Safaricom Maintains Dividend

KES 0.65 final dividend brings total dividend for the year to KES 1.20

👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover Safaricom PLC FY 2024 results, Stanbic Holdings PLC Q1 2024 results, and Kenya’s debut KES 3B Linzi Sukuk Bond.This week's newsletter is brought to you by The African Pre-Seed Podcast

We're thrilled to unveil the newest episode of The African Pre-Seed Podcast, packed with valuable lessons gleaned from the Africa Early-Stage Investor Summit 2023.

Whether you prefer watching on YouTube or listening on Spotify, they've got you covered!

For a continuous stream of enriching content, follow Founders Factory Africa on X.

Safaricom FY 2024 Results

Service Revenue Crosses KES 300B: For the fiscal year ended 31st March 2024, service revenue edged higher by 13.4% year-on-year to reach KES 335.4B, accounting for 95.9% of total revenue [FY 2023: 95.1%]. Handset revenue declined by 7.9% to KES 10.5B while other income totaled KES 3.6B, representing a 5.6% decline. In sum, revenues for the year amounted to KES 349.4B [FY 2023: KES 310.9B] up 12.4%.

KES 140B M-PESA Revenues: M-PESA revenues edged higher by 19.4% year-on-year to reach KES 139.91B, equivalent to 40% of gross revenues [FY 2022/2023: 38%]. Transaction value and volume grew by 9.6% and 35.1% to reach KES 40.24T and 31.6B, respectively. Across its new growth areas under the M-PESA mobile money platform, Lipa na M-PESA customer base was 633K, with an almost-equivalent number of Pochi La Biashara tills amounting to 632.7K, representing a growth of 4.3% and 116.2%, respectively.

The M-PESA Visa Card which was launched in June 2022, closed FY 2024 with 143.4K active customers, KES 6.1M in transacted volume, and KES 14.5B in value transacted, up 175.9%, 222.1%, and 156.7%, respectively. Mali closed the year with 119.3K active customers, with KES 1.9B in Assets Under Management (AUM). These new growth areas generated revenue totalling KES 7.3B, KES 0.8B, KES 0.2B, and KES 10M, respectively.

Voice, Messaging, and Data: Voice revenues were down for the second year, declining by 1.9% to reach KES 79.51B, equivalent to 23.7% of service revenues [FY 2022: 27.4%]. Data revenue edged higher by 17.2% to reach KES 63.2B, equivalent to 18.9% of service revenues [FY 2022/2023: 18.2%]. In FY 2022/2023, after registering 4.6% year-on-year growth in revenue - the first in 5 years, the messaging segment saw its revenue grow by 8.0% in FY 24 to KES 12.3B. Other service revenue surpassed the KES 50B mark to reach KES 54.5B - representing 15.2% year-on-year growth.

OpEx up 12.4%: At the top line, the direct costs associated with revenue generation were KES 97B, up 5.22%, to account for 27.8% of total revenue [FY 2023: 29.7%]. Operating expenses (OpEx) totalled KES 83.3B, growing at parity with gross revenues at 12.4%. The net finance cost for the year was KES 16.6B, more than double the KES 7.1B recorded in FY 2023. Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) were up 16.8% year-on-year to reach KES 163.3B, while Earnings Before Interest and Taxes (EBIT) totalled KES 80.3B, down 5.5%. Notably, the net finance cost for the fiscal year rose sharply, closing at KES 16.6B, which is 2.35X that recorded in FY 2023.

Profitability and Dividends: The net profit attributable to the equity holders of Safaricom totaled KES 62.9B, up by a marginal 1.2% as compared to FY 2023. When adjusted for KES 20.3B in net losses attributable to non-controlling interests, the net result at the Group level stood at KES 42.7B, representing a decline of 18.7%. The Board of Directors declared a final dividend of KES 0.65 [FY 2023: KES 0.62], which, in addition to the interim dividend of KES 0.55, brings the total dividend for the year to KES 1.20 [FY 2023: KES 1.20].

Safaricom-M-PESA Split: At the Monetary Policy Committee (MPC) Media Press Briefing held on 4th April 2024, the Governor of the Central Bank of Kenya, Dr. Kamau Thugge, answered a question on the separation of M-PESA from Safaricom’s telecommunications business, pointing out that efforts were ongoing, and at the same time acknowledging the KES 75B tax liability associated with the separation. Last week, Safaricom PLC CEO, Mr. Peter Ndegwa, while underscoring the tax obligations associated with the separation, also noted that no decision yet had been taken in this regard, with the Group having a preference for M-PESA operating as a financial technology (fintech) company as opposed to stand-alone banking subsidiary which would otherwise attract heavier legal requirements.

