👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.This week, we cover Kenya’s options ahead of the maturing 2024 Eurobond, the Central Bank of Kenya MPC meeting, IFC’s investment in Safaricom Ethiopia, and Stanbic Holdings 1H2023 results.First off, enjoy a dose of our weekly business news in memes.

This week's newsletter is brought to you by:

Co-operative Bank of Kenya. Fuel up the convenient way with your Co-op Bank ATM card. No need to carry cash at the pump; just tap, pay and go. Make your trips smoother, faster, and cashless at NO extra cost.

Click below to see available card discounts.

Redeeming the 2024 Eurobond

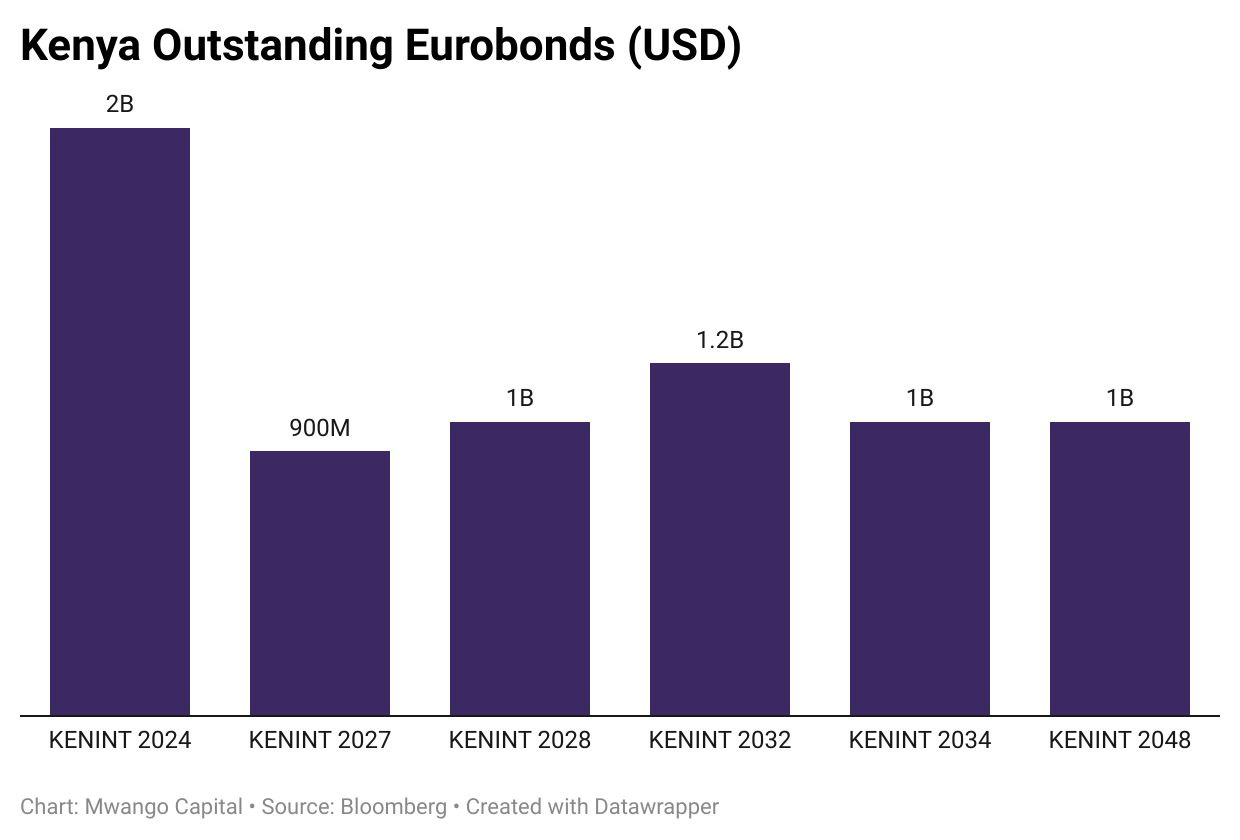

Upcoming Maturity: Kenya has at least 10 months to the bullet payment of the USD 2B eurobond borrowed in June 2014 at a coupon rate of 6.875%. The upcoming maturity accounts for 50.8% of FY 2023/24 external redemptions and the government is exploring various options to settle the debt and avoid a default.

