👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover key themes from 2023, tax changes in 2024, and Sasini’s FY 2023 results.This week's newsletter is brought to you by:

Co-operative Bank of Kenya. Pay For E-Citizen services conveniently with Co-op Bank.

2023 in Charts

NSE Performance: Umeme was the top performer, gaining 115.63% to KES 16.00, while Unga Group was the worst performer, shedding 47.34% to KES 16.85. Across sectors, Agriculture led, gaining 25.19%, while Insurance lost the most value at 11.45%. All indices closed in the red, with NASI, NSE 20, and NSE 25 losing 27.74%, 10.44%, and 24.04% to 92.11, 1,501.16 and 2,380.23 points, respectively. Overall market capitalization fell by 27.54% to KES 1.4T.

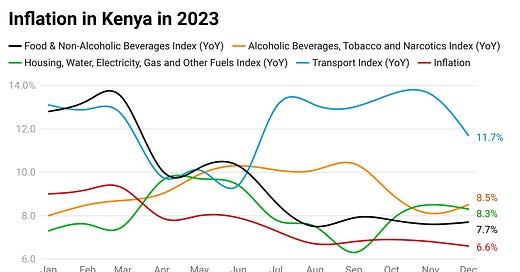

Inflation: Inflation closed at 6.6% in December 2023, down 10 bps from November to mark the 6th consecutive month inflation stayed within CBK’s target of 5% ± 2.5 pp. Average inflation in 2023 was 7.7%, up 10 bps from 2022. Across indices, there was moderation in year-on-year growth across the Food and Non-Alcoholic Beverages index as well as the Alcoholic Beverages, Tobacco and Narcotics index, while the Housing and Transport indices registered fairly elevated year-on-year growth in 2023 relative to 2022.

