👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover the decision by the Central Bank of Kenya’s Monetary Policy Committee to hold rates, the KNBS's Economic Survey 2024, and the Q3 2023/2024 Quarterly Economic and Budgetary Review (QBER).This week's newsletter is brought to you by The Kenya Mortgage Refinance Company.

First-time homebuyer? Confused about repayments? KMRC can help! Get the info you need to navigate homeownership finances with confidence. Learn more: KMRC website.

MPC Holds the CBR Steady

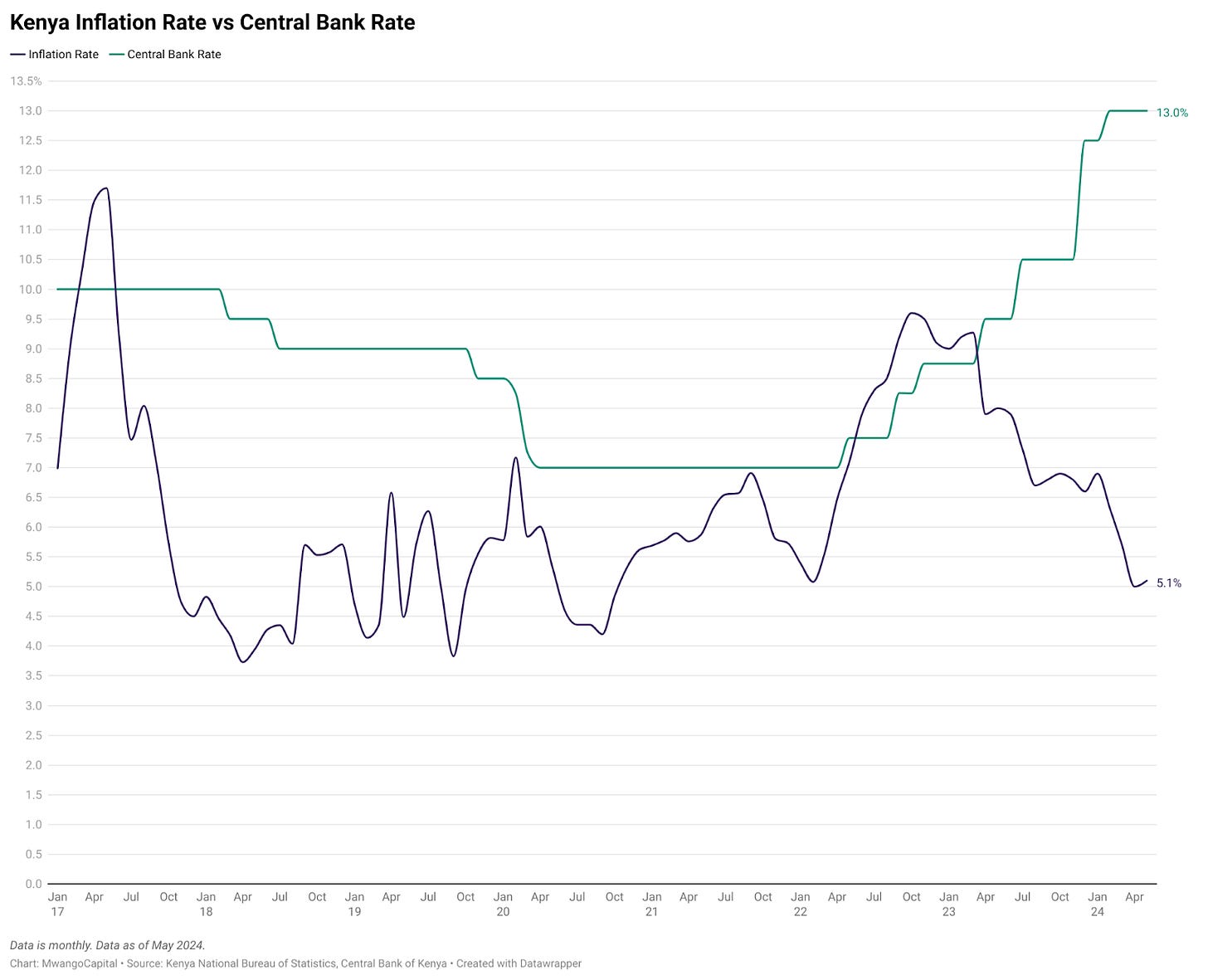

Rates Held Steady: This week, the Monetary Policy Committee (MPC) of the Central Bank of Kenya (CBK) decided to keep the central bank rate (CBR) steady at 13.00%, as expected, for the fifth sitting in a row. This decision aligns with expectations, reflecting the CBK's commitment to a higher interest rate environment for an extended period. In a notable move, the committee narrowed the interest rate corridor to ±150 basis points (bps) from the previous ±250 bps around the CBR. Additionally, the discount window rate was adjusted to +300 basis points above the CBR, down from +400 basis points. These changes suggest a possible inclination toward future rate cuts. Here is what the governor had to say on the MPC’s decision to hold rates:

