👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover the Central Bank of Kenya’s interest rate hike.This week's newsletter is brought to you by:

Co-operative Bank of Kenya. Pay For E-Citizen services conveniently with Co-op Bank.

CBK’s 200bps Jumbo Hike

200 Bps Rate Hike: The Monetary Policy Committee (MPC) of the Central Bank of Kenya (CBK) surprised the market with a 200 basis points (bps) increase in base rates to 12.5% to bring the CBR to the highest point in 11 years. The hike brings the aggregate rate hikes this year to 375 bps, the highest since 2011 when the aggregate hikes in the year amounted to 1,225 bps. With our data that goes back to June '08, there have been 111 MPC meetings since with 21 increases, 15 decreases, and 75 no-changes. There has never been a 200 bps move until this week but there have been 4 200+ bps moves since. (2 positives in Oct 2011 and Nov 2011 and 2 negatives in Sept and Nov 2012):

“[This was] a significant surprise to our and consensus expectations for rates to be left unchanged. This hike brings rates further into restrictive territory, in our view, as the (ex-post) real interest rate is now 5.7%. The MPC took a decidedly hawkish tone in its statement, highlighting the inflationary and fiscal risks arising from ongoing Shilling depreciation, as well as the risks arising from the recent volatility in international oil prices.”

Goldman Sachs Analysts, Andrew Matheny and Bojosi Morule

“My working assumption has been that the authorities wanted to get the currency to about 5-10% cheap (based on my Real Effective Exchange Rate model) – to help improve the current account and ensure they can meet their forthcoming external debt obligations. Today’s interest rate hike helps ensure some of the highest real interest rates in Africa – which is again helpful in containing inflation. It’s also helpful in reassuring foreign investors about their commitment to macro stability”

FIM Partners Head of Macro-strategy, Charlie Robertson

“We are of the view that the CBK used fuel inflation as a proxy for the FX passthrough as the sub-index contributed 2.9pp to the month’s inflation. Electricity prices and regulated fuel pump prices, which went up by an average 40.0% y/y and 28.8% y/y, respectively, cements our view. The overarching theme of the December 2023 MPC meeting was the emphasis on FX risks. Although overall YTD KES weakness has been 19.5%, the pace of depreciation has moderated to an average of 1.7% m/m in the 3-month period ending November 2023, down from an average of 2.9% m/m in the 3-month period ending April 2023. We think the ongoing efforts to restore the FX interbank market has somewhat cooled the FX pressures lately despite the Governor admitting a lack of ammunition to prop up the local currency since he took the stint in June 2023.”

IC Asset Managers Economist, Churchill Ogutu

Taming the Shilling’s Depreciation: The MPC highlighted the pass-through effects of the weakening Kenya Shilling to inflation was the key factor underpinning the hike with the depreciation contributing to 3.0 pp to inflation in November 2023. By hiking the interest rate, part of the expected outcome is more inflows into the country on account of rising attractiveness of shilling-denominated assets, thereby stemming the USDKES depreciation. Inflation in November closed at 6.8%, down 10 bps from October 2023 to be the fifth consecutive month in which it has remained within CBK’s target of 5.0 +/- 250 bps.

The last time the hikes were this aggressive - in 2011, inflation was in double digits and the shilling on a depreciating trend. Significant hikes in H2 2011 including 400 bps on 5th October, 550 bps on 1st November, and 150 bps on 1st December saw the USDKES close December at 84.95 from 102.10 before the October hike.

The Kenyan shilling is currently exchanging at 153.35 units to the US Dollar, down 24.29% year-to-date and down 25% over the last one year. Month-on-month, the rate of depreciation ticked upwards in November 2023 to 1.8%, upending the downtrend recorded between September and October 2023.

2024 Eurobond Update: Kenya is expecting external flows from regional development banks, with USD 500M expected from the Trade Development Bank in mid-December, out of which USD 300M will be used to buy back part of the Eurobond - in line with the President’s remarks on the partial buyback of the Eurobond by the end of December 2023 during this year’s State of the Nation Address. Further, in the pipeline is a USD 1B China loan before the end of FY 2023/2024, and the CBK Governor has not ruled out its deployment in the settlement of the Eurobond.

“As far as I'm aware, the National Treasury is mobilizing external resources from regional development banks as well as multilateral development banks. And as far as I'm aware the buyback will is still on. Of course, it will also depend on how much money they are able to mobilize quickly. I think it suffices to say that the National Treasury is engaged with the Chinese government to get the USD 1B. The timing of that is still not certain, but I believe that that could be coming in this financial year that will end in June 2024. It could be used to address the maturity of the Eurobond.”