“To address the stress around splitting M-PESA from the group, no decision has been made about separating M-PESA from the GSM business. We recently went through a new strategy approval with the board. One of the things we want to do is consider the reasons for separation and whether it benefits customers, investors, and Kenya. The description of an imminent M-PESA separation is not accurate because no decision has been made. The question was also linked to how we would look at the financial services business. Currently, we aim to stay as a fintech operation, not a full banking business, as that would require more significant prudential requirements and banking capabilities.”

“Our intention is to use partnerships on the credit side and for any future insurance, wealth, or savings products we might introduce. From a separation perspective, no decision has been made by the board. Should we feel it is appropriate, we will proactively consider it and report back to this group or make an announcement. Regarding the tax issue, it is a normal consideration when reorganizing a business within Kenya. Current tax law sees you having obligations on the transfer of operations in internal reorganization, which is what the CBK governor mentioned.”

Safaricom PLC Chief Executive Officer, Peter Ndegwa

Safaricom Ethiopia Performance: As at the end of FY 24, 90-day active customers totaled 4.4M while 90-day active data customers were 2.8M. Noteworthy, total registered M-PESA customers grossed 4.5M, and the network encompassed 62.7K active merchants and 25.8K agents. 1-month active voice customers were 3.1M, while 30-day active SMS customers totaled 1.1M and the total gross adds were 9.4M. The total value transacted through M-PESA grossed KES 24.5B (USD 186.9M) across 31.5M transactions.

Voice, messaging, and mobile incoming revenues amounted to KES 1.03B, KES 42.3M, and KES 360.4, respectively. Mobile Money services via the M-PESA platform brought in KES 91.9M in revenue, and the aggregate service revenue totaled KES 5.8B, representing a growth of KES 500M from FY 2023. Mobile data was the largest revenue-earning segment at KES 4.2B, which was equivalent to 72.4% of gross service revenue.

Ethiopia CapEx Slows: Aggregate Capital Expenditures (CapEx) totaled KES 93.5B, down by 2.7% year-on-year, with Kenya accounting for KES 47.3B and Ethiopia KES 46.2B. Compared to FY 2023, CapEx in Kenya edged higher by 17.2%, but slowed in Ethiopia at a rate of 17.1%. With Safaricom Ethiopia under its scaling phase, the bulk of CapEx, at 68.7%, was accounted for by Radio Access, followed by 10.2% for the core network and 8.8% for transmission.

In FY 2025, Safaricom Ethiopia CapEx is projected to be between KES 21B - 24B, with 694 additional sites targeted to bring the total count to 3,500, and the aggregate CapEx for the first 5 years has also been revised to USD 1B - USD 1.3B from USD 1.5B - USD 2B. In terms of network rollout, Safaricom Ethiopia has opted to collocate network towers with State-owned Ethio Telecom instead of putting up independent infrastructure.

“We are building a world-class network that is currently the size of almost Kenya’s network.”

Safaricom PLC Chief Executive Officer, Peter Ndegwa

FX Devaluations in Ethiopia: According to Safaricom Ethiopia’s Q3 FY 24 update, the firm noted that it was not on the priority list for US Dollars in Ethiopia. Given the scaling phase that Safaricom Ethiopia is currently in, the CapEx requirements necessitate the acquisition of equipment and hardware which requires FX for import needs for further local assembly, integration, and installation. To mitigate the challenges around accessing and securing foreign currency, coupled with the devaluations of Ethiopia’s local currency, the Ethiopian Birr, Safaricom Ethiopia is taking steps to localize CapEx as well as cut exposure to foreign currency.

“A year ago, our CapEx was probably 90% to 95% denominated in foreign currency. As part of our mitigation plans to hedge against possible devaluations, we need to localize our supply chains and cost structures, both on the CapEx side and operational side. In terms of CapEx, we've made some good progress. For example, next week, I'll give you a heads-up, we are doing an official handover. We have procured 68 towers made in Ethiopia, and there will be a handover ceremony next week on Tuesday. This is just one piece of evidence where we are trying to localize the CapEx, particularly at the base stations and towers.”