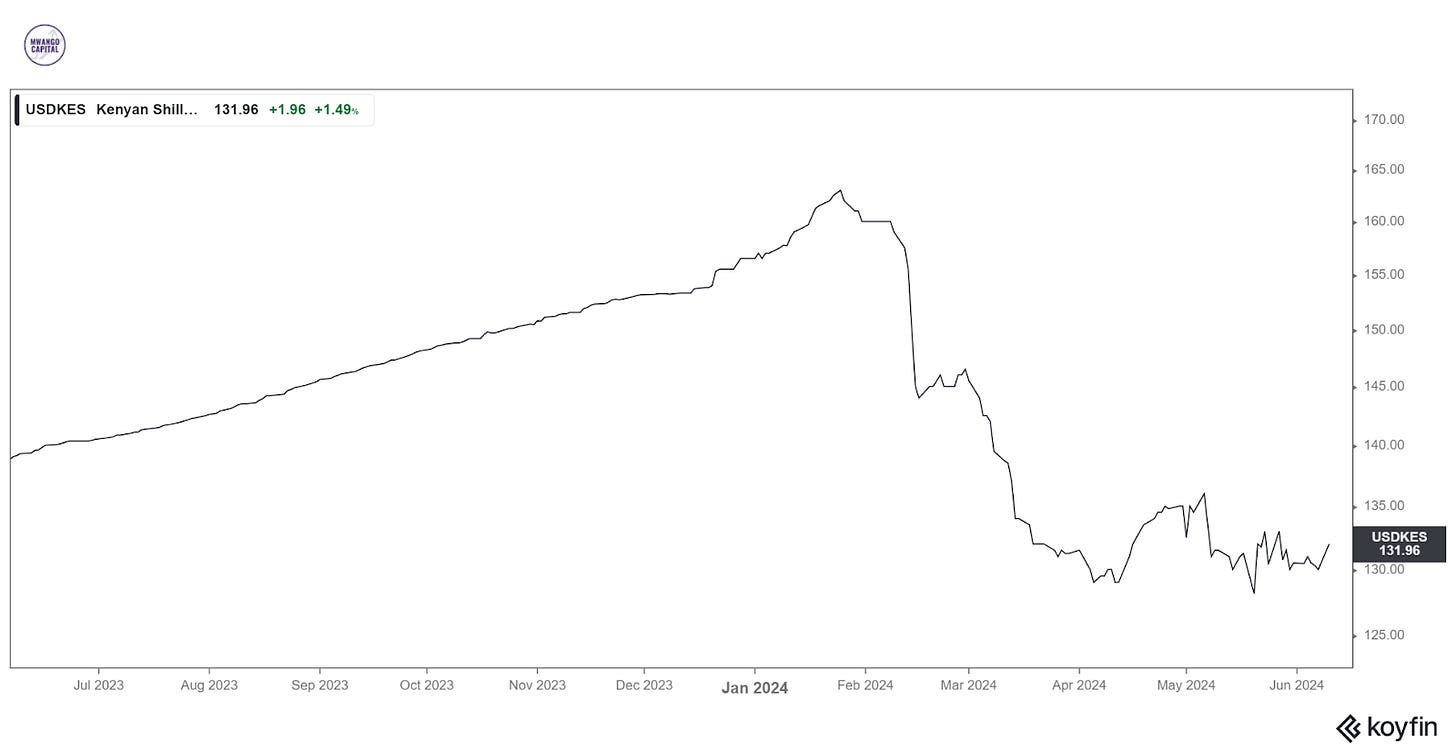

"The decision by the MPC took into account global developments and from what we see at the global level is that inflation rates have been quite sticky, and if you look at the US, it's only now that they have been able to go below 3.5% inflation, now it's 3.4%. There is some stickiness and because of that stickiness, they have also delayed reduction in their policy rates. Therefore, the expectation is international interest rates will remain higher for a much longer time than we had anticipated. And we have to be very cautious that we don't take measures here that will cause the same kind of problem that we had last year, which is to again widen the interest rate differentials between Kenya and those advanced economies whereby we again see capital flowing out because return is lower than abroad. That starts to put pressure on the exchange rate, the pressure on the exchange rate starts to put pressure on imported inflation, on fuel inflation, and we go back to the situation where we were with a depreciating exchange rate and higher inflation."

Central Bank of Kenya Governor, Dr. Kamau Thugge

According to Goldman Sachs Analysts Bojos Morule and Andrew Matheny, the decision by the CBK to hold rates constant was underpinned by inflation coming to the midpoint of the target on the back of the strengthening of the Kenya Shilling. Goldman Sachs predicts that the CBK will start cutting rates from Q3 2024.

"In our view, the MPC maintained a balanced tone in its statement. We continue to expect the CBK to deliver its first policy cut of the cycle in Q3 2024."

Goldman Sachs Analysts, Bojos Morule and Andrew Matheny

Surging NPLs: A critical concern highlighted in the MPC press release is the alarming rise in the banking sector’s stock of Non-Performing Loans (NPLs), which reached an 18-year high of 16.1% in April 2024, up from 15.5% in February 2024, indicating strain across the client base in servicing their facilities.