Redemption Options: There are several options Kenya can pursue in redeeming the debt ranging from buying back the debt to a debt swap. Here is a summary covering possible options the government can pursue:

Return to Eurobond Markets: Kenya has selected Citi and Standard Bank as the lead arrangers for the country’s return to the international bond markets in the 2023/24 fiscal year. The appointment of the arrangers is in the backdrop of the efforts around repayment of the eurobond whose redemption options might necessitate a debt buyback or debt swap.

“Although Kenya’s return to the international markets could happen as early as September if market conditions are favourable, January 2024 could also be a favourable timing as international investors get free cash allocations from their shareholders.”

REDD Intelligence

Confident: In the post-Monetary Policy Committee (MPC) press briefing last week, the CBK Governor, Dr. Kamau Thugge, pointed out that the country will have sufficient stock of forex reserves to settle the debt when it falls due.

“What we are expecting is a significant inflow between now and December. On how we are going to deal with the eurobond, of course, we are identifying the lead arrangers. That discussion about the modalities and how we are going to do it is still ongoing but suffice it to say that we will have enough reserves to be able to deal with the eurobond from even a cash point of view if the market does not behave by next June. I believe we will have enough reserves to be able to pay all those people holding the eurobond."

CBK Governor, Dr. Kamau Thugge

CBK Retains Rate at 10.5%

Hold! In Dr. Kamau Thugge’s second Monetary Policy meeting since assuming office in June as Central Bank Governor, the CBK MPC retained its benchmark rate at 10.5% pointing out that the effects of the 100 bps hike delivered on 29th June 2023 were still transmitting in the economy. The MPC also cited subdued food inflation and inflation coming back to within the 5%±2.5pp range as a critical factor underpinning the decision.

New Policy Framework: The CBK also introduced a new monetary policy framework that will introduce an interest rate corridor around the CBR set at ± 250 basis points. With the CBR at 10.5%, this places the interbank rate between 8% and 13%, with the maximum way below the 17% recorded on 11th August 2023. Notably, the interbank rate closed the week at 9.1%. The policy objective is to have the interbank as an operating target that closely tracks the CBR.

The MPC also agreed to reduce the applicable interest rate through the discount window to 400 basis points above the CBR from the current 600 bps. The new measure targets to lower the cost of borrowing through the discount window.

“The idea is that the interbank rate remains within the interest rate corridor. If there is a bank that cannot be able to get the liquidity it requires from the banking system, it can then come to the Central Bank and get its liquidity requirements or needs, but it would then have to pay an interest rate which is the CBR plus 400 bps.”

CBK Governor Dr. Kamau Thugge

“The CBK will be able to transmit monetary policy better because the interbank rate which drives the cost to the banks will be maintained within the policy range. Of significance, however, and just to demonstrate that there is a deliberate effort to ensure that these measures are self-reinforcing, CBK also reduced the borrowing rate at the overnight borrowing window.”

Kenya Bankers Association CEO Habil Olaka

Goldman Sachs commentary: Here are Goldman Sachs’ Bojosi Morule and Andrew Matheny commenting on this new policy implementation framework by the CBK:

Given the trade-off between interest rate and FX volatility, more stable short-term interest rates (within the CBK’s new interest rate corridor) may entail more exchange rate flexibility going forward (potentially also including two-way volatility). In this sense, the nominal anchor of monetary policy may shift from FX to targeting inflation. We expect these policies to support the long-term strengthening of Kenya’s external balances, while improved external liquidity will likely strengthen Kenya’s near-term external buffer.

