Fitch Revises Kenya’s Outlook

Long-term foreign-currency IDR revised to negative and affirmed at ‘B’

👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.This week, we cover Kenya’s revised ratings by Fitch, IMF-Kenya Fifth Reviews, BAT Kenya's HY 2023 results, and telecommunication updates.First off, enjoy a dose of our weekly business news in memes.

This week's newsletter is brought to you by:

Co-operative Bank of Kenya. Ready to take control of your financial future? Start your journey to financial success with a YEA Account. Save, invest, and grow your wealth with access to mobile loans and a range of financial benefits.

Fitch Revises Kenya’s Outlook

Downgrade to Negative: Fitch Ratings has revised Kenya’s long-term foreign-currency Issuer Default Rating (IDR) from stable to negative and affirmed the IDR at ‘B’. The review comes on the backdrop of heightened funding requirements, higher financing costs, weak foreign exchange reserves, and uncertainty around tax revenue.

“The revision of Kenya's Outlook to Negative reflects increased external financing constraints amid high funding requirements, including a USD 2B Eurobond maturity in 2024, weakening international reserves, rising financing costs, and uncertainty regarding the fiscal trajectory, for example, due to execution risks of the announced tax hikes amid social unrest. The rating affirmation balances Kenya's relatively high government debt and external indebtedness and its narrow revenue base against the authorities' commitment to fiscal consolidation anchored by the IMF programme and strong medium-term growth prospects.”

External Funding Requirements: According to Fitch, the total external debt service (amortisation and interest) is set to total USD 4.3B by the end of FY 2023/2024 - equal to 4.3% of GDP. The USD 2B KENINT 2024 Eurobond set to mature in June 2024 is the largest debt service component in the current fiscal year, equivalent to 46.5% of FY 2023/2024 external debt service.

“Fitch assumes that the government will meet its financing obligations in FY24 through a combination of official lending, syndicated loans and a drawdown in reserves. Expected external financing in FY24 includes approximately USD1.0 billion in IMF disbursements, USD1.9 billion in project loans from official creditors and continued use of syndicated loans.”

Weak Forex Reserves: In 2022, Kenya’s foreign exchange reserves fell by 15.2% from USD 8.765B (5.36 months of import cover) as of 6th January 2022 to USD 7.439B (4.17 months of import cover) as of 29th December 2022. In May 2023, the reserves closed at a low of USD 6.297B. On a year-to-date basis, the reserves are down marginally by 1.4% to USD 7B as a result of external disbursements in June.

“External official and commercial disbursements helped reserves recover in June, but we project reserves will decline to USD 7B at end-2024, reflecting financing constraints and persistent depreciation pressures on the shilling. Reserve coverage will then be equivalent to 2.8 months of current external payments, below the projected 'B' median (3.4 months).”

Domestic Debt Markets: Out-of-reach international capital markets have forced Kenya to increase domestic borrowing which has piled pressure on yields. In addition, there has been a frequent under-subsciption of government securities in the domestic debt market, which, according to Fitch, combined with tax revenue shortfalls, has led to the piling of public sector pending bills which were equivalent to 3.8% of GDP as of the end of March 2023.

“Near-term domestic liquidity pressures seem to have eased somewhat, thanks to a USD1 billion World Bank loan disbursed in May, and the sovereign issued long-dated bonds (including a seven-year infrastructure bond) in June. Nevertheless, debt service costs are high and on an increasing trend, creating risks for debt sustainability. We project government interest payments to reach 28% of revenue in FY24, nearly three times the current 'B' median forecast of 10.6%.”