Central Bank of Kenya Governor, Dr. Kamau Thugge

Other Salient Macro Data: In the 12 months to October 2023, goods exports fell by 2.0% year-on-year, while imports were down 14.9% as compared to a 14.7% growth in the same period in 2022. Tourist arrivals grew by 34.2%, while remittances totaled USD 4.165B, up 4.2%. In October 2023, private sector growth grew by a marginal 30 bps to 12.5% from September 2023. The current account deficit is projected to be at 3.7% of GDP compared to an estimated 4.1% in 2023 and 4.2% in 2024.

Banks Adjust Rates: As a result of the hike, banks have started adjusting interest rates in tandem on their Kenya-shilling-denominated facilities.

“Following the adjustment of the Central Bank Rate from 10.5% to 12.5%, Equity Bank wishes to notify our customers and the general public, that the Bank shall, effective 11th December 2023, adjust Equity Bank’s Reference Rate (EBRR) from the current 14.69% to 17.56%. Consequently, the final Interest Rate shall be EBRR (17.56%) plus a margin (currently at a maximum of 8.5%) per annum. This shall apply to all new Kenya-shilling-denominated facilities.”

“We hereby advise that we have reviewed your Kenya Shillings Loan interest rate from 14.50% to 16.50% p.a effective 8th January 2024.”

Fitch Ratings Banking Sector Outlook

Outlook Neutral: Fitch Ratings has issued a neutral outlook on the Kenyan banking sector, highlighting adequate buffers despite the expected fall of asset quality in 2024. Latest data from last week’s MPC indicated the banking sector’s NPL was 15% at the end of August 2023, and Fitch projects it to rise to 16% - 17% at the end of 2023.

"Kenyan banks are exposed to the sovereign through holdings of debt securities, which are largely local-currency assets. The banks’ exposure to Kenyan Eurobonds maturing in June 2024 is generally not material. FC liquidity risks are only moderate due to the banks’ limited FC wholesale borrowings and adequate liquidity buffers."

Markets Wrap

NSE: In Week 49 of 2023, Bamburi was the top-performing stock, up 18.0% to close at KES 41.35. Eveready was the worst-performing stock, down 14.5% to close at KES 1.12. All indices were green, with the NSE 20, NSE 25, NSE 10, NASI rising by 1.3%, 1.1%, 0.6%, and 1.8% to close at 1,513.2, 2,422.22, 926.2 and 93.9 points, respectively. Equity turnover edged higher by 37.2% to KES 1.4B from KES 987.172M in the prior week while bond turnover closed the week at KES 12.2T compared to the prior week’s KES 9.7T.

Treasury Bills: The weighted average interest rate of accepted bids for the 91-day, 182-day, and 364-day were 15.6348%, 15.7487%, and 15.7947% respectively. The total amount on offer was KES 24B with the CBK accepting KES 35.5B of the KES 37.7B bids received, to bring the aggregate performance rate to 156.90%. The 91-day and 364-day instruments recorded 786.08% and 8.00% performance rates, respectively.

Treasury Bonds: In the tap sale of the IFB1/2023/6.5, out of KES 25B on offer, the total bids received at face value were KES 47.2B, with the CBK accepting KES 47.9B at cost, at an average rate of 17.9327%. Noteworthy, the performance rate in the tap sale (188.96%) exceeded that in the primary issuance (177.80%).

Eurobonds: In the week, yields were mixed across the 6 outstanding papers.

KENINT 2024 was the only paper whose yield rose week-on-week, up by 45.10 bps to 13.732% while KENINT 2028 fell the most, depreciating by 22.90 basis points to 10.824%. The average week-on-week change stood at -4.52 bps.

KENINT 2024 rose the most on a year-to-date (YTD) basis, appreciating by 112.90 bps while KENINT 2048 rose the least at 13.70 bps.

Prices were mixed week-on-week, with KENINT 2048 rising the most at 1.0% to 77.109. KENINT 2024 was the only depreciating eurobond at 0.1% to 96.578. Year-to-date, KENINT 2024 rose the most, appreciating by 4.4%. The largest price losses YTD were 1.9% for KENINT 2034 to 76.065. The average price change week-on-week and YTD was 0.5% and 0.6%, respectively.

Market Gleanings

🛠️ | AALTO HAPS in Kenya | Airbus subsidiary Aalto Haps Limited, which is developing high-altitude, solar-powered drones that offer communications services, plans to build its first hub in Kenya as it looks to commence commercial operations with a plan to create ~1K jobs.

“The weather, the wide open spaces, the uncongested airspace, stable government, economic environment, well educated young, tech-savvy population. There’s so many good reasons to be here.”

AALTOPORT Operations Vice-president, Tom Guilfoy

“We have other options also, but we are focusing on getting Kenya going first.”