“However, equipment, of course, cannot be localized as there are no local vendors for some components. So, we will always have some foreign currency exposure. But, we are trying to reduce this component by localizing civil works and services, and now by localizing towers. We are hopeful that we will be able to reduce that 90% foreign currency component to probably 40%, 50%, or 60% overall over the next few months. This is one way of hedging against devaluation risk.”

“On the operational side, we are undergoing the same exercise. Originally, when you start a network from scratch, you don't know the country, and you are discovering the capabilities—what is possible and what is not possible. In the beginning, we relied heavily on the usual vendors we have worked with in Kenya and other countries. Now, we are also localizing some of the services, so that our cost structure is based on local currency and not foreign currency. We aim to move from the current 60%-70% foreign currency exposure to less than 30%-40%. This will help us hedge ourselves against possible devaluation when our structures are in local currency.”

Safaricom Ethiopia Chief Executive Officer, Wim Vanhelleputte

FY 2024/2025 Guidance: For FY 2025, EBIT at the Group level is expected to range from KES 103B - KES 109B, with that for Kenya ranging in between KES 149B - KES 152B, with losses from Ethiopia projected at KES 46B - KES 43B. In terms of CapEx, for Kenya, projections are at KES 52B - KES 55B, and at the Group level, between KES 73B - KES 79B.

Share Price: As at close of the trading session last week, the share price gained by 3.45% from the previous session to KES 16.50, with KES 45.9M traded, accounting for 13.8% of market turnover. In terms of foreign participation, buys totaled KES 35.4M, while sells were KES 1.1M.

Find our analysis here, the investor presentation here, the results booklet here, and the press release here.

Stanbic Reports Q1 2024 Earnings

Stanbic Holdings PLC last week became the first listed lender to report its set of Q1 2024 results, with Per Share Earnings standing at KES 23.43, up 2.7% year-on-year. The deposit base edged higher by 22.2% to reach KES 355.5B, accounting for 72.34% of the asset base, up from 74.31%.