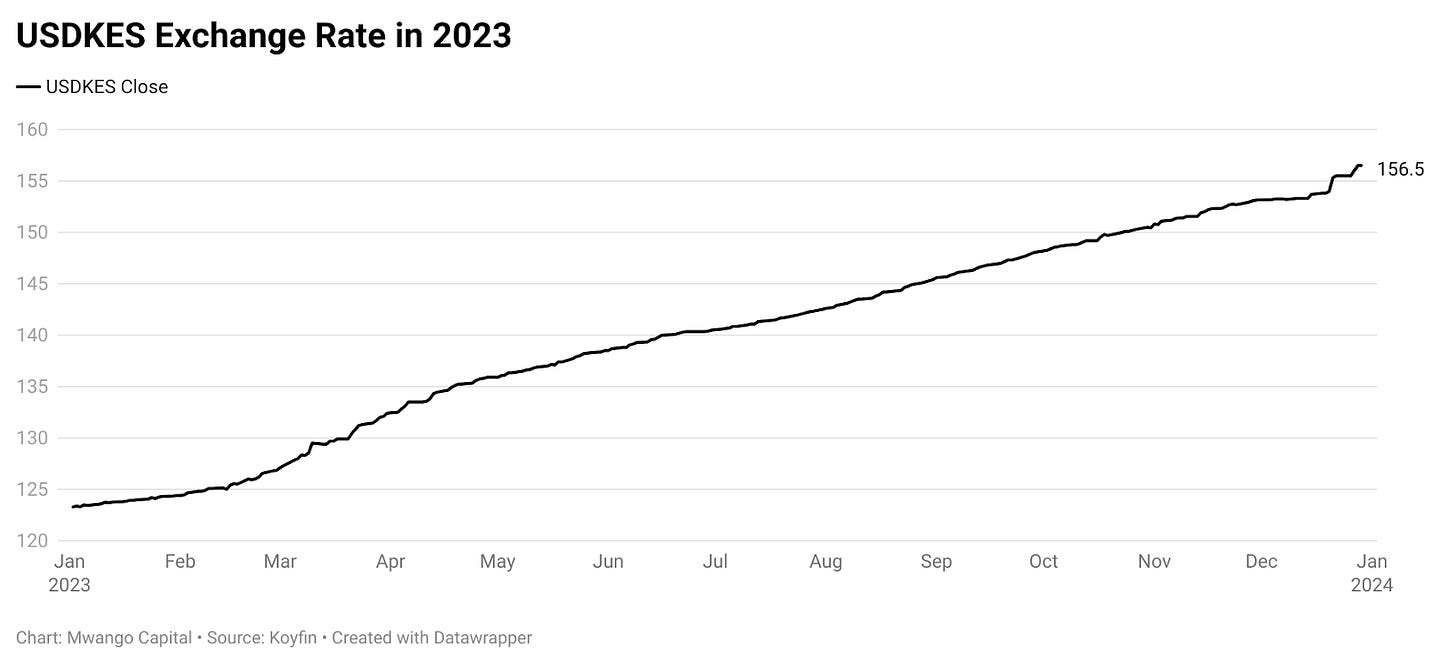

USD/KES Exchange Rate: In the year, the shilling depreciated at 27% - a rate last recorded 15 years ago in 2008 when Post Election Violence (PEV) broke out in the country. Authorities have pointed out the rapid depreciation as an adjustment process of the shilling to its market value after artificial management in previous years.

Central Bank Rate: The CBK’s Monetary Policy Committee (MPC) delivered 375 basis points (bps) in rate hikes in 2023, the highest in 11 years, bringing the CBR to 12.5%. Across 7 MPC meetings in 2023, 3 resulted in hikes - 2 under Dr. Kamau Thugge who took charge of the apex bank on 19th June 2023. The largest hike in 2023 was in December at 200 bps targeted at countering the Shilling’s depreciation. Here is what Eric Musau had to say on this in the first edition of Mwango Spaces in 2024 last week.

“The new [inflation] target now seems to be closer to 5%. The exchange rate weakening accounted for almost half of the inflation - so for the last inflation of 6.6%, half of it, 3.3%, was actually due to the exchange rate, which means if we did not have weakening of the exchange rate as it did, our inflation would be at 3.3%. So, obviously, stabilizing the currency becomes an important driver for the MPC and that’s why they decided to raise rates. Whether it works or not, the jury is still out there.”

Executive Director - Research, Standard Investment Bank, Eric Musau

Eurobonds: In 2023, yields across Kenya’s 6 outstanding eurobond notes declined by an average of 56.10 bps relative to 2022. The yield on KENINT 2024 fell the least, by 7.30 bps to 12.530%, while KENINT 2027 recorded the largest decline at 84.50 bps to close at 9.874%. Except for KENINT 2024 and KENINT 2048, yields on the other papers all closed the year at single digits.