Domestic Borrowing Update: The MPC pointed out that the government had identified new external financing that is projected to cut domestic borrowing by 46.1% from KES 586.5B to KES 316B and further reduce the interest rate on domestic debt. Interest rates on treasury bills have surged in 2023 with yields on all tenors rising past 13% in last week’s auctions. A year ago, the yields on the 91-day, 182-day, and 364-day papers were at 8.47%, 9.40%, and 9.92%, respectively.

“..financing would be largely from multilateral institutions both international monetary institutions as well as regional institutions. So, to that extent, that funding will be concessional but there’s also some that the Treasury intends to access perhaps though it may not be concessional. Essentially, the sources of financing have been identified, and that is why the National Treasury has indicated to us that their borrowing requirements have now been reduced from KES 586B to KES 316B.”

CBK Governor, Dr. Kamau Thugge

IFC’s Investment in Safaricom Ethiopia

Debt and Equity: In the week, the International Finance Corporation (IFC) announced the formal closure of the World Bank’s $157.4M (KES 22.5B/ETB 8.7B) equity investment into the Global Partnership for Ethiopia (GPE), a package that also includes a USD 100M A-loan to Safaricom Ethiopia. Alongside this, the Multilateral Investment Guarantee Agency (MIGA) is also providing $1B in guarantees to essentially cover equity investments for GPE shareholders including Vodafone Group, Safaricom PLC, and British International Investment.

"The IFC transaction is significant for a number of reasons. For Safaricom Ethiopia, the first thing is that it introduces USD 157M in equity, and IFC comes in as a significant shareholder now in the business, a significant minority shareholder. We get USD 100M in debt and it's long-term debt with a fairly decent moratorium period which is good to support the CapEx rollout and what the business is trying to achieve...And then with the wider World Bank Group, we should not forget that we've also signed a USD 1B program with MIGA, which provides insurance, basically portable risk insurance on this transaction. So in total, the package with the World Bank Group, IFC and MIGA works out to over USD 1.275B, which is, I think, the most significant transaction in the region for the World Bank Group and for the IFC with a private company."

Safaricom PLC Chief Strategy Officer, Michael Mutiga

More Capital Investment: Michael Joseph has pointed out that the investment by the World Bank will be allocated towards expanding the network in Ethiopia including radio and M-PESA. In an announcement in June this year, the IFC highlighted the investment and guarantees would help Safaricom Ethiopia roll out and operate 4G and 5G networks across the country covering both rural and urban areas.

“The importance of IFC is not just the money that they bring us, and that's important as an equity partner, but I also think it's the experience of operations around the world as partners in various investments that they make. They bring that experience to the board, but also I think it's the stature of the investment. When you have the World Bank, the IFC involved in your organization as a partner not just as a financier but as an equity partner, it brings a lot of [credibility] to that organization.”

Safaricom Ethiopia Board Chairman, Michael Joseph

Clashes in Amhara: At least 9 months after the Ethiopian government reached an agreement with the Tigray Peoples’ Liberation Front to end a 2-year war, clashes between government forces and rebels broke out in Northern Amhara, prompting the government to declare a state of emergency in the region. Ethiopian Airlines suspended flights to the region and Safaricom Ethiopia has shut down its sites there as a result.

“Today, as you know, there is a state of emergency and we cannot go to the Amhara region and had to shut our sites down there. All these are challenges that we have to deal with.”

Safaricom Ethiopia Board Chairman, Michael Joseph

Fun Fact on Safaricom Ethiopia: As at the end of July 2023, Safaricom Ethiopia had 2.7M customers since its launch in October 2022, and the firm is on track to launch M-PESA in the market by September 2023.