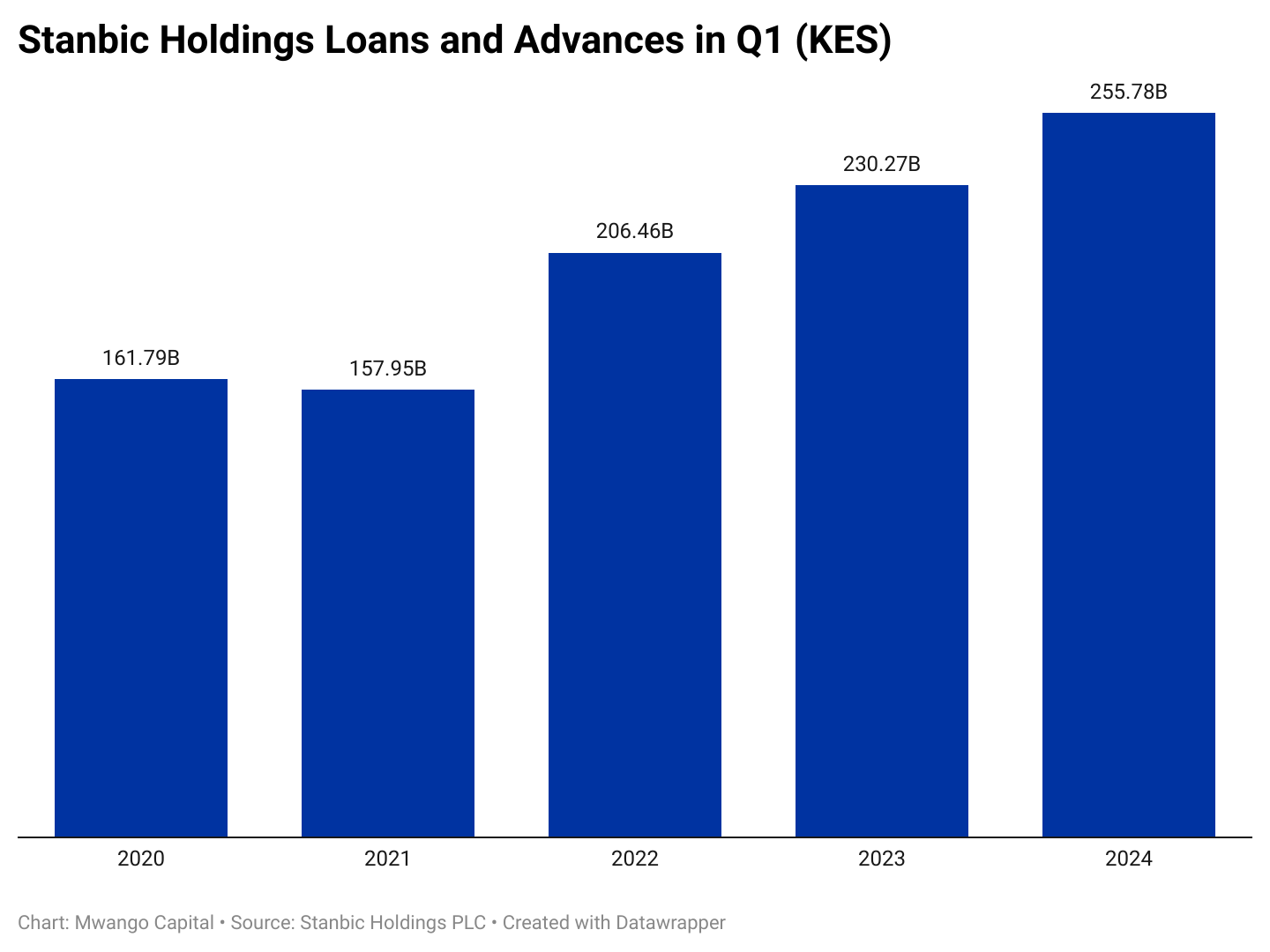

Asset Allocation: The asset base expanded by 25.5% year-on-year to reach KES 491.5B, with the loan book growing at 11.1% to reach KES 255.8B to account for 52.0% of the asset base [Q1 2023: 58.8%]. In terms of the funding of the balance sheet, the deposit base edged higher by 22.2% to reach KES 355.5B, equivalent to 72.3% of total assets as compared to 74.3% in FY 22.

