paper (BROP) in September, followed by the draft Budget Policy Statement (BPS) in December, the final BPS in mid-February, the Finance Bill and Draft Budget Estimates in April, and culminates in the Budget Statement in June. During the week, the National Treasury released the Programme Based Budget for FY 2024/25 and the budget summary and supporting information which give insight into the FY 2024/25 budget.

3.9T Budget: The FY 2024/25 budget estimate is at KES 3.914T, representing a KES 273.3B cut from the KES 4.188T earlier outlined in the FY 2024/25 Budget Policy Statement. The executive is set to account for the largest share at KES 2.243T, followed by the Consolidated Fund Services (CFS) at KES 1.213T, counties at KES 391.1B, Parliament at KES 43.6B, and the Judiciary at KES 23.7B. The KES 273.3B reduction is distributed across the executive and the CFS at KES 245.6B and KES 27.7B, respectively.

Trimming Expenditure: The cuts in the Executive’s share of the budget have seen various sectors allocated lower funds as compared to FY 2023/24, including agriculture, roads and transport, healthcare, education, lands, petroleum, energy, and mining, as well as cooperatives and micro, small and medium enterprises (MSMEs). The ministry that recorded the largest budget cut was that of Petroleum, Energy and Mining at KES 28.91B with the state department of petroleum recording the single largest reduction at KES 25.79B. Voteheads that saw increases in their budgets include the Executive Office of the President, the National Police Service, the Teachers Service Commission (TSC), and sports, youth affairs, and immigration services departments.

Revenue: The National Treasury intends to mobilize its revenue collections from 14.0% of GDP in FY 2023/24 to 16.1% of GDP in FY 2024/25, and the government targets revenue collected as a percentage of GDP at 18% in FY 2024/25, 19% in FY 2025/26 and 20% in FY 2026/27.

Fiscal Deficit: For the 2024/25 financial year, the fiscal deficit as a percentage of GDP has been projected at 3.9%, for FY 2025/26 at 3.6%, and for FY 2026/27 at 3.6%. As of December 2023, the fiscal deficit target according to the Governor of the Central Bank of Kenya was 4.7% of GDP. The latest data vide the supplementary budget II FY 2023/24 projects the overall fiscal deficit including grants at 5.6% of GDP in FY 2023/24, which is 90 basis points (bps) above the target highlighted in December.

Find more analysis on the Programme Based Budget in this thread by Business Redefined Host, Julians Amboko.

Finance Bill 2024: The Bill that outlines revenue-raising measures for the 2024/2025 fiscal year was submitted by the National Treasury to Parliament by the deadline of 30th April but has not yet been tabled in Parliament nor published and released to the public. Last year, there were fiery discussions around the Finance Bill 2023.

Supplementary Budget II FY 2023/24: Last week, the National Treasury released the Supplementary Estimates No. II for the 2023/2024 financial year which highlighted the country’s fiscal performance through the end of March 2024, and the outlook to the end of the fiscal year in June. As at the end of March, total revenue was KES 1.86T, (11.5% of GDP), short of the target by KES 270.7B (1.7% of GDP).

Gross expenditure and net lending amounted to KES 2.395T (14.8% of GDP), which was below the target by KES 392.3B. The overall fiscal deficit including grants has been projected at 5.6% of GDP, with net domestic and net foreign financing projected at 2.5% and 3.1% of GDP, respectively.

Find the Supplementary Estimates No. II FY 2023/24 here, the Budget Summary and Supporting Information Document here, and the Programme Based Budget here.

April Inflation Edges Lower

5.0%: Kenya’s inflation in April 2024 was 5.0%, down 70 bps from 5.7% in March 2024 and 7.9% in April 2023. This is the first time inflation has hovered around the Central Bank of Kenya’s mid-point of its target range (5±2.5%) since February 2022 when it stood at 5.08%. Year-on-year, the overall Consumer Price Index (CPI) rose from 131.83 in April 2023 to 138.40 in April 2024. It however declined from the 138.66 recorded in March 2024.

Across Indices and Commodities: The transport index recorded the highest year-on-year change at 9.2%, followed by the alcoholic beverages, tobacco, and narcotics index at 8.3%, and the food and non-alcoholic beverages index at 5.6%. Month-on-month, however, these indices were down 0.3%, up 0.2% and down 0.1%, respectively. The insurance and financial services index recorded the lowest change relative to April 2023 at 0.9%, and month-on-month, it remained flat.

