👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover the IMF-Kenya January 17th, 2024 Executive Board Meeting.This week's newsletter is brought to you by:

Co-operative Bank of Kenya. Pay For E-Citizen services conveniently with Co-op Bank.

IMF - Kenya Executive Board Meeting

Sixth Reviews Concluded: The International Monetary Fund’s (IMF) Executive Board last week concluded the 2023 Article IV consultation with Kenya alongside the sixth reviews and augmentations of access under the Extended Fund Facility (EFF) and Extended Credit Facility (ECF). The approval unlocked USD 624.5M for immediate disbursement under EFF/ECF arrangements - to bring the total disbursements under EFF/ECF to USD 2.6B. Initially approved in April 2021, the EFF and ECF arrangements have been extended to April 2025 to further support Kenya’s economy.

“Kenya’s growth remained resilient in the face of increasing external and domestic challenges. The EFF/ECF and RSF arrangements continue to support the authorities’ efforts to sustain macroeconomic stability, strengthen policy frameworks, withstand external shocks, push forward key reforms, and promote more inclusive and green growth. Kenya’s performance under the ECF/EFF arrangements have been mixed with adherence to quantitative targets being broadly satisfactory. The authorities have made welcome progress in some key areas, including governance and public financial management. Continued implementation of corrective measures to address missed targets and accelerated reforms will be important.”

IMF Deputy Managing Direction and Acting Chair, Ms. Antoinette Sayeh

First Review of the RSF: Further, the IMF also concluded the first review under the Resilience and Sustainability Fund (RSF) arrangement - a 20-month program approved in July 2023 - allowing for an immediate disbursement of USD 60.2M. Kenya initially sought access to the RSF in H1 2023, and the Board approved USD 542.8M - equivalent to 75% of the USD 551.4M in July 2023 after the completion of the fifth reviews in July 2023. The USD 60.2M disbursement brings the remaining funds accessible in the approved RSF quota to USD 482.6M.

Pivot to Concessional, Commercial Loans: Due to constrained access to global markets on account of higher interest rates, Kenya will not issue a bond to refinance the KENINT 2024 USD 2B eurobond maturing in June. The government is instead seeking additional concessional and commercial financing, and this forms the backdrop against the requested augmentation of access under EFF/ECF equivalent to 130.3% of the program’s quota (USD 941.2M). Reports in the week indicated Kenya received a USD 210M loan from the Trade and Development Bank as part of efforts around bolstering FX reserves in the run-up to the redemption of the eurobond. In July 2023, Kenya announced plans to raise USD 1B through a syndicated loan with the Trade Development Bank as the arranger, and based on that quantum, the estimation is an outstanding ~USD 790M in expected financing if the government follows through with its plans.

Key Takeaways on Kenya’s Economy: The IMF’s Executive Board gave an analysis of Kenya’s economy and here is a run-down of some of the key takeaways:

G2G Oil Deal: Kenya plans to exit the government-to-government oil deal introduced in April 2023 on account of distortions introduced in the FX market and increased risk associated with the underlying financing arrangements. Further, the National Treasury said it is exploring a new fuel pricing strategy to implement a passthrough mechanism for FX fluctuations and associated risks, aligning with the IMF's reform roadmap.

Domestic Debt Market: Kenya introduced the new Central Securities Depository System (CSD) that enables direct transactions in the primary and secondary markets in a bid to improve liquidity in the market, and plans are in the works to enhance market infrastructure through operationalization of an Over-The-Counter automated exchange to complement intermediation at the NSE.

