The G2G Oil Deal

The gov't seeks to renegotiate parts of the deal, including freight and premium

👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.This week, we cover the G2G oil import deal, Centum RE FY 2023 Results and Kenya’s Tax Revenue in FY 2022/2023.First off, enjoy a dose of our weekly business news in memes.

This week's newsletter is brought to you by:

Co-operative Bank of Kenya. With a Co-op Prepaid Card, you can instantly send pocket money to your child from anywhere, and receive transaction alerts for every purchase they make.

The G2G Oil Deal

Reviewing the Deal: Under the Government-to-Government (G2G) arrangement introduced in April 2023, Kenya receives fuel products on credit for 6 months, as compared to spot transactions previously. The arrangement was brought as a way to ease pressure on dollar demand for the importation of petroleum products, which in 2022 averaged 26.1% of total imports from an average of 18.3% in 2019. The deal requires selected international oil companies (IoCs) to supply products to a lead oil marketing company (OMC) with letters of credit (LCs) from banks underwriting the IoCs. The lead OMC then distributes the product to other OMCs and opens an escrow account to deposit Kenya Shillings receipts to be converted to US Dollars for IoC payment. In the ongoing phase, KCB Group, NCBA Group, Absa Bank Kenya, Stanbic Bank Kenya, Co-operative Bank Group, and Afreximbank issued LCs to the IoCs involved.

“We eliminated the spot purchases of US Dollars by those over 100 oil marketing companies who really created a lot of speculative tendencies in the market. $500M and $503M is sitting in their account - the escrow account. And some KES 57B which is in the escrow account is dedicated for payments of these products when they come and fall due.”

Energy Cabinet Secretary, Davis Chirchir

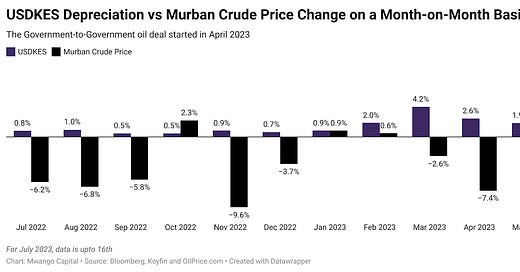

Impact on the Kenya Shilling: According to the Energy CS, the G2G oil deal has eased the monthly depreciation of the Kenyan Shilling. Data indicates that since the deal came into force, the shilling’s month-on-month depreciation has fallen from 4.2% in April 2023 to 1.4% in June 2023. Month-to-date, the depreciation stands at 0.4%.

“Chair, the G2G has eased pressure on the shilling with a reduction in the depreciation against the US Dollar from a high of 3% every month. Our shilling was depreciating at the rate of 3% every month. And currently, if you follow the macro and microeconomics from the Central Bank, you’ll see the depreciation being published at an average of 1%. So, a depreciation of 3% to 1% is a great saving for this country.”

Energy Cabinet Secretary, Davis Chirchir

Renegotiation of the Arrangement: The CS also pointed out the government was seeking to renegotiate some components of the G2G deal, including freight and premium, as well as the removal of the confirmation charges on the LCs.

“That we were seeking to remove the confirmation charges on LCs and, more importantly, to renegotiate the F and P - the freight and premium - which has since come down and which was locked at the time when we went to tender. It was at a high of a hundred plus, and currently, it is something between 40, 60, 70, and that was also successful.”

Energy Cabinet Secretary, Davis Chirchir

In the week, the President hosted a Kenya-Saudi Arabia business delegation of more than 30 firms led by the Saudi Arabia Minister of Investment Khalid Al-Fatih. Here is what the President had to say about the negotiations on fuel prices:

“I am looking forward to the conclusion of the negotiations that are going on and I really want to appreciate the positive consideration that we are receiving from Saudi Arabia for the supply of fuel products that shortly, maybe in a month or two, I want to see new prices that will help deliver better prices for our consumers. We can reduce the cost of petroleum products that go to the people of Kenya.”

President of Kenya, William Ruto

Crude Oil Performance: At the start of April 2023, the price of Murban Crude Oil stood at $86.23 per barrel, and closed the month of June at $75.87, and is currently trading at $81.06 - down 6.4% from April.