Across commodities, 1 kilogram of onion (leeks and bulbs) rose the most year-on-year, up 71.4%, followed by 1 kilogram of oranges at 17.9%, and 1 litre of paraffin at 16.6%. Month-on-month, these commodities were up 5.8%, 4.0%, and down 9.7%, respectively.

Impact of CBK Rate Hikes: In 2023, the Central Bank of Kenya hiked the Central Bank Rate (CBR) by a total of 375 bps to cool inflation and counter the depreciation of the Kenya Shilling against the US Dollar. The 200 bps rate hike in December 2023 was the most aggressive in the year, which the Monetary Policy Committee pointed out was also targeted towards curbing the depreciation of the shilling which had contributed 3.0% to the 6.8% inflation print in November 2023. In December 2023, inflation was down to 6.6%, rose to 6.9% in January 2024, and has since been downward to 5.0% in April 2024.

“The downward inflation trend thus far in 2024, is mainly on the back of lower food and fuel inflation. Last year's harvest has ensured a good grain supply and the appreciation of the shilling against the dollar has played a big role in the reduction of both fuel and electricity prices. I see the MPC maintaining the benchmark rate at 13%, as the effects of the previous rate hikes transmit into the economy and as the country strives to remain competitive with regards to investment inflows.”

Standard Investment Bank Senior Associate, Research, Stellar Swakei

Find the entire press release here.

FY 2023 Results Wrap

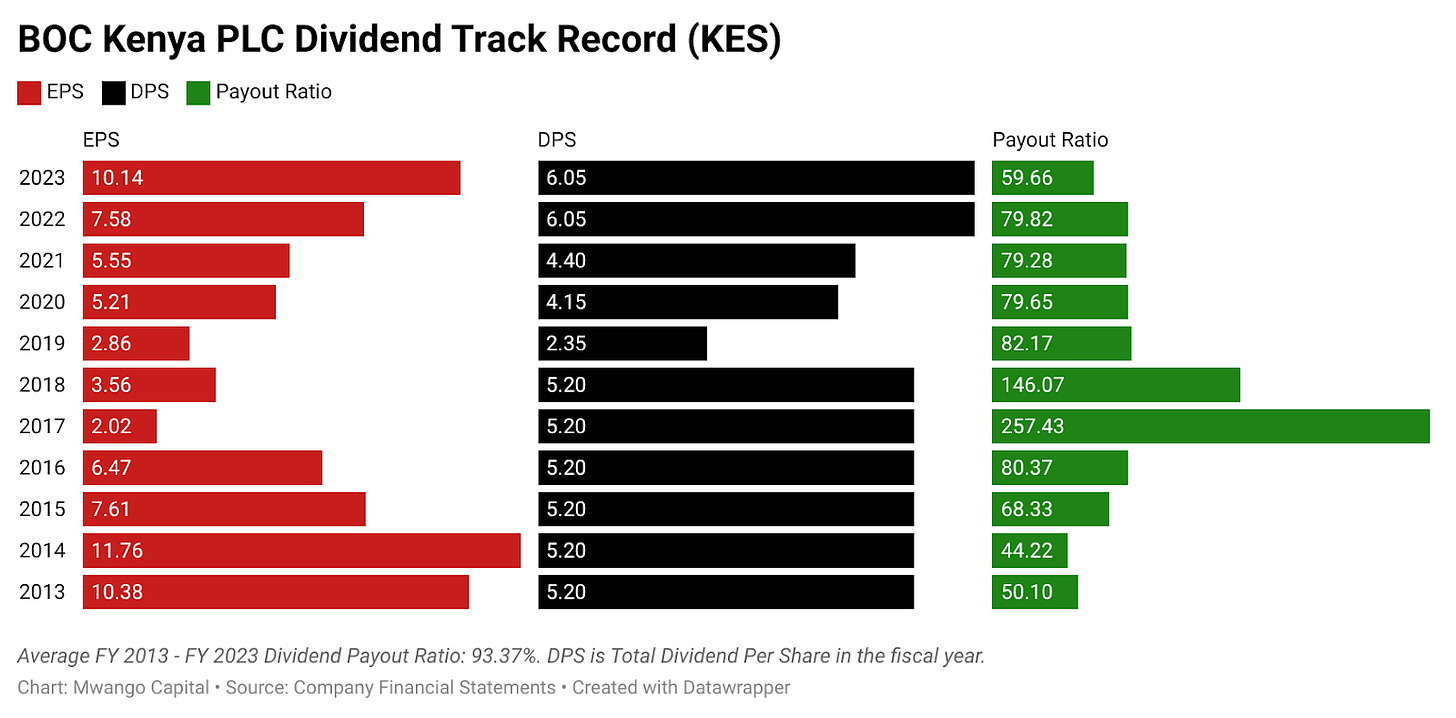

BOC Kenya Net Profit up 34%: In the fiscal year ended 31st December 2023, turnover grew by 19.6% year-on-year to reach KES 1.5B on the back of gas infrastructure installation contracts and improved sales in medical oxygen. As a result, operating profit edged higher by 52.8% to KES 269.7M, and net profit for the year was KES 198.1M, up 33.8%. Per share earnings were KES 10.14, up 33.8%, and the Board of Directors declared a first and final dividend of KES 6.05 [FY 2022: KES 6.05 Total Dividend].