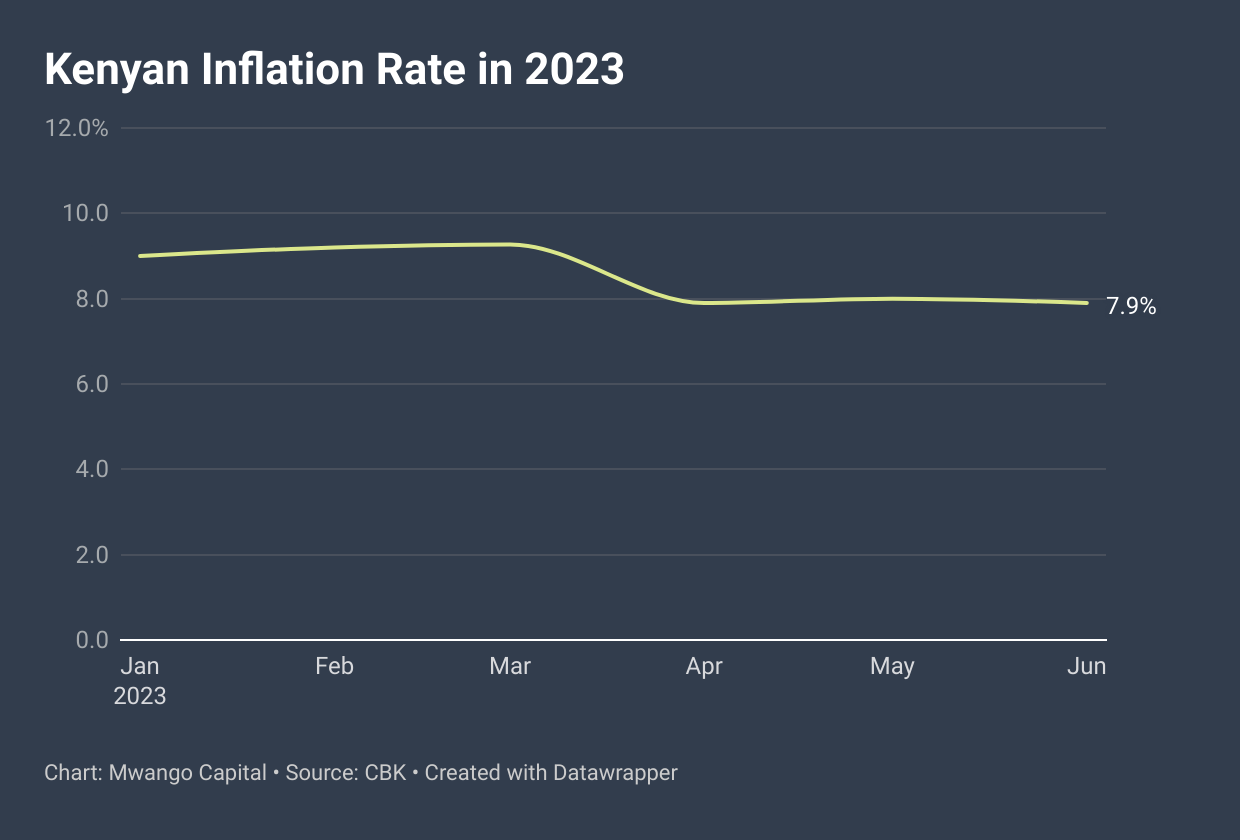

Inflation Outlook: Fitch expects that inflation will average at 8% in 2023, up 40 basis points from 2022, before finally levelling off to below 7.0% in 2024. In the week, the CBK Governor, at the Kenya-DRC Road Show, spoke of inflation possibly retreating to 7.5% by September, October 2023.

“The rate of inflation had accelerated to about 9.6% through October last year and since that time it has kind of trended downward. In June it reached 7.8% and the month before it was 8.0%…We don't expect the inflation to go below 7.5%, however, we have seen indicators that food prices may be coming down, there are indications that food harvest will be quite good in the next 2 to 3 months and therefore we do expect the food inflation component of the CPI to decline substantially. So, maybe by September or October, we would expect that as food prices come down then the overall inflation rate would now come within the band and below 7.5%.”

CBK Governor, Dr. Kamau Thugge

Fiscal Deficit: The projection, according to Fitch, is the deficit declining to 5.5% of GDP in FY 2023/2024 from 6% in FY 2022/2023, which is above the budget target of 4.4%. Kenya’s National Treasury's ongoing fiscal consolidation strategy plans to reduce the deficit from 5.3% in FY 2023/2024 to 3.6% in FY 2026/2027. On revenue collection, Fitch has pointed out that while the Finance Act 2023 could bring in about 1.5% of GDP in more revenue, the numbers could fail to reach this target due to delays in the implementation of the Act. The Court of Appeal is set to determine an application to lift orders barring the Act’s implementation on 28th July 2023.