July/August 2023 Pump Prices: EPRA has lowered the price of super petrol and kerosene by KES 0.85 and KES 3.96 to KES 194.68 per litre and KES 169.48 per litre, respectively. The price of diesel remained unchanged at KES 179.67. Notably, the price of murban crude oil per barrel rose by 5.7% to $84.11 in June 2023 [May 2023: $79.55]. According to the regulator, the mean monthly USD/KES exchange rate was $144.48, a depreciation of 2.2% [May 2023: $141.39].

Denomination of PPAs: The agitation by Members of Parliament to change the denomination of Power Purchase Agreements (PPAs) from Kenya Shillings to US Dollars has hit a dead end after the Energy CS ruled out the viability of Kenya Shilling-denominated PPAs.

“On the viability of introducing a policy that uses local currency denominated PPAs, or having a mix of local and foreign currency PPAs in renewable energy, the sector recently conducted a feasibility study on the viability of Kenya shilling denominated PPAs and the study found that this option is not viable.”

Energy Cabinet Secretary, Davis Chirchir

Centum RE FY 2023 Results

Revenue Mapping: For the fiscal year ending 31st March 2023, of the 1,151 units [2022: 1,422] under construction with a total projected revenue of KES 10.9B [2022: 13.3B], 889 [2022: 1,052] have been sold for an aggregate value of KES 8.2B [2022: KES 9.6B]. This brings the value of unsold units to KES 2.7B [2022: 3.7B]. Across ongoing projects, of the 564 units that were completed pending revenue recognition 222 [39.4%] were recognized in the year, down 27% year-on-year [2022: 304]. On a net basis, revenue grew by 3.5% to KES 1.9B while gross profit edged lower by 14.7% to KES 285.7M.

Operating Landscape: In the period, fair value gains on investment properties grossed KES 2.1B compared to KES 513M in FY 2022. The sale of development rights completed in the period had a total value of KES 172M and the net gain on the disposal was KES 75.6M [2022: KES 111M]. Operating and administrative expenses edged higher by 49.1% to KES 748.5M bringing the operating profit to KES 1.9B, up 2.9X from 2022. Finance costs rose by 12% to KES 889.7M while the net result for the year was KES 147M as compared to a restated loss of KES 486.9M in FY 2022.

“The increase in finance cost in the year is explained by the depreciation of the KES against the USD by 16% in FY 23 resulting in unrealized foreign exchange losses on the USD-denominated liabilities.”

Balance Sheet Decomposition: Total assets grew by 13.4% to reach KES 46.4B with investment property accounting for the bulk of the assets at KES 31.5B (68%). Residential units under construction accounted for 12.7% (KES 5.9B) of the assets while completed units represented 6.4% (KES 2.98B). In sum, inventory totalled KES 8.9B [2022: KES 7.6B]. On the liabilities composition, shareholder funding was the largest component at KES 25.6B. Deferred revenues stood at KES 8.2B, and noteworthy, deferred income tax liabilities stood at KES 5.6B, exceeding borrowings which were KES 5.2B.

You can find the results here.