Framework Reviewed: The MPC also reviewed the new monetary policy implementation framework introduced on 9th August 2023 targeted at improving the functioning of the interbank market, which set a corridor around the CBR at ± 250 basis points (bps). According to the MPC, the framework has narrowed interest rate spreads and improved the transmission of monetary policy, and in this regard, the MPC decided to reduce the corridor from CBR ± 250 basis points to CBR ± 150 basis points. Further, the MPC also approved the recommendation to cut the applicable interest rate through the discount window to 300 bps above the CBR from the current 400 bps.

“We believe that moving in this direction will improve the effectiveness of monetary policy and make the transmission of the changes of policy by the Monetary Policy Committee transmit quicker and more effectively to the economy.”

Central Bank of Kenya Governor, Dr. Kamau Thugge

Salient Macro Data: In the 12 months to April 2024, exports grew by 2.9% vis-a-vis the 7.7% decline recorded on imports, but the latest data for January to April 2024 has shown that exports were up 15.2% year-on-year, with imports ticking up 2.2% higher.

"The 12-month exports through April compared to the same period in 2023 show an increase of 2.9%. However, if we just take the first 4 months of 2024 & compare them with the first 4 months of 2023, we see a significant improvement in exports of 15.2%."

Central Bank of Kenya Governor, Dr. Kamau Thugge

Local currency-denominated commercial bank credit to the private sector grew by 14.3% in April 2024, compared to a decline of 14.2% in foreign currency-denominated loans as a result of the movement of the exchange rate. Overall, growth in commercial bank credit to the private sector was 6.6%, 130 bps lower than the 7.9% recorded in March 2024. The governor further highlighted the improved performance of diaspora remittances, which edged higher by 4% from January to April 2024.