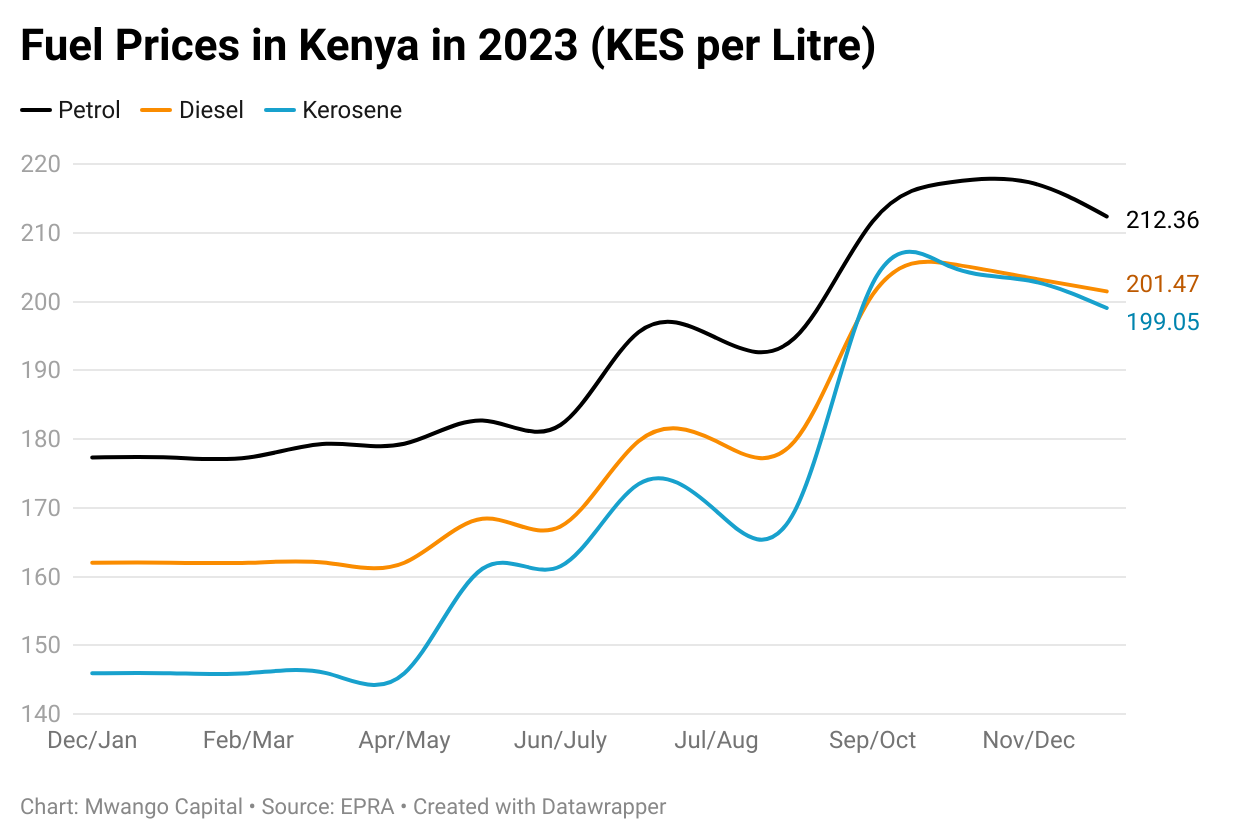

Fuel Prices: 2023 was the year when pump prices breached the KES 200 mark, with petrol, diesel, and kerosene surging by 19.8%, 24.4%, and 36.4%, respectively to close at KES 212.36, KES 201.47, and KES 199.05, respectively. Landed costs rose by 24.6%, 13.4%, and 13.2%, while taxes were up 24.7%, 27.5% and 33.7%, respectively. From April 2023, the Government-to-Government oil deal took effect, changing the calculus of oil procurement from spot transactions to deferred payments to alleviate US Dollar demand in the market.

Interbank Rate: The average interbank rate was 9.76%, with the average number and value of deals standing at 35 and KES 21.7B, respectively. The interbank rate was highest on 3rd August at 17.38% while the highest number of deals was 79 on 30th June, with the highest value recorded at KES 50B on 8th September. Notably, the CBK’s MPC on 9th August introduced a new framework introducing an interest rate corridor around the interbank rate at CBR ± 250 bps. Data shows that since the policy’s introduction, the difference between the interbank rate and the CBR has not breached the ± 250 bps corridor, unlike the 28X it did in 2023 before the policy.

Treasury Bill Yields: Domestic short-term yields soared in the year, and the 91-day paper particularly saw its yield rise significantly, up 661.29 basis points. The 182–day and 364-day papers registered increases of 614 bps and 579 bps, respectively. Further, investors concentrated on short-term positions in their allocations to Treasury bills to avoid duration risks associated with longer-term papers given the uncertain macroeconomic environment.

Government Debt: The latest data by the CBK indicates that domestic debt stood at KES 4.9T as of September 2023, while external debt stood at KES 5.7T [USD 38.27B]. On a gross basis, the total public debt stood at KES 10.6T, equivalent to 65.6% of GDP.

Diaspora Remittances: In the 11 months to November 2023, diaspora remittances totaled USD 355M, up 2.8% year-on-year. Month-on-month, the remittances fell by 0.2%. For the 12 months to November 2023, the remittances totaled USD 4.175B, up 3.8% year-on-year.

Forex Reserves: Kenya’s stock of forex reserves closed the year at USD 6.612B, equivalent to 3.54 months of import cover, as compared to USD 7.38B, equivalent to 4.13 months of import cover at the start of the year, registering a drop of 10.4% in absolute terms.