Kenya’s Tax Revenue in FY 2022/2023

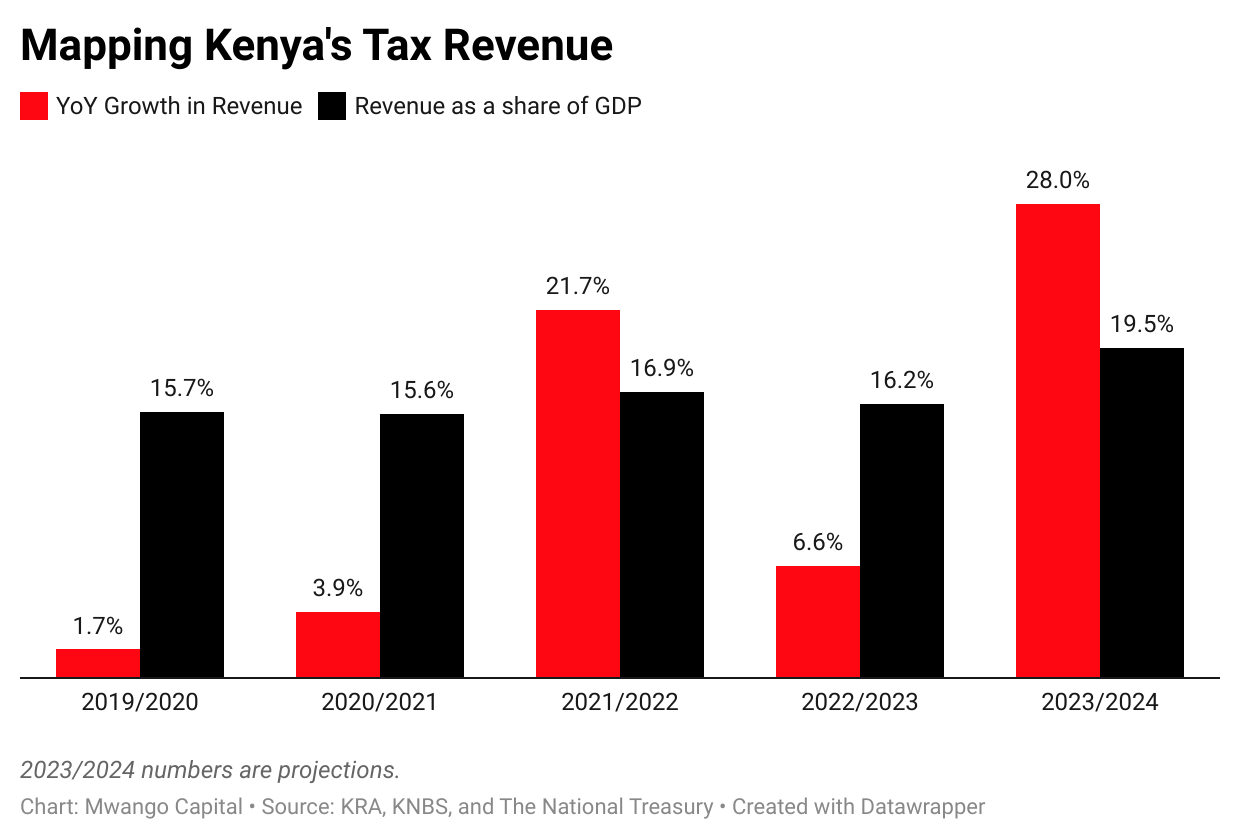

Tax Revenue Grows 6.7%: The Kenya Revenue Authority (KRA) recorded a 6.7% growth (July 2022 - June 2023) in tax revenue collected to KES 2.166T from KES 2.031T in FY 2021/22.

Composition of Collections: Exchequer revenue i.e. international trade taxes, excise taxes, income taxes, profits and capital gains taxes and property taxes, accounted for the lion’s share of collections at 93.7% and grew by 6.9% to KES 2.030T. Agency revenue on the other hand grew by 3.7% to KES 136.390B and accounted for 6.3% of total collections.

Trade vs Domestic taxes: Trade taxes grew by 8.5% to KES 1.407T against a KES 1.481T target while domestic taxes grew by 3,5% to KES 754.090B representing a 95.6% performance rate. The overall tax revenue was equivalent to 16.2% of GDP in 2022 down from 16.9%. The collections have grown by KES 586.259B [37%] over the last 5 years.

Performance of Key Tax Heads:

P.A.Y.E Tax Nears KES 500B: Pay As You Earn Tax (P.A.Y.E) edged higher by 7.2% to KES 494.98B, accounting for 22.9% of total tax revenue. The revenue growth was on the back of growth in remittances from the public sector and private firms which rose by 1.09% and 10.7%, respectively.

eTIMS Bolsters VAT: Domestic Value Added Tax (VAT) collected grew by 11.3% to KES 272.45B, largely due to the implementation of TIMS which enhanced compliance. As of the end of FY 2022/2023, 95,732 VAT-registered taxpayers had been onboarded to the Electronic Tax Invoice Management System (eTIMS) - which allows for real-time tax collection - contributing KES 272.365B in remittances.

“It is important to note that VAT growth scaled up to 18.0% in February - June 2023 upon implementation of Tax Invoice Management System (TIMS & eTIMS), from an earlier slower growth of 6.7% in the first 7 months of FY 2022/23. This performance is expected to be sustained in the coming year once the full rollout of eTIMS is realised amongst the VAT-registered taxpayers.”

Corporation Tax: Corporation tax edged higher by 9% to reach KES 263.819, equivalent to 12.2% of total tax revenue. Tax collections under this head registered a performance rate of 94.2%.