"Diaspora remittances continue to perform very well, and in 2023, they recorded a 4% increase in the first four months of this year. We have seen a significant improvement over last year of 20%, and we expect this to continue."

Central Bank of Kenya Governor, Dr. Kamau Thugge

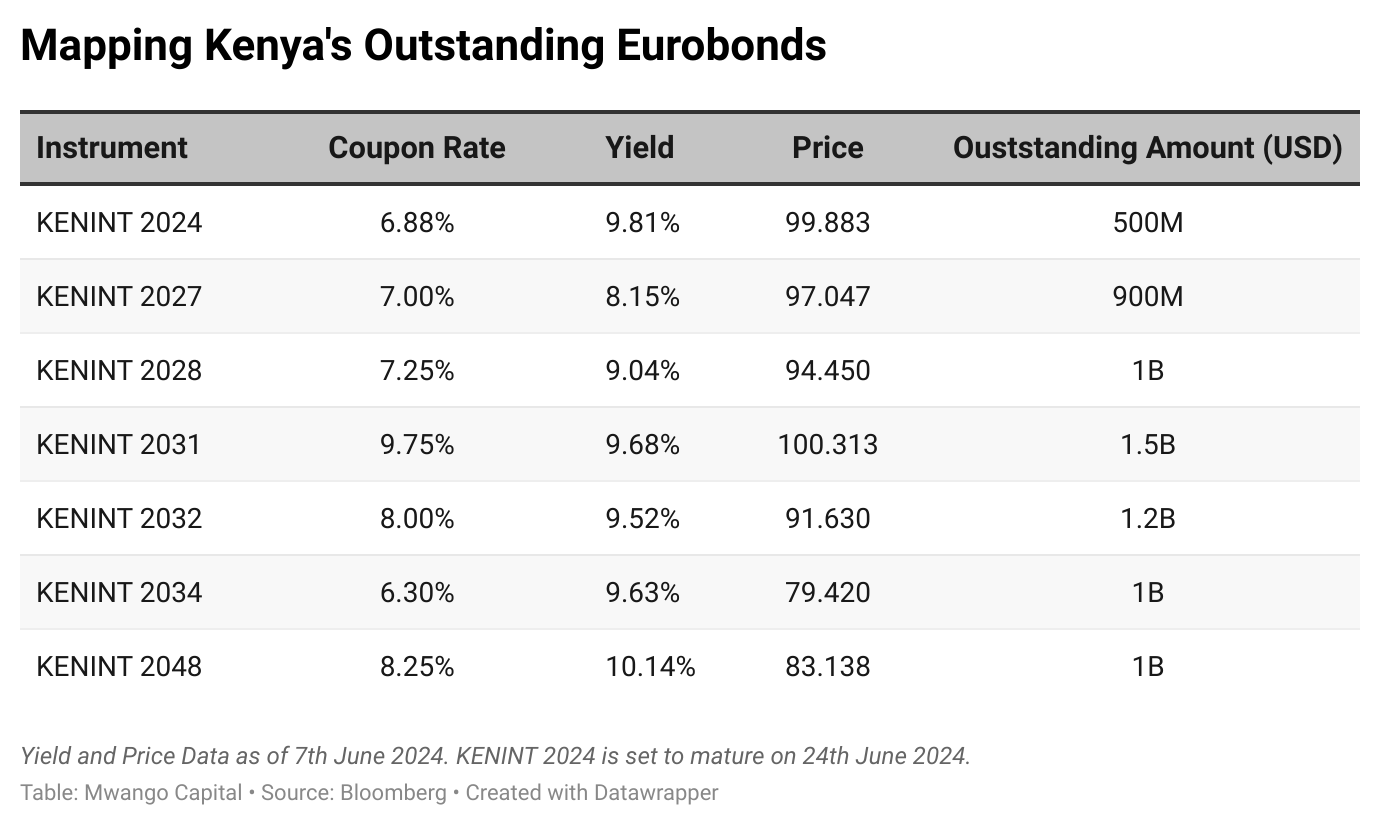

Another Buyback? In an update on Kenya released in the week, the World Bank highlighted that Kenya is considering another Eurobond buyback in 2024 totaling USD 1B, which could likely be executed in H1 FY 2024/2025 given that FY 2023/2024 is winding up. Earlier this year, the government bought back USD 1.5B of the USD 2B KENINT 2024 eurobond which is set to mature on 24th June.