“Fitch believes that budget projected spending cuts will face offsetting pressure from rising government spending commitments, especially increases in debt servicing costs and government pensions and gratuities. The Finance Bill 2023, which seeks to enhance revenue mobilisation, was signed into law at end-June and could bring about 1.5% of GDP in additional revenue. Although the government has moved ahead with measures including increasing the VAT rate on petroleum products, execution risks are high due to protests and legal challenges.”

Current State of Kenya Ratings: The latest action by Fitch Ratings to revise Kenya’s outlook on long-term foreign-currency Issuer Default Rating from B negative to B stable comes after Moody’s Investors Service downgraded Kenya’s long-term foreign currency and local currency issuer ratings and senior unsecured debt ratings from B2 to B3 earlier in May. All rating actions on Kenya in 2023 by the leading Global Credit Rating agencies including S&P, Fitch and Moody’s have been some form of downgrades.

IMF Completes Kenya’s Fifth Reviews

Highlights: The IMF Executive Board this week completed the fifth reviews under the EFF/ECF arrangements for Kenya allowing for an immediate disbursement of about USD 415.4M. The board also agreed on a 20-month arrangement under the Resilience and Sustainability Facility (RSF) for about USD 551.4M to support Kenya’s efforts to build resilience to climate change. The latest funding brings the total disbursements under the arrangements to SDR 1.51B (USD 2.04B). The Board also extended the EFF/ECF arrangements from 38 to 48 months through 1st April 2025. Key policy priorities include reducing debt vulnerabilities through fiscal consolidation efforts, raising tax revenues, rationalising spending and protecting priority social and development spending.

”The approval of the FY2023/24 Budget and 2023 Finance Act are crucial steps to support ongoing consolidation efforts to reduce debt vulnerabilities while protecting social and development expenditures. The reforms under the RSF program are expected to advance Kenya’s already strong track record at addressing climate-related challenges.”

Kenya Seeks More Funding: Separately, Kenya will look to raise USD 1B (KES 141.4B) through a syndicated loan in August 2023 with the Trade and Development Bank as the arranger. This comes after the recent closing of a similar USD 500M (KES 70.7B) facility through a consortium of banks including Citibank, Rand Merchant Bank, Standard Bank, and Standard Chartered Bank.

Across the Region: In the week, the IMF Executive Board approved a 38-month arrangement under the Extended Credit Facility (ECF) for Burundi, providing financing of about USD 271M, with an immediate disbursement of about USD 62M. The ECF arrangement will help support Burundi’s reform agenda aimed at reducing debt vulnerabilities, restoring external sustainability and strengthening inclusive economic growth and governance.

“Under the ECF arrangement, the authorities aim to recalibrate Burundi’s macroeconomic policy mix. They plan to restore external sustainability with the unification of the official and parallel exchange rate markets and foreign exchange market liberalization, while being attuned to financial sector vulnerabilities.”

Here is a link to IMF’s report on Kenya’s fifth reviews.