Betting Excise Tax: Domestic excise tax edged higher by 2.8% to KES 68.1B bolstered by the 60.6% growth recorded in the cosmetics sub-head. Integration of betting and gaming firms into KRA remittance systems realized KES 15.9B in excise duty and withholding tax from 28 taxpayers. Excise on betting increased by 30% to KES 6.64B, surpassing the KES 5.72B target by 16.2% or KES 925M in absolute terms.

Tax Base: Efforts to expand the tax base generated some KES 14.649B in revenue as an additional 940,483 active taxpayers were recruited in the operating period.

Digital Economy: The total collection netted from digital service tax and VAT on digital market supply rose by 207.9% to reach KES 5.328B. Noteworthy, this is equivalent to 80.2% of excise on betting.

Debt Collection: Collection from debt programmes on non-compliant taxpayers raised KES 99.3B equivalent to 4.6% of total revenue. Follow-ups on demand notices and mutually-agreed debt instalment plans realised KES 64.5B while follow-ups on agency notices brought in KES 34.591B.

Dispute Resolution: In the period under review, KRA concluded 7,458 cases through various avenues including litigation, alternative dispute resolution and the Tax Appeals Tribunal. KES 71.836B was realized, equivalent to 3.3% of total revenue.

FY 2023/2024 Guidance: KRA is targeting an ambitious KES 2.768T in collections in the current financial year, 27.8% higher than in FY 2022/2023. In the medium term, the target is tax revenue exceeding KES 3T by fiscal year 2024/2025.

Markets Wrap

NSE: In Week 28 of 2023, Umeme was the top-performing stock on the Nairobi Securities Exchange, appreciating by 40.3% to KES 14. HF Group was the worst-performing stock, falling 6.2% to KES 4.52. The NSE 20 index rose by 0.4% to 1,624.7 points while the NSE 25 index was up 2.3% to 2,902.9 points. The NSE All Share Index (NASI) edged higher by 2.3% to close at 113.9 points. Equity turnover fell by 47.5% to KES 834.6M while bonds turnover rose by 5.6% to KES 12.5B.

Treasury Bills: The weighted average interest rate of accepted bids for the 91-day, 182-day, and 364-day closed at 12.109%, 12.271% and 12.452% respectively. The total amount on offer was KES 24B with the Central Bank of Kenya (CBK) accepting KES 36.3B of the KES 36.4B bids received, to bring the aggregate performance rate to 151.85%. The 91-day and 364-day instruments recorded 833.06% and 17.74% performance rates, respectively. All rates were firmly above the 12% mark in the week.

Treasury Bonds: Across the re-opened FXD1/2016/10 and new five-year FXD1/2023/05 Treasury bonds, the total bids received at cost were KES 26.6B and KES 29B, respectively. The CBK accepted KES 15.7B and KES 22.8B, bringing the weighted average rate of accepted bids to 16.3% and 16.8%, respectively. The performance rates were 56.6% and 72.7%, respectively. Notably, the new bond opened in the year - the FXD1/2023/05, had a 16.844% coupon rate, hovering around the 17% mark.

Eurobonds: In the week, the yields fell across the 6 outstanding papers on a week-on-week basis.

KENINT 2024 fell the most, down by 179.4 basis points to 11.960%, while KENINT 2034 fell the least, down by 6.2bps to 10.543%. The average week-on-week change stood at 44.02 bps.

The yields were mixed on a year-to-date (YTD) basis, with KENINT falling by 64.3 bps, while for the remaining instruments, they appreciated, with KENINT 2028 rising the most, up by 100.9 bps, while KENINT 2048 rose the least, up by 46.9 bps to 11.293%. The average increase was 50.1 bps.

KENINT 2024 led price gains week-on-week and year-to-date, rising by 1.7% and 3.4%, respectively, to 95.62. The average price change on a week-on-week and YTD basis was -2.1% and 1.0%, respectively.

Market Gleanings

🧾 | Finance Act 2023 | The High Court on 10th July extended the orders preventing the government from implementing the Finance Act 2023. The court dismissed the government’s application to lift the freeze, saying the CS for National Treasury did not provide enough evidence to convince the court to suspend the order. Justice Mugure Thande however granted a request to certify the case as involving significant constitutional issues. The case was referred to Chief Justice Martha Koome who will constitute a bench to hear and determine the matter.

