Kenya Eyes $1.5B UAE Financing

The facility is aimed at plugging the fiscal deficit in FY 2024/2025

👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover Kenya’s engagement with the UAE for a USD 1.5B facility, telecom sector updates, and Unga Group FY 24 results.Note: We have reserved the sections after the first story for our paid subscribers. Please consider subscribing to keep enjoying our newsletter.

Kenya in Talks with UAE for USD 1.5B Loan

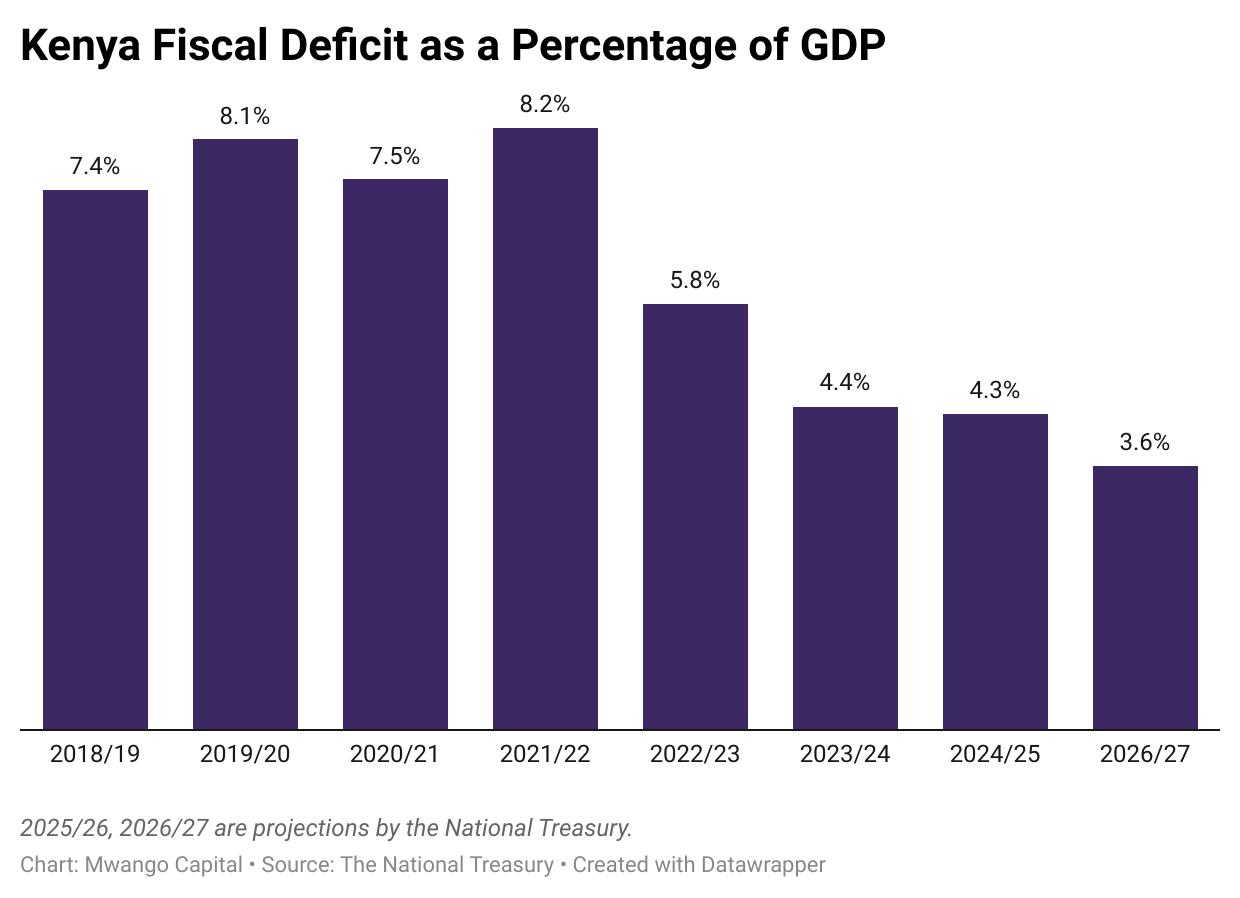

USD 1.5B Debt at 8.2%: The Kenyan government is currently in talks with the United Arab Emirates for a USD 1.5B facility bearing an interest rate of 8.2%. This is 1.55% lower compared to the USD 1.5B eurobond debt secured in February this year which was promptly utilised to buy back part of the KENINT 2024 USD 2B eurobond that matured in June. The ongoing talks with the UAE aim to plug the fiscal deficit in FY 2024/2025, cognizant of the developments around the Finance Bill, 2024, that have thrown the FY 2024/2025 revenue-raising measures into disarray. The fiscal deficit is estimated to be around 4.3% of GDP in the current financial year.