BAT HY 2023 Results

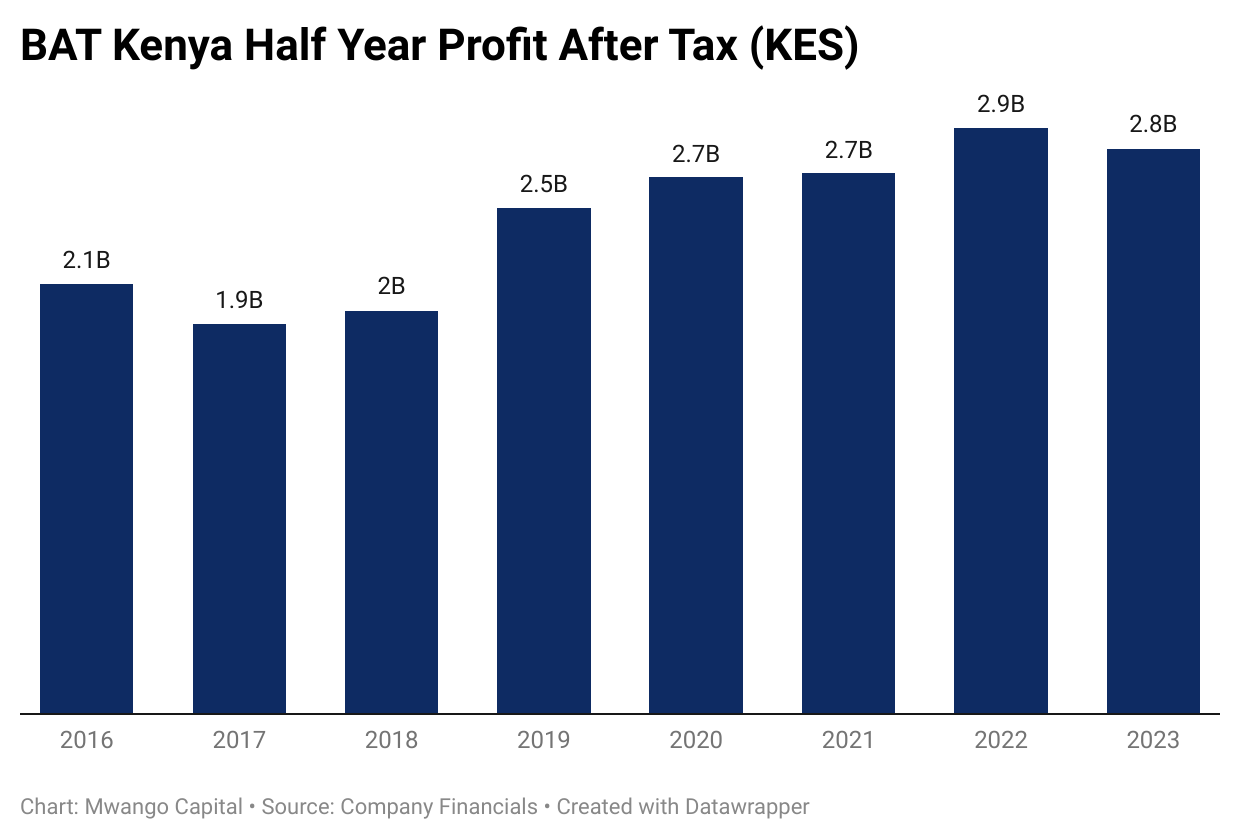

Revenue Dips: Gross sales fell by 4% year-on-year in H1 2023 to reach KES 20.9B. Excise and value-added taxes totalled KES 7.9B, up 1.3%, to account for 37.5% of gross sales [2022: 35.5%]. From data dating back to 2016 however, the percentage of excise duty and VAT to gross sales has fallen by 770 basis points from 45.2% to 37.5% in 2023. The operating profit edged lower by 6.5% to reach KES 3.9B bringing the operating margin to 18.5% [2022: 19%].

Profitability: Pre-tax profits edged lower by 3.5% to reach KES 2.8B while the net result for the year was down 3.5% to KES 2.8B, bringing the net margin to 13.4%, unchanged from 2022 and 2021. Earnings per share stood at KES 28.22, down 3.5%.

Dividend: For the operating period, BAT has announced an interim dividend totalling KES 5 per share. BAT’s dividend policy is to pay not less than 65% of earnings, and data indicates that on a full financial year basis, the dividend payout ratio has averaged 83.7% since fiscal 2018.

“The Board of Directors has approved an interim dividend in respect of the year ending 31 December 2023 of KES 5 per share. The interim dividend, which is subject to withholding tax, will be paid on or about 22 September 2023 to shareholders on the register as at the close of business on 18 August 2023.”

NSE Performance: At the Nairobi Securities Exchange, BAT share price is up 8.2% and 17% year-to-date and over the last 1 year, respectively, to KES 440.

Find a link to the results here.