AALTO Chief Executive Officer, Samer Halawi

🛑 | Court Halts Privatization Programme | Justice Chacha Mwita of the High Court last week issued conservatory orders up to 6th February 2024, halting the planned privatization of the 11 State Owned Enterprises (SOEs) the government had earmarked for privatization.

🪓 | Diageo to Divest Tusker? | Axios reported that Diageo might be looking to divest the rest of its beer portfolio apart from its flagship brand Guinness. Among the beer brands the company could sell is EABL's Tusker. Diageo increased its stake in EABL from 50% to 65% earlier this year through a tender offer that closed on 17th March where it acquired 118.4M shares to bring its total shareholding in EABL to 514M shares. The company declined to comment on the matter stating that they do not respond to speculations.

⚡️ | Kenya Power’s New Board | Kenya Power in the week conducted elections seeking to elect members of its Board of Directors. Through its major shareholding, the government appointed 5 directors, while other shareholders appointed 4 directors. Separately, the utility in the week launched its new 5-year 2023/24 - 2027/28 corporate strategic plan to guide its operations in the medium term.

🚗 | Across Automobiles | Changan Automobile has launched in the Kenyan market and has picked Inchape Kenya as distributor for its passenger and light commercial models. Separately, NCBA Group and CFAO Motors Kenya have entered into a strategic partnership that will allow customers to access up to 100% financing to purchase a wide range of new and pre-owned vehicles.

🧾 | Affordable Housing Fund | The government has introduced the Affordable Housing Bill 2023 through which it seeks to cure the unconstitutionality of the Housing Levy as determined by the High Court. The new bill seeks to establish the Affordable Housing Fund that will house the housing levy.

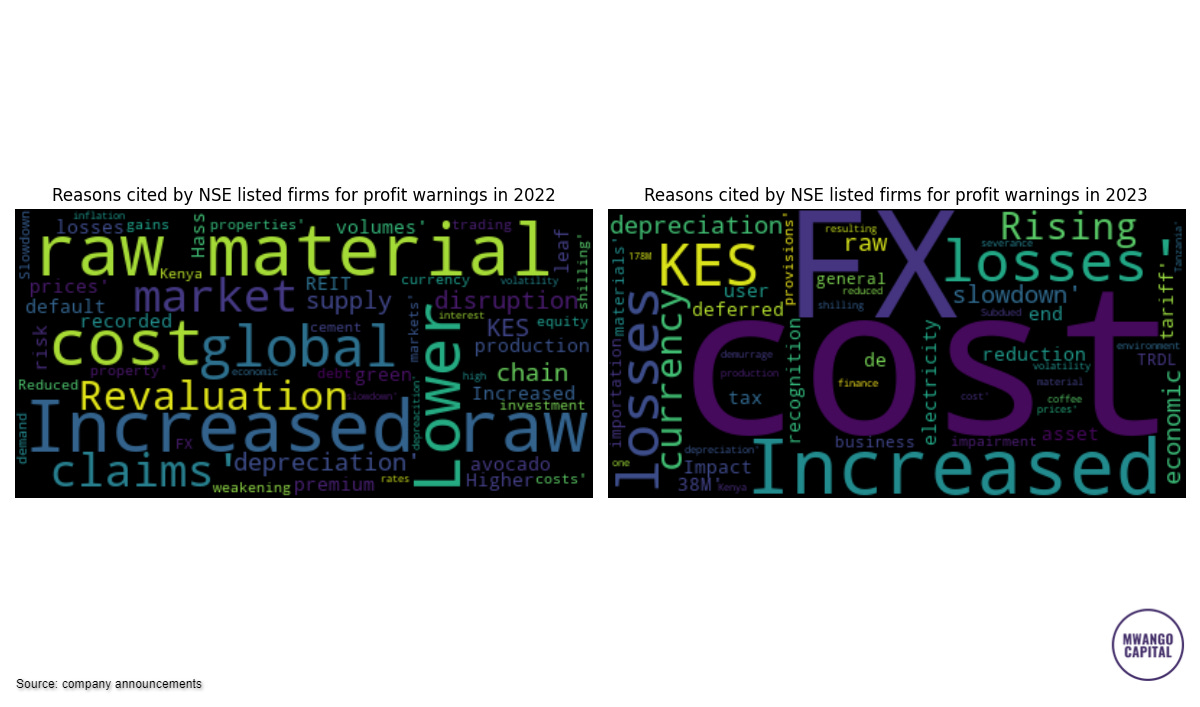

⚠️ | More Profit Warnings | Kakuzi PLC and Express Kenya issued profit warnings last week, forecasting net earnings for FY 2023 may be at least 25% lower than those of FY 2022 - bringing the number of NSE-listed firms that have issued profit warnings in 2023 to 14. Kakuzi has cited anticipated losses in the Macadamia business, while Express Kenya pointed out that low economic activities were hurting demand.