Diversification of Sources: The rejection of the Finance Bill, 2024, along with the legal challenges that have affected the Finance Act, 2023, the government is finding it challenging to work the fiscal. The delay in the approval of USD 600M in funds under the seventh reviews of the Extended Credit Facility (ECF) and Extended Fund Facility (EFF) in Kenya’s current programme with the IMF has also thrown a spanner into the works, leaving the government to source external financing from other sources, including the UAE as is currently the case.

Growing UAE - Kenya Cooperation: There has been growing engagement between Kenya and Abu Dhabi as evidenced by the various high-level engagements and agreements between the two countries. In Q1 2023, the government entered into a Government-to-Government (G2G) oil deal with the Kingdom of Saudi Arabia’s Saudi Aramco and UAE’s Abu Dhabi National Oil Company to supply diesel and petrol. The main purpose of the G2G framework at its inception was to alleviate the pressure on the US dollar supply in the country by shifting from spot USD payments for oil to having in place a 180-day letter of credit allowing OMCs to pool funds in a Kenya shilling escrow account for onward dollar conversion to effect the external payments

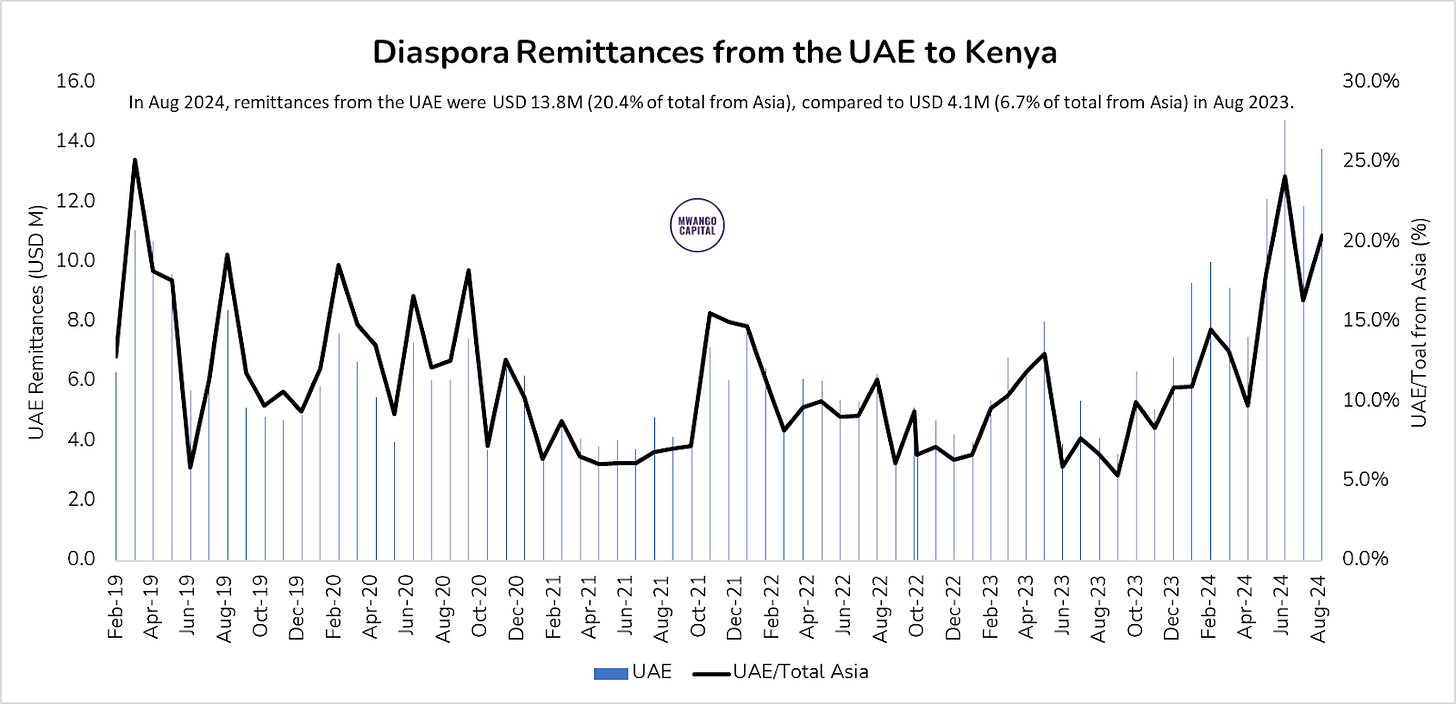

Earlier this year, ADQ, an Abu Dhabi Investment Fund with USD 199B (KES 26.8T) in assets under management (AUM) as of April 2024, announced that it had set up a finance and investment framework with the National Treasury to explore investments of up to 0.5% of Kenya’s GDP (USD 500M / KES 67.4B) in Kenya’s economy. Diaspora remittances from the UAE to Kenya have grown 3X between August 2023 to August 2024 to become the second largest source of remittances from Asia after the Kingdom of Saudi Arabia. To put this further into perspective, the remittances were USD 13.8M in August 2024, compared to Australia’s USD 18.7M, Germany’s USD 15.8M, Canada’s USD 11.3M,