Across Telecommunication

Vodacom Tanzania Quarterly Results: Vodacom Tanzania reported its trading results for the quarter ending 30th June 2023. Here are the key operating highlights:

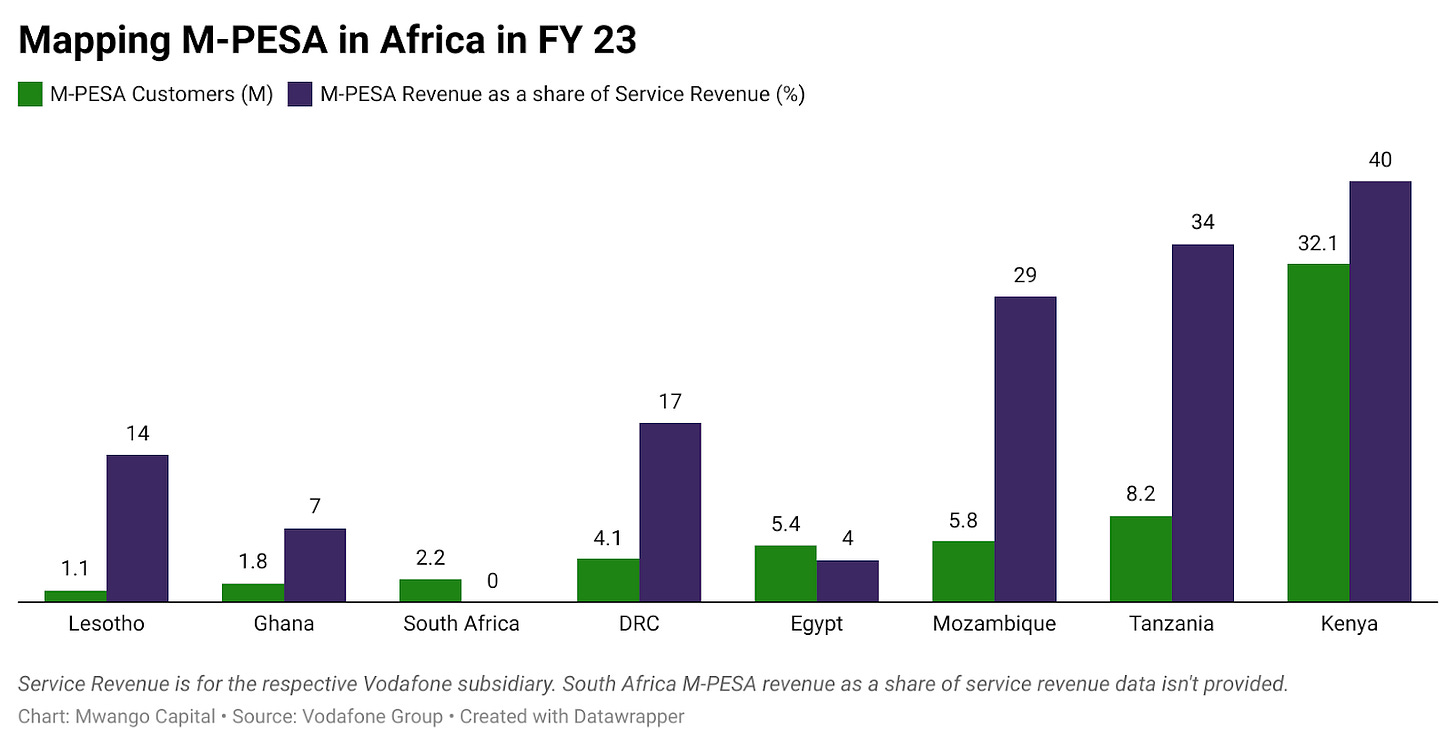

Operational Updates: Customers edged higher by 11% year-on-year to 17.3M. Data and M-PESA customers were 9.2M and 8.2M, up 23.5% and 10.7%, to account for 53.2% and 47.6% of the aggregate customer base, respectively. The Average Revenue Per User stood at TZS 5.4K, up 7.4%.

Financial Highlights: Revenue grew at 60 basis points higher at 8% to TZS 290B (USD 122.2M). Total operating expenses rose by 21% to TZS 113.3B (USD 47.7M) while the operating profits were up 2.2X to TZS 17.7B (USD 7.5M), bringing the operating margin to 6.1% [2022: 3.3%].

FX Losses Impact Earnings: In the operating period, foreign exchange losses weighed heavily on earnings with the company reporting TZS 7.0B (USD 2.9M) in net losses, a reduction of TZS 2.4B (USD 1M) from 2022’s net loss.