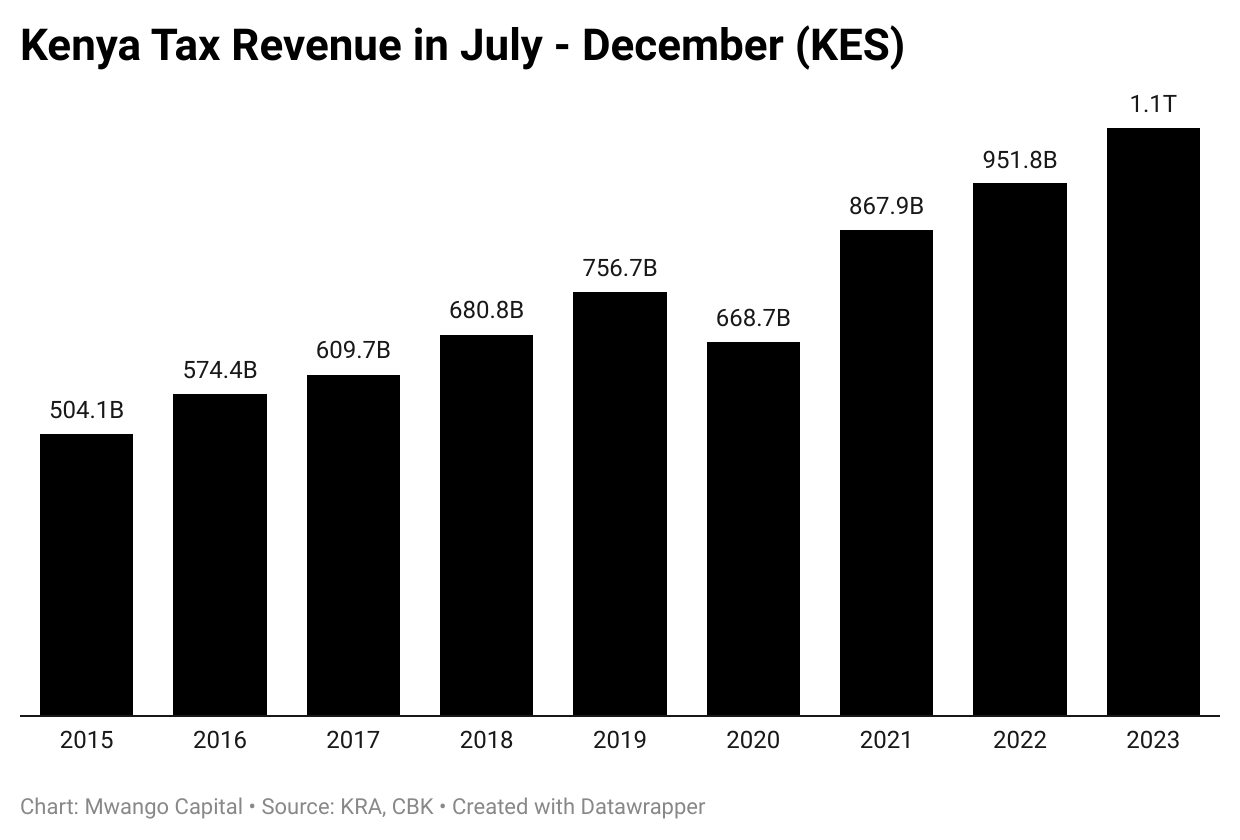

Shortfall in Tax Collections: The Board raised concerns over shortfalls in tax collections - in particular highlighting a KES 79B shortfall in Q1 FY 23/24 despite a 10.6% growth to KES 514.3B. Further focus was on the deterioration in Kenya’s Tax-to-GDP ratio which was 13.1% in 2020 from 15.5% in 2014 on account of declining income taxes. The tax target for 2023 is 14.4% and the implementation of the Finance Act 2023 is expected to yield 1.5%. Latest data shows that in December 2023, Kenya’s tax revenue rose by 4.9% year-on-year to KES 203.5B, while H1 23/24 revenues were up 10.3% to KES 1.05T.

Medium-Term Revenue Strategy: The Medium-Term Revenue Strategy (MTRS) is expected to get in force early 2024 - the IMF’s proposed structural benchmark is February 2024, and its implementation is expected to increase revenues by ~5% of GDP. The 2024 Finance Bill to be tabled before the National Assembly by end April 2024 will incorporate the elements of the MTRS.

Cash-Strapped State-Owned Enterprises: The government provided KES 2.35B and KES 19B in budget support for Kenya Airways (KQ) and Kenya Power in FY 22/23, respectively, and a further redemption of USD 95M of KQ debt. The airline closed FY 22/23 with KES 302B in debt, and its restructuring plans have been halted to review the associated costs. Separately, the net contribution to the budget in FY 22/23 by State Corporations and Semi-Autonomous Government Agencies excluding the CBK and pension funds was -0.1% of GDP; with profits totaling to 0.6% of GDP against losses aggregating to 0.7% of GDP.

You can access the entire report here. We also have an upcoming space to discuss this.

Mergers, Deals, and Acquisitions

Spire Bank’s Voluntary Liquidation: At an extraordinary general meeting held on 22nd December 2023, members of Spire Bank Limited, in Nairobi, resolved to wind up the bank through a members voluntary liquidation. Furthermore, they requested the Central Bank of Kenya (CBK) to appoint the Kenya Deposit Insurance Corporation as the liquidator. This resolution is subject to any applicable regulatory approvals.

Heri Holdings acquires Nova Academies: The Competition Authority of Kenya has unconditionally approved the acquisition of 100% of the issued share capital of Nova Academies Tatu City Property Limited by Heri Holdings Limited, an investment and management company. Nova Academies leases properties to Nova Pioneer Kenya Limited, which operates seven secondary schools across Kenya. The transaction only involves the school’s physical assets, with no change in its operations or transfer of its programs, brand, or personnel.

Terrafund Financing: 36 organizations and enterprises in Kenya are set to receive USD 7.5M in grants, loans, and equity finance from TerraFund for AFR100, a fund for locally-led landscape restoration projects operating in Africa. The investment forms part of a second cohort of investments, named TerraFund for AFR100 Landscapes, focusing on restoring land in three of the continent’s vital landscapes: the Greater Rift Valley of Kenya, the Lake Kivu and Rusizi River Basin in Rwanda, Burundi, and the Democratic Republic of Congo, and the Ghana Cocoa Belt.