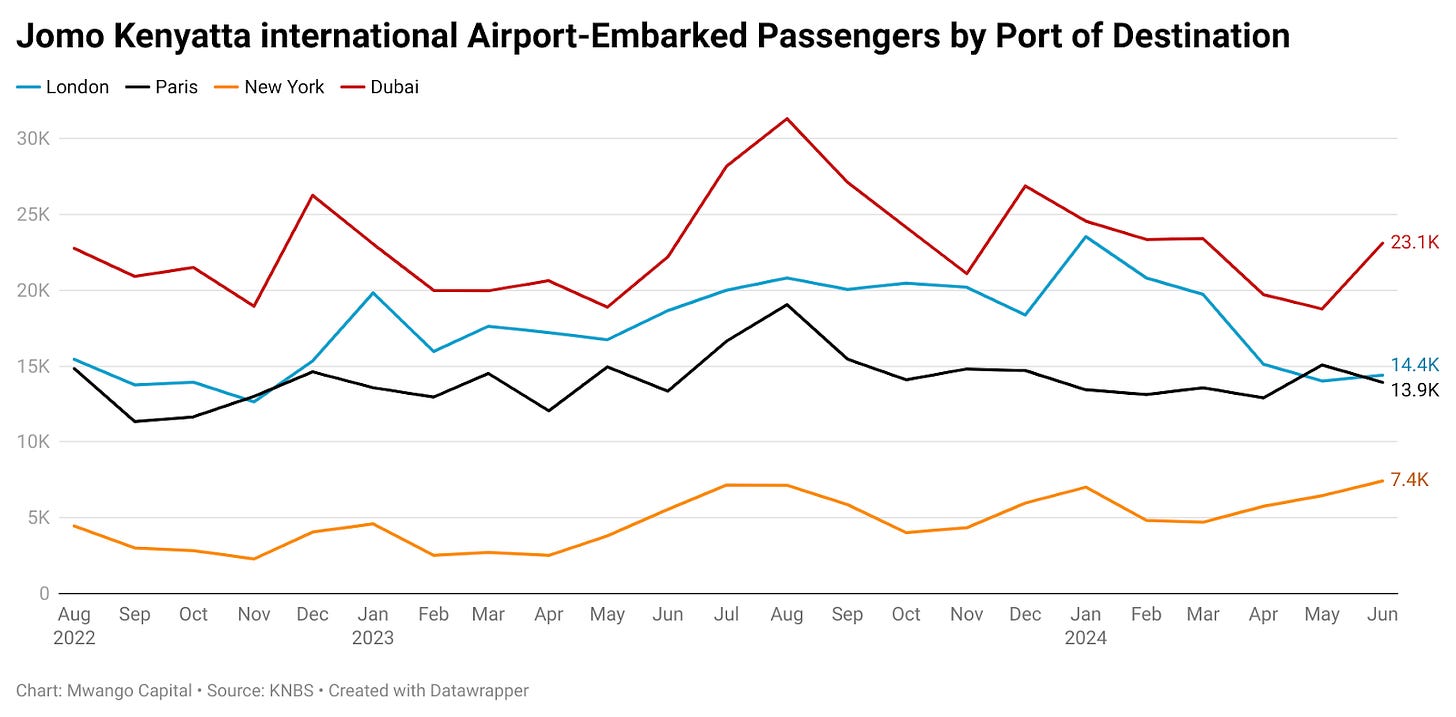

Across aviation, in November 2022, Kenya Airways launched a Mombasa to Dubai direct flight route operating four times a week. Fly Dubai airline also launched 4 direct weekly flights from Moi International Airport in Mombasa to Dubai International Airport in a move aimed at adding the options available to travellers on the route. Further, Air Tanzania also announced the launch of a direct flight from Dar es Salaam to Dubai effective 31st March 2024, underscoring the growing integration between the region and the UAE.

In terms of trade, Kenya’s trade relations with the UAE have continued to evolve, with the Gulf nation ranking as the second largest major source of imports behind China. Imports of petroleum products are key here given that the country mostly sources its oil from Dubai. While the UAE remains a relatively modest destination for Kenyan exports compared to other nations, there has been significant growth in bilateral trade. From August 2022 to July 2024, Kenyan exports to the UAE surged 1.3 times, marking one of the top growth rates across the period when compared to other regions. Uganda led the pack with exports growing 1.8 times, while outside of Africa, Germany, recorded the highest growth rate at 1.7. Pakistan and the Netherlands followed closely, with growth of 1.4X each.

This week's newsletter is brought to you by The Kenya Mortgage Refinance Company. First-time homebuyer? Confused about repayments? KMRC can help! Get the info you need to navigate homeownership finances with confidence.

Learn more: KMRC website.

Telecom Sector Updates

Keep reading with a 7-day free trial

Subscribe to The Mwango Weekly to keep reading this post and get 7 days of free access to the full post archives.