“Excluding the impact of foreign exchange losses of TZS 9.9B (USD 4.2M), the underlying performance would be a net profit after tax of TZS2.9B (USD 1.2M). Foreign exchange losses are a result of local currency depreciation driven by varying global economic fundamentals, reflecting economic policies’ changes in the major economies.”

Vodacom Tanzania Managing Director, Philip Besiimire

Here are links to the results and analysis.

Ethio Telecom FY 2022/2023 Results: Ethiopia’s state-owned Ethio Telecom released its results for the fiscal year ending 30th June 2023. Here are some of the key operating highlights:

Revenue: The company reported a 23.5% year-year-on-year increase in revenue to 75.8B Birr (USD 1.38B) from mobile voice (43.7% of revenue), data& internet (26.6%), international business (9%), value-added service for (6.9%), devices (4.7%), and others (7.2%). The company generated USD 164.1M in foreign exchange from international business.

Subscribers and Integration: The company has a total of 72M subscribers, with 69.5M voice customers, 33.9M data customers and 27.2M Mobile Money (MoMo) subscribers on Telebirr, representing 47.6% of total subscribers. Telebirr has integrated with 23 banks, 136 master agents, 521 institutions, 615 service centres and 107.3K agents.

MoMo Gaining Traction: Across newly-launched micro-loan and micro-saving products, Telebirr micro-loan customers reached 2.4M with 4.1B Birr (USD 74.7M) in micro-loans, while micro-saving customers totalled 768K with 3.6B Birr (USD 65.6M) in micro-savings. Ethio-Telecom’s partnership with Commercial Bank of Ethiopia launched in June 2023 to provide more digital financial services realised 155.3M Birr (USD 2.8M) in micro loans to 25,666 customers; with 2,564 customers saving 14.2M Birr (USD 258.6K) within 13 days of launch. Since its launch in May 2021, Telebirr reported 34.3M subscribers and a transaction value of 679.2B Birr (USD 12.4B).

Here are links to the results and analysis.

Starlink Launches in Kenya: In the week, Starlink, a satellite internet company owned by SpaceX, launched in Kenya as part of its expansion in Africa. Starlink’s internet service is delivered via satellites and uses a large constellation of advanced satellites in low earth orbit to provide high-speed and low-latency connectivity. Customers will pay USD 650 for the kit which includes a Starlink dish, mounting stand, cables and a power source with a monthly subscription of USD 46. Karibu Connect, a provider of internet connectivity in East Africa, announced it had been appointed as the first authorised reseller of Starlink in Kenya.

“Karibu Connect will extend Starlink’s high-speed, low-latency connectivity to diverse sectors in rural Kenya, including small businesses, industry, telecommunications, multi-dwelling units, education, tourism and hospitality, maritime, and government organizations. Karibu connect is offering Starlink enterprise services for both fixed and mobile applications, including vehicle-mounted solutions for use on the go or on boats and ships operating both inland and offshore.”

Markets Wrap

NSE: In Week 29 of 2023, CIC Insurance was the top-performing stock on the Nairobi Securities Exchange, appreciating by 10.6% to KES 2.2. TransCentury was the worst-performing stock, falling 16.9% to KES 0.59. All indices were in the red, with NSE 20, NSE 25, and the NSE All Share Index (NASI) edging lower by -0.7%, -1.3% and -2.9%, respectively to close at 1,613.1, 2,864.7 and 110.7 points, respectively. Equity turnover increased by 3.8% to KES 802.6M while bonds turnover increased by 12.2% to KES 14.1B.

Treasury Bills: The weighted average interest rate of accepted bids for the 91-day, 182-day, and 364-day closed at 12.233%, 12.322% and 12.708% respectively. The total amount on offer was KES 24B with the Central Bank of Kenya (CBK) accepting KES 36.7B of the KES 39.5B bids received, to bring the aggregate performance rate to 164.5%. The 91-day and 364-day instruments recorded 711.59% and 23.77% performance rates, respectively. All rates were firmly above the 12% mark in the week.