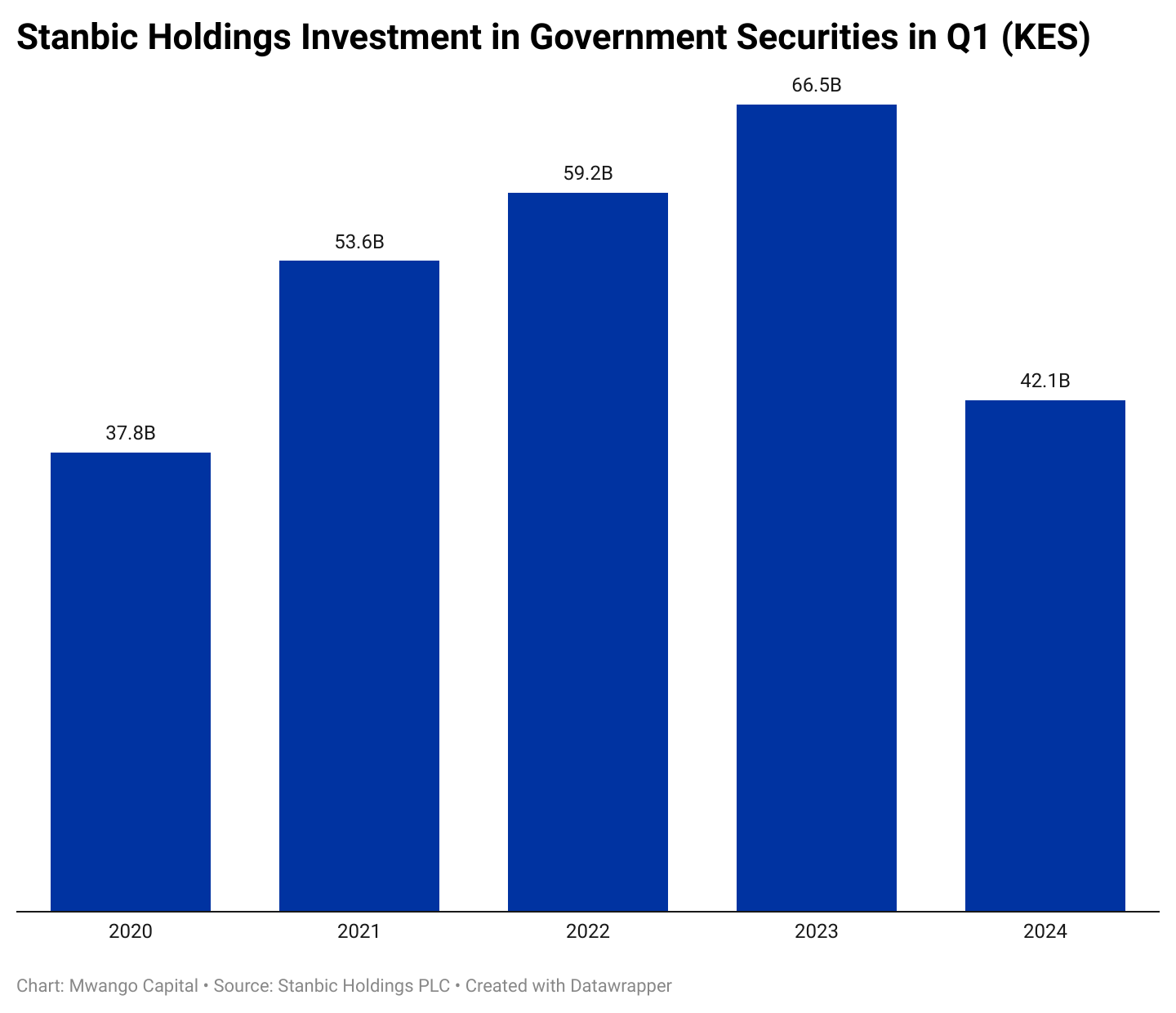

Govt Securities Slashed: The aggregate holdings of government securities on the balance sheet were slashed by 36.67% to KES 42.1B to account for 8.6% of the balance sheet as compared to 16.9% in Q1 2023. The cut in holdings of government securities coincided with an 11.08% growth in the loan book to KES 255.8B and a 4.2X or KES growth in balances due from banking institutions in the group from KES 25.2B in Q1 2023 to KES 106.8B.

Asset Quality: The stock of gross non-performing loans (NPLs) fell by 17.3% to reach KES 24.2B, accounting for 9.47% of the loan book, down from 12.72% in Q1 2023, while net NPLs also declined by 31.3% to reach KES 6.7B, accounting for 2.62% of the loan book from 4.23% in Q1 2023. Loan loss provisions on the Profit and Loss statement edged lower by 0.5% to KES 1.1B, equivalent to 23.7% of operating expenses [Q1 2023: 20.2%].

FX Income Down: Interest income from loans grew by 52.9% to reach KES 9.2B, with that from government securities declining by 1.2% to KES 1.3B. In sum, gross interest income amounted to KES 12.1B, and when adjusted for interest expenses, surged by 130.2% to reach KES 5.6B. Across Non-Funded Income (NFI), FX trading income declined by 44% to KES 2.4B, with aggregate NFI falling by 33.98% to KES 3.8B. As a result, operating income declined by 7.96% to reach KES 10.3B.

PBT Down 0.5%: Operating expenses declined by 15.2% to reach KES 4.8B, which when netted off from operating income, brings pre-tax profits to KES 5.467B, down from KES 5.494B in Q1 2023. On a net basis, however, profits edged higher by a marginal 2.8% to KES 3.9B on account of a softer tax bill relative to Q1 2023. Per Share Earnings were KES 23,43, up 2.7%.

Find our analysis here and the full results here.

Updates on Telcos Across Africa

Vodacom Tanzania FY 23 Results: Vodacom Tanzania last week released its preliminary results for the full year 2024. The company’s revenue increased by 19.1% to TZS 1,278.2B, while operating profit saw a significant jump of 64.8% to TZS 134.3B. Net profit after tax also grew by 19.9% to TZS 53.4B. The operating free cash flow (FCF) surged by 95.5% to TZS 123.8B, and FCF rose by 74.4% to TZS 95.7B. Capital expenditure increased by 9.1% to TZS 170.1B with earnings per share (EPS) growing by 19.9% to 23.8.

Airtel Africa FY 24 Results: For the fiscal year ended 31st March 2024, total revenue grew by 20.9% in constant currency terms to reach USD 4.9B. EBITDA margins stood at 48.8%, and the devaluation of the naira coupled with rising energy costs in some operating markets. The net result for the year was a USD 89M loss on account of significant FX headwinds. CapEx for the year amounted to USD 737M. The Board of Directors approved a sharer buyback programme of USD 100M to be executed over 12 months, and the buyback amount is about 14.7% of the USD 680M cash held by the Holding Company as of financial year-end. The Board further recommended the payment of a final dividend of USD 3.57 cents per share, bringing the total dividend for the year to USD 5.95 cents.