Vodafone - Microsoft: Vodafone and Microsoft announce a new 10-year partnership to bring generative AI, digital services and the cloud to more than 300M businesses and consumers. Part of the focus here is housing M-Pesa on Azure & enabling the launch of new cloud-native applications on M-Pesa. In the first half of 2024, M-PESA accounted for 26.3% of Vodafone’s total service revenue.

Safaricom Spark Accelerator: Safaricom, M-PESA Africa & Sumitomo Corporation have launched the Spark Accelerator - a 3-month program offering training, mentorship & funding to foster growth & scale. The program focuses on Fintech & content startups. Separately, the Pangea Accelerator has introduced the Climate-Tech Accelerator Program, a 6-month initiative offering up to KES 40M in funding to East African SMEs in sectors like sustainable agriculture and renewable energy, to combat climate challenges.

Markets Wrap

NSE: In Week 3 of 2024, Sanlam was the top-performing stock, up 26.7% to close at KES 7.60. TransCentury was the worst-performing stock, down 11.8% to close at KES 0.45. The NSE 20 index increased by 0.2% to close at 1,516.8 points, the NSE 25 increased by 0.5% to close at 2,429.2 points, and the NASI index increased by 0.6% to close at 93.4 points. Equity turnover decreased to KES 616.94M from KES 684.07M the prior week while bond turnover closed the week at KES 17.11B compared to the prior week’s KES 9.8B.

Treasury Bills: The weighted average interest rate of accepted bids for the 91-day, 182-day, and 364-day were 16.2347%, 16.3007%, and 16.4917% respectively. The total amount on offer was KES 24B with the CBK accepting KES 34.1B of the KES 35.3B bids received, to bring the aggregate performance rate to 146.99%. The 91-day and 364-day instruments recorded 638.95% and 35.26% performance rates, respectively.

Treasury Bonds: Across the tap sale on FXD1/2024/003 and FXD1/2023/005 treasury bonds, total bids received at face value were KES 9.3B and KES 2.6B. The CBK accepted bids totaling KES 9.3B and KES 2.4B bringing the weighted average rate of accepted bids to 13.385% and 18.769%, respectively. On aggregate, the performance and acceptance rates were 79.07% and 78.37%, respectively.

Eurobonds: In the week, yields fell across the 6 outstanding papers.

KENINT 2024 fell the most week-on-week, down by 55.80 bps to 12.865% while KENINT 2027 fell the least, depreciating by 0.50 basis points to 12.865%. The average week-on-week change stood at -13.55 bps.

KENINT 2024 rose the most on a year-to-date (YTD) basis, appreciating by 33.50 bps while KENINT 2028 rose the least at 13.30 bps.

Prices rose across the board week-on-week, with KENINT 2034 rising the most at 0.5% to 80.182. Year-to-date, KENINT 2027 fell the most, depreciating by 0.8%, while KENINT 2024 was the only paper that appreciated, up 0.1% to 97.588%.

Markets Gleanings

🏦| Equity’s Overdraft Facility | Equity Bank Kenya has introduced ‘Boostika’, an unsecured overdraft facility allowing customers to overdraw their accounts up to KES 100,000. The new product, aimed at competing with Safaricom’s Fuliza, enables customers with insufficient funds to complete transactions and repay within a month at an 8.5% cost of credit.

📈| KCB Reviews Lending Rate | KCB Bank has reviewed its base lending rate for facilities denominated in Kenya Shillings. The pricing on KES loans will now be based on the bank’s current variable base lending rate of 14.7%, plus a variable margin based on the customer’s credit rating. These changes became effective on 27th December 2023.

⚠️| Umeme Profit Warning | Umeme Limited last week announced a projected decline in the company’s net profit for the year ending 31st December 2023 by more than 25% compared to the previous year. This is attributed to an increased amortization charge following the alignment of the amortization of its non-current assets. Umeme becomes the second firm to issue a profit warning in 2024.

🛠️| Kenya Debt Swap Plans | Kenya is considering a debt swap to bolster its finances as it faces a USD 2B debt repayment deadline in June. The proposed deal, similar to debt-for-nature swaps, would refinance existing debt at more favourable rates and redirect savings toward social projects such as healthcare.

🧾| BoT’s New Policy | The Bank of Tanzania (BoT) last week held its first Monetary Policy Committee (MPC) under the new interest-based monetary policy framework, setting the Central Bank Rate (CBR) at 5.5% for Q1 2024 - aiming for 5% inflation control and 5.5%+ economic growth.

💸| Ivory Coast Eurobond Issuance | After nearly two years, Ivory Coast is set to become the first sub-Saharan African nation to issue a Eurobond. President Ouattara announced the upcoming deal, aiming to fuel investments in tech, transport, and resource exploration. Following the announcement, yields on the country’s Eurobond due July 2024 fell 17 basis points to trade at 8.36%.

🤝| IMF - Ghana Programme | Last week, the International Monetary Fund (IMF) Executive Board completed the 2023 Article IV consultation and the first review of Ghana’s 36-month Extended Credit Facility (ECF) arrangement. This approval enables an immediate disbursement of about USD 600M bringing Ghana’s total disbursements to about USD 1.2B.