“The GoK is considering another Eurobond buyback in 2024, bringing the total 2024 buyback to approximately USD 2.5B, smoothing the amortization profile as was done for the recent issuance which was smoothed over 3 years.”

Here is what the governor had to say on the settlement of the eurobond maturing at the end of this month:

"We do expect some disbursements from the World Bank of about $1.2B related to the development policy operations. Part of that disbursement will be used to settle the USD 500M of the remaining eurobond."

Central Bank of Kenya Governor, Dr. Kamau Thugge

Shilling’s Stability: The governor emphasized the recent stability of the USD/KES exchange rate, attributing it to increased foreign exchange inflows counterbalancing market demand. Recent market data underscores this stability, with the exchange rate consistently oscillating between 130 and 135 over the past few months. When asked about whether this range represents the equilibrium given recent trends, the governor provided the following insights:

“Recently, the inflows of foreign exchange have been somewhat higher than the demand, and so we expect going forward, a fairly stable exchange rate. We don’t see a significant strengthening or significant weakening. I think there should be stability now in the exchange rate. This will continue to be market determined and we will intervene when we need to if there is excessive volatility on either side but we will let the market determine.”

Central Bank of Kenya Governor, Dr. Kamau Thugge

Find the press release here, the post-MPC media briefing here, and a thread with key highlights from the press briefing here.

2024 Economic Survey

The Kenya National Bureau of Statistics released the Economic Survey 2024 and here are a few key highlights:

Kenya’s KES 15.1T GDP: In 2023, Kenya’s real Gross Domestic Product (GDP) grew at 5.6%, from a revised growth of 4.9%. In nominal terms, the GDP expanded by 12% year-on-year to reach KES 15.1T. Across sectors, Agriculture was the top contributor to nominal GDP at 21.8%, followed by Transportation and Storage at 13.6%, Real Estate at 8.4%, and Financial and Insurance activities at 7.8%.

Capital Formation: Gross Fixed Capital Formation (GFCF) entails the improvements in land, acquisition of equipment, road construction, and set up of private residential dwellings, commercial, and industrial buildings. At current prices, GFCF expanded by 3.7% year-on-year to reach KES 2.6T, equivalent to 17.2% of GDP [2022: 18.1%]. Dwellings accounted for the largest share of GFCF assets at KES 892.1B, up 4.1% to account for 5.9% of GDP as compared to 6.2% in 2022.

Informal Sector Employs More: Total employment edged higher by 4.7% to 20M, with formal sector employment expanding by 4% to 3.3M and informal sector employment at 4.5% to 16.7M. The total jobs created in the formal sector was 127.2K, while those in the informal sector were 720.9K, constituting 85.1% of all the 848.1K new jobs created.

Manufacturing Sector: The sector expanded by a marginal 2.0% year-on-year in 2023 with the value of output growing by 13.1% to reach KES 3.6T, equivalent to 23.8% of GDP [2022: 23.2%]. Value added edged higher by 10% to KES 1.1T, and the compensation of employees in the sector amounted to KES 283.1B, representing a 9.6% growth. Credit extended to the sector by commercial banks and industrial financial institutions was KES 639.0B, up 20.8%, equivalent to 21.6% of total commercial bank lending to the private sector [2022: 16.3%].

Banking Sector: The highlight in 2023 was the reduction in commercial bank credit to the private sector, which amounted to KESS 2.96T, coming in at the sub-KES 3T mark as compared to the KES 3.3T advanced in 2022. In sum, total commercial bank credit was KES 4.4T, up 6.6% to represent 84.4% of commercial banks assets [2022: 82.2%].

Find the entire document here.