End of An Era as Michael Joseph Exits: Michael Joseph has resigned from the Board of Directors of Safaricom PLC effective 1st August 2023 after 23 years of service in various capacities including General Manager, CEO, Director, and Board Chairman. He will still be involved in Safaricom Ethiopia (as Chairman of the Holding Company, Voda Family Company, and the Safaricom Ethiopia Company). In an exit interview with Julians Amboko of NTV, he said this about the exit:

“The main reason is that I have been on this board for 23 years now right from the very beginning of Safaricom all the way through either as CEO, board chairman and then director and I just thought that the time has come for me to step down from the main Safaricom board.”

Reflecting on this time at Safaricom and whether this was the end of the golden era of Safaricom:

“When I stepped down, Bob Collymore came on board and I had some concerns about him but he came around to the right way of thinking and continued steering the ship in the right direction. Then we hired Peter who is a different guy with a different personality and you have some concerns in the beginning about whether he will keep the ship going in the right direction and I feel that he is. Maybe he has a different way of doing things. Maybe I wouldn’t have done it that way but he certainly is a strong manager. It certainly is the end of an era; I just hope not the golden era.”

Safaricom Ethiopia Chairman, Michael Joseph

Stanbic Holdings Profit Rises 47%

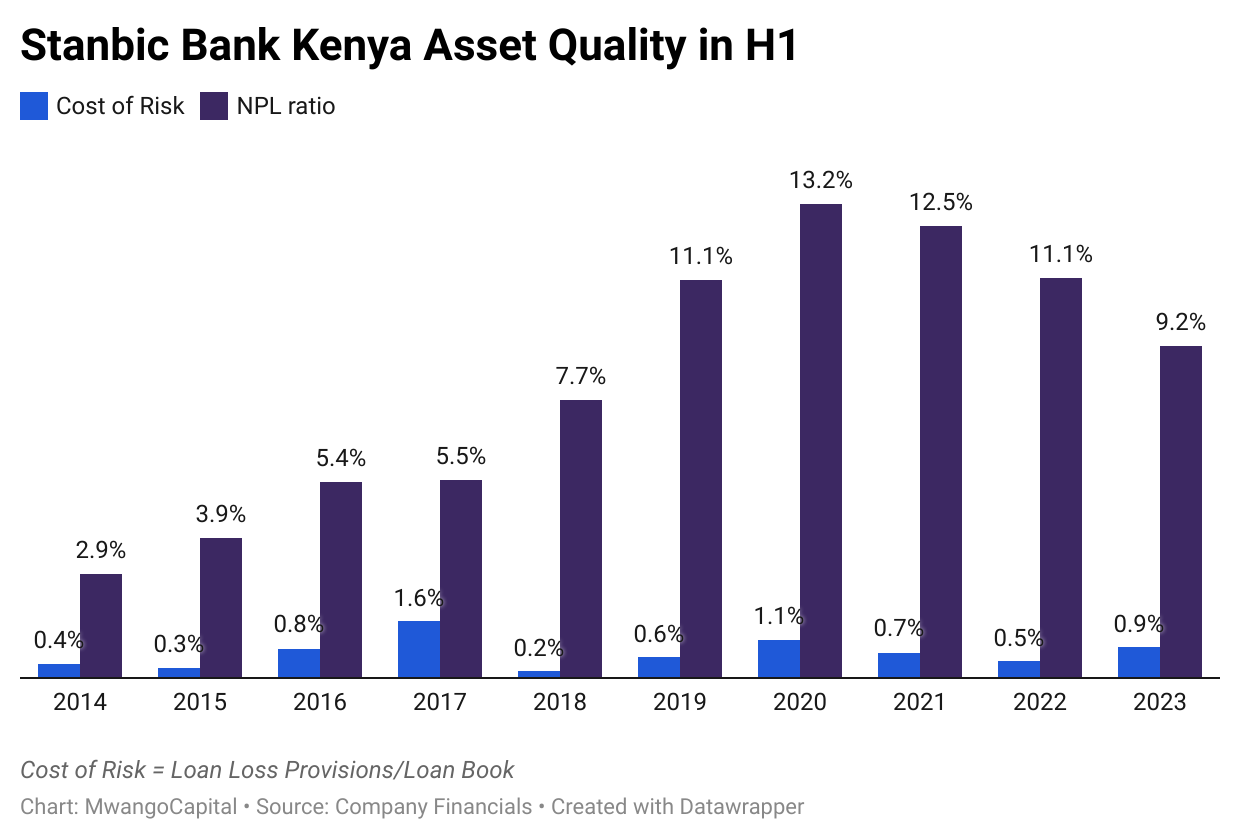