Treasury Bonds: Across the tap sale issues of FXD1/2016/10 and FXD1/2023/05, the total bids received at face value were KES 32.2B and KES 12.2B, respectively. The CBK accepted KES 31.2B and KES 12.2B, bringing the weighted average rate of accepted bids to 16.3% and 16.8%, respectively. The aggregate performance rate was 222.1%.

Market Gleanings

📈 | Kenyan Banks NPLs | According to EFG Hermes, the non-performing loans ratio of Kenyan banks might rise by 100 - 200 bps by the end of Q3 2023 as a result of delays in government payments and lacklustre macro.

“After 2020, when banks took significant provisions, we thought the NPL ratios would start to normalize, maybe even go back to single digits. This hasn’t happened, clearly, and as things stand, the NPL ratio has been ticking up.”

EFG Hermes Director of Frontier Banks, Ronak Gadhia

🧾 | Update on TRIFIC | Two Rivers International Finance and Innovation Centre (TRIFIC) this week announced the appointment of Brenda Mbathi as its First CEO and Justus Kariuki Mate as its COO. Mbathi was previously the President & CEO of General Electric East Africa, while Kariuki was the Executive Vice President at Tatu City. TRIFIC has also completed the acquisition of certain assets of Two Rivers Development Limited (TRDL), including development rights on the Two Rivers land. Three international companies have already booked office space, with a pledge to create 5,400 jobs by the end of 2023. Bookings have also commenced for the upcoming TRIFIC Tower Two, with a completion date of Q4 of 2024.

“The appointments of the TRIFIC executive team and the successful acquisition of assets from TRDL, including development rights on the Two Rivers land, means it is now all systems go at the Special Economic Zone.”

Centum Investment PLC CEO, Dr. James Mworia

Separately, Centum PL, set to release FY 2022/2023 earnings on 28th July 2023, has issued a profit warning as a result of recent transactions around TRIFIC which impacted Group earnings:

“Centum Investment Company Plc took up the offer by TRDL and acquired the balance of the undeveloped land of TRDL and secured the gazettement of part of the property as a special economic zone. Following this sale and based on a review of the business plans of TRDL, the Board of TRDL made a prudent decision to impair the balance of the unsold assets on its balance sheet. Although TRDL is a 58% subsidiary of Centum, International Financial Reporting Standards require that the performance of this entity be fully consolidated into the group financials of Centum. These impairments will result in Centum’s consolidated profit/loss being at least 25% lower than that recorded in FY 2022.|”

Centum Investment PLC CEO, Dr. James Mworia

💰 | Hustler Fund Update | As of 16th July 2023, KES 33.1B had been disbursed through the Hustler Fund, with the amount repaid standing at KES 22.5B. Total opted-in customers stood at 20.7M with repeat customers at 7.2M. The aggregate number of transactions done on the platform stood at 45.8M. The savings account stood at KES 1.7B.

💲 | East Africa FDI | According to the United Nations Conference on Trade and Development, Foreign Direct Investment (FDI) to East Africa increased by 3% year-on-year to USD 9.7B (KES 1.4T). Flows to Ethiopia were USD 3.7B, down 14% from 2021. Greenfield projects had a significant impact on flows to Uganda and Tanzania.

“In Uganda FDI rose by 39% to USD1.5B. Two large greenfield projects were announced by TotalEnergies (France): the development of the Lake Albert oil field in a joint venture with China National Offshore Oil Corporation and the Uganda National Oil Company for USD 6.5B, and the construction of the 1,440-kilometre East African Crude Oil Pipeline in a USD 3.5B joint venture with the Uganda National Oil Company, the Petroleum Development Corporation (United Republic of Tanzania) and the China National Offshore Oil Corporation. FDI to the United Republic of Tanzania rose by 8% to USD 1.1B; the number of announced greenfield projects in the country rose by 60%; the number of international project finance deals also increased.”

🌐 | Global Indebtedness | In 2022, global public debt accounted for 95% of GDP or USD 92T in absolute terms, 5X 2002 levels. In contrast, global GDP has grown 3X over the same timeframe. On average, global debt per capita stands at USD 11.7K (KES 1.7M) compared to global GDP per capita of USD 12.2K (KES 1.7M). Developing countries accounted for 30% of the debt or USD 28T, with 70% or USD 20T outstanding to China, India and Brazil.