QEBR Q3 2023/2024 Highlights

The National Treasury released the Quarterly Economic and Budgetary Review for the quarter ending 31st March 2024 (Q3 2023/2024). Here are some of the key takeaways from the report:

Economic Growth: In 2023, the Kenyan economy grew by 5.6% from a growth of 4.8% in 2022. The growth was primarily underpinned by a rebound in agriculture activities and a continued resilience of the service sector.

Balance of Payments: The current account deficit improved to USD 4.5B, equivalent to 4.3% of GDP in February 2024 [2023: USD 5.3B (4.5% of GDP)]. The capital account, which tracks net investment flows into the country, recorded a USD 1.4M decline to a USD 132M surplus.

Revenue and Expenditure: Total revenue collection as at 30th March 2024 was KES 1.91T, up 13.8%. Ordinary revenue was KES 1.6T accounting for 82.6% of total revenue, down from 85.5% in Q3 2022/2023. The aggregate expenditure and lending was KES 2.63T, out of which KES 1.9T [72.5%] was recurrent expenditure [Q3 2022/2023: 73.9%].

Pending Bills: As at 31st March 2024, the gross outstanding national government pending bills were KES 486.9B. State corporations accounted for the bulk at 83.3% [KES 405.4B], while Ministries, Departments and Agencies (MDAs) accounted for KES 81.5B [16.7%].

Public Debt: Domestic debt grew by 13.5% to KES 5.2T, while external debt increased by 6.4% to KES 5.1T [49.5% of gross debt] [2023: 51.16%,]. In sum, gross public debt crossed the KES 10T mark to reach KES 10.4T, up 9.8%.

Debt Service: During the period ending 31st March 2024, the government paid KES 17.4B in guaranteed debt owed to Kenya Airways, consisting of KES 14.3B in principal and KES 3.1B in interest. The aggregate external debt service payments to external lenders amounted to KES 632.2B, out of which 70.3% [KES 445.1B] was principal and 29.7% [KES 188.1B] in interest. 56.2% of the total external debt service was to commercial creditors [bilateral: 30.7%, multilateral:13.1%].

Find the entire document here.

Markets Wrap

NSE: In Week 23 of 2024, BK Group was the top-performing stock, up 13.9% to close at KES 36.10. TransCentury was the worst-performing stock, down 13.5% to close at KES 0.45.. The NSE 20 was up 2.3% to close at 1,762.7 points, the NSE 25 surged by 0.8% to close at 2,984.2 points, while the NASI index went up 1.4%, to close at 114.6 points. Equity turnover remained unchanged at KES 11.7B similar to the prior week while bond turnover remained steady at KES 28.72B with no changes from the prior week.

Treasury Bills: The weighted average interest rate of accepted bids for the 91-day, 182-day, and 364-day were 15.9654%, 16.6405%, and 16.7311% respectively. The total amount on offer was KES 24B with the CBK accepting KES 34.16B of the KES 36.23B bids received, to bring the aggregate performance rate to 150.98%. The 91-day and 364-day instruments recorded 626.53% and 52.00% performance rates, respectively.

Treasury Bonds: In the T-bonds market, the total bids received in the reopened sale of FXD1/2023/02 and FXD1/2024/03 treasury bonds were KES 32.8B out of a target amount of KES 30B, bringing the performance rate to 109.5%.The CBK accepted KES 30.9B in bids bringing the acceptance rate to 94%.

Eurobonds: In the week, the yields were mixed across the 7 outstanding papers.

KENINT 2024 and KENINT 2048 were the only papers whose yield rose week-on-week, up 59.20 bps and 7.20 bps to 9.814% and 10.138%, respectively. The other papers recorded declines, led by KENINT 2028 at 9.10 to 9.044% while KENINT 2034 declined the least, down 2.20 bps to 9.627%. The average week-on-week change stood at 5.53bps.

With the exception of KENINT 2034 and KENINT 2048 which gained 29.00bps and 1.10 bps, yields on the remaining papers declined on a year-to-date (YTD) basis, with KENINT 2024 falling the most by 271.60 bps followed by KENINT 2027 at 88.40 bps to 8.145%.