MTN Uganda’s 20M Customers: MTN Uganda, a telecoms operator headquartered in Kampala, Uganda, last week achieved a significant milestone by reaching 20M customers, which is equivalent to more than 78% of the 25M+ Ugandans within the age of 15 and 64. The company, which boasts a 98% coverage area, has further solidified its domestic presence and extended its global reach. The firm reported strong financial performance in 2023, with a net profit of USD 127.1M, up 21.43% from the previous year.

Markets Wrap

NSE: In Week 19 of 2024, HF Group was the top-performing stock, up 17.1% to close at KES 4.38. Standard Group was the worst-performing stock, down 9.5% to close at KES 5.70. The NSE 20 was up 0.7% to close at 1,660.1 points, the NSE 25 increased by 1.1% to close at 2,791.5 points, with the NASI index increasing by 1.8%, to close at 106.5 points. Equity turnover was up 75.4% to KES 1.1B from KES 648.7M in the prior week while bond turnover closed the week at KES 25.6B compared to the prior week’s KES 29.7B.

Treasury Bills: The weighted average interest rate of accepted bids for the 91-day, 182-day, and 364-day were 15.9036%, 16.5014%, and 16.5067% respectively. The total amount on offer was KES 24B with the CBK accepting KES 49.5B of the KES 53.6B bids received, to bring the aggregate performance rate to 223.57%. The 91-day and 364-day instruments recorded 431.34% and 134.39% performance rates, respectively.

Treasury Bonds: The CBK has announced a tap sale on Treasury Bond FXD1/2024/10, and the period of sale is from 7th May to 9th May 2024. A gross amount of KES 15B is on offer and the bond’s coupon rate is 16.00% with an adjusted average price of KES 100.9926 per KES 100.