“The applications dated 30th of June 2023 and 1st of July 2023 are hereby dismissed the application dated 29th of June 2023 is hereby allowed, pursuant to Article 165 (4)this matter is certified as raising a substantial question of law and the file is hereby transmitted to the Chief Justice for assignment of a bench of not less than three judges to hear and determine the petition.”

High Court Judge, Justice Mugure Thande

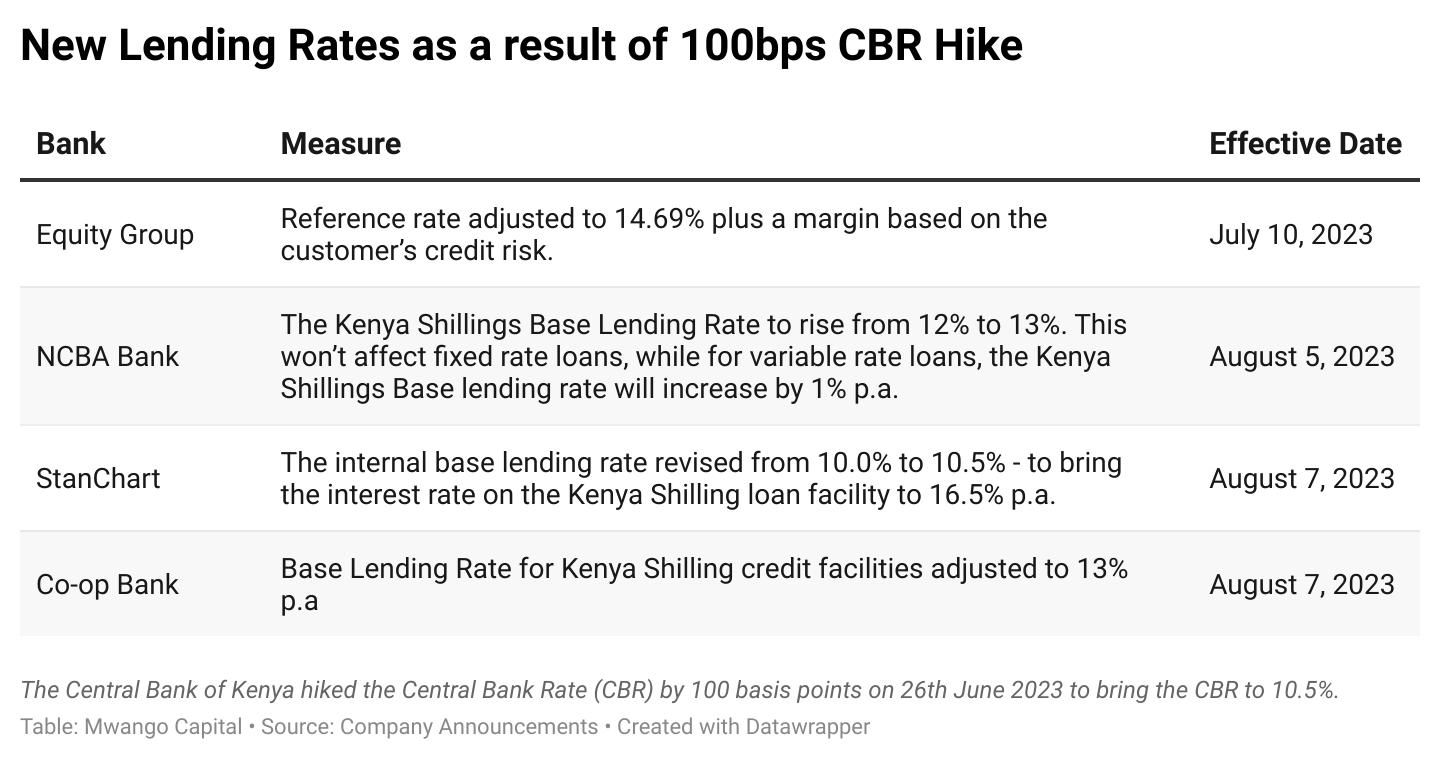

🏦 | Across Banking | Co-operative Bank of Kenya is the latest listed Kenyan bank to adjust its lending rate for Kenya Shilling credit facilities following the 100 bps rate hike by the CBK’s Monetary Policy Committee on 26th June 2023. In the week, the bank also received a 7-year $100M (KES 13.8B) Tier II Facility from a consortium led by DEG for on-lending to Micro, Small and Medium-sized Enterprises in Kenya. Separately, Standard Chartered Bank and Access Bank PLC have entered into agreements for the sale of StanChart’s shareholding in its subsidiaries in Angola, Cameroon, Gambia, and Sierra Leone, as well as its Consumer, Private & Business Banking business in Tanzania. This development is part of StanChart’s plan to exit 7 markets in Africa and the Middle East.

🪓 | Foreign Tech Firms Spared Ceding Stake | Foreign tech firms won’t cede 30% shareholding after the government agreed to delete the rule from the national ICT policy guidelines. The development comes off the back of Amazon’s request to review the rule prior to its entry into the country. Under the requirement, firms had until March 2024 to comply. Earlier in the year, Airtel Kenya stated it would be willing to list its Kenyan operations on the NSE had the government maintained the requirements.

⚖️ | Carbacid - BOC Kenya | The proposed acquisition of BOC Kenya by Carbacid Investments PLC which was announced in November 2020 has faced a series of legal challenges. Lucy Njoroge, a former director of BOC Kenya filed a petition in the high court to halt the takeover but the court dismissed her petition. Another legal challenge was filed by Ngugi Kiuna, the company’s former chairman, and is currently before the Capital Markets Tribunal. The Tribunal will begin hearing several cases, including this acquisition, which has been pending for years due to lack of quorum.