Trade: Available data indicates that in October 2023, total imports were KES 239.7B, up 27.3% year-on-year, while total exports were KES 74.8B, up 23.9% - bringing the trade deficit to KES 164.9B, up 28.9%. The cumulative imports in the 10 months to October 2023 were KES 2.1T, up by a marginal 1.2%, while exports totaled KES 743.9B, up 15.5% - to bring the trade deficit to KES 1.4T, down 5.2% as compared to the same period in 2022.

Tax Changes in 2024

Some tax measures via the Finance Act 2023 took effect in January 2024, and here is a summary of the changes:

Retirement Income Taxation: Tax on investment income from a post-retirement medical fund has been reduced to 30%.

Tax Claims on Mortgage Expenses: Tax claims on mortgage interest expenses have been reduced to 30%.

Corporation Tax for Branches: Entities with operational branches in Kenya will see reduced tax rates to 30% from 38%.

Residential Rental Income: Property investors and landlords to benefit from the reduction of residential rental income tax to 7.5% from 10%.

Taxation for Non-Residents: Non-residents with a permanent establishment in Kenya will be required to pay a 15% tax on repatriated income. Further, their corporate income tax rate has been slashed to 30% from 37.5%.

SEZ Tax Incentives: For Special Economic Zones, Kenya has reduced the Capital Gains Tax (CGT) on property transfers within these zones to 15% - and this is ostensibly geared to spur economic activities and unlock opportunities within these designated zones.

eTIMS Update: The Tax Procedures (Electronic Tax Invoice) Regulations 2023 have exempted businesses with annual turnover below KES 5M from the mandatory issuance of eTIMS-generated invoices. So far, only 6K businesses have registered for eTIMS and KRA expects 663K registered businesses to be on board by March 2024, out of an estimate of 7M. You can find the entire regulations here.

Markets Wrap

NSE: In Week 2 of 2024, Liberty was the top-performing stock, up 18.5% to close at KES 5.00. NBV was the worst-performing stock, down 12.2% to close at KES 2.16. All indices were red, with the NSE 20, NSE 25, NSE 10, NASI falling by 1.4%, 1.9%, 2.0%, and 2.1% to close at 1,491.9, 2,375.7, 907.4 and 92.0 points, respectively. Equity turnover edged lower by 64.0% to KES 487.66M from KES 1.4B in the prior week while bond turnover closed the week at KES 21T compared to the prior week’s KES 12.2T.

Treasury Bills: The weighted average interest rate of accepted bids for the 91-day, 182-day, and 364-day were 16.1452%, 16.1874%, and 16.3917% respectively. The total amount on offer was KES 24B with the CBK accepting KES 45.9B of the KES 57.9B bids received, to bring the aggregate performance rate to 241.54%. The 91-day and 364-day instruments recorded 1,114.40% and 32.9% performance rates, respectively.

Treasury Bonds: The reopened FXD1/2023/005 and FXD1/2024/003 recorded performance rates of 23.04% and 83.11% respectively attracting bids worth KES 8.1B and KES 29.1B respectively, against a cumulative KES 35B sought. The CBK accepted KES 2.9B and KES 22.1B respectively and the market-weighted average rates were 19,07% and 18.63%, respectively. In aggregate, the performance rate was 106.17% with KES 25.02B of KES 37.2B accepted.

Eurobonds: In the week, yields fell across the 6 outstanding papers.

KENINT 2024 fell the most week-on-week, down by 231.50 bps to 13.423% while KENINT 2048 fell the least, depreciating by 21.00 basis points to 10.260%. The average week-on-week change stood at -69.37 bps.

KENINT 2024 rose the most on a year-to-date (YTD) basis, appreciating by 89.30 bps while KENINT 2028 rose the least at 13.30 bps.

Prices rose across the board week-on-week, with KENINT 2034 rising the most at 2.3% to 79.745. Year-to-date, KENINT 2048 fell the most, depreciating by 1.2%, while KENINT 2024 fell the least at 0.2% to 97.278.

Markets Gleanings

📉 | Sasini FY 2023 Results | Sasini PLC, a Kenyan agricultural company, announced its financial results for the fiscal year ending September 2023. The company experienced a contraction in revenue by 22.1%, settling at KES 5.7B. The Profit before tax was down by 44%, standing at KES 873M with the profit after tax declining by 54% to KES 543M. The earnings per share decreased by 53% to KES 2.41. Despite these financial headwinds, Sasini declared an increased total dividend of KES 1.50 per share, up from KES 1.00 per share in the previous year.