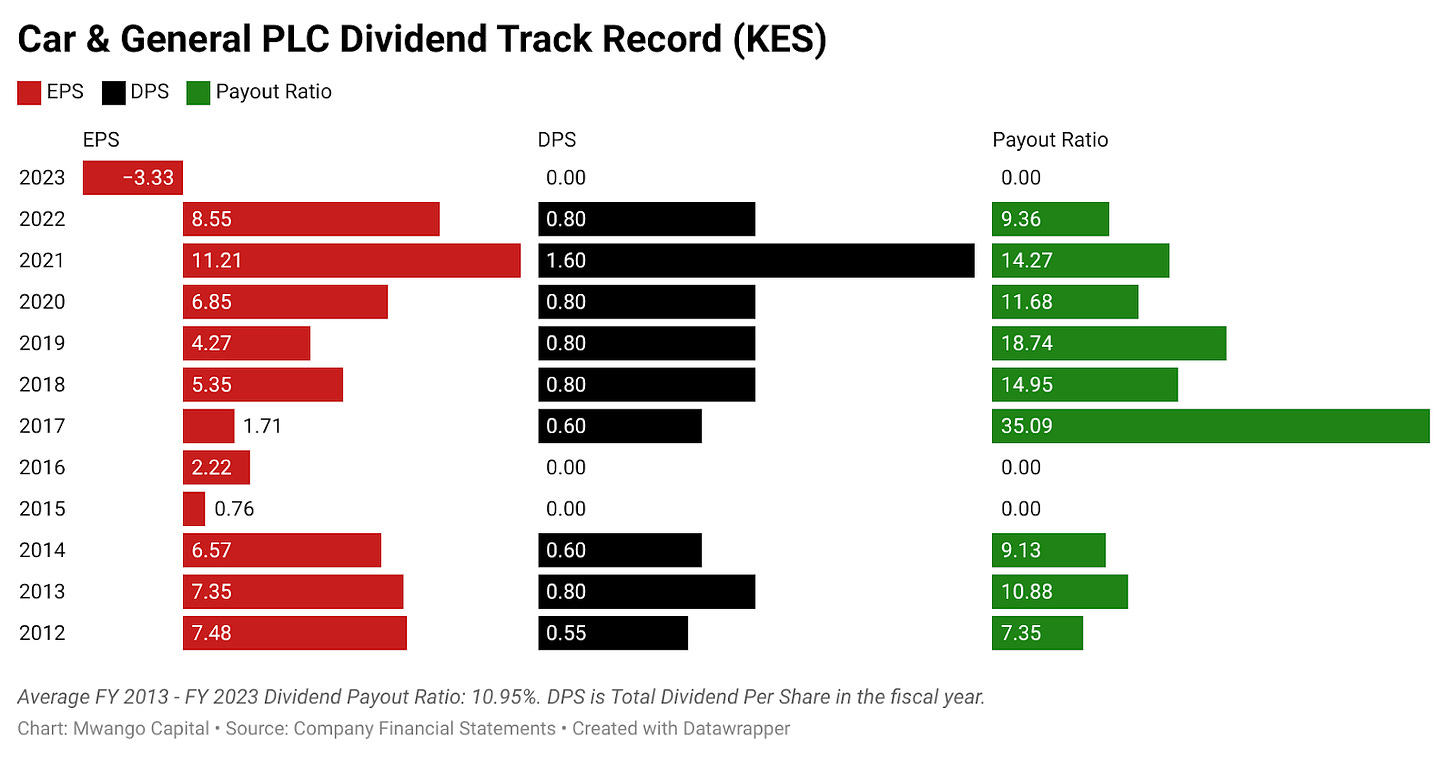

Car and General Sinks into Loss: Late last year, Car and General announced a change in its financial year-end from 30th September to 31st December. For the fifteen months ended 31st December 2023, turnover grew by 40.4% year-on-year to KES 27.2B, with gross profit amounting to KES 4.1B, up 35.1%. Operating expenses surged by 46.6% to KES 3.3B. US Dollar shortages as well as devaluation in Kenya and Tanzania resulted in KES 645M in FX losses, resulting in a doubling of finance costs to KES 1.9B. The FX losses, coupled with KES 180M in demurrage costs in Tanzania, pushed the firm into a KES 273.7M net loss compared to KES 679.5M in net profit in FY 2023. The Board of Directors did not recommend payment of a dividend.