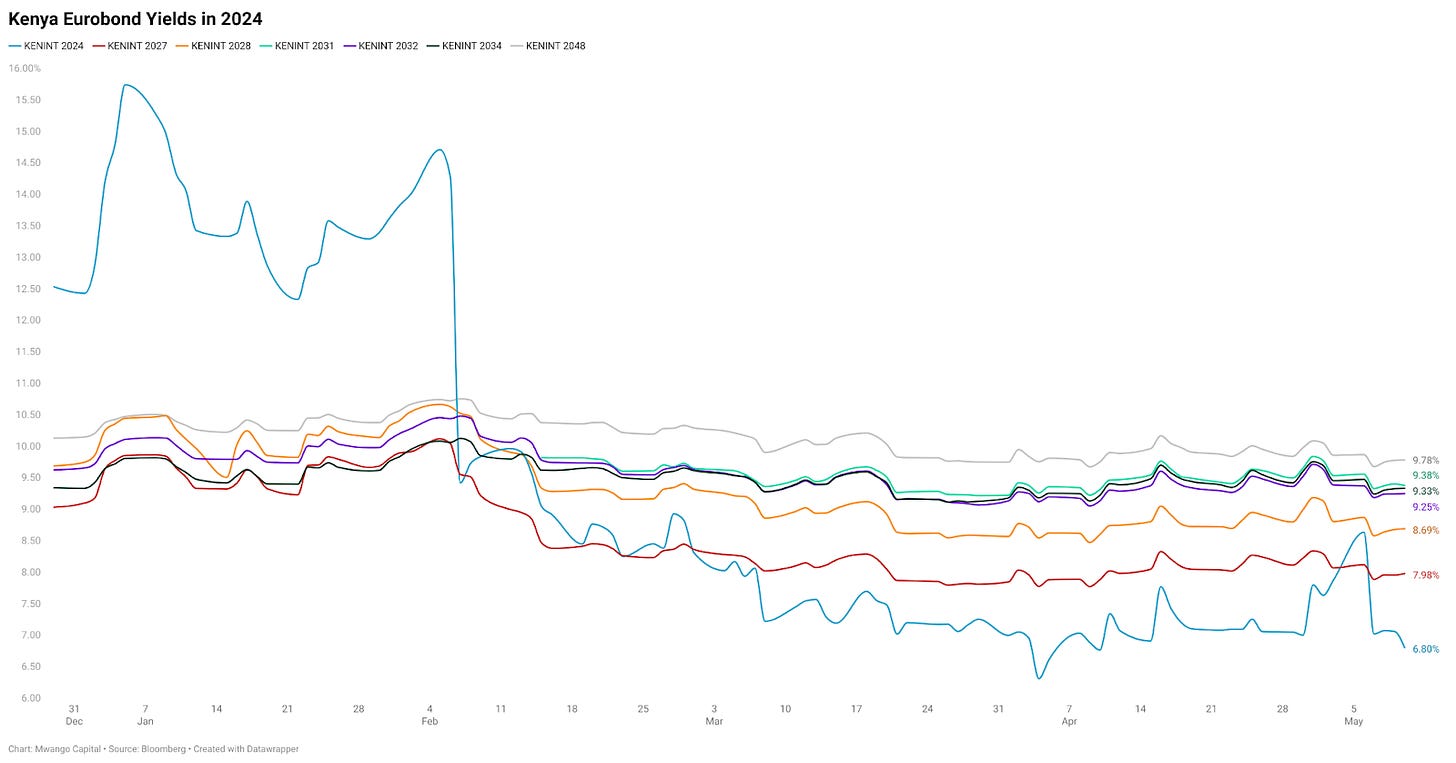

Eurobonds: In the week, the yields fell across the 7 outstanding papers.

KENINT 2024 fell the most, down 107.20 bps to 6.802% while KENINT 2027 fell the least, down by 8.90 bps to 7.978%. The average week-on-week change stood at -25.13bps.

Yields on all papers declined on a year-to-date (YTD) basis, with KENINT 2024 falling the most by 572.80 bps while KENINT 2034 fell the least at 0.60 bps to 9.331%.

Prices gained week-on-week, with KENINT 2034 recording the highest gains at 0.9% to 80.992, while KENINT 2024 had the lowest gains at 0.1% to 99.988. YTD, KENINT 2028 rose the most at 3.9% to 95.420, while KENINT 2034 fell the most, down by 0.6% to 80.922.

Market Gleanings

💸| KES 3B Linzi Sukuk to be Listed | The Nairobi Securities Exchange (NSE) last week admitted the Linzi Sukuk, a KES 3B Islamic Secured Residential Lease Based Security, on its Unquoted Securities Platform (USP). This marks the first Shari’ah-compliant product to be admitted on the platform. The Linzi Sukuk, issued by Ling FinCo Trust, will mature in 15 years and offers an internal rate of return of 1.13%..

☕| Sasini HY 2024 Results | Last week, Sasini Plc announced its financial results for the first half of 2024. Despite a 32.1% increase in revenue to KES 2.99B, the company’s gross profit fell by 14.3% to KES 626.8M. Sasini reported a net loss after tax of KES 37.67M a shift from the KES 122.1M profit in the same period of 2023. The Board of Directors did not recommend the payment of an interim dividend.

⚡| Captive Energy Generation | Two companies, Magiro Hydro Electricity Limited and Hydrobox Kenya Limited, are applying for licenses to generate and distribute electricity in Kenya. Magiro Hydro Electricity Limited is applying for a license to generate electricity from a hydropower plant in Murang’a County. Hydrobox Kenya Limited is applying for a license to generate electricity from a 140kW hydropower plant and a 142kW solar power plant in Kirinyaga County.

📄| B Commodities’ Purchase | B Commodities ME (FZE), a UAE-based company, last week announced its indirect acquisition of a controlling stake in Limuru Tea Plc. The transaction, which is expected to close in Q3 2024, involves the purchase of shares from EkaterraHoldco UK Limited, which owns a majority stake in Lipton Teas and Infusions Kenya plc, and in turn, holds 51.99% of Limuru Tea.

🏦| SBM Bank Kenya’s New CEO | SBM Bank (Kenya) Limited last week announced the appointment of Mr. Bhartesh Shah as its new Chief Executive Officer (CEO), effective May 9, 2024. Mr. Shah, with over twenty years of experience in the financial services industry, will succeed Mr. Mopzz Mir, who served as CEO for six years.

🧾| KUSCO Board Disbanded, Reorganized | The board of directors of the Kenya Union of Savings and Credit Union (KUSCCO) was earlier last week disbanded by the Ministry of Cooperatives and MSMEs Development due to serious management and operational discrepancies. The ministry later last week appointed an interim board, comprising influential SACCO leaders, to restore confidence and accountability.