All prices rose week-on-week, except KENINT 2024, which was flat at 99.883, and KENINT 2048, which fell by 0.7% to 83.138. YTD, KENINT 2028 rose the most at 2.9% to 94.450, followed by KENINT 2024 at 2.5%. Only the KENINT 2034 price fell YTD, down 1.3% to 79.420.

Market Gleanings

🤝| Kenya -South Korea Deal | Across the sidelines of the 2024 Korea-Africa Summit held in Seoul, South Korea, from 4th to 5th June 2024, Kenya and South Korea inked a concessional development funding agreement worth USD 485M (KES 62.8B) equivalent to 0.4% of Kenya’s GDP. This includes a substantial allocation of USD 238M (KES 30.8B) for the Konza Digital Media City Project.

📊| Stanbic Bank Kenya PMI | In May, Stanbic Bank Kenya’s Purchasing Managers’ Index (PMI) reached 51.8, its highest level since January 2023, indicating a significant improvement in private sector business conditions. This was driven by a sharp expansion in activity, the strongest in 20 months, due to falling cost burdens and rising new business. Input costs fell for the second consecutive month, largely due to reductions in fuel prices and import costs, enabling Kenyan firms to increase their output for the first time since February.

🔴| NMG’s Workforce Reduction | Nation Media Group (NMG) last week announced a significant strategic transformation to adapt to the digital age. This transformation involves the reduction of its workforce. The decision comes in response to the rapidly changing media landscape, marked by shifts in audience consumption habits, technological advancements, and macroeconomic factors.

🛬| Brussels Airlines Resumes Flights to Nairobi | Brussels Airlines, part of the Lufthansa Group and Star Alliance, last week marked a significant milestone by resuming direct flights to Nairobi after a pause of nine years. The airline will operate six weekly flights, a move that aligns with Kenya’s strategic decision to abolish visa requirements for all international visitors earlier this year.

🛩️ | JamboJet New Route | Jambojet, is set to launch a new direct route from Mombasa to Zanzibar starting July 1, 2024. Initially, Jambojet will operate four flights per week between the two destinations, with plans to increase the frequency to daily flights in the subsequent months.

💼 | Appointments |

Old Mutual: Dr. Habil Olaka, the former CEO of the Kenya Bankers Association was last week appointed as an independent Non-Executive Director at Old Mutual Holdings, effective from June 3, 2024. The appointment is subject to regulatory approval from the Insurance Regulatory Authority.

Standard Chartered: Standard Chartered Bank Kenya announced the appointment of Robert Mbugua as an independent Non-Executive Director effective June 4, 2024. Robert was previously a Partner in the Johannesburg office of PricewaterhouseCoopers (PwC) and subsequently held various senior executive roles within Standard Bank Group.

Unga Group: Unga Group Plc also announced the appointment of James Nyutu as the Acting Group Managing Director effective 4th June 2024. He has been serving as the Group Finance and ICT Director for Unga Group PLC and its subsidiaries.

Standard Group: The Board of Directors of Standard Group last week appointed Marion Gathoga Mwangi as the Group CEO, effective July 15, 2024. She succeeds Joe Munene who has been serving as the acting CEO since July 2023.

💰| IMF Reaches Agreements with Egypt, Zambia |

Egypt: The International Monetary Fund (IMF) and Egypt last week reached a staff-level agreement on a set of comprehensive policies and reforms. This agreement is necessary to complete the third review under the Extended Fund Facility (EFF) arrangement. The agreement is subject to approval by the IMF’s executive board and if approved Egypt will gain access to approximately USD 820M.

Zambia: The IMF in the week also reached a staff-level agreement with Africa’s first pandemic-era defaulter Zambia on economic policies and reforms, marking the successful conclusion of the third review of the Extended Credit Facility (ECF). This comes amidst a challenging economic environment worsened by ongoing drought conditions in the country. The arrangement was initially approved by the board for USD 1.3B on 31st August 2022.