Provisions double: Loan loss provisions through the income statement rose 98% year-on-year to KES 2.5B. The cost of risk - which is the share of loan loss provisions to the loan book - edged higher by 40 basis points to close at 0.9% - a 6-year high. At the Kenya level, gross Non-Performing Loans (NPLs) were KES 23.8B, down 1.2%, while net NPLs were down 4.5% to KES 18.9B. The NPL ratio improved to 9.2% from 10.4% in the prior year. The latest industry average stands at 14.5%.

“Our NPL ratio is a function of many factors. One, it is a function of who we bank. We are keen and careful to bank customers and not bank projects, so that allows us to really vet the character of the customer. If we can get our NPL ratio to 9%, I will be very comfortable.”

Stanbic Holdings CFO, Dennis Musau

The depreciation of the shilling against the US Dollar - so far at 20.3% over the last 1 year and 16.4% year-to-date - has also had an impact on the NPL ratio:

“About 55% of our NPL facilities are FCY. If I go back to a year ago and I freeze where the currency was, and if I exchange them at that currency, my NPL ratio would not be 9.2%. It would probably be 8.6% or 8.7%. So, there are 50 - 60 basis points that are sitting there.”

Stanbic Holdings CFO, Dennis Musau

Top and Bottom Line

Interest Income: Net Interest Income (NII) grew by 44%, double the growth registered in H1 2022, breaching the KES 10B mark to settle at KES 12.1B. This is nearly double the NII posted in H1 2021. Non-Funded Income (NFI) edged higher by 30% to KES 8.9B, to bring the total operating income to KES 20.9B, up 38%. The NII:NFI contribution mix to operating income was 58:42 [H1 2022: 55:45].

Surging Interest Expenses: Interest expenses have been rising across the board as witnessed in Q1 2023 earnings. For H1 2023, the Kenyan banking operation recorded KES 4.8B in interest expenses, up 51.5%, as compared to a decline of 2.2% recorded in H1 2022 and a decline of 9.9% in H1 2021.