🔴 | Limuru Tea Profit Warning | Last week, Limuru Tea PLC issued a profit warning, expecting its Net profit to decline more than 25% year-on-year in the fiscal year ending 31st December 2023. The firm cited increased labour costs, the impact of KES depreciation on fertilizer imports, and a projected loss in Biological Asset valuation. Limuru Tea PLC becomes the first firm to issue a profit warning in 2024.

⛽ | Jan/Feb 2024 Fuel Prices | For the January/February 2024 pumping cycle, the Energy and Petroleum Regulatory Authority has slashed the prices of Super Petrol, Diesel and Kerosene by KES 5.00, KES 5.00 and KES 4.82 to KES 207.36, KES 196.47 and KES 194.23 per litre, respectively. In the current cycle, Diesel’s price has been cross-subsidized with that of Super Petrol, with OMCs set to receive compensation from the Petroleum Development Fund.

💸 | IMF-Kenya Programme Update | On January 17, 2024, the IMF executive board will discuss Kenya’s 6th Reviews under the EFF/ECF Arrangements whose completion is set to grant Kenya immediate access to USD 682.3M, bringing the total IMF financial support under the EFF/ECF and RSF arrangements in the current programme to USD 2.68B. Separately, the Fund projects Kenya’s GDP to grow at 5.3% in 2024, with Sub-Saharan Africa (SSA) overall growth projected at 4% in 2024 [2023: 3.3%]. Notably, 6 of the top 10 performing global economies in 2024 are forecasted to be from this region.

🏭 | Kenya Carbon Offset Projects | The Kenyan government has proposed new regulations for earnings from carbon emissions offset projects. The government plans to claim a minimum of 15% of earnings from terrestrial projects and at least 25% from Ocean-based initiatives. Furthermore, project developers will be mandated to share a portion of their earnings with host communities. Specifically, land-based community projects will be required to contribute at least 40% of their aggregate earnings from the previous year back to the community.

🛠️ | Ghana’s Debt Restructuring | Ghana has reached a critical agreement with its official creditors under the G20 Common Framework on debt treatment, and the specific terms of the agreement are set to be formalized in a Memorandum of Understanding before implementation begins. The Agreement paves the way for approval of the first review of the IMF programme, unlocking USD 600M; and from the World Bank, approval of a Development Policy Operation set to unlock USD 300M and a further USD 250M for the establishment of a Financial Stability Fund.

💰 | Upcoming SSA Debt Maturities | Various SSA countries are faced with eurobond maturities in 2024, with Kenya facing the largest amount due at USD 2B in June. With the prevailing high interest rates, these countries are set to see higher debt service costs and it remains to be seen whether there will be any defaults or restructuring in the year.

“Yes, the eurobond has been a major discussion point for investors for most of 2023, and in fact many people are speculating whether Kenya will be the next to default or something along those lines. Of course, Ethiopia defaulted on its Eurobond. But one has to look at what Kenya has been doing. It raised taxes, if you look at a lot of the countries that went to default, they had populist governments and they lowered taxes and ended up with lower collections. If you look at the case of Sri Lanka, Zambia, Ghana - looking at the run-up to the default, they had all those risky signs around trying to cut taxes in order to build up the economy, but really cutting taxes doesn’t raise revenues and we saw where those countries ended up. The revenue-raising efforts by the current administration have been good in improving the possibility of paying the debt.”

Executive Director - Research, Standard Investment Bank, Eric Musau

In an outlook last week, Moody’s Investors Service pointed out higher interest rates might impact the debt refinancing process:

“Most of the SSA sovereigns we rate took advantage of record-low interest rates over the last decade to borrow for infrastructure and other projects, and to support their economies during the coronavirus pandemic. Debt burdens have climbed as a result. With many of these debts now coming due and interest rates having risen sharply during the past two years, SSA sovereigns are facing difficulties refinancing at affordable rates.”

JPMorgan do not think that there will be any defaults across SSA:

“Despite constrained access to international capital markets, we think a wave of sovereign defaults in Sub-Saharan Africa (SSA) remains unlikely.”