Homeboyz Back to Losses: In FY 2023, turnover fell by 9.4% year-on-year to reach KES 332.4M. Directo costs were down by 13.2% to KES 217.3M, bringing the gross profit to KES 115.1M, a 1.1% decline. Administrative and finance costs were up 2.5X and 6.2X to KES 72.4M and KES 7.6M, respectively, and the net result for the year was a KES 30.4M loss. This is the third fiscal-year loss Homeboyz has reported since its listing on the Growth and Enterprise Market Segment (GEMS) of the Nairobi Securities Exchange (NSE) in 2020 with a KES 4.66 share price and a KES 294.5M valuation, and Homeboyz shares began trading at the NSE on 19th June 2023.

Find results for TotalEnergies Marketing Kenya, Crown Paints, WPP ScanGroup and Express Kenya.

Delayed Results: Listed Insurers including Kenya Re, CIC, and Jubilee Holdings have pushed forward the release of their FY 2023 results, citing delays in finalizing the financials in line with IFRS 17. Britam Holdings, Liberty Kenya Holdings, and Sanlam Kenya PLC are the only listed insurers that have reported FY 2023 results.

Coming Up: Safaricom is expected to release its full-year results for the year ended March 2024 on 09 May 2024. The share price closed Friday’s trading session down 0.3% to KES 15.95 and is up 14.7% YTD.

Markets Wrap

NSE: In Week 18 of 2024, BOC Kenya was the top-performing stock, up 20.5% to close at KES 80.75. Olympia was the worst-performing stock, down 16.8% to close at KES 2.58. The NSE 20 was down 2.4% to close at 1,647.8 points, the NSE 25 decreased by 3.4% to close at 2,762.1 points, and the NASI index decreased by 2.7%, to close at 104.6 points. Equity turnover was down 55.5% to KES 648.7M from KES 1.4B in the prior week while bond turnover closed the week at KES 29.7B compared to the prior week’s KES 31.4B.

Apr 2024: the top 10 best performers were led by Trans-Century Plc, which saw a significant price increase of 32.65%, up from 0.49 to 0.65. East African Breweries Plc and TPS Eastern Africa Ltd followed with increases of 22.22% and 17.83%, respectively. On the other hand, the worst performers were led by The Co-operative Bank of Kenya Ltd, which saw a decrease of 17.00%, followed by I&M Group Plc and Olympia Capital Holdings Ltd with decreases of 16.78% and 15.59%, respectively.

Jan-Apr 2024: the top 10 best performers were led by Liberty Kenya Holdings Ltd, which saw a significant price increase of 53.39%, going from 3.69 to 5.66. East African Breweries Plc and KCB Group Plc followed with increases of 39.91% and 36.76%, respectively. On the other hand, the worst performers were led by Nairobi Business Ventures Ltd, which saw a decrease of 14.81%, followed by Eaagads Ltd and Olympia Capital Holdings Ltd with decreases of 13.98% and 12.23%, respectively.

Treasury Bills: The weighted average interest rate of accepted bids for the 91-day, 182-day, and 364-day were 15.8652%, 16.4875%, and 16.4952% respectively. The total amount on offer was KES 24B with the CBK accepting KES 25.8B of the KES 25.9B bids received, to bring the aggregate performance rate to 108.2%. The 91-day and 364-day instruments recorded 252.58% and 106.61% performance rates, respectively.

Treasury Bonds: In the re-opened FXD1/2024/10 total bids received at cost were KES 14.9B. The CBK accepted KES 10.9B bringing the weighted average rate of accepted bids to 16.2%. On aggregate, the performance and acceptance rates were 59.9% and 73.4%, respectively. Separately, the government is formulating plans to foster the development of the secondary market through reforms in the restructuring of primary market activities. These reforms include managing the competition between tax-free infrastructure bonds and Treasury bonds by limiting the availability of infrastructure bonds to retail investors. Additionally, the government intends to implement a detailed issuance calendar to stabilise demand and ensure that the size of the auctions aligns with their targets, among other proposed measures.

Eurobonds: In the week, the yields were mixed across the 7 outstanding papers.