🤝 | Kenya - IMF | On July 17 2023, the IMF Executive Board is set to meet to consider the fifth review of Kenya’s ECF/EFF programme. If approved, Kenya will receive an additional USD 410M, bringing the total IMF support to USD 2.017B under the programme. On 23rd May 2023, IMF staff and Kenya reached a staff-level agreement encompassing commitments to fiscal consolidation, transparency, energy sector reforms and business environment improvement.

“The agreement is subject to IMF management approval and consideration by the Executive Board, which are expected in July. Upon completion of the fifth review by the IMF Executive Board, Kenya would have immediate access to SDR 306.7 million (about US$410M), including from the augmentation of access under the ECF/EFF. This would bring total IMF financial support disbursed under the EFF and ECF arrangements to SDR1,509 million (about US $2,017M). With the EFF/ECF augmentations and the RSF support, the total IMF commitment under these arrangements would be SDR2.633B (about US$3.52B).”

Separately, the IMF has completed its first review of Zambia’s 38-month Extended Credit Facility arrangement, allowing for an immediate disbursement of SDR 139.88M ($189M). This brings the total disbursements under the arrangement to SDR 276.79M ($374M).

🗳️ | Diaspora Remittances | In June 2023, remittances totalled $345.9M, up 6.1% year-on-year. On a month-on-month basis, the remittances decreased by 1.8% with the cumulative 12-month remittances to the month ending June 2023 reaching $4.017B.

📄 | Q1 2023 Claims Report | Data by the Insurance Regulatory Authority shows that GA Life Assurance Limited, Capex Life Assurance, and Prudential Life Assurance had the highest claim payment ratios in Q1 2023 at 99.4%, 96.2% and 95.4% respectively.

📉 | NSSF Payout Down 7.9% | In 2022, contributions receivable from members increased by 9.97% to KES 15.9B. Benefits payable fell by 7.9% to KES 5.4B, accounting for 34.1% of contributions receivable [2021: 41.3%]. Investment income grew by 23.9% to KES 26.8B while the change in the market value of investments in the year totalled KES -29.2B [2021: KES 11.5B].