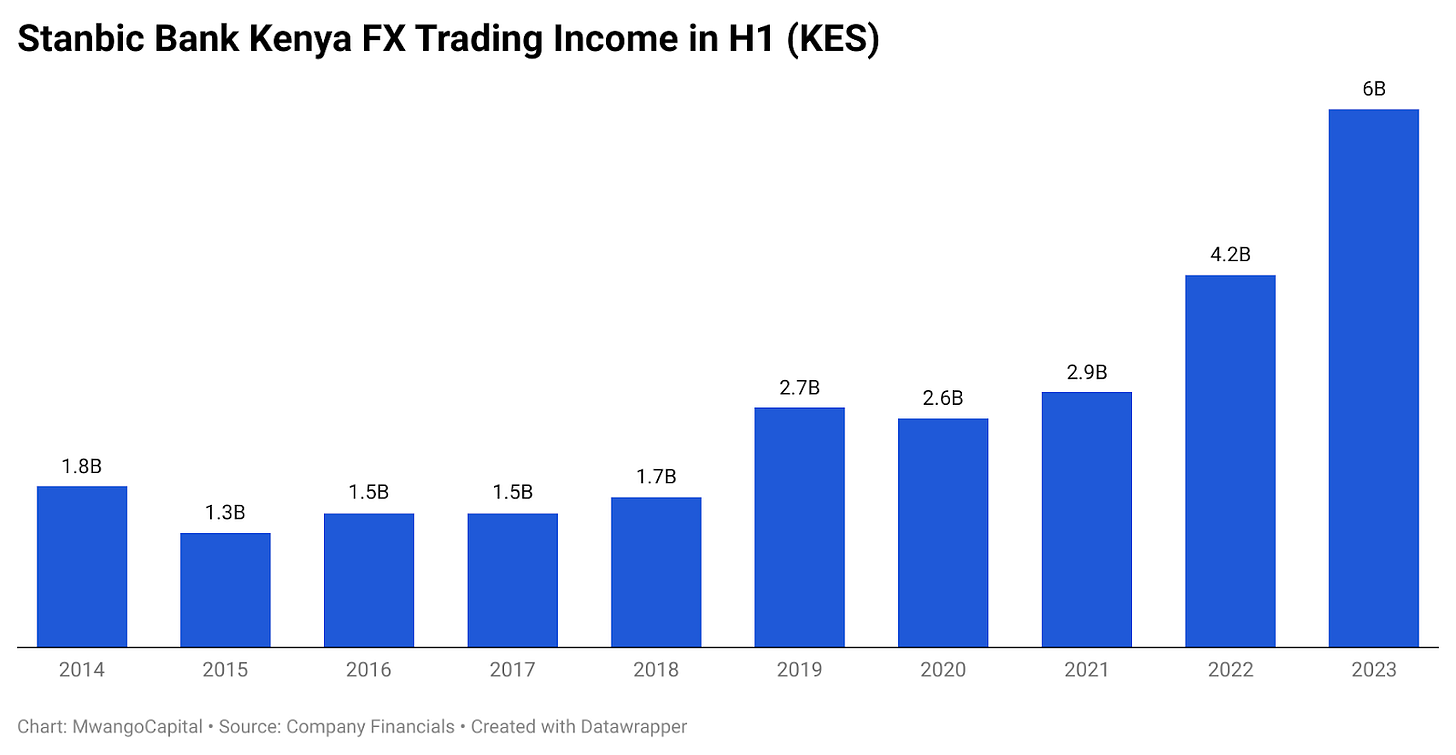

FX Trading Income: As a result of the challenges around the sourcing of dollars in the country, banks have reported record growth in their foreign exchange trading income over the last 1 year. In H1 2023, the Kenyan banking unit reported KES 6B in FX trading income, up 44.4% and 2.1X that reported in 2021. FX trading income accounts for 69.9% of non-funded income (NFI) from 63.3% prior year.

Profitability: Net profit for the year grew by 47% to reach KES 7.1B, equivalent to 34% of gross operating income [H1 2022: 32%].

Shareholder Returns: Earnings Per Share (EPS) in H1 23 was KES 17.84, an increase of 47.1% and double the KES 8.99 reported in 2018. The Board of Directors also declared an interim dividend of KES 1.15 per share payable on 27th September 2023. The bank has resumed paying a dividend in H1 after a hiatus in 2022 and 2020. At the NSE, Stanbic’s share price has appreciated by 16.91% to KES 121.75 year-to-date, the highest price return across Kenya’s listed banks.

“We are very excited to be paying a dividend in this kind of market conditions. Even more exciting is that we have just paid in June the full-year dividend for the year 2022. What is more exciting is our Stanbic Holdings share has appreciated the most in this industry since January this year. We couldn’t be happier for our shareholders.”

Stanbic Holdings CFO, Dennis Musau

Markets Wrap

NSE: In Week 32 of 2023, Britam was the top-performing stock, up 18.2% to KES 5.14. EA Portland was the worst-performing stock, down 11.2% to KES 6.5. The NSE 20 was unchanged from last week, while the NSE 25, and NASI indices were down 1.8%, and 2% respectively closing at 2,709.3, and 104 points respectively. Equity turnover rose 197.7% to KES 1.2B while bonds turnover rose by 63.9% to KES 14.3B.