KENINT 2024 was the only paper that rose week-on-week, up by 81.80 bps to 7.874%. KENINT 2027 fell the most, down by 17.30 bps to 8.067%. The average week-on-week change stood at 10.66 bps.

All papers except for KENINT 2034 had their yields fall on a year-to-date (YTD) basis, with KENINT 2024 falling the most by 465.60 bps while KENINT 2034 rose by 11.40 bps.

Prices were mixed week-on-week, with KENINT 2024 the only paper that fell, by 0.1% to 99.845 while other papers recorded gains, led by KENINT 2048 at 0.9% to 85.337. YTD, KENINT 2028 rose the most at 3.5% to 95.047, while KENINT 2034 was the only paper that fell, down by 0.3% to 80.239.

Market Gleanings

✈️| KQ Suspends DRC Flights | Kenya Airways last week suspended flights to Kinshasa effective April 30th, 2024 due to the ongoing detention of their employees by the DRC's Military Intelligence Unit. The decision comes as the continued detention has hindered the airline’s ability to effectively support its operations, including customer service, ground handling, and cargo activities.

💰| Upcoming IMF Visit | President William Ruto last week confirmed that officials from the International Monetary Fund (IMF) are set to arrive on 9th May for a review aimed at unlocking a USD 1B loan tranche. The President expressed confidence in the ongoing discussions, highlighting productive talks between Kenyan officials and the IMF during the recent World Bank/IMF spring meetings. This comes amidst significant government spending pressures occasioned by the recent floods.

📝| Acquisitions |

Saturn Resources Acquisition: The Competition Authority of Kenya (CAK) has approved Saturn Resources Limited's acquisition of 100% of Shanta Gold Limited. Saturn Resources, a newly formed Kenyan company owned by the investment firm ETC Group, will take full control of Shanta Gold. Shanta Gold is a Kenyan gold exploration company with mining licenses in western Kenya.

East African Packaging Industries Takeover: Canadian Overseas Packaging Industries Limited has made a cash offer to acquire up to 100% of the issued ordinary shares of East African Packaging Industries Limited (EAPI). The offer deadline is April 17th, 2024, with all acceptance documents needing to be received by 5:00 pm on that date.

Ascent Capital Acquisition: The Competition Authority of Kenya (CAK) has unconditionally approved Ascent Capital Holdings Africa II Limited's acquisition of a minority controlling stake (up to 49%) in Dune Packaging Limited, a Kenyan manufacturer of paper packaging materials. While Ascent Capital is a Mauritian financial services firm, Dune Packaging is a key player in Kenya's paper and polypropylene packaging industry, with a subsidiary that manufactures woven polypropylene bags.

📄| CRDB, NMB Q1 2024 Results |

CRDB: In Q1 2024, CRDB reported growth across key metrics. Total assets increased by 4.8% to TZS 13.9T, loans and advances rose 4.9% to TZS 8.9T, and customer deposits grew by 6.8% to TZS 9.4T. The net interest income increased by 31.1% to TZS 252.3B with non-interest income climbing 21.5% to TZS 129.3B. Overall, profit after tax went up 41.3% to TZS 127.5B.

NMB: NMB Bank also reported their results for Q1 2024 last week. Total assets increased 2.3% to TZS 12.5T, loans and advances rose 2.2% to TZS 7.9T, and customer deposits grew 1.7% to TZS 8.4T. Net interest income jumped 17.9% to TZS 253.8B, and non-interest income surged by a significant 39.8% to TZS 146.2B. Profit after tax increased by 30.6% to TZS 160.4 billion.

🥤| Coca-Cola’s Potential IPO | Coca-Cola Co. is preparing for a potential initial public offering (IPO) of its African bottling business, as early as next year, after previously pausing these plans. The company is considering a dual listing for Coca-Cola Beverages Africa in Johannesburg and Amsterdam, with a potential valuation exceeding USD 5B. Coca-Cola owns 66.5% of the bottling unit.

🏦| Fed Keeps Rates Unchanged | The Chairman of the Board of Governors of the Federal Reserve System Jerome Powell last week delivered the Federal Open Market Committee’s interest rate decision, with the FOMC opting to keep the Fed Funds Rate unchanged at the 5.25% - 5.50% target range.

"Like most people, I have dampened my expectations for developed market rate cuts in the second half of the year. It now looks like the European Central Bank may precede rate cuts from the US Federal Reserve and Bank of England. I think it means that some of the emerging market issuers who were waiting to issue in the second half of the year and 2025 will likely bring forward their issuance."

REDD Intelligence Senior Analyst, Mark Bohlund