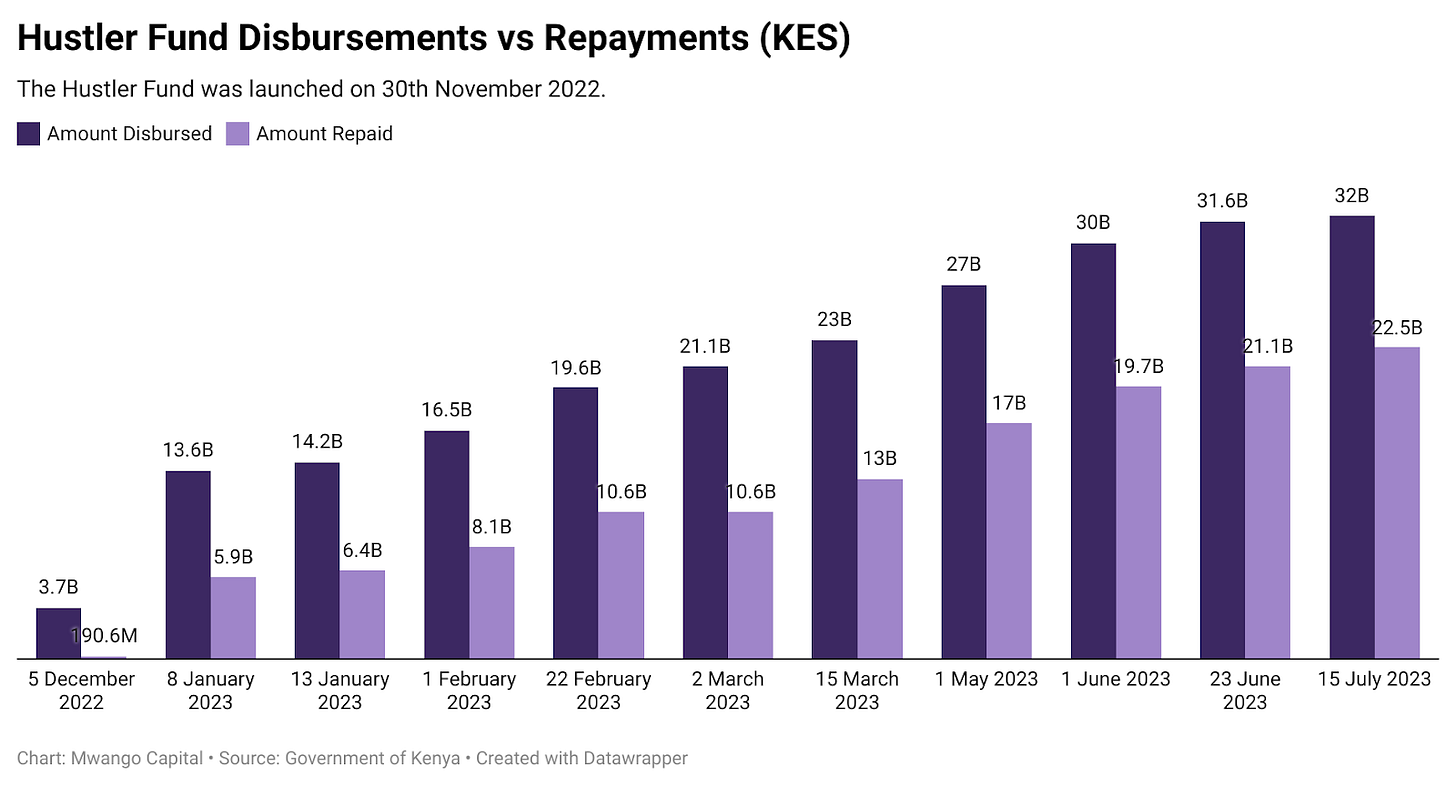

💰 | Hustler Fund | As of 15th July 2023, KES 32B had been disbursed through the Hustler Fund, with the amount repaid standing at KES 22.55B. The total number of borrowers stood at 22M. The aggregate number of transactions done on the platform stood at 46M. The savings account stood at KES 1.6B. Across the Group product, 340,363 groups had been registered with some 402,172 members pending approval. The number of groups cleared to borrow stood at 27,880, with disbursements and savings related to the groups totalling KES 110M and KES 5.4M, respectively.

💲 | Nigeria Eurobond Redemption | On 12th July 2023, Nigeria successfully redeemed a USD 500M Eurobond, fulfilling its debt service obligations. According to its Debt Management Office, the Eurobond was issued in July 2013 for a tenor of 10 years at a coupon of 6.375% per annum. Prior to this redemption, the country had also redeemed a USD 500M Eurobond in July 2018, another USD 500M Eurobond in January 2021 and a USD 300M diaspora bond in June 2022. Nigeria has now redeemed USD 1.8B in securities in the international capital markets.