Treasury Bills: The weighted average interest rate of accepted bids for the 91-day, 182-day, and 364-day closed at 13.11%, 13.438%, and 13.34% respectively. The total amount on offer was KES 24B with the CBK accepting KES 10.3B of the KES 11.29B bids received, to bring the aggregate performance rate to 47.08%. The 91-day and 364-day instruments recorded 1,044.62% and 8.95% performance rates, respectively. Notably, the rates on the 91-day and 182-day T-bills breached the 13% mark in the week.

Eurobonds: In the week, the yields fell across the 6 outstanding papers this week.

KENINT 2024 fell the most, down by 39.1 basis points to 12.593%, while KENINT 2034 fell the least, down 3.3bps to 10.344%. The average week-on-week change stood at -15.07 bps.

Yields were mixed on a Year-To-Date (YTD) basis. KENINT 2024 was the only paper that fell, down 1bps, while KENINT 2034 led gains, appreciating by 69.9 bps. The average increase was 32.02 bps.

All instruments recorded price gains week-on-week. KENINT 2048 led price gains week-on-week, appreciating by 0.9% to 77.503. On a YTD basis, only KENINT 2024 and KENINT 2027 appreciated, rising by 3.2% and 0.5% to 95.460 and 90.430, respectively. KENINT 2034 led losses at -3.8%. The average price change on a week-on-week and YTD basis was 0.5% and -0.4%, respectively.

Market Gleanings

📈 | Airtel Uganda Listing | Airtel Uganda, a wholly owned subsidiary of Airtel Africa, this week announced the intention to list on the Main Investment Market Segment of the Uganda Securities Exchange. The company intends to embark on an initial public offering (IPO) of 8B existing ordinary shares, equivalent to a 20% stake.

🧾| MTN Uganda H1 2023 Results | Total revenue increased by 16% year-on-year to USHS 1.3T ( USD 356.2M), while EBITDA grew by 17% to USHS 641B (USD 175.6M), with a margin of 51% up from 50.2% in 2022. EBIT increased by 22% to USHS 429B (USD 117.5M), with a margin of 34% up from 32% in 2022. Profit after tax (PAT) grew by 18% to USHS 228B (USD 62.4M) with earnings per share (EPS) also increasing by 18% to USHS 10.2. MTN Uganda also declared an interim dividend of USHS 5.6 per share.

⚖️| Finance Act 2023 Update | This week, the High Court scheduled the hearing of 14 petitions contesting the Finance Act 2023 for September 13 and 14. The Court also dismissed an application by Busia Senator Okiya Omtatah to cross-examine the Senate speaker Amason Kingi regarding his affidavit on the Finance Bill 2023. Additionally, the Energy and Petroleum Regulatory Authority (EPRA) Director General Daniel Kiptoo was also summoned by the court to show cause why he should not be held in contempt for disobeying the order on the Finance Act 2023.

🤝 | KQ - Delta Airlines Partnership | Delta Airlines and Kenya Airways this week announced the expansion of their partnership to offer travellers more travel options within North America and Africa with 31 additional connections available through Nairobi and another 57 across the United States and Canada. KQ currently operates the only daily non-stop flight service from Nairobi to New York across East Africa.

🖥️ | NCE Direct Settlement System | Out of the 12 firms that had submitted bids to provide the Direct Settlement System for the National Coffee Exchange (NCE), Co-operative Bank Kenya was selected to provide the clearing and settling of coffee earnings to farmers. Worth noting is earlier in June this year, Co-operative Bank migrated to a new core banking system worth $50M (KES 6.95B). This is what Standard Investment Bank had to say about the selection of Co-operative Bank:

“The lender will offer the Direct Settlement System (DSS) technology that facilitates payment of coffee growers’ proceeds as well as the recovery of other commitments the producer owes service providers within two days. Co-op Bank, which is majority-owned by cooperative societies, has strong ties to the agricultural sector. This move should boost the lender’s non-funded income when it goes live.”

Am really glad to have read the article. Very informative. Keep up the good work.